5 Dividend Stocks to Buy While They Are Cheap

The roller-coaster market of 2016 has tossed a lot of companies around.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The roller-coaster market of 2016 has tossed a lot of companies around. We've identified five that have good long-term prospects but have valuations (sometimes due to recent setbacks) that spell good growth potential — and solid dividend yields to cash in on while you wait for their shares to appreciate.

Prices and other data are as of June 8.

Ameriprise

- Symbol: AMPShare price: $101.4452-week range: $76.00 - $130.69Earnings per share: Current year: $9.43, next year: $10.99Price-earnings ratio: 10

- SEE ALSO: 6 Great ETFs for Holding Value Stocks

The firm is transitioning from a life insurer to an investment powerhouse, with more than $800 billion in assets under management. Worries about the impact of the Department of Labor’s new fiduciary rule for advisers have weighed on the stock, but any additional regulatory hurdles won’t impair the business significantly, says Mark Finn, manager of the T. Rowe Price Value fund. The shares sell for 10 times estimated earnings and yield a healthy 3.0%.

Apple

- Symbol: AAPLShare price: $98.9452-week range: $89.47 - $132.97Earnings per share: Current year: $8.27 (FY ending September 2016), next year: $9.11 (FY ending September 2017)Price-earnings ratio: 12 (based on estimated earnings for the next four quarters ending March 2017)

You can debate whether the iPhone 7, expected to launch this fall, will be a blockbuster or a dud, but Apple’s stock, down 12% since mid-April, is trading as though the company’s legendary smartphones are facing a long-term decline. Sales of iPhones may not be growing as rapidly as they once did, but demand is more resilient than the stock implies, says Morningstar analyst Brian Colello. Meanwhile, Apple generates tons of cash, which it shares via stock buybacks and a rapidly growing dividend. The stock yields 2.3%.

Capital One Financial

- Symbol: COFShare price: $72.1052-week range: $58.49 - $92.10Earnings per share: Current year: $7.54, next year: $8.18Price-earnings ratio: 9

- SEE ALSO: Best Low-Volatility Stocks for the Next Bear Market

Credit cards still supply the bulk of Capital One’s profits, but the company is evolving into a diversified commercial and consumer lender. Loan growth has room to run before credit losses start to accelerate. We’re in the bottom of the third inning when it comes to the credit cycle, says Morgan Stanley. Yet the stock trades at just 9 times estimated year-ahead earnings and yields 2.2%.

