Great Dividend Stocks for Retirement Savers

While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While you wait—and wait—for the Federal Reserve to raise interest rates, you can collect generous checks by investing in dividend stocks. And you don’t have to wander far to find attractive payers. Just look at Standard & Poor’s 500-stock index. Of its 500 member companies, 84% pay dividends, up from 75% a decade ago. On top of that, many of the index’s constituents are rewarding shareholders by boosting their payouts; so far this year, 169 S&P companies have done so.

To find the best dividend payers today, we divided the index into two groups: "High-yielders" are stocks with about double the S&P 500’s yield (currently 2.0%); and "dividend-growers" are companies that pay a bit less but have raised their dividends by at least 10% annualized over the past five years. Beyond that, we looked for firms with solid earnings outlooks, figuring that those companies were most likely to maintain and boost their disbursements. The result: a list of nine dividend-paying stocks worth owning now. You’ll probably recognize most of the high-yielders, but you may be surprised by some of the dividend-growth picks.

Stocks are listed alphabetically. Figures are as of May 14.

Accenture

- Headquarters: Dublin, IrelandType: Dividend-growerShare price: $96.98Market capitalization: $60.7 billionYield: 2.1%

In a slow-growing world, Accenture’s (ACN) performance stands out. The consulting and technology services firm has exceeded analysts’ revenue forecasts for four consecutive quarters, as businesses invest in technology and look for ways—with Accenture’s help—to operate more efficiently. So on March 26, when Accenture reported earnings per share of $1.08 for the quarter that ended in February, beating analysts’ estimates by a penny, shares climbed 6.7% the same day. The stock has advanced 28% since mid-October.

One downside to Accenture’s success is that the stock is no longer cheap, trading at 20 times estimated year-ahead earnings. But even at today’s price, the stock may yet deliver higher returns on the strength of Accenture’s growing digital services business (in which Accenture helps companies use, say, social media or a corporate Web site more effectively). During the latest quarter, revenues for the segment climbed 20% year-over-year.

Accenture, which is based in Ireland and trades on the New York Stock Exchange, operates in more than 50 countries. So the robust dollar has put a dent in its earnings, which analysts believe will climb by just 5% in the current fiscal year, which ends in August. But that shouldn’t stop dividend seekers. Over the past five years, Accenture has lifted its payout an average of 22% annually, and the company uses only about one-third of its free cash flow to make the distribution, providing plenty of room for future dividend hikes.

