Four Steps to Funding an Education

Prepare, plan, prioritize and persevere.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As Americans, we have the freedom to explore opportunities and pursue our goals; the sky is the limit. Our belief in endless possibilities is particularly true when it comes to educating our children. Every generation wants to provide their kids with more years of school and a higher-quality education than they received. That’s because we believe that a good education is necessary for a better life. In fact, on average, a college degree will result in higher earnings. According to the Bureau of Labor Statistics, an individual with a bachelor’s degree or higher is typically expected to earn 67.7% more than an individual with only a high school degree.

But while the aspiration of providing our children with a better education makes sense, we also have to face reality. One obstacle stands between our goal of educating our children and our ability to achieve it: money.

The education funding puzzle is both challenging and complex. The good news is that, like many puzzles, there is a solution. The bad news is that finding the solution requires focus, time and effort. There isn’t a “one size fits all” solution to achieving this goal. Instead, each family’s solution is unique and reflects their philosophy of education, the reality of their cash flow and a realistic assessment of their financial resources.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

To create your solution and achieve your goal, you must do four things: prepare, plan, prioritize and persevere.

Prepare

While preparation is the key to achieving any financial goal, it is especially true when it comes to college funding.

First, you need to decide whether it would be valuable to work with a financial adviser. You may want to choose an adviser because s/he has the experience and expertise to help you determine the cost of your goals, advise you on how to achieve those goals and help you navigate the investment markets along the way.

Next, with or without an adviser you have to determine how much a child’s education will cost in today’s dollars and how much those costs may increase in the future.

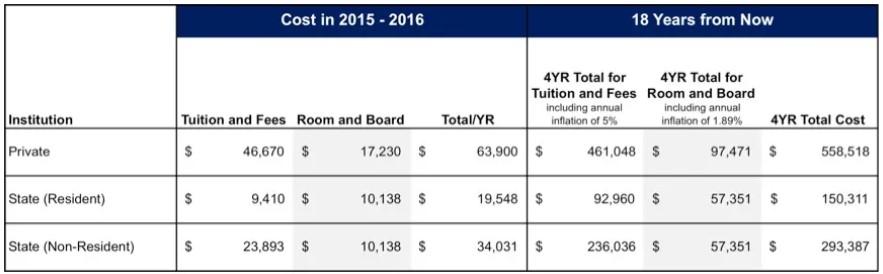

In the chart above, the first column lists the three most common types of four-year educational institutions: private, state (resident) and state (non-resident).

The second column shows annual costs in today’s dollars for each type of school, separated between tuition and fees and room and board. Transportation, books and other fees are not included.

The third column illustrates how those costs may increase if school attendance begins 18 years from now. Because tuition and fee expenses have historically increased at higher average rates than room and board costs, a higher rate of increase has been applied to those costs. (Sources: State school costs, The College Board. Private school costs, Scholarshipworkshop.com. Assumptions: 1.89% core inflation rate applied to annual room and board increases. Tuition and fees are assumed to increase at 5% per year, according to The College Board.)

If you’re like most people, the numbers will surprise you. How much it takes to fund a college education for one or more children can be shocking. But, this is reality.

To make any financial goal more palatable and achievable, you must first determine the entire cost—then reduce the numbers to monthly costs.

Assuming you begin funding your child’s education at birth, you would have to invest the following amounts every month for 21 years (until and through the college years) while earning a 4% average annual rate of return on the dollars you invest:

| Private college: | $1,413.06 |

| State (resident): | $380.29 |

| State (non-resident): | $742.28 |

Plan

Now that you know how much it can cost to fund four years of college, it’s time to create a plan. Begin by asking yourself these questions:

- Given the costs, is college the best and only choice?

- Would a two-year college, technical or trade school be an alternative?

- What kind of higher education funding vehicles are available to high school graduates? Scholarships, grants?

- Would I expect my children to work during high school and save money to offset some of their higher education expenses?

- Are grandparents a source of funding?

Your answers to these questions will help you decide which approach is most realistic and gives you the best odds of success.

Prioritize

Once you’ve answered these questions and you’ve managed your expectations, it’s time to prioritize. Today, just as young couples are having children, often they’re still paying off their own student loans. At the same time they’re paying off student loans, their parents are trying to fund their own retirement. Because there are many moving parts, the approach you take and how you prioritize your options requires flexibility and a balancing of various activities.

Persevere

You’ve calculated your goal, and you know what you need to do to achieve it. Now your challenge is to calmly and consciously remain committed to achieving the goal, month after month, year after year. Financial goals are achieved by people who persevere. You want to remain up-to-date and current on education funding laws and options. You want to regularly invest and stay invested through thick and thin despite changes in your life. You want to focus on your goals regardless of the changes, challenges or discouragement you face.

You can solve the education funding puzzle and achieve your goal by preparing, planning, prioritizing and persevering.

Jan Blakeley Holman, CFP, CIMA, ChFC, CDFA, CFS, GFS, is Director of Advisor Education at Thornburg Investment Management, a global investment management firm.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jan Blakeley Holman is director of advisor education at Thornburg Investment Management. She is responsible for identifying and creating advisor education programs that support financial advisors as they work with their clients and prospects. Jan has spent more than four decades in the financial services industry. Over the course of her career, she’s served as a financial advisor, an advisor to financial advisors and a financial services corporate executive. Visit Thornburg’s website to enjoy more of Jan’s articles and podcasts.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)

I'm a Financial Planner: These Small Money Habits Stick (and Now Is the Perfect Time to Adopt Them)February gets a bad rap for being the month when resolutions fade — in fact, it's the perfect time to reset and focus on small changes that actually pay off.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised FundIf a charitable remainder trust puts too many constraints on your family's charitable giving, consider combining it with a donor-advised fund for more control.

-

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in RetirementThis kind of planning focuses on the intentional design of your estate, philanthropy and long-term care protection.

-

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in Prison

A Wake-Up Call and a Healthy Dose of Terror: How to Survive Your First Days in PrisonThis young man needed to be scared straight after his mother expressed her fear that he was on a path to prison. Hearing these eight do's and don'ts worked.