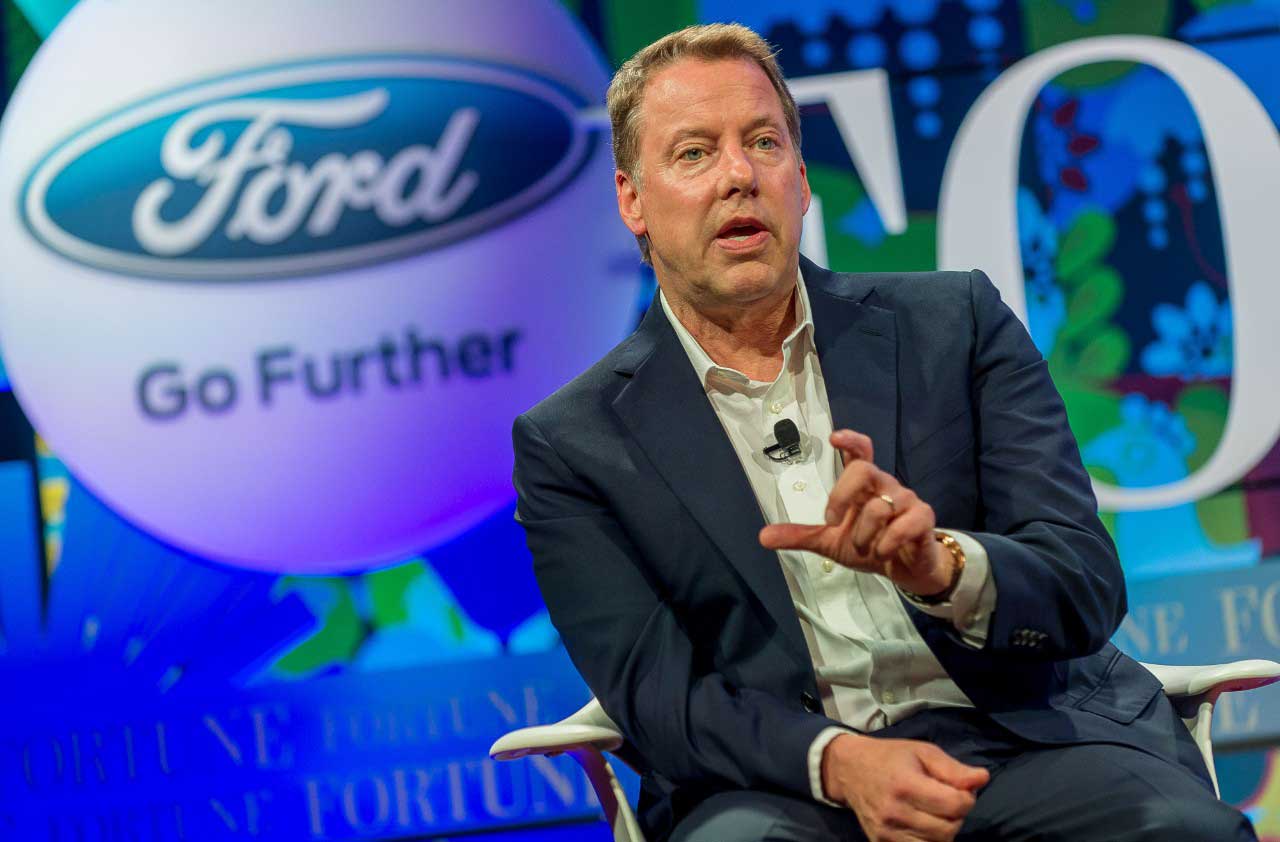

Ford Motor Co.

- Symbol: FShare price: $13.3652-week range: $10.44 - $15.84Earnings per share: Current year: $2.09, next year: $2.13Price-earnings ratio: 6

A pickup in gasoline prices hasn’t kept buyers away from Ford’s vehicles—April’s U.S. sales were the best in a decade. The country’s second-largest carmaker is keeping a lid on costs, improving economies of scale by building more models on common platforms and pruning the product mix to focus on its Ford and Lincoln brands. The stock yields 4.5%, and S&P Capital IQ sees the annual payout rate of 60 cents a share heading higher.

Microsoft

- Symbol: MSFTShare price: $52.0452-week range: $39.72 - $56.85Earnings per share: Current year: $2.66 (FY ending June 2016), next year: $2.89 (FY ending June 2017)Price-earnings ratio: 19 (based on estimated earnings for the next four quarters ending March 2017)

- SEE ALSO: 7 Good Utility Stocks Paying Steady Dividends

Shares of the desktop-software giant took a one-day hit of 7% in April after the company reported disappointing quarterly results. But a shift in focus from a weakening personal-computer market to the company’s rapidly growing cloud business holds promise. “The cloud is a huge opportunity,” says T. Rowe Price’s Finn. Yield is 2.8%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

Best Mutual Funds to Invest In for 2026

Best Mutual Funds to Invest In for 2026The best mutual funds will capitalize on new trends expected to emerge in the new year, all while offering low costs and solid management.

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Stocks Slip Ahead of July CPI Report: Stock Market Today

Stocks Slip Ahead of July CPI Report: Stock Market TodayThe latest inflation updates roll in this week and Wall Street is watching to see how much of an impact tariffs are having on cost pressures.

-

Nasdaq Ends the Week at a New High: Stock Market Today

Nasdaq Ends the Week at a New High: Stock Market TodayThe S&P 500 came within a hair of a new high, while the Dow Jones Industrial Average still has yet to hit a fresh peak in 2025.

-

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market Today

Stocks Swing Lower as Eli Lilly, Fortinet Spiral: Stock Market TodayThe main indexes finished well off their session highs after a disappointing batch of corporate earnings reports.

-

Stocks Rally on Apple Strength: Stock Market Today

Stocks Rally on Apple Strength: Stock Market TodayThe iPhone maker will boost its U.S. investment by $100 billion, which sent the Dow Jones stock soaring.

-

The Best Stocks of the Century

The Best Stocks of the CenturyAs we near the 25-year mark, we looked at which stocks have returned the most. Here are the 10 best stocks of the century so far.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.