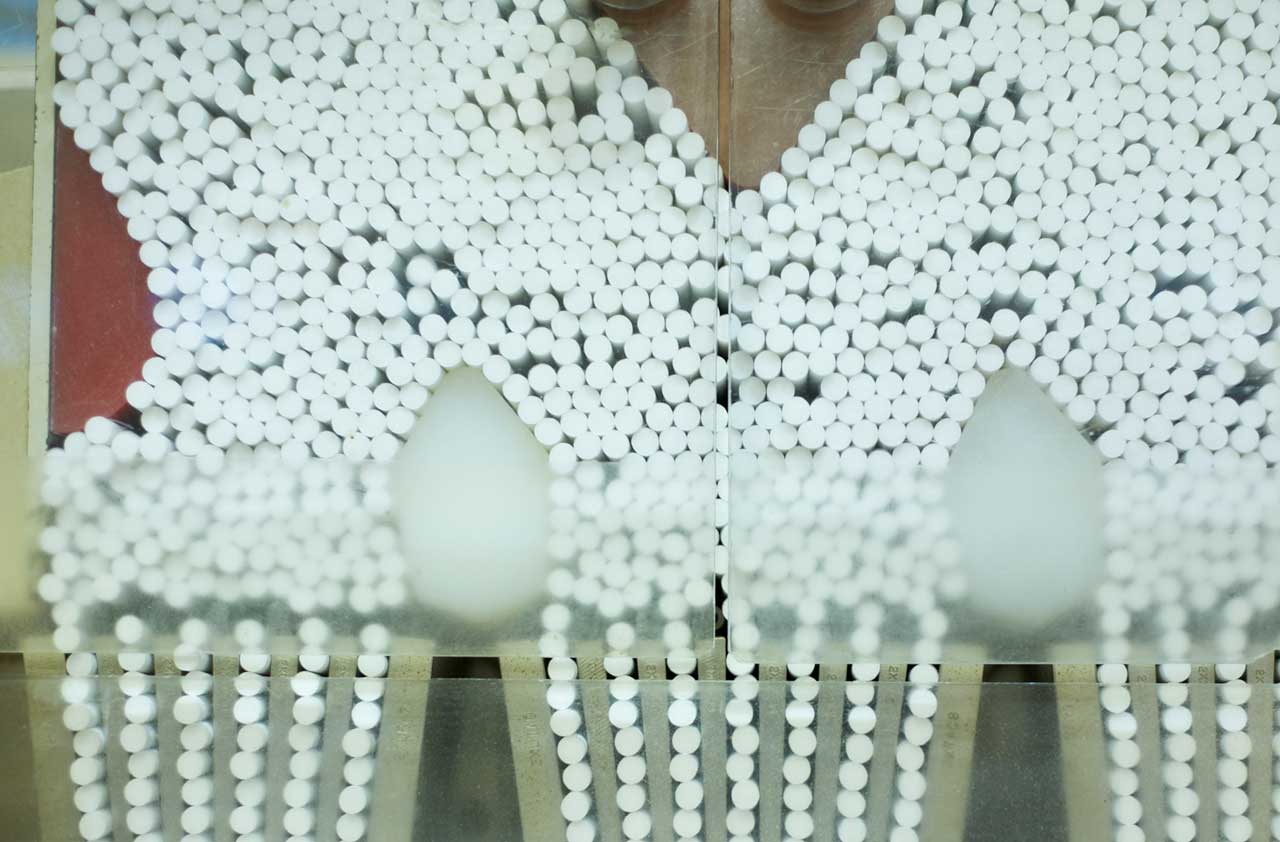

Altria Group

- Headquarters: RichmondType: High-yielderShare price: $52.60Market capitalization: $103.6 billionYield: 4.0%

We understand that cigarette stocks are not for everyone. But if you have no qualms about investing in a tobacco company, you’ll find a cash-generating machine in Altria (MO). The company owns Philip Morris USA, America’s largest tobacco producer. Altria continues to thrive despite a long-term decline in cigarette sales in the U.S. Low fuel prices are giving consumers more money to spend on cigarettes, says RBC Capital, and Altria has been able to raise prices. During the first quarter, sales increased 5.3% from the year before, and profits rose 11%. Analysts believe earnings will rise 9% in 2015, to $2.80 per share.

One source of growth for Altria is the burgeoning market for e-cigarettes, devices that deliver nicotine smoke-free. Increased government scrutiny of these products could be a hurdle, but Altria has proved to be resilient. Over the past 10 years, the stock has delivered a 15.9% annualized total return, nearly double the performance of the S&P 500. And although Altria doesn’t make the cut as a big dividend booster, it has increased its payout for 45 consecutive years. That warrants an above-average P/E ratio for the stock, which trades for 19 times projected 2015 profits.

Cummins Inc.

- Headquarters: Columbus, Ind.Type: Dividend-growerShare price: $143.22Market capitalization: $25.8 billionYield: 2.2%

An aging truck fleet in the U.S. and Canada is driving sales of new commercial vehicles—and benefiting diesel engine maker Cummins (CMI). The company’s share of the North American heavy-duty engine market is projected to reach 36% in 2015, more than any rival. Cummins is also buying up its North American distribution network. Acquisitions this year are expected to add about $600 million to 2015 revenues, and at least $0.60 per share in earnings, says CEO Thomas Linebarger. Overall, analysts forecast that Cummins’s profits will rise 9% this year, to $9.99 per share.

Like most firms on this list, slower global growth has been a hurdle for Cummins, which does more than 50% of its business overseas. The stock has fallen 11% since June 2014, and execs have trimmed their sales forecast this year to about $20 billion, down from as much as $23 billion. That shouldn’t impact the dividend, though. Cummins, which has increased its payout by an average of 25% over the past five years, has pledged to return 50% of its 2015 operating cash flow to shareholders in the form of dividends and stock repurchases. The stock trades at a reasonable 14 times projected 2015 earnings.

General Motors

- Headquarters: DetroitType: High-yielderShare price: $34.65Market capitalization: $55.8 billionYield: 4.2%

The U.S. automaker, which filed for bankruptcy protection in 2009 and was roiled by a recall scandal last year, is still trying to shake off its troubles. First-quarter earnings for GM (GM) of $0.86 per share came in 11% short of what analysts were expecting. The company cited costs related to the recalls of Chevrolet Cobalts and its decision to stop selling certain models in Russia.

But the long-term future looks brighter. In the first quarter, GM vehicle prices, net of incentives, rose 3.5% from the same period a year earlier, and RBC Capital Markets says it expects prices to remain firm for the rest of 2015. A spiffier lineup of cars is helping. Two of the company’s vehicles—the Cadillac CTS and the Chevrolet Corvette Stingray—were among Car and Driver’s 10 best cars for 2015. So even with the first-quarter earnings slip, analysts project that GM’s profits will jump 47% this year, to $4.49 per share. The stock trades at a mere 8 times that estimate. With cyclical companies, such as automakers, a low price-earnings ratio isn’t always a buy signal because the low valuation could suggest that profits are near a peak. But analysts expect GM’s earnings to rise another 14% in 2016, suggesting that the stock really is a deal. In April, GM, which reinstated its dividend last year, lifted its quarterly payout rate by 20%, to $0.36 per share.

