6 Problems with Dividend Investing

This strategy may be all the rage with investors today, and that's just one good reason to stay away from it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you pay attention to financial pundits and money blogs, you have probably heard at least a handful of "experts" praise dividend investing. Simply put, "dividend investing" involves investing in companies that offer cash distributions. Most dividend investors roll their distributions back into their investment to accumulate even more wealth over time.

Obviously, this is genius! I mean, who wouldn't want to earn cash dividends they can reinvest for a greater return?

Unfortunately, the allure of dividend investing is worse than smoke and mirrors; it's downright propaganda. Regardless of whether dividend investing has been trending lately, it's not the foolproof retirement answer it's made out to be. Here's why:

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

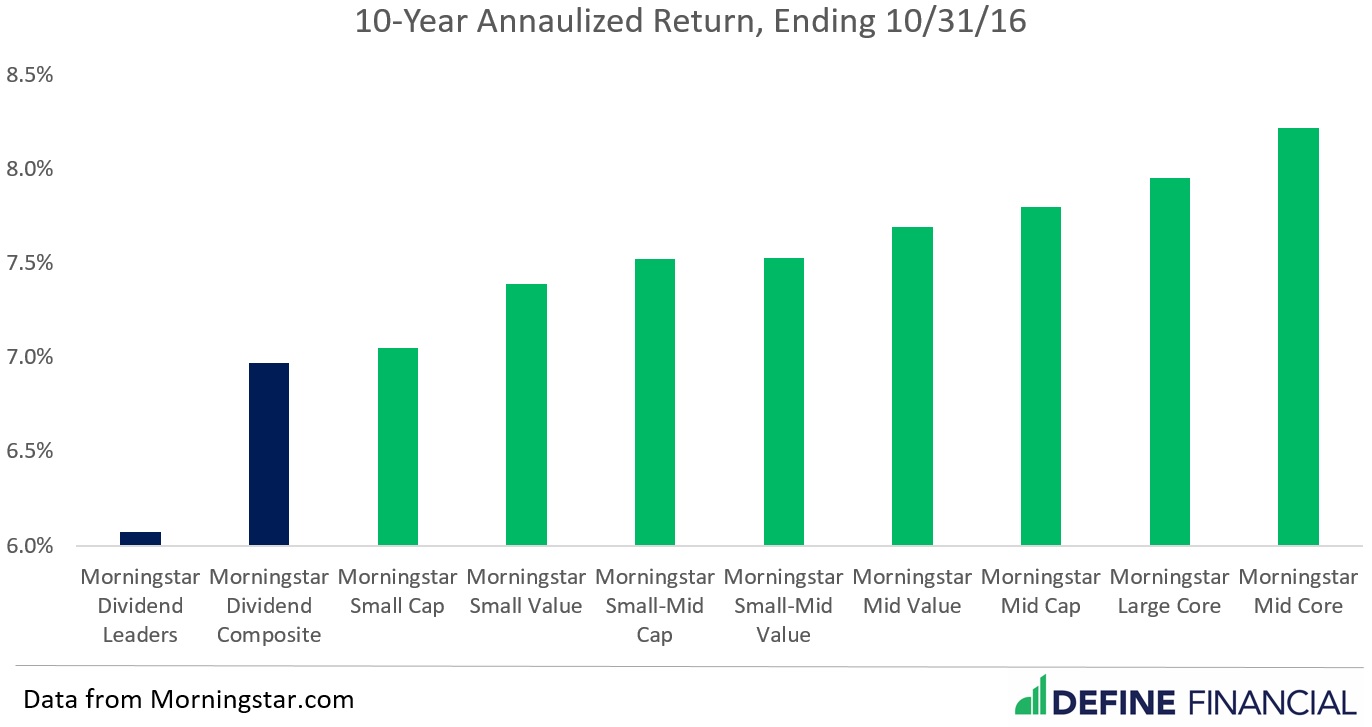

1. Historic Performance

Cash dividends sound great, but is the proof in the pudding? Unfortunately, all signs point to "no" since dividends fail the historic performance test.

