Why I Would Avoid Index Funds

Actively managed funds are poised to beat index funds over the next year or two.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

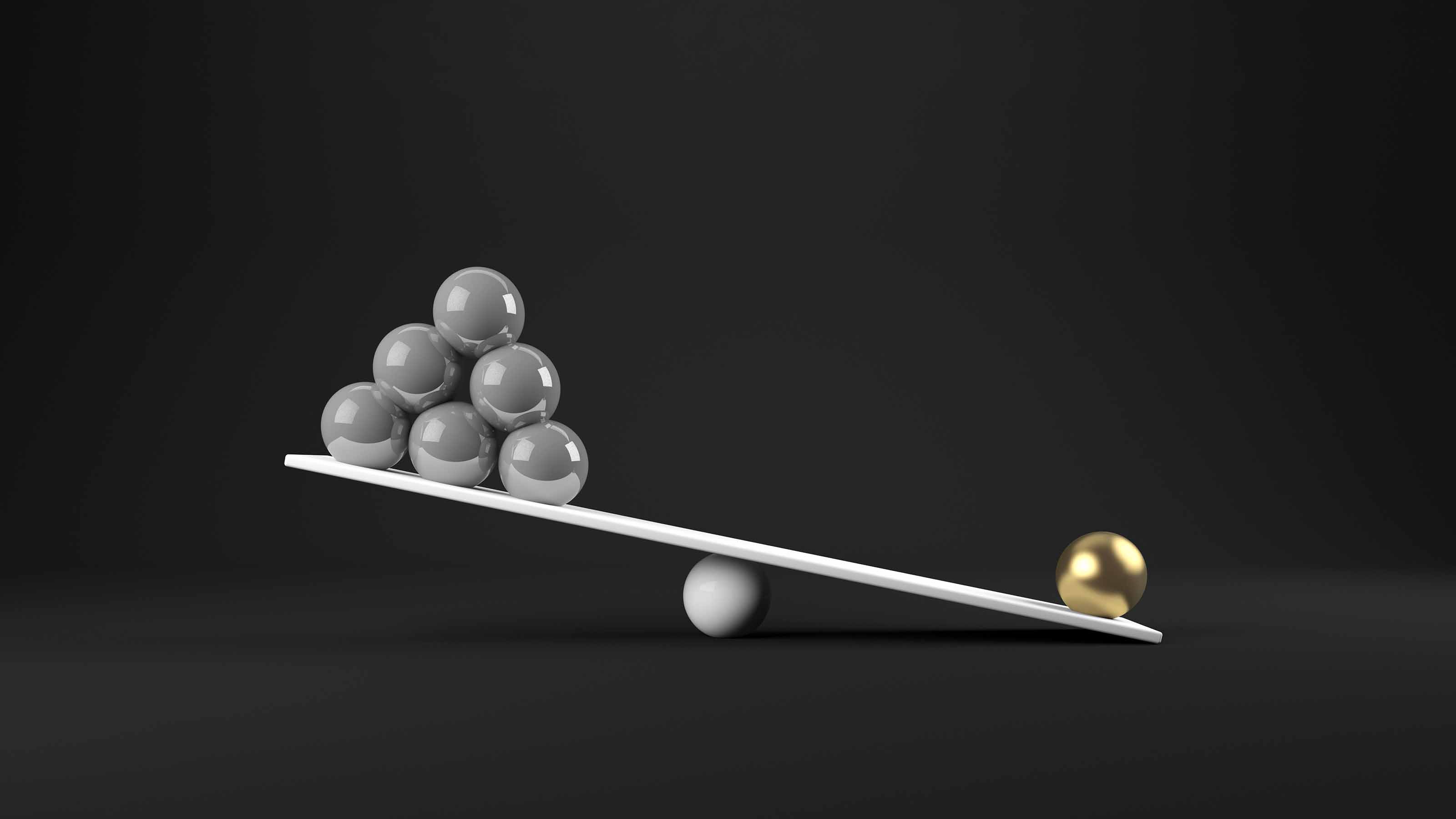

In a typical year, at least two-thirds of actively managed funds fail to beat index funds that fish in the same waters. One reason is that index funds cost a lot less to operate than actively managed funds do. Another is that many managers aren't especially good at their job. But I see good reasons to favor actively managed funds over the next year or two.

First, there's the matter of taxes, which are a headache for actively managed stock funds. Every year, funds are required to distribute to shareholders essentially all realized capital gains, net of capital losses. Index funds pay out little or nothing in taxable capital gains to investors until you sell the fund -- because, in merely tracking an index, they make few stock trades. Exchange-traded funds, which almost always seek to match an index, are even more tax-friendly.

