5 Defense Stocks to Buy to Toughen Up Your Portfolio

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Hold on to your hats, brace yourself for an uptick in volatility … and perhaps give defense stocks a look this October.

Goldman Sachs’ equity derivatives strategist John Marshall, in a recent report to clients, writes that, since 1928, volatility has been 25% higher on average during the month of October.

“Not only are earnings day moves rising relative to average daily moves, but October tends to be the quarter with the largest absolute earnings day moves for U.S. stocks,” Marshall writes. And it’s no coincidence. “We believe it is a critical period for many investors and companies that manage performance to calendar year-end.”

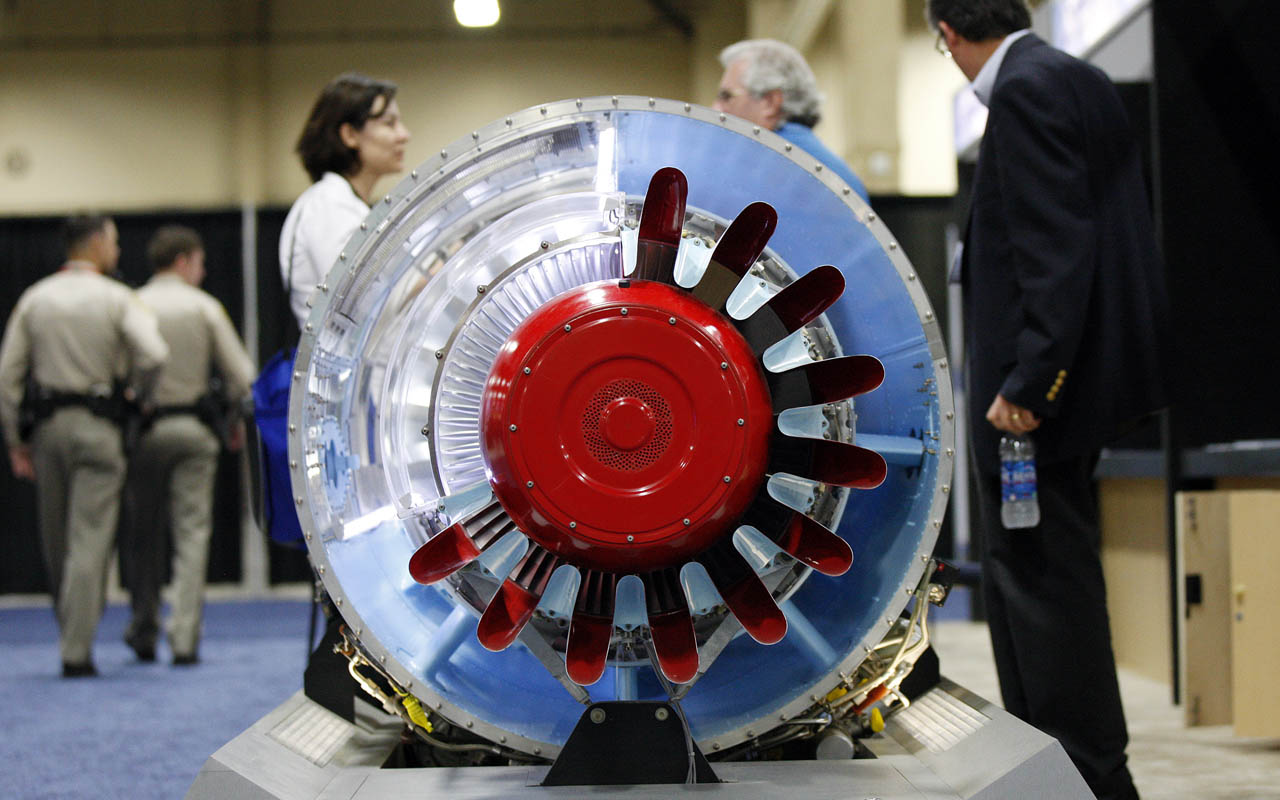

How should investors play this potential bout of choppiness? Get defensive – with defense stocks. Aerospace, defense and other companies that have a hand in national security are traditionally more defensive investments. They also offer notably low exposure to Chinese trade war tensions.