A mountain of investment data exists to show how and why investing makes sense. Stocks, for example, have generated investment over-and-above inflation. However, dividend-paying stocks historically have provided lower returns than other types of stocks. The chart below shows exactly what I mean:

Remember, there are three keys to becoming a successful investor: keeping investment costs low, diversifying your investments broadly and not chasing performance.

These three key factors don't really jive with dividend investing—bringing us to the next three problems.

2. Cost

On average, keeping your investment costs low is the key to scoring the best investment return. When you pay less to invest, you keep more money for yourself. The math is pretty simple.

People who focus on dividend investing tend to ignore ongoing costs. A dividend-centered investment fund (a mutual fund or exchange-traded fund) is almost always more expensive than a broader, more-diversified fund.

Let's use these two examples as a basis for this argument:

- iShares Core S&P Total U.S. Stock Market ETF expense ratio: 0.03%

- iShares Select Dividend ETF expense ratio: 0.39%

Look at the two funds above and you'll notice the dividend fund costs 13 times as much as the broader, more diversified fund. And this comparison assumes you're buying low-cost funds to begin with. Obviously, the price difference might be even worse if you're opting for the expensive active-management route.

Believe it or not, you could be paying up to 36 times (or more) for a dividend-focused fund compared to a low-cost broadly diversified index fund.

Over time, these added costs will chip away at your earnings. So, you may be receiving dividends, but you're paying a lot more money out than those dividends are worth.

3. Diversification

The value of diversification is so ubiquitous that I'm sure you've heard this before. Still, it bears repeating that you should never put all of your eggs in one basket.

When you focus your investments on those companies that pay dividends, you're doing the opposite of diversification: you're concentrating your investments into just one type of company. This makes your investments riskier.

So, if you think dividend investing is a safe strategy, I would caution you. Focusing on dividends can be very risky. Let's not forget that it was the very same euphoria for dividend-paying companies that caused a stock market bubble and poor stock market performance of the 1970s.

4. Performance Chasing

Studies continue to demonstrate the value of sticking with buy-and-hold investments. The gist of these studies is this: Over time, investors who buy and hold long-term investments, and specifically low-cost index funds, earn more money than investors chasing the latest investment trend. The recent popularity of dividend investing is no exception.

If you think you're the only one investing in dividends, think again. Trust me when I say everyone and their grandma is doing it, and countless people are blogging about it, too. It's only a matter of time until the dividend bubble follows the gold bubble, real estate bubble and tech bubble of previous generations.