The one good side effect of the fierce 2007-09 bear market is that most funds now boast enormous capital-loss carry-forwards. These are capital losses that funds can employ in the future to offset gains from selling stocks that have appreciated. The upshot: You likely won't owe any capital-gains taxes on an actively managed fund for many years to come -- unless you sell the fund.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The bear market wreaked indiscriminate havoc, and a lot of stocks fell much more than they should have. Declines in the share prices of many great companies, such as Johnson & Johnson (symbol JNJ), Microsoft (MSFT) and Procter & Gamble (PG), were right up there with the dregs. Why? Because hedge funds and other highly leveraged investors needed to raise cash quickly to meet brokerage margin calls as prices tumbled. They often sold shares of well-established companies because they could unload blue chips without moving their prices as dramatically as they would stocks of smaller companies.

Quality stocks now trade at little or no premium to the rest of the market. For example, the three companies mentioned above trade at less than 14 times their past 12 months' earnings. Fund managers can find plenty of growing companies with durable franchises and little debt selling at low prices relative to earnings, sales and other measures.

What's more, in the current market really junky stocks have performed better than high-quality fare. Turner Investment Partners found that since the market bottomed on March 9, the best performers have been those that had fallen the most in price during the bear market, carried the highest ratios of price to book value (assets minus liabilities), were the most volatile and sported the lowest share prices.

All these factors generally presage lousy stock performance. Companies trading at high price-to-book-value ratios typically make poor investments. Stocks that bounce around in price a lot also may be suspect. Lousy companies often deserve to sell for single-digit share prices. Turner calls the rise of these junky stocks "an atypical, perverse phenomenon…. an investing anomaly."

This kind of stock-market behavior never lasts long. Indeed, Turner found that from May 9 through mid June, high-quality stocks outpaced junk stocks. I think that trend will continue for months or years to come-regardless of whether the market goes up, down or sideways.

I'm not alone. The editors of No-Load Fund Analyst, an investment newsletter, say many managers they've interviewed cite exceptional opportunities in stocks -- even if the economy continues to worsen. "We believe we are in the midst of a period in which the environment for stock picking may be much better than the overall outlook for the market," the newsletter concludes.

I wouldn't put much, if any, new money in most index funds just now. Rather than invest in a fund that tracks Standard & Poor's 500-stock index, I'd buy Vanguard Primecap Core (VPCCX), Selected American Shares (SLASX) or Fidelity Contrafund (FCNTX). Instead of a foreign index fund, I'd invest in Dodge & Cox International (DODFX). For stocks of small companies, consider T. Rowe Price Small-Cap Value (PRSVX) in place of a fund that tracks the Russell 2000 index or some other small-cap benchmark. (All of these funds are members of the Kiplinger 25.)

The market gods stack the odds against actively managed funds, with their higher expense ratios and tax disadvantages. I'd bet on the funds mentioned in the preceding paragraph over index funds in any kind of market. But in today's environment, I'm willing to lay odds that good actively managed funds will prevail over the next year or two.

Steven T. Goldberg (bio) is an investment adviser.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

ESG Gives Russia the Cold Shoulder, Too

ESG Gives Russia the Cold Shoulder, TooESG MSCI jumped on the Russia dogpile this week, reducing the country's ESG government rating to the lowest possible level.

-

The 10 Best Schwab Funds for 2022

The 10 Best Schwab Funds for 2022ETFs Whether you're looking to build a core portfolio or position yourself for 2022, Schwab funds offer diversified exposure for a song.

-

New PINK Healthcare ETF Will Donate Fees to Cancer Research

New PINK Healthcare ETF Will Donate Fees to Cancer ResearchIndex Funds Simplify has launched a rare actively managed fund in the healthcare sector. It’s not cheap, but you’ll feel good about where your fees are going.

-

A Simple Portfolio Is All You Need

A Simple Portfolio Is All You NeedFinancial Planning It’s possible to build wealth with only a few funds—or even just one.

-

PODCAST: ETFs and Mutual Funds with Todd Rosenbluth

PODCAST: ETFs and Mutual Funds with Todd RosenbluthIndex Funds Which is better: ETFs or mutual funds? And how do you decide where to put your investments? CFRA fund expert Todd Rosenbluth has some answers. Also, how to take advantage of your leased car’s true value.

-

Water Investing: 5 Funds You Should Tap

Water Investing: 5 Funds You Should TapETFs As the importance of water sustainability becomes ever more apparent, so too do the potential rewards of investing in water.

-

The Truth About Index Funds

The Truth About Index FundsIndex Funds You may think you're diversified by buying an S&P 500 Index fund, but you're making a substantial wager on a handful of stocks.

-

10 Best Value ETFs to Buy for Bundled Bargains

10 Best Value ETFs to Buy for Bundled BargainsETFs Value stocks are finally having their day, and many expect the run to continue. These are the best value ETFs to leverage this long-awaited revival.