IRS Tax Deadline Approaching for Storm Victims in These 4 States

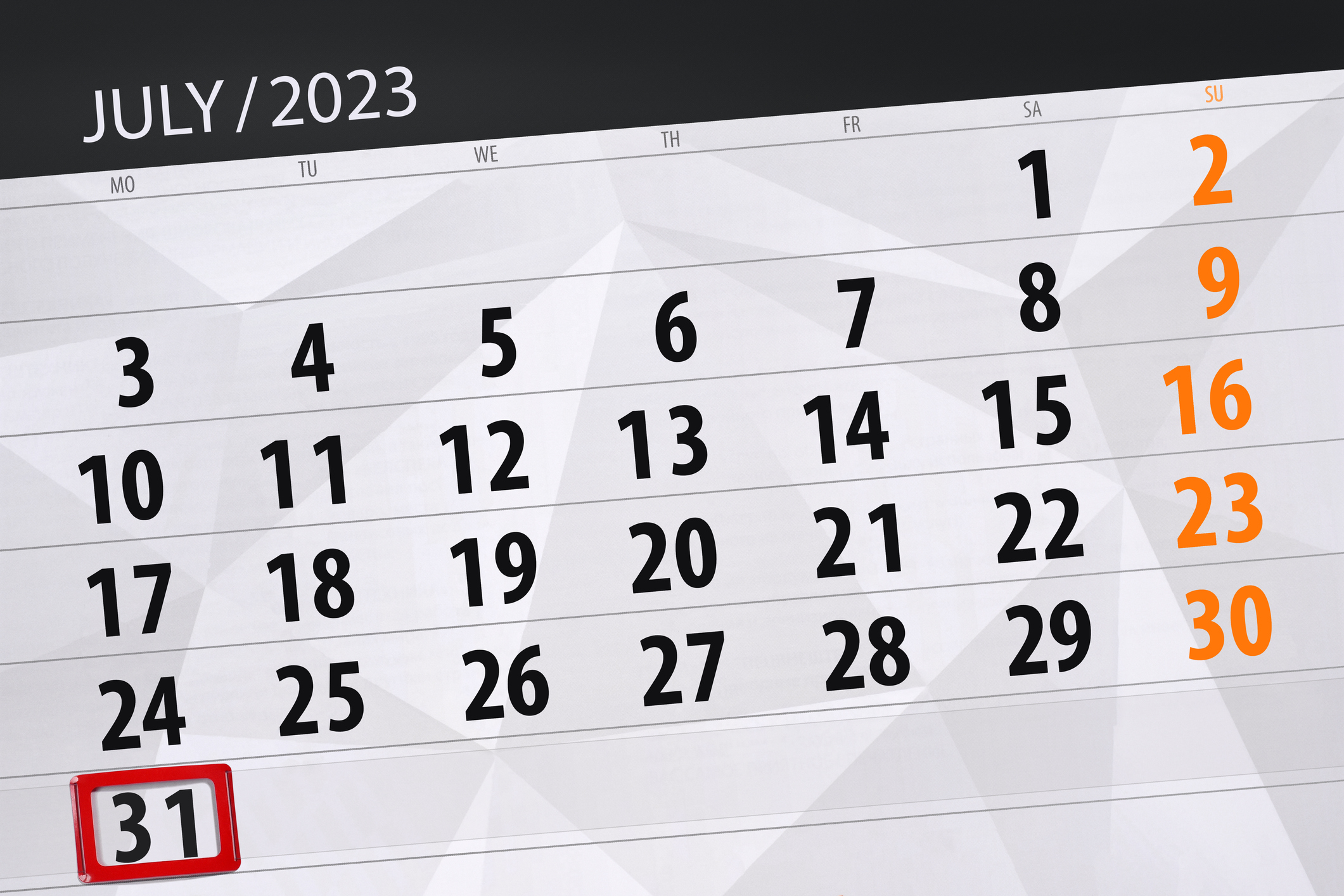

The IRS extended the tax deadline to July 31 for storm victims in several states. Here are the counties in Arkansas, Indiana, Mississippi, and Tennessee that need to file — and pay — federal taxes soon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Following severe storms, the IRS extended the deadline for several states to file federal income tax returns for the 2022 tax year. (Those are the returns normally due in April each year.) However, the IRS extended deadlines were different for various states. So, although not all storm victims have a July 31 tax deadline, impacted taxpayers in 36 counties across four states, Arkansas, Indiana, Mississippi, and Tennessee, do. That deadline is just around the corner.

Tax Deadline in Arkansas

Impacted Arkansas taxpayers that had businesses or lived in federally declared disaster areas were granted a tax deadline of July 31 as a result of tornadoes and severe storms in March.

The extended Arkansas tax deadline applies to individual and business tax returns normally due April 18, 2023. The extension also applies to estimated tax payments that would have normally been due between April 15 and July 31. The extended deadline applies to the following counties.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

- Cross County

- Lonoke County

- Pulaski County

Affected taxpayers in these counties who wish to contribute to 2022 IRAs and HSAs may still do so (as long as contribution limits allow) until July 31, 2023.

Tax Deadline for Indiana Tornado Victims

The IRS extended the Indiana tax deadline for taxpayers in areas impacted by tornadoes that hit the state in March and April. Impacted taxpayers in the following Indiana counties have until July 31 to file federal tax returns, make estimated tax payments, and contribute to 2022 IRAs and HSAs.

- Allen, Benton, and Brown Counties

- Clinton, Grant and Howard Counties

- Johnson, Lake, and Monroe Counties

- Morgan and Owen Counties

- Sullivan and White Counties

Mississippi Tax Deadline Extension

Storm victims in Mississippi received an extended IRS tax deadline after a March tornado devastated areas of the state. The July 31 Mississippi tax deadline applies to estimated tax payments that would have normally been due April 15 and June 15.

Affected taxpayers also have until July 31 to file federal tax returns and contribute to HSAs and IRAs for 2022. Below are the Mississippi areas that qualified for the extension.

- Carroll County

- Humphreys County

- Monroe County

- Montgomery County

- Panola County

- Sharkey County

- Washington County

Tennessee Storm Victims Tax Deadline

The IRS granted a federal tax extension of July 31 for several Tennessee counties after severe storms devastated areas of the state in March and April.

Affected taxpayers in the below counties have until the end of July to file federal tax returns and make estimated tax payments normally due between April 15 and July 31.

- Cannon, Giles, and Hardeman Counties

- Hardin, Haywood, and Johnson Counties

- Lewis, Macon, and McNairy Counties

- Morgan and Rutherford Counties

- Tipton and Wayne Counties

Subject to normal contribution limits, taxpayers with a Tennessee tax deadline of July 31 can contribute to 2022 HSAs and IRAs until the July 31 deadline.

Information for Disaster Victims

Taxpayers affected by storms can visit the IRS’ FAQs for Disaster Victims webpage for more information about extended tax deadlines and other available tax relief. A complete list of federally declared disaster areas can be found on FEMA’s website.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Katelyn has more than 6 years of experience working in tax and finance. While she specialized in tax content while working at Kiplinger from 2023 to 2024, Katelyn has also written for digital publications on topics including insurance, retirement, and financial planning and had financial advice commissioned by national print publications. She believes knowledge is the key to success and enjoys providing content that educates and informs.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.