The Glitter of Precious-Metals ETFs

These five exchange-traded funds give investors a stake in gold, silver, platinum and palladium.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

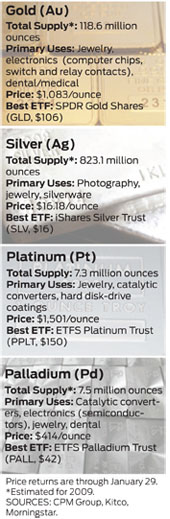

For decades, gold bugs have argued the bullish case for their favorite metal. In recent years, they’ve actually been right. The price of gold has climbed steadily for the past nine years, from $277 an ounce in 2001 to a record high (not adjusted for inflation) of $1,213 in December 2009 as investors piled into the yellow metal because of its reputation as a safe haven and as a hedge against a falling dollar. Gold closed at $1,115 on February 2.

The rising price and the rise of exchange-traded funds have attracted investors in droves. Thanks to ETFs, investors can buy gold without having to open their own Fort Knox. Last year, investors around the world bought 51.2 million ounces of gold, and 35% of that amount came through ETFs. In the case of silver, the figure is even more astounding. Investors snatched up 172 million ounces of silver last year, and 87% of it was via ETFs. Silver closed February 2 at $17 an ounce, well below the record of $50, set in 1980, but far above the $5 level of recent years.

The price gains don’t mean it’s too late to bet on precious metals, but you may want to expand your horizons to commodities that are less well known. In particular, the arrival of two new ETFs makes it easier than ever to invest in platinum and palladium, two precious metals with a wider array of industrial uses than gold and silver. The creative names of these new vehicles are ETFS Physical Platinum Shares (symbol PPLT) and ETFS Physical Palladium Shares (PALL).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

To invest in platinum and palladium, you need to have faith in the strength and durability of the economic recovery. Both metals are used in the catalytic converters found in cars, so strong auto sales would be bullish. The pace of car sales in the U.S. is still well below the record set in 2000, but autos are zooming out of lots in China, which recently supplanted the U.S. as the world’s biggest car-buying nation.

A plus for platinum is a supply shortage stemming from power cuts in South Africa, the world’s largest producer of the metal. Jeffrey Christian, managing director of the CPM Group, a commodities-research firm in New York City, says the price of platinum, now $1,580 an ounce, could go to as high as $1,800, and that of palladium could hit $525, from $442 currently.

Investing in raw materials doesn’t come without risk -- and, in fact, prices of platinum and palladium are actually more volatile than those of gold. Precious metals should represent only a small slice of your portfolio -- 5% at most and probably less for most people.

Despite steady gains in the price of gold, the yellow metal still has many supporters. Juan Carlos Artigas, investment research manager at the World Gold Council, a gold-mining trade group headquartered in London, argues that a dearth of new gold discoveries, buying by central banks, and demand from China and India suggest that the metal has more room to run.

The current metals mania differs from the one seen in the early 1980s, says Christian. “The move into precious metals this time is more permanent because the economic imbalances are worse than they were back then,” he says. Christian sees gold going to $1,400 an ounce early this year, before sinking back to about $1,100 as investors gain confidence in the sustainability of the economic recovery. The price of silver, which is used in flat-screen TVs and solar panels, could end the year as high as $21 an ounce, he says.

The best way to get a piece of gold is through the popular and liquid SPDR Gold Shares (GLD). The ETF sports an expense ratio of 0.40%. (If you’d rather track gold stocks, you can buy another ETF, Van Eck Market Vectors Gold Miners ETF (GDX), which tracks an index of gold-mining stocks.) For access to silver, buy the iShares Silver Trust (SLV), which charges 0.50% per year. Both GLD and SLV provide a stake in the metals, which are housed in vaults located in London. That way you don’t need to buy bars and worry about where to store them safely.

One idea is to buy a bit of all four metals. “What gets people into trouble is making a bet that’s too concentrated,” says Jack Reutemann, founder of Research Financial Strategies.

Or spread your risk by buying an ETF that includes gold and silver as well as other materials, such as oil, corn and soybeans. For broad exposure, we like the PowerShares DB Commodity Index Tracking Fund (DBC). The ETF, based on the Deutsche Bank Liquid Commodity Index, tracks the futures prices of 14 raw materials. Its expense ratio is 0.85%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.