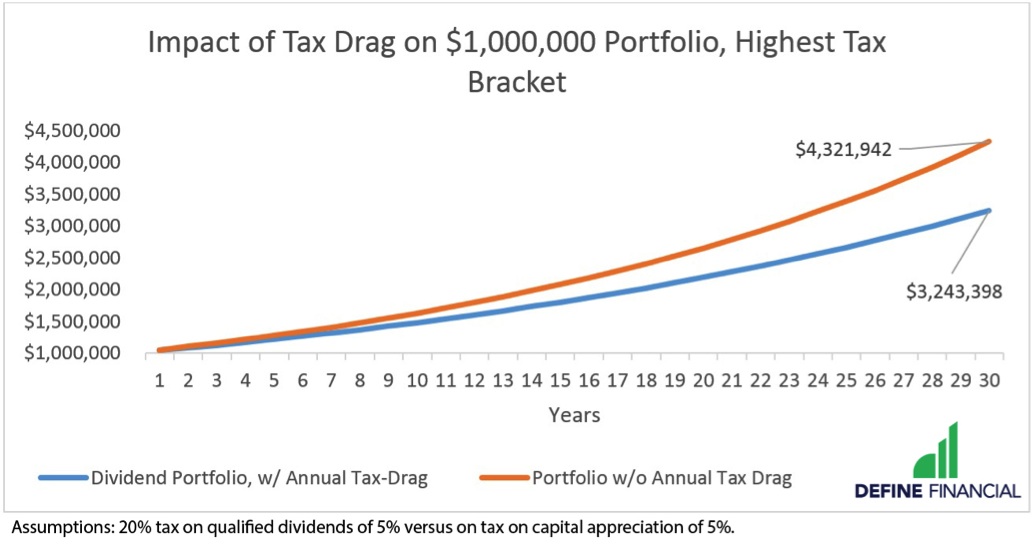

5. Taxes

The final problem with dividend investing is that it comes with hefty tax consequences. Even if you're holding your dividend-paying investments longer than one year (to get better tax treatment), you're still paying taxes every single year. This hurts your investment returns.

Each time you receive a dividend, you get a tax bill. Companies that reinvest their profits are able to give you an investment return without an immediate tax consequence, but that doesn't mean you won't eventually pay the piper. Check out the chart below to see how taxes might drag down your performance over time:

Remember, your tax bill matters more than you think. And over time, more taxes coupled with higher fees and less diversity means less money in your pocket—not more.

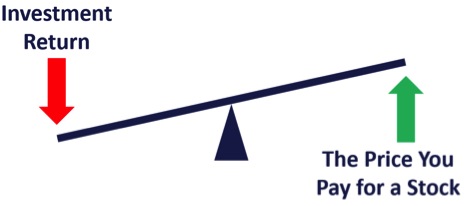

6. Today's Valuations

Simply put, valuations measure how expensive or cheap something is—and they're even more important than taxes. This information is valuable because, historically, cheap things tend to become expensive. On the flip side, expensive things usually go back to being cheap.

So, if you buy something when it's cheap, you can sell it when it becomes expensive and turn a profit. If you buy something expensive, on the other hand, you'll lose money if you sell it after it loses value.

Now, consider this:

Dividend-paying companies are in such demand that the Vanguard Group recently closed the doors on its dividend fund. The significance of this bears repeating: So many people were pouring money into this fund that Vanguard felt they were running out of investment opportunities. The market for dividends is crowded and the investments are expensive. Is this something that you want to put your money in?

How expensive is it? Check out the price-to-book ratio (a commonly used measure of valuation that compares a company's current price to its book value) on the Vanguard dividend fund. It's 60% more expensive than the stock market average. That's pricey!

The Bottom Line: Invest Smarter, and Ignore the Trends

Remember, it's important to think about total return investing—not just a handful of cute dividends. When you invest for total return, you look at all the money you get from your investments. This income can come in the form of dividends paid out in cash or as an increased investment price as the value rises.

Most folks opt for the dividend-investing strategy because they want the income that comes from dividends. The thing is, the alternative to dividend investing—investing for total return—will get you even more money than a dividend-investing strategy ever will.

Skip dividend investing for proven, low-cost, diversified investments instead, and you'll be a lot better off in the end.

See Also: Dividend-Paying Stocks: An Investor's Swiss Army Knife

Taylor Schulte, CFP® is founder and CEO of Define Financial, a San Diego-based fee-only firm. He is passionate about helping clients accumulate wealth and plan for retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Taylor Schulte, CFP®, is founder and CEO of Define Financial, a fee-only wealth management firm in San Diego. In addition, Schulte hosts The Stay Wealthy Retirement Podcast, teaching people how to reduce taxes, invest smarter, and make work optional. He has been recognized as a top 40 Under 40 adviser by InvestmentNews and one of the top 100 most influential advisers by Investopedia.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AI

I Met With 100-Plus Advisers to Develop This Road Map for Adopting AIFor financial advisers eager to embrace AI but unsure where to start, this road map will help you integrate the right tools and safeguards into your work.

-

The Referral Revolution: How to Grow Your Business With Trust

The Referral Revolution: How to Grow Your Business With TrustYou can attract ideal clients by focusing on value and leveraging your current relationships to create a referral-based practice.