What Small Businesses Must Know About the SBA's New Stimulus Loans

CARES Act expands select loan programs administered by the Small Business Administration. See if you qualify.

Small-business owners will be able to get loans under the stimulus bill this week. On March 27, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act. The legislation provides a stimulus package worth approximately $2 trillion. The CARES Act expanded certain loan programs administered by the Small Business Administration. It also created a new SBA program to help small-business owners affected by the coronavirus outbreak. The loan programs all have different purposes, so small businesses will have to compare what option works best for them.

The bill established a new $349 billion program to help smalls keep their workforce on the payroll. The Paycheck Protection Program will provide capital to small businesses without collateral requirements, personal guarantees or SBA fees. All loan payments will be deferred for six months but will accrue interest during this period. The SBA will forgive the portion of the loan that is used to cover the first eight weeks of payroll costs, rent, utilities and mortgage interest. Businesses must keep their workforce largely intact during that period to qualify for loan forgiveness. No more than 25% of the forgiven amount can be used for non-payroll costs. Loans can be up to 2.5 times the borrower’s average monthly payroll costs or up to $10 million. The interest rate will be fixed at 1%. (Here's more information about the program. A sample application form for borrowers can be found here.)

Many small businesses will likely qualify for Payroll Protection loans. Businesses and other employers must have been in operation on February 15, 2020, to qualify. Small businesses, nonprofits, self-employed individuals and veterans organizations with 500 or fewer workers can apply for the loans under the new program. Some businesses with fewer than 1,500 employees in certain industries may qualify too (click here to see more information about the SBA’s size standards). Businesses that have pending or existing SBA disaster assistance loans can still receive funding through the Paycheck Protection Program as long as the loans aren’t used for the same thing. A single business can only apply for one loan under the program. Small-business owners can begin applying for PP loans on April 3. Independent contractors and people who are self-employed can begin applying on April 10.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Some lenders will have to become certified by the SBA before they can participate in the PP program. Because the anticipated response is greater than anything ever experienced by the SBA, the agency will allow lenders that don’t currently participate in any of its loan programs to process and service these loans. Federally insured banks, credit unions, farm banks and a broad range of nonbanks can participate in the Paycheck Protection Program, but they must be certified by the SBA first. The loans will come with a 100% guarantee from the SBA. The agency will speed up the certification process and will issue guidance for lenders interested in participating. Lenders have the authority to approve loans on the spot so folks can get their money on the same day. The only requirement is that the loan is first registered with the SBA to make sure the borrower hasn’t already gotten a loan through another bank. Lenders will be compensated by processing fees paid by Uncle Sam. New lenders can submit their application via email to the SBA. The agency has yet to provide any application forms or criteria that these companies will have to meet.

For businesses that need a quick infusion of capital to cover expenses right now, a disaster loan and an emergency grant could help your business. The CARES Act broadened the existing Economic Injury Disaster Loans program maintained by the SBA. The CARES Act significantly expanded the disaster loan eligibility and may provide emergency cash advances that can qualify for forgiveness if used for paid leave, payroll maintenance, meeting higher supply chain costs and other qualified expenses. Those applying for a disaster loan can also receive a cash grant of up to $10,000 within three days of applying for the loan. There are restrictions on businesses that receive the loans. Small businesses must apply for the loans directly with the SBA.

For those needing help to keep up with payments on your current or future SBA loan, the SBA’s Small Business Debt Relief program could help. The program provides immediate relief to small businesses with non-disaster SBA loans, such as the SBA’s 7(a) and 504 loans, and microloans. Under the program, the SBA will cover all payments on these loans, including principal, interest and fees, for six months. You can apply for one of these loans through any lender already participating in these SBA loan programs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rodrigo Sermeño covers the financial services, housing, small business, and cryptocurrency industries for The Kiplinger Letter. Before joining Kiplinger in 2014, he worked for several think tanks and non-profit organizations in Washington, D.C., including the New America Foundation, the Streit Council, and the Arca Foundation. Rodrigo graduated from George Mason University with a bachelor's degree in international affairs. He also holds a master's in public policy from George Mason University's Schar School of Policy and Government.

