A Grumpy Old Man’s Guide to 401(k) Investing

It’s tough-love time: If you’re lucky enough to have a 401(k) plan, and you’re not filling it to the max, you’re making a rookie mistake.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

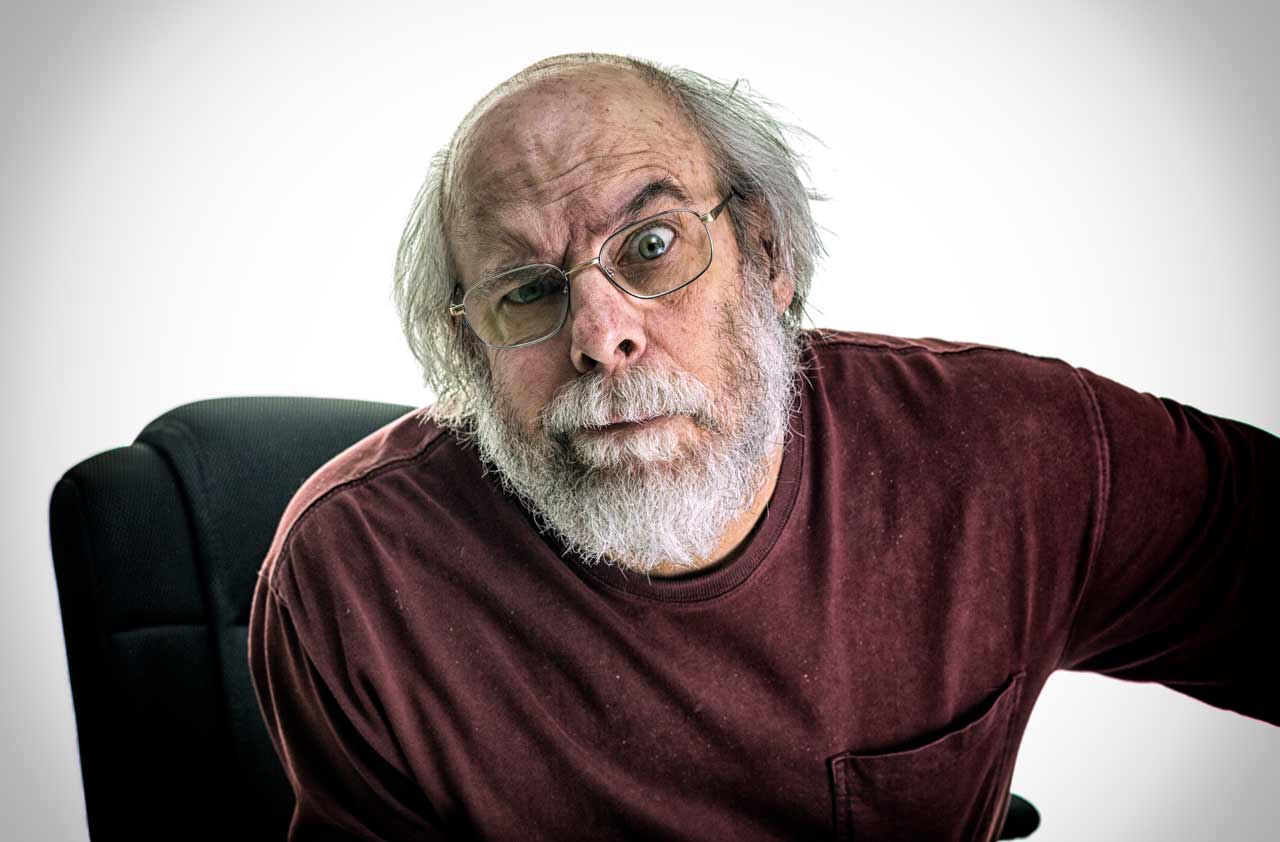

Perhaps I’ve been spending too much time with my young kids, but I’ve gotten to be quite good at wagging my finger and speaking in a stern, fatherly voice. I love my kids dearly, but at times the rascals need a little discipline. And chances are, when it comes to making full use of your 401(k) plan, you do too. So, as my glasses slide down my nose, I’m going to put on my slippers, roll up my Financial Times newspaper and shake it in your general direction.