Encouragingly, the iShares U.S. Aerospace & Defense ETF (ITA) is currently trading up 30% year-to-date. That’s better than the S&P 500 (+18% YTD) and Dow Jones Industrial Average (+15%).

Here are five intriguing defense stocks to buy for … well, defense. We turned to TipRanks for analyst ratings across the industry. All five of these stock picks score a Moderate Buy or Strong Buy consensus based on ratings from the last three months.

Data is as of Sept. 29.

CACI International

- Market value: $5.7 billion

- TipRanks consensus price target: $250.00 (10% upside potential)

- TipRanks consensus rating: Moderate Buy

- CACI International (CACI, $227.50) provides information solutions and services to support national security missions. For example, to address the growing threat posed by drones, CACI’s SkyTracker Technology Suite can covertly detect and track unmanned aircraft systems (UAS).

At CACI’s recent investor day, management revealed that its key focus now comes from driving growth through its mission technology offerings, which currently account for about 30% of product revenue. CACI estimates mission technology has a $90 billion total addressable market (TAM) that will grow at an impressive 6% annually over the next five years – that’s three times as fast as the estimated 2% CAGR for the company’s enterprise business, which has an estimated TAM of $130 billion.

Credit Suisse’s Robert Spingarn applauds that decision. “Mission technology (a ~$1.7B business now) has higher market growth, higher margin potential, and is a top priority for the (Department of Defense) customer – making it an understandable choice for management’s focus,” he writes. His Outperform rating (equivalent of Buy) comes with a Street-high $269 price target that implies 18% upside potential from current prices.

Multiple analysts reiterated their bullish calls on CACI after the event. Most notably, Goldman Sachs’ Gavin Parsons boosted his Buy rating to a rare Conviction Buy. That rating is given to equities that Goldman holds in particularly high regard, making CACI among the top defense stocks to buy at the moment. The analyst cited his expectation for “accelerating organic revenue growth to drive higher estimates.”

This positive review came alongside a $258 price target, suggesting 13% upside from here. See what other top analysts have to say about CACI on TipRanks.

Boeing

- Market value: $215.4 billion

- TipRanks consensus price target: $419.00 (9% upside potential)

- TipRanks consensus rating: Moderate Buy

- Boeing (BA, $382.86), largest among defense stocks, currently garners a Moderate Buy consensus from the Street. No doubt, it’s an expression of cautious optimism as analysts wait to see what happens next with the company’s 737 Max. The fastest-selling plane in Boeing’s history was grounded in March after two fatal crashes killed a total of 346 people.

The latest? Boeing CEO Dennis Muilenburg said in mid-September that “a phased ungrounding of the airplane amongst regulators from around the world is a possibility.”

Credit Suisse’s Robert Spingarn expressed optimism a week before Muilenburg’s comments, writing, “We continue to expect that the plane will return to service eventually, and reiterate our long-term positive view and Outperform rating on Boeing.”

Morgan Stanley’s Rajeev Lalwani has gone one step further. He calls BA his “top pick” in the aerospace and defense industry and sees a “clear path” for shares to reach $500 (31% upside potential). The analyst points out Boeing’s strong balance sheet, and that the company has managed to retain “meaningful leverage to mitigate liquidity risks.”

“The combination of a healthy free cash flow yield, a stable commercial aerospace backdrop, and positive upcoming data points” are more bullish points. Lalwani is forecasting annual earnings per share (EPS) growth of 10% to 15% (vs peers at under 10%) beyond 2020, and he argues that the grounding “creates a buying opportunity while the aerospace cycle is steady.” You can check out other current pro opinions on BA at TipRanks.

Heico

- Market value: $16.7 billion

- TipRanks consensus price target: $146.13 (17% upside potential)

- TipRanks consensus rating: Moderate Buy

- Heico (HEI, $124.74) is a rapidly growing aerospace and electronics company, and its focus on niche markets stands out among defense stocks. Shares have surged 61% year-to-date, and while some analysts are wary at these levels, others argue that HEI’s lofty valuation is justified.