International Paper Company

- Headquarters: MemphisType: Dividend-growerShare price: $53.62Market capitalization: $22.6 billionYield: 3.0%

Paper production is hardly an exciting business. But it turns out to be a great place to look for rising dividends. International Paper (IP) makes containerboard for shipping boxes, along with other paper products, such as food cups and office paper. Since 2010, the manufacturer has delivered dividend growth of 32% annualized, in part because of a growing cash pile. In the first quarter, for example, free cash flow increased 25% from the previous year, to $319 million. IP is jettisoning noncore businesses and reducing supply-chain expenses with the aim of squeezing out $1.2 billion in cost savings over three years through 2016. Analysts figure that all the restructuring will help lift earnings by 30%, to $3.90 per share, in 2015.

Last year, IP explored the idea of forming a master limited partnership for its paper mills. The stock popped from $45 in October to more than $50 by November, but it has stayed relatively flat since. A recent proposed ruling by the Internal Revenue Service has decreased the likelihood of an MLP conversion. But IP’s shares could still get a lift if demand for shipping improves along with the economy. And at today’s price, the stock is relatively cheap, trading at 14 times estimated 2015 profits, compared with 15 and 16, respectively, for competitors Packaging Corporation of America and Rock-Tenn Company.

Principal Financial Group

Headquarters: Des Moines

Type: Dividend-grower

Share price: $51.99

Market capitalization: $15.3 billion

Yield: 2.9%

Principal Financial (PFG) has not always been a reliable dividend story. During the financial crisis, the company cut its disbursement by 50%, and its stock plummeted from $71 in 2007 to less than $8 in 2009. But the firm is making up for the stumble. Principal, once largely an insurance concern, has enlarged its asset management business, with $530 billion under management today, up from just under $300 billion five years ago. The company has also expanded overseas to markets such as China, Brazil and Mexico. Today, Principal generates about one-fifth of its profits abroad.

With more foreign operations, Principal’s results are susceptible to a strengthening dollar. That’s one reason analysts expect no earnings growth this year. But they do expect profit gains of 8% in 2016, to $4.74 per share, thanks to the growing investment needs of rising middle-class populations overseas. Principal has increased its dividend an average of 19% annually since 2010, and the stock trades for just 12 times this year’s estimated earnings.

Rockwell Automation

- Headquarters: MilwaukeeType: Dividend-growerShare price: $124.41Market capitalization: $16.7 billionYield: 2.1%

You might not expect a company that sells factory software and equipment to be thriving and raising dividends in a ho-hum economy. But Rockwell Automation (ROK) is doing exactly that. In China, for example, food manufacturers have turned to Rockwell for help with automating their systems to meet higher safety standards. In Mexico, a wave of foreign investment in energy production is driving demand for Rockwell’s services. So, during the January-March quarter, sales rose 2.7% compared with the year before, not accounting for the strong greenback, and earnings per share of $1.59 trounced analysts’ expectations by 12%. To top it off, Rockwell’s free cash flow expanded 43% year-over-year, providing plenty of room for future dividend hikes. The company has raised its disbursement by an average of 13% annually since 2010.

Concerns about the global economy dinged Rockwell shares last year, as they fell 23% from June through October. But they have since rebounded 26%. The stock trades for 19 times estimated 2015 earnings of $6.62 per share, which represents a 7% increase from last year’s profits.