So, you — yes, you there! Sit down and listen up because this is important. And don’t you dare click out of this column. What I’m about to tell you is for your own good.

If you’re not taking full advantage of your 401(k) plan … well, shame on you. Those things aren’t free, you know. Your employer spends a lot of money administering the thing … for your benefit. So, if you can’t be bothered to log in or fill in the forms to participate, you’re just a derned fool. Do you know how many starving children in Ethiopia would love to have a 401(k) plan like yours?

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

At my first job, we didn’t have 401(k) plans. I had to settle for the measly $2,000 I was allowed to contribute to an IRA at the time. Well, I maxed out that IRA, and I loved it! But what I wouldn’t have done for a proper 401(k) plan. So, show some gratitude, would ya?

I know, I know. Money saved in a 401(k) plan is money you can’t spend on some newfangled gewgaw. But if you make decent money, a huge chunk of it is just going to end up going to the tax man.

Stop and use your head for a minute. If you’re in the 28% tax bracket — and if you’re still single (at your age!), you would be in the 28% bracket at an income of just $91,150 — then you effectively earn a 28% “return” on every dollar you contribute, as of Day One. Would you rather that 28% go to the government? Yeah, that’s what I thought.

You can save $18,000 in a 401(k) plan in 2017. That’s $692 per paycheck. You can do that. Your grandmother used to feed a family of seven growing kids on $692 per year and never complained. So stop your whining, log in to your plan or call your HR department now and get your contributions on track.

Don’t make me come over there and swat you with my newspaper.

And matching … don’t even get me started on matching. When I was your age, I was lucky if my cheapskate boss matched me even 2%. These days, I’ve seen companies match as much as 6% or 7%. If you’re too big of a sissy to contribute the full $18,000 in salary deferral to your 401(k) plan, then for crying out loud, at least contribute enough to get the full matching amount from your employer. If you don’t, you’re leaving money on the table. And I don’t know about you, son, but I don’t have a money tree in the backyard. When someone offers me free money, I take it.

OK, I’m going to unroll the newspaper and push my glasses back into place for a moment. In all seriousness, this is the time of year to make changes to your 401(k) plan. If you’re not already maxing out your 401(k) for the full $18,000 (or $24,000 if you’re 50 or older) you really should make that a priority. Even if the stock market fails to return a single red cent, the tax savings and employer matching alone make it more than worthwhile.

I realize that not everyone can realistically defer $18,000 of their annual pay. If you’re young, recently started a family or have a non-working spouse, that might not be an attainable goal. But here are a few tips to get you closer.

If you got a raise to start the year, I strongly encourage you to allocate the difference to your 401(k) plan. You were already surviving at your previous pay rate; continue to live your current lifestyle a little longer, and push the salary increase into your retirement plan. Years from now, you’ll be happy you did.

If you generally get large tax refunds every year, consider chatting with your HR department about increasing the number of exemptions you claim. This will cause you to withhold less in taxes, which will boost your paychecks. You can then use your higher effective pay to contribute more to your 401(k) plan.

And finally, consider living more modestly. If you rent an apartment, consider getting a roommate or downgrading to a cheaper place. Money spent on rent is effectively money wasted. It’s better to use that money to build your future.

Listen to me, son. It’s for your own good.

Charles Lewis Sizemore, CFA is chief investment officer of Sizemore Capital Management LLC, a registered investment adviser based in Dallas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas. Charles is a frequent guest on CNBC, Bloomberg TV and Fox Business News, has been quoted in Barron's Magazine, The Wall Street Journal, and The Washington Post and is a frequent contributor to Yahoo Finance, Forbes Moneybuilder, GuruFocus, MarketWatch and InvestorPlace.com.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.