-

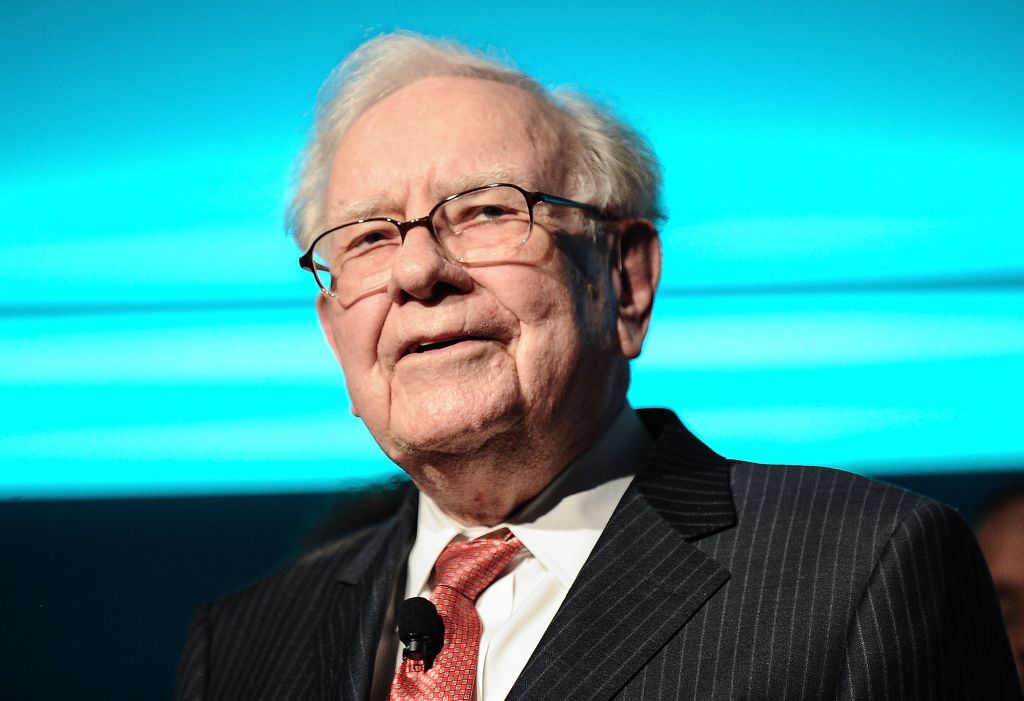

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have TodayBerkshire Hathaway is a long-time market beater, but the easy money in BRK.B has already been made.

-

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor Trusts

New SALT Cap Deduction: Unlock Massive Tax Savings with Non-Grantor TrustsThe One Big Beautiful Bill Act's increase of the state and local tax (SALT) deduction cap creates an opportunity to use multiple non-grantor trusts to maximize deductions and enhance estate planning.

-

Amazon Resale: Where Amazon Prime Returns Become Your Online Bargains

Amazon Resale: Where Amazon Prime Returns Become Your Online BargainsFeature Amazon Resale products may have some imperfections, but that often leads to wildly discounted prices.

-

Roth IRA Contribution Limits for 2025

Roth IRA Contribution Limits for 2025Roth IRAs Roth IRA contribution limits have gone up. Here's what you need to know.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Five Ways to a Cheap Last-Minute Vacation

Five Ways to a Cheap Last-Minute VacationTravel It is possible to pull off a cheap last-minute vacation. Here are some tips to make it happen.

-

How Much Life Insurance Do You Need?

How Much Life Insurance Do You Need?insurance When assessing how much life insurance you need, take a systematic approach instead of relying on rules of thumb.

-

When Is Amazon Prime Day? Everything We Know, Plus the Best Deals on Apple, Samsung and More

When Is Amazon Prime Day? Everything We Know, Plus the Best Deals on Apple, Samsung and MoreAmazon Prime Amazon Prime Day is four days this year. Here are the key details you need to know, plus some of our favorite deals to shop during the sale.

-

How to Shop for Life Insurance in 3 Easy Steps

How to Shop for Life Insurance in 3 Easy Stepsinsurance Shopping for life insurance? You may be able to estimate how much you need online, but that's just the start of your search.