Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

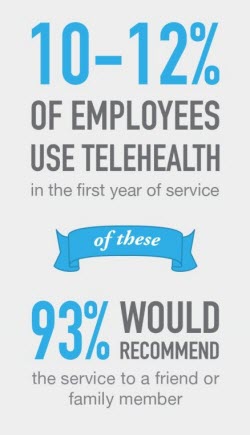

According to a National Business Group on Health survey, 74% of employers plan to offer telehealth in 2016, up from just half in 2015. In fact, employers of all types—from retail stores to airliners—are offering their employees telehealth services. These services can vary from online urgent care to nutrition programs to wellness programs to behavioral and occupational health offerings.

On the road to telehealth adoption, there are many different factors benefits managers need to take into consideration to determine which offerings and vendors are right for them. This telehealth checklist will guide you during your search and help you ultimately implement a successful program:

✔ Test the platform

Each telehealth vendor’s platform is different, and the best way to experience those differences first-hand is to actually test the product by having an online doctor’s visit. During the visit, ask yourself:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- Is it straightforward or confusing to sign up?

- Is it easy or difficult to select and connect with a doctor of your choice?

- Is the service available after business hours and on weekends?

- Would your employees be able to use the program easily and effectively?

These may seem like simple questions, but you’d be surprised how often they can be overlooked. The main goal of telehealth is to make medical care quick, convenient, and affordable without sacrificing quality of care. If the process isn’t seamless, your employees will never use the service.

✔ Know your launch options

Contrary to popular belief, you don’t have to launch telehealth with your annual benefits cycle. In fact, often it’s better to launch telehealth off-cycle to help highlight the benefit to employees without added distractions. Be sure to talk with each vendor about your launch options. Included in launch logistics should be the vendor’s ability to assist with practice set-up, provide customized communications collateral, and ensure health plan notification and carrier readiness.

✔ Determine eligibility

Do you plan to offer telehealth to your employees and their dependents, or do you offer it only to employees who take advantage of employer health benefits? Can you offer different telehealth practices—occupational health, behavioral health, wellness, etc.—to different groups? Make sure to ask your vendor these questions, and be sure they understand your vision and have the technology in place to support it.

✔ Understand the cost savings

Many employers turn to telehealth not only to provide their employees with a great benefit, but to reduce medical costs and save money. Compared to urgent care and emergency visit options, telehealth costs a fraction of the price; and even with primary care visits, telehealth is typically a better value. This means if only a portion of your employees replace their traditional healthcare visits with telehealth visits your cost savings can be substantial. Make sure the telehealth vendor can work with you to create a realistic, attainable, and customized ROI model based on your company’s unique telehealth goals.

✔ Weigh the importance of integrations

Integrating telehealth with your health plan allows for automated eligibility and claims. Real-time eligibility calls are used to verify coverage, services, and copays for your employees, while claims are generated automatically so doctors don’t have to focus on the paperwork—just their patients. Whichever vendor you choose should be experienced in these types of integrations, as well as be able to work with any health plan you select.

✔ Track your success

Once you have successfully implemented telehealth, it’s important to be able to track utilization. Utilization not only shows how many employees are taking advantage of the benefits; it can also give you a glimpse into the accuracy of your ROI model. Be sure to ask vendors if they provide utilization reports by month and year so you can track progress and cost savings.

With this checklist, you’ll be well on your way to implementing the telehealth service that’s right for your company, offering an important and much needed employee benefit.

To learn more about best practices for employer telehealth, download American Well’s Employer Best Practices eBook here.

This content was provided by American Well. Kiplinger is not affiliated with and does not endorse the company or products mentioned above.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

9 Types of Insurance You Probably Don't Need

9 Types of Insurance You Probably Don't NeedFinancial Planning If you're paying for these types of insurance, you might be wasting your money. Here's what you need to know.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and More

When Does Amazon Prime Day End in October? Everything We Know, Plus the Best Deals on Samsonite, Samsung and MoreAmazon Prime The Amazon Prime Big Deal Days sale ends soon. Here are the key details you need to know, plus some of our favorite deals members can shop before it's over.

-

How to Shop for Life Insurance in 3 Easy Steps

How to Shop for Life Insurance in 3 Easy Stepsinsurance Shopping for life insurance? You may be able to estimate how much you need online, but that's just the start of your search.