NYC Congestion Pricing: 'Ghost Tax' or Necessary Fee?

Despite legal hurdles, drivers headed to Manhattan’s downtown district face a new toll as of January 5th.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Running late? Traffic in the ‘City That Never Sleeps’ may get better this year.

New York City’s MTA board cemented Gov. Kathy Hochul’s initiative to implement the nation’s first congestion pricing, imposing fees on drivers entering lower Manhattan.

As of January 5, commuters will pay a new toll of $9 to enter Manhattan’s Central Business District south of 60th Street. The plan is designed to provide $15 billion in funding for the city’s transit system and alleviate congestion.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The MTA will phase the toll structure over six years, gradually increasing to $12 in 2028 and $15 by 2031. Overall, the new plan features a 40% reduction in all tolls for vehicles entering downtown Manhattan. It’s expected to save commuters up to $1,500 a year.

The controversial toll has also been the subject of multiple lawsuits, including one from New Jersey, which alleges the fees are illegal and an “unfair burden” on commuters. (More on that below.)

Here’s what you need to know about the nation’s first congestion toll.

Are congestion tolls a tax?

At its root, congestion pricing is designed like a “sin tax” for driving in overcrowded areas, according to the Tax Policy Center.

That’s because congestion tolls impose a slightly higher fee than a regular highway or cross-bridge toll on drivers entering a certain area to reduce traffic and air pollution, as well as the negative implications of highly commuted areas.

Note: “Sin taxes,” such as a cigarette tax, are excise taxes levied to discourage behaviors that negatively impact society, the environment, or your health. The funds are then earmarked for related costs.

For instance, New York’s congestion toll aims to reduce the gridlock in downtown Manhattan and alleviate air pollution. Funds gathered through the toll will be directed to:

- Expanding bus service to outer borough residents and plans to build an Interborough express – slashing 30 minutes of commuting time between Brooklyn and Queens

- Extending Second Avenue Subway

- Investing in the Long Island Rail Road (LIRR)

- Improving elevator service for seniors and people with disabilities

How much will commuters pay?

The amount you’ll end up paying at the toll will depend on the type of vehicle you’re driving, the time of day, and if you have an E-ZPass – the city’s electronic toll collection system stamp.

You’ll be charged more if you commute during MTA’s peak hours (5 a.m. to 9 p.m. on weekdays and 9 a.m. to 9 p.m. on weekends). Overnight toll rates will be 75% cheaper compared to driving into the Congestion Relief Zone during the peak period.

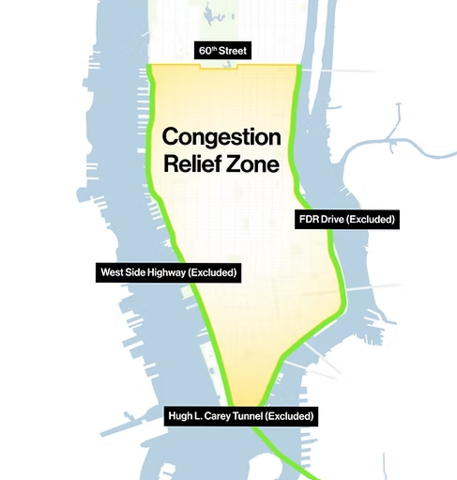

Map of New York City's Congestion Relief Zone, which encompasses downtown Manhattan south of 60th Street. (Source: The Metropolitan Transportation Authority).

Small passenger and commercial vehicles with E-ZPass will pay:

- $9 during MTA’s peak period and $2.25 during the overnight period

- Motorcyclists will pay a $4.50 toll during peak hours and $1.05 during the overnight period

- These vehicles will be charged only once per day.

Passenger vehicles without E-ZPass will be required to pay $13.50 during peak period, and $3.50 overnight. Likewise, motorcyclists will be charged $6.75 during peak hours and $1.65 overnight.

The size of your vehicle will also cost you.

- Large (multi-unit trucks) and tour buses will be charged a peak toll of $21.60, and $5.40 during the overnight period

- Small (single-unit) trucks and some buses will pay $14.40 during peak hours and $3.60 during the overnight period

Catching an Uber or a green cab? Instead of paying a daily toll, for-hire vehicles licensed with the NYC Taxi & Limousine Commission will be eligible for a smaller per-trip charge paid by the passenger. The charge will apply for each trip “to, from, or within” the congestion relief zone.

- Taxis, green cabs, and black cars will charge a 75-cent fee per trip

- App-based services like Uber or Lyft will pay a $1.50 fee per trip for both the peak and overnight period

Discounts and exemptions

Emergency vehicles, school buses, and specialized government vehicles are exempt from the toll charges related to New York’s congestion pricing, but there are some programs you can apply to today.

- A 50% discount is available for low-income drivers enrolled in the Low-Income Discount Plan. The discount kicks in after the first 10 trips of the month and applies to peak periods after that. You must have an adjusted gross income at or below $50,000 to qualify.

- A vehicle registered to a person or designated caregiver of someone with an Individual Disability Exemption Plan (IDEP) may be exempt.

- Organizations that operate vehicles that transport people with disabilities may be exempt if they apply for the Organizational Disability Exemption Plan (ODEP).

Additionally, New York residents with incomes under $60,000 may qualify for a low-income tax credit for the amounts of tolls paid. More information will be provided in the upcoming months.

Will Manhattan’s new toll program last?

It remains to be seen whether Manhattan’s congestion pricing will stick as its popularity has failed to resonate with many residents of the Tri-State area.

New Jersey Gov. Phil Murphy (D) filed a lawsuit alleging the tolls unfairly impact New Jersey commuters. The governor said “it could not be a worse time” to implement a $9 toll on individuals traveling to downtown Manhattan for work, leisure, or school given the economic climate.

Hochul’s congestion pricing framework is also the focus of multiple lawsuits fighting the program, including those brought by the Trucking Association of New York and the United Federation of Teachers, the city’s largest teacher’s union.

“No one disputes that New York needs to invest in public transit. But doing it on the backs of the working people of New York City is wrong, and tone deaf,” UFT President Michael Mulgrew said in a statement

New York House Republicans are also urging President-elect Donald Trump to kill Hochul’s congestion plan once he takes office in January, according to Congressman Mike Lawler.

Note: As of January 2, a federal judge has largely cleared the way for the New York City congestion pricing plan despite the New Jersey lawsuit. The recent ruling requires additional environmental review but doesn't prevent the implementation of the toll for vehicles entering Manhattan below 60th Street.

New Jersey officials continue to contest the plan, arguing potential economic and traffic impacts, but the court's decision suggests the tolling program will proceed as planned. As of January 5, the new congestion tax was implemented in NYC.

Stay tuned for any new developments that may impact your commute.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.