Interestingly, while the stock scores a cautiously optimistic Moderate Buy consensus from all analysts, it garners a more bullish Strong Buy consensus over TipRanks’ top-rated analysts. For instance, five-star Credit Suisse analyst Robert Spingarn (Outperform) anticipates consistent annual EPS growth of about 16% between 2018 and 2021.

“Though valuation remains in the stratosphere, we continue to believe that HEI’s exceptional execution, compounding cash flows, and solid M&A track record warrant a sizable premium,” Spingarn writes. He made the call after Heico reported a “beat-and-raise” quarter and sustained its recent streak of blockbuster organic sales growth.

Spingarn reiterated his Outperform rating and boosted his price target on the defense stock from $133 all the way to $163. That indicates 31% of additional upside potential from here. The analyst is confident that Heico can continue to outgrow its addressable market thanks to new product introductions, greater customer penetration and an expanding client base. “HEI’s long-term focused investor base appears willing to hold the shares despite the valuation,” he writes, suggesting to buy on any weakness. Find out how the Street’s average price target for HEI breaks down.

United Technologies

- Market value: $117.7 billion

- TipRanks consensus price target: $152.25 (12% upside potential)

- TipRanks consensus rating: Moderate Buy

Keep a close eye on aircraft manufacturing giant United Technologies (UTX, $136.39). The company is on the cusp of a whopping $50 billion merger with major U.S. defense contractor Raytheon. If the “merger of equals,” announced in June, receives approval at special shareholder meetings in October, the result will be a new aerospace and defense powerhouse boasting $74 billion in 2019 pro forma revenues.

“We like the proposed RTN merger for technology synergies and enhanced financial flexibility,” top Cowen analyst Cai von Rumohr writes. Shareholder approval seems likely given diminished activist resistance, he argues, and the Defense Department appears to support the deal.

But this is a “win-win” situation, because von Rumohr is a fan of UTX with or without Raytheon. He says if the merger doesn’t go through, United Technologies should move closer to its estimated sum-of-the-parts valuation of $155 to $160 per share, “since UTX Aero will be the last large cap commercial aero systems ‘pure’ play.” That would be 17% upside at the high end of the range.

Von Rumohr also believes investors are underappreciating major cyclical turns at Otis (the elevator division) and Pratt (the aerospace division), as well as United Technologies’ recession-resistance. Discover more UTX insights from the Street at TipRanks.

Kratos Defense & Security Solutions

- Market value: $1.9 billion

- TipRanks consensus price target: $26.25 (43% upside potential)

- TipRanks consensus rating: Strong Buy

- Kratos Defense & Security Solutions (KTOS, $18.37) specializes in unmanned systems. This includes everything from satellite communications to cybersecurity to missile defense and hypersonic systems.

It also has the highest implied potential upside among the defense stocks on this list, at 43%. That’s in part because of a significant drop in the face of Kratos losing out on a hypersonic test drone contract award to Northrop Grumman (NOC), and despite second-quarter sales and earnings that beat the analyst consensus.

Top-rated B. Riley FBR analyst Mike Crawford is particularly excited about the company’s prospects when it comes to unmanned aerial vehicles (UAVs). For instance, Crawford notes that demand for Kratos’ Valkyrie – an experimental stealthy combat drone that completed its first flight in March 2019 – “continues to both firm and expand.”

The analyst says the Defense Department has moved beyond the question of whether UAVs make sense, and is instead considering operative questions about how to integrate these tactical vehicles into the fleet. That means enabling the machines with sensors, payloads, datalinks and artificial intelligence.

“KTOS, as an early mover and clear leader in the low-cost, tactical UAV space, stands poised to capitalize on its investments in proprietary IP and capabilities, and we believe shareholders will continue to be rewarded by this investment,” Crawford writes. He reiterated his Buy rating two months ago, listing a $26 price target that implies 42% upside from here. Get the full scoop on Kratos Defense’s analyst consensus at TipRanks.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 5,500 Wall Street analysts as well as hedge funds and insiders. You can find more of their stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.