Safe Ways to Bank With Your Smart Phone

Follow these steps to lower the risk of having your personal information stolen.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Using your smart phone to check your bank account balance or deposit a check is convenient. But is it safe?

Hackers are getting better at finding ways to tap into smart phones and capture people’s account numbers and other personal information. However, there are ways to lower your risk of becoming a victim, says Michael Gregg, a cyber security expert and founder of Superior Solutions. Here are his tips:

Don’t use public Wi-Fi to access accounts online. Use your phone provider’s network, instead, because it’s more difficult for hackers to tap into it. Public Wi-Fi connections, on the other hand, are easily compromised not just by savvy cybercriminals but by anyone who downloads a free program, which allows users to see what others are doing online and log onto their accounts as them.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Watch out for smishing (fake text messages). If you get a text message supposedly from your financial institution warning you that there may be a problem with your account, don’t click on any links or call a number in the message. The link could take you to a phony site with malicious software that will give criminals access to your phone. And the number could connect you with scammers who are trying to collect your account information. Go directly to your bank’s Web site to check your account or to get a customer service number. And if you get a text message asking you to download a security update for your phone, don’t be fooled. Smart phone makers don’t send out security updates by text message, Gregg says.

Be careful where you browse. Go to sites you know to conduct financial transactions. And before downloading any banking applications, check your financial institution’s site to make sure it offers one. Apple puts all apps for the iPhone through serious scrutiny, but other smart phone makers do not. A year ago, more than 50 fraudulent mobile banking apps appeared in the Android marketplace and were removed once they were discovered -- after many had bought and downloaded the apps.

Don’t jailbreak your iPhone. You’ll lose your security mechanisms, Gregg says, if you tamper with your iPhone so it can run on another service provider’s network or download additional apps.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Award-winning journalist, speaker, family finance expert, and author of Mom and Dad, We Need to Talk.

Cameron Huddleston wrote the daily "Kip Tips" column for Kiplinger.com. She joined Kiplinger in 2001 after graduating from American University with an MA in economic journalism.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

When Tech is Too Much

When Tech is Too MuchOur Kiplinger Retirement Report editor, David Crook, sounds off on the everyday annoyances of technology.

-

I Let AI Read Privacy Policies for Me. Here's What I Learned

I Let AI Read Privacy Policies for Me. Here's What I LearnedA reporter uses AI to review privacy policies, in an effort to better protect herself from fraud and scams.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

Five Ways to Save on Vacation Rental Properties

Five Ways to Save on Vacation Rental PropertiesTravel Use these strategies to pay less for an apartment, condo or house when you travel.

-

How to Avoid Annoying Hotel Fees: Per Person, Parking and More

How to Avoid Annoying Hotel Fees: Per Person, Parking and MoreTravel Here's how to avoid extra charges and make sure you don't get stuck paying for amenities that you don't use.

-

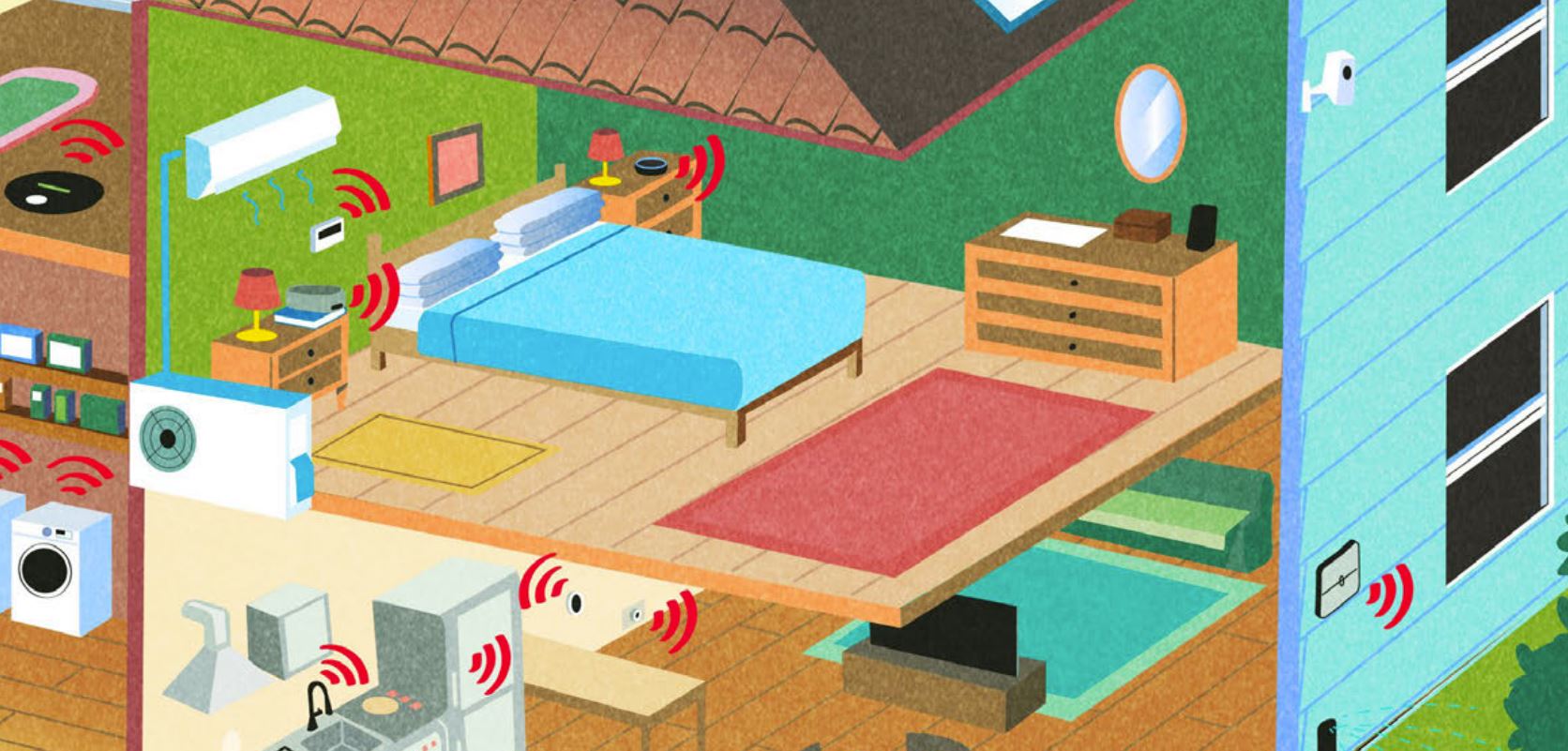

The 27 Best Smart Home Devices

The 27 Best Smart Home Devicesgadgets Innovations ranging from voice-activated faucets to robotic lawn mowers can easily boost your home’s IQ—and create more free time for you.

-

How to Appeal an Unexpected Medical Bill

How to Appeal an Unexpected Medical Billhealth insurance You may receive a bill because your insurance company denied a claim—but that doesn’t mean you have to pay it.

-

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime Membership

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime MembershipFeature Amazon Prime will soon cost $139 a year, $180 for those who pay monthly. If you’re a subscriber, maybe it’s time to rethink your relationship. Here’s a step-by-step guide to canceling Prime.