5 Top ESG Stocks on RBC Capital’s ‘Best Ideas’ List

If you want to invest with a clean conscience, look no further.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you want to invest with a clean conscience, look no further. RBC Capital has just released a report revealing its favorite stocks for sustainable investing. These are stocks that the firm rates Outperform (the equivalent of Buy) according to its traditional fundamental financial analysis – and that score highly on key environmental, social and governance (ESG) factors.

ESG spans a wide array of factors, from being environmentally sustainable and protecting consumers to boasting gender diversity in the boardroom and ensuring equal pay for employees, and many more.

“It is thought that ESG factors can be strong signals for future opportunities as well as potential risks including share price volatility, earnings stability and issues management,” write RBC Capital analysts, adding, “incorporating environmental, social and governance factors alongside traditional financial analysis can be additive as indicators of corporate performance.”

Indeed, a Morningstar study of its ESG indexes released earlier this year showed that sustainable investing pays off. “We found that 41 of the 56 Morningstar’s ESG indexes outperformed their non-ESG equivalents (73%) since inception,” it says. “… Morningstar ESG indexes tend to select companies that are less volatile and possess stronger competitive advantages and healthier balance sheets than their non-ESG equivalents.”

Here are five of the best ESG stocks on RBC Capital’s “Global ESG Best Ideas List.” Each of the stocks not only gets RBC’s seal of approval, but sports a Moderate Buy or Strong Buy consensus rating from analysts tracked by TipRanks.

Data is as of Aug. 18.

Salesforce.com

- Market value: $126.0 billion

- TipRanks consensus price target: $182.75 (27% upside potential)

- TipRanks consensus rating: Strong Buy

- Salesforce.com (CRM, $143.89) was included on Fortune’s list of the “World’s Most Admired Companies” in 2019 – its seventh consecutive year to make the grade. The customer relationship manager (CRM) leader is ticking all the boxes right now. Not only is the company committed to best practices in data security, it also is more than halfway toward reaching its impressive goal of 100% renewable energy by 2022.

According to RBC Capital, Salesforce incorporates sustainability into its supply chain by working with suppliers to set emissions-reduction targets and partners with small businesses and diverse suppliers.

Salesforce is no slouch of a stock, either. CRM has shot 168% higher over the past five years, well more than tripling the 48% return of Standard & Poor’s 500-stock index. And Wall Street thinks more is on the way. Over the past three months, 23 of 24 analysts tracked by TipRanks have published bullish calls on the stock. Their price target suggests shares can surge 27% over the next 12 months or so.

“We think that Salesforce continues to grow billings >20% and that there are many avenues to sustain growth, including service and marketing, the platform, and international and future initiatives,” RBC Capital’s Matthew Hedberg writes.

The five-star analyst calls deceleration “inevitable” but still thinks CRM “can continue to drive premium growth” thanks to strong pricing power and its popular new AI platform, Einstein. What are other financial experts saying about this ESG stock’s outlook? Find out now on TipRanks.

Nvidia

- Market value: $97.2 billion

- TipRanks consensus price target: $183.91 (15% upside potential)

- TipRanks consensus rating: Moderate Buy

Graphics chipmaker Nvidia (NVDA, $159.56) is another stock singled out by RBC Capital for its top-notch practices. RBC’s analysts note that Nvidia works hard to act responsibility both within the organization and further afield. For example, “Policies on social standards for suppliers are aligned with … the Responsible Business Alliance, and due diligence for conflict mineral identification uses external third-party audits from the Conflict-Free Sourcing initiatives