What the WaMu Collapse Means for Its Customers

Their money is safe and it will be business as usual as JP Morgan Chase takes over their accounts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

I have an account with Washington Mutual. What changed when the FDIC put the bank into receivership?

Not much. The FDIC took over Washington Mutual on September 25, 2008 -- the largest bank failure in history -- then almost immediately sold all of the bank's deposits, loans and branches to JP Morgan Chase for $1.9 billion. All accounts were transferred to Chase, regardless of the size, even if they were above the FDIC limits. Nobody lost any money on deposits at Washington Mutual.

"Life is exactly as it was for Washington Mutual customers on Friday as it was on Thursday except they are now backed by a bigger, stronger bank," says Chase spokesman Tom Kelly. Washington Mutual customers can continue to use their WaMu ATM cards, checks, debit and credit cards, online services and branches. Direct deposit and automated payments will remain the same, and Washington Mutual customers should continue to send their credit card and loan payments to the same place. Loan terms are governed by contract and will remain the same.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Washington Mutual customers will soon be able to use Chase ATMs fee-free, will eventually receive Chase debit cards (their WaMu debit cards will continue to work for now), and will receive Chase-branded credit cards when they reissue. Washington Mutual customers should continue to use WaMu branches, but should be able to use Chase branches sometime next year after the two banks' systems are merged.

