NYC Congestion Pricing: 'Ghost Tax' or Necessary Fee?

Despite legal hurdles, drivers headed to Manhattan’s downtown district face a new toll as of January 5th.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Running late? Traffic in the ‘City That Never Sleeps’ may get better this year.

New York City’s MTA board cemented Gov. Kathy Hochul’s initiative to implement the nation’s first congestion pricing, imposing fees on drivers entering lower Manhattan.

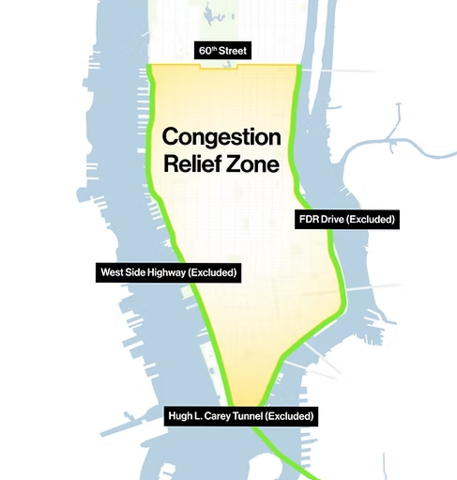

As of January 5, commuters will pay a new toll of $9 to enter Manhattan’s Central Business District south of 60th Street. The plan is designed to provide $15 billion in funding for the city’s transit system and alleviate congestion.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The MTA will phase the toll structure over six years, gradually increasing to $12 in 2028 and $15 by 2031. Overall, the new plan features a 40% reduction in all tolls for vehicles entering downtown Manhattan. It’s expected to save commuters up to $1,500 a year.

The controversial toll has also been the subject of multiple lawsuits, including one from New Jersey, which alleges the fees are illegal and an “unfair burden” on commuters. (More on that below.)

Here’s what you need to know about the nation’s first congestion toll.

Are congestion tolls a tax?

At its root, congestion pricing is designed like a “sin tax” for driving in overcrowded areas, according to the Tax Policy Center.

That’s because congestion tolls impose a slightly higher fee than a regular highway or cross-bridge toll on drivers entering a certain area to reduce traffic and air pollution, as well as the negative implications of highly commuted areas.

Note: “Sin taxes,” such as a cigarette tax, are excise taxes levied to discourage behaviors that negatively impact society, the environment, or your health. The funds are then earmarked for related costs.

For instance, New York’s congestion toll aims to reduce the gridlock in downtown Manhattan and alleviate air pollution. Funds gathered through the toll will be directed to:

- Expanding bus service to outer borough residents and plans to build an Interborough express – slashing 30 minutes of commuting time between Brooklyn and Queens

- Extending Second Avenue Subway

- Investing in the Long Island Rail Road (LIRR)

- Improving elevator service for seniors and people with disabilities

How much will commuters pay?

The amount you’ll end up paying at the toll will depend on the type of vehicle you’re driving, the time of day, and if you have an E-ZPass – the city’s electronic toll collection system stamp.

You’ll be charged more if you commute during MTA’s peak hours (5 a.m. to 9 p.m. on weekdays and 9 a.m. to 9 p.m. on weekends). Overnight toll rates will be 75% cheaper compared to driving into the Congestion Relief Zone during the peak period.

Map of New York City's Congestion Relief Zone, which encompasses downtown Manhattan south of 60th Street. (Source: The Metropolitan Transportation Authority).

Small passenger and commercial vehicles with E-ZPass will pay:

- $9 during MTA’s peak period and $2.25 during the overnight period

- Motorcyclists will pay a $4.50 toll during peak hours and $1.05 during the overnight period

- These vehicles will be charged only once per day.

Passenger vehicles without E-ZPass will be required to pay $13.50 during peak period, and $3.50 overnight. Likewise, motorcyclists will be charged $6.75 during peak hours and $1.65 overnight.

The size of your vehicle will also cost you.

- Large (multi-unit trucks) and tour buses will be charged a peak toll of $21.60, and $5.40 during the overnight period

- Small (single-unit) trucks and some buses will pay $14.40 during peak hours and $3.60 during the overnight period

Catching an Uber or a green cab? Instead of paying a daily toll, for-hire vehicles licensed with the NYC Taxi & Limousine Commission will be eligible for a smaller per-trip charge paid by the passenger. The charge will apply for each trip “to, from, or within” the congestion relief zone.

- Taxis, green cabs, and black cars will charge a 75-cent fee per trip

- App-based services like Uber or Lyft will pay a $1.50 fee per trip for both the peak and overnight period

Discounts and exemptions

Emergency vehicles, school buses, and specialized government vehicles are exempt from the toll charges related to New York’s congestion pricing, but there are some programs you can apply to today.

- A 50% discount is available for low-income drivers enrolled in the Low-Income Discount Plan. The discount kicks in after the first 10 trips of the month and applies to peak periods after that. You must have an adjusted gross income at or below $50,000 to qualify.

- A vehicle registered to a person or designated caregiver of someone with an Individual Disability Exemption Plan (IDEP) may be exempt.

- Organizations that operate vehicles that transport people with disabilities may be exempt if they apply for the Organizational Disability Exemption Plan (ODEP).

Additionally, New York residents with incomes under $60,000 may qualify for a low-income tax credit for the amounts of tolls paid. More information will be provided in the upcoming months.

Will Manhattan’s new toll program last?

It remains to be seen whether Manhattan’s congestion pricing will stick as its popularity has failed to resonate with many residents of the Tri-State area.

New Jersey Gov. Phil Murphy (D) filed a lawsuit alleging the tolls unfairly impact New Jersey commuters. The governor said “it could not be a worse time” to implement a $9 toll on individuals traveling to downtown Manhattan for work, leisure, or school given the economic climate.

Hochul’s congestion pricing framework is also the focus of multiple lawsuits fighting the program, including those brought by the Trucking Association of New York and the United Federation of Teachers, the city’s largest teacher’s union.

“No one disputes that New York needs to invest in public transit. But doing it on the backs of the working people of New York City is wrong, and tone deaf,” UFT President Michael Mulgrew said in a statement

New York House Republicans are also urging President-elect Donald Trump to kill Hochul’s congestion plan once he takes office in January, according to Congressman Mike Lawler.

Note: As of January 2, a federal judge has largely cleared the way for the New York City congestion pricing plan despite the New Jersey lawsuit. The recent ruling requires additional environmental review but doesn't prevent the implementation of the toll for vehicles entering Manhattan below 60th Street.

New Jersey officials continue to contest the plan, arguing potential economic and traffic impacts, but the court's decision suggests the tolling program will proceed as planned. As of January 5, the new congestion tax was implemented in NYC.

Stay tuned for any new developments that may impact your commute.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By Much

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By MuchFood Prices Arkansas and Illinois are the most recent states to repeal sales tax on groceries. Will it really help shoppers with their food bills?

-

New Plan Could End Surprise Taxes on Social Security 'Back Pay'

New Plan Could End Surprise Taxes on Social Security 'Back Pay'Social Security Taxes on Social Security benefits are stirring debate again, as recent changes could affect how some retirees file their returns this tax season.

-

New Gambling Tax Rule Impacts Super Bowl 2026 Bets

New Gambling Tax Rule Impacts Super Bowl 2026 BetsTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.