Gov. Hochul Wants to Triple the New York Child Tax Credit

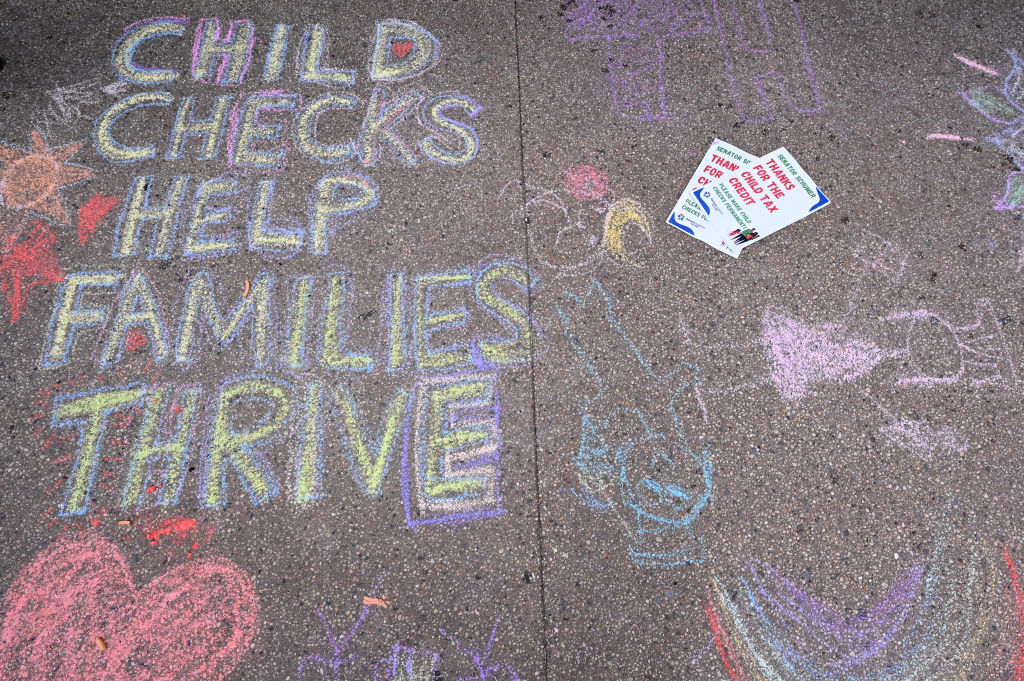

Millions of New York families could get a larger state child tax credit check over the next two years under a new proposal.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

New York Gov. Kathy Hochul proposed expanding the Empire State Child Credit as part of her 2025 State of the State executive agenda to triple its current worth.

The proposal aims to increase the maximum annual credit to $1,000 per child under age 4 and up to $500 per child between the ages of 4 and 16. Currently, New York families can get up to $330 per child. According to the governor, the increase would benefit 1.6 million New York taxpayers and as many as 2.75 million children.

Hochul’s latest pledge comes as nearly 80% of New York families are struggling to afford groceries, according to data from No Kid Hungry. To add insult to injury, families commuting to lower Manhattan are facing steep tolls as part of NYC’s new congestion pricing this year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Here’s what you should know about Hochul’s new child tax credit expansion proposal, and how it may ease the strain in your pocket if successful.

New York child tax credit increase

Last year, more than 1 million New York families received the Empire State Child Credit without any need to apply for financial aid.

As Kiplinger reported, some $350 million in NY state revenues were delivered to eligible New Yorkers through August, helping parents afford childcare expenses, food, and other necessary items.

Gov. Hochul’s plan would triple the maximum credit amount for infants and nearly double the amount for older children, but the changes would be phased in over two years.

- Eligible families with children under 4 would get a maximum $1,000 credit in 2025

- Those with kids between the ages of 4 and 16 would get a maximum of $500 credit during the 2026 tax year

Additionally, the proposed expansion would adjust the income threshold for the credit, helping middle-class families gain eligibility.

- Households with incomes up to $110,000 would get the full $1,000 credit for younger children and $500 for older children

- The benefit would gradually decrease until phasing out at a $170,000 income level

Millions of children would benefit from the CTC expansion

Gov. Hochul’s pledge comes a year after she successfully expanded the Empire State Child Credit to include newborns and children under 4. In 2023, the credit was only available for children 4 years and older.

That measure alone broadened the credit’s availability to more than 600,000 previously excluded children last year.

If successful, Hochul’s new proposal is estimated to reduce child poverty by 8.2%. When combined with other policy changes by Gov. Hochul, including expanding subsidized child care, it would reduce poverty levels by 17.7%.

According to the Governor's office, the impact of the expansion would be notable:

| Region | Estimated Household Benefiting | Estimated Children Benefiting |

| New York City | 740,000 | 1.2 million |

| Long Island | 215,000 | 355,000 |

| Mid-Hudson | 180,000 | 330,000 |

| Western New York | 118,000 | 207,000 |

| Finger Lakes | 104,000 | 180,000 |

| Capital Region | 86,000 | 145,000 |

| Central New York | 67,000 | 116,000 |

| Southern Tier | 51,000 | 89,000 |

| Mohawk Valley | 43,500 | 76,500 |

| North Country | 35,000 | 61,000 |

What’s next for New York taxpayers in 2025

Millions of New York families would greatly benefit from Gov. Hochul’s proposed expansion of the Empire State Child Credit. Not only is the cost of quality child care rising, but inflation is also putting pressure on the price of everyday goods and services.

Separately, a recent survey from No Kid Hungry revealed that families across New York were struggling to keep up with the rising costs of food.

- 79% of New Yorkers said it was harder to afford groceries last year, up 6% from 2023

- 85% said the cost of food outpaced their income

- 58% of New Yorkers said they were stressed about affording nutritious food compared to the previous year

While an expansion to the Empire State Child Credit would be welcome, NY residents are also battling other new taxes this year that are taking a bit out of their earnings.

As reported by Kiplinger, New York City’s new congestion pricing tax increased toll costs for commuters entering lower Manhattan. The tax has faced major backlash and multiple lawsuits contesting the fees.

So, stay tuned to any changes that may impact your taxes in New York.

More on New York Taxes

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Gabriella Cruz-Martínez is a finance journalist with 8 years of experience covering consumer debt, economic policy, and tax.

Gabriella’s work has also appeared in Yahoo Finance, Money Magazine, The Hyde Park Herald, and the Journal Gazette & Times-Courier.

As a reporter and journalist, she enjoys writing stories that empower people from diverse backgrounds about their finances, no matter their stage in life.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump AccountTax Breaks Filing income taxes in 2026? You won't want to miss Form 4547 to claim a $1,000 Trump Account for your child.

-

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By Much

In Arkansas and Illinois, Groceries Just Got Cheaper, But Not By MuchFood Prices Arkansas and Illinois are the most recent states to repeal sales tax on groceries. Will it really help shoppers with their food bills?

-

7 Bad Tax Habits to Kick Right Now

7 Bad Tax Habits to Kick Right NowTax Tips Ditch these seven common habits to sidestep IRS red flags for a smoother, faster 2026 income tax filing.

-

New Plan Could End Surprise Taxes on Social Security 'Back Pay'

New Plan Could End Surprise Taxes on Social Security 'Back Pay'Social Security Taxes on Social Security benefits are stirring debate again, as recent changes could affect how some retirees file their returns this tax season.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

New Gambling Tax Rule Impacts Super Bowl 2026 Bets

New Gambling Tax Rule Impacts Super Bowl 2026 BetsTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.