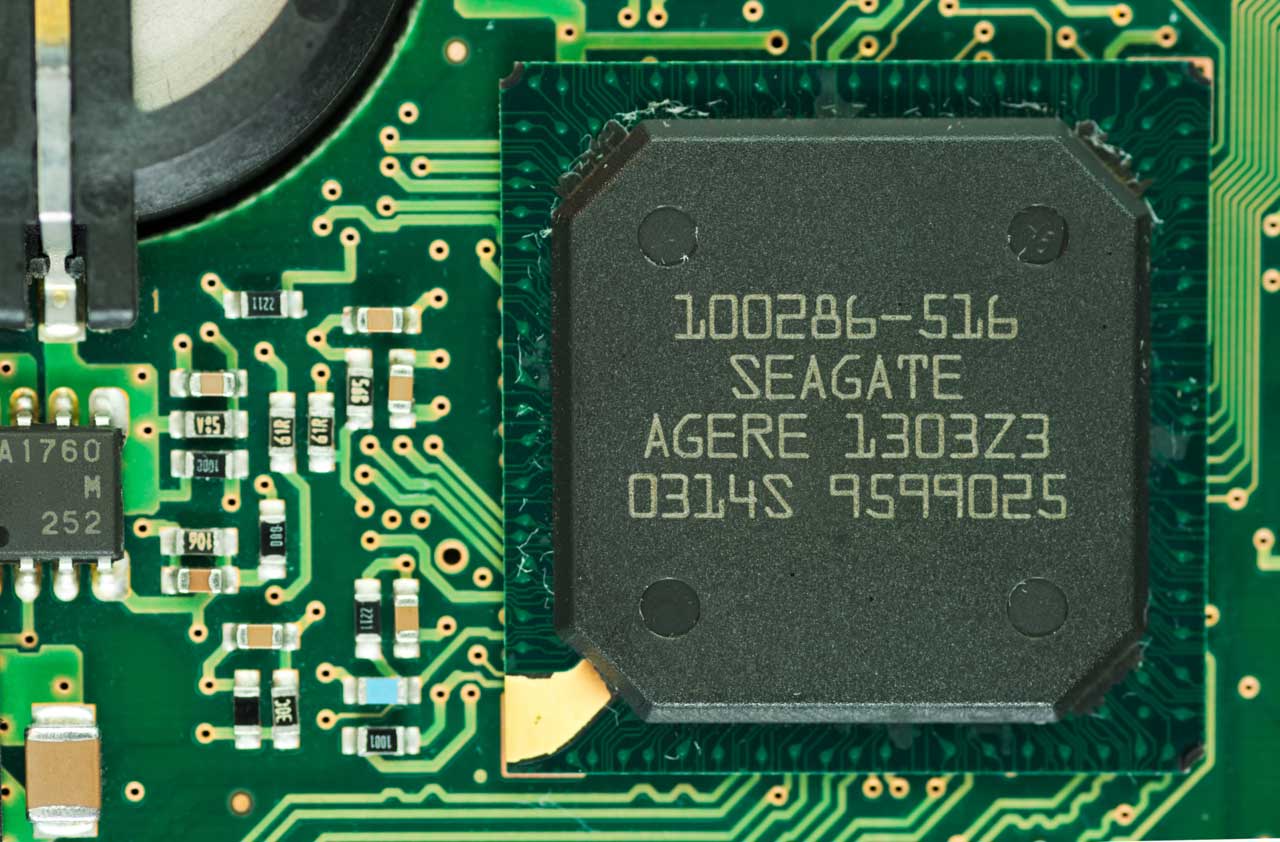

Seagate Technology

- Headquarters: Dublin, IrelandType: High-yielderShare price: $57.43Market capitalization: $18.2 billionYield: 3.8%

Investors are down on Seagate (STX) because of declining personal computer sales and general concerns about economic growth. Shares of the storage device maker have sunk 12% since December.

But analysts say the pessimism is overdone. Seagate is increasingly focusing on serving the business sector, and during the January-March quarter corporate orders for hard drives hit 9.1 million, up 18% from the same period a year earlier. That figure is likely to increase, too, because 60% of business orders are expected to be placed in the second half of 2015, according to RBC Capital. Any rebound in economic growth and back-to-school PC sales would also give Seagate a lift. So although analysts project that earnings for the fiscal year that ends in June will fall 5%, to $4.78 per share, they expect profits to rise to $5.09 per share in the following fiscal year. Seagate uses only 27% of its annual free cash flow to fund its quarterly dividend, which the company suspended during the financial crisis but reinstated in 2011. Seagate increased its disbursement 26% last year, to $0.54 per share. The stock is cheap, priced at 12 times projected year-ahead profits. (Although Seagate is incorporated in Ireland, its executive offices are in Cupertino, Calif.)

Verizon Communications

- Headquarters: New York CityType: High-yielderShare price: $49.94Market capitalization: $203.9 billionYield: 4.4%

Verizon (VZ) stands out among its peers because of the quality of its wireless network and the firm’s ability to generate ample cash. In fact, analysts at Morningstar project that Verizon’s free cash flow (cash profits remaining after the capital expenditures needed to maintain the business) will exceed this year’s dividend requirements by 50%, a “strong” figure, and grow 5% to 6% annually over the next several years.

More consumers are opting to pay the full cost of their phones in exchange for lower plan fees. But mobile-device sales, which rose 80%, to $3.4 billion, in the first quarter from the same period a year earlier, are helping make up for the dip in revenue. Heavy investment in the state-of-the-art 4G LTE wireless network gives Verizon as much as a year’s head start on competitors, according to analysts at William Blair & Company. And Verizon’s announcement on May 12 that it plans to buy AOL for $4.4 billion will likely open opportunities for growth in digital content and online advertising. Analysts project that Verizon’s earnings will rise 15%, to $3.84 per share, in 2015. The stock sells for 13 times that estimate, well below the S&P 500’s price-earnings ratio of 18.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.