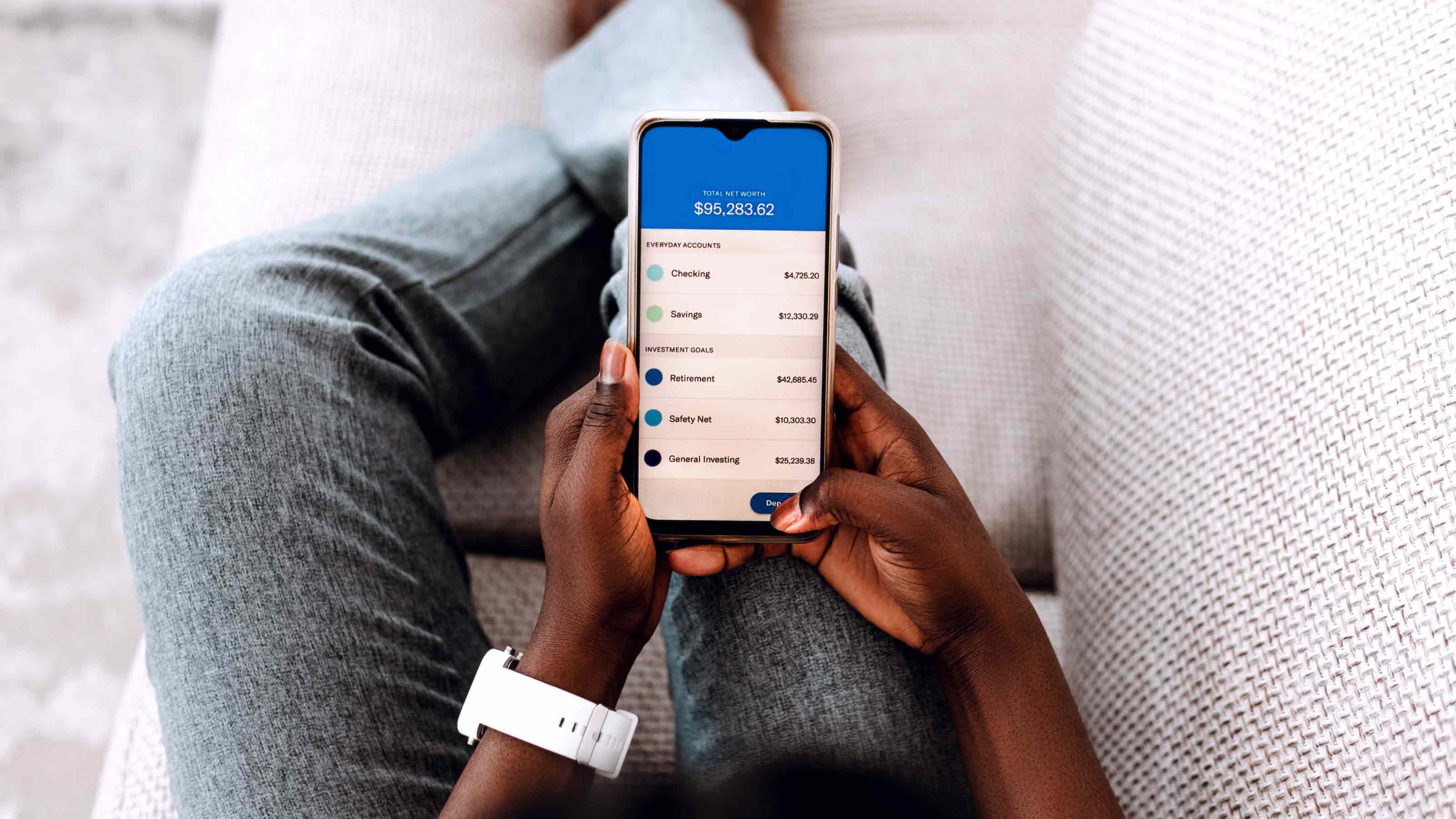

Washington Mutual customers who already had a Chase account eventually need to be careful about FDIC limits. Chase and WaMu will have separate FDIC limits for six months (or until your CDs mature after that), but then the FDIC limits will be combined -- with a total of $100,000 for individual accounts, $100,000 for your share of joint accounts, and $250,000 for retirement accounts, as it is at any one bank. For more information about FDIC limits, see Is My Bank Safe? for more information.

For more information, see the FDIC's Q&A Guide for Washington Mutual Customers or call the FDIC's call center at 877-275-3342.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

As the "Ask Kim" columnist for Kiplinger's Personal Finance, Lankford receives hundreds of personal finance questions from readers every month. She is the author of Rescue Your Financial Life (McGraw-Hill, 2003), The Insurance Maze: How You Can Save Money on Insurance -- and Still Get the Coverage You Need (Kaplan, 2006), Kiplinger's Ask Kim for Money Smart Solutions (Kaplan, 2007) and The Kiplinger/BBB Personal Finance Guide for Military Families. She is frequently featured as a financial expert on television and radio, including NBC's Today Show, CNN, CNBC and National Public Radio.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

Best One-Year CD Rates

Best One-Year CD RatesSavings The best 1-year CD rates are a smart way to achieve short-term savings goals.

-

What Is a High-Yield Savings Account?

What Is a High-Yield Savings Account?A high-yield savings account is essentially the same as a traditional account with one key difference — it pays a higher-than-average APY on deposits.

-

Trusting Fintech: Four Critical Moves to Protect Yourself

Trusting Fintech: Four Critical Moves to Protect YourselfA few relatively easy steps can help you safeguard your money when using bank and budgeting apps and other financial technology.

-

Four Steps to Prepare Your Finances for Divorce

Four Steps to Prepare Your Finances for DivorceDivorce is rarely easy, but getting financial paperwork in order, working with professionals and making tough decisions now can take some of the stress out of it.

-

How to Open a Savings Account Online

How to Open a Savings Account OnlineYou may be wondering how to open a savings account online. The process is usually simple and straightforward — with just a few steps you’ll be able to start saving your hard-earned cash.

-

10 Easily Fixable, But Often Overlooked, Financial Planning Items

10 Easily Fixable, But Often Overlooked, Financial Planning Itemspersonal finance It’s easy to let important financial tasks slip your mind, so take a minute to check this list for any to-do items you may have forgotten. It could make a big difference in your bottom line.

-

How to Keep Your Savings Safe

How to Keep Your Savings Safesavings If you want to keep your savings safe but they exceed FDIC and NCUA limits, it's time to open multiple accounts, preferably ones with high yields.

-

Money Market Account or Money Market Fund? How to Choose

Money Market Account or Money Market Fund? How to Choosemoney market accounts Whether you choose a money market account or money market fund largely depends on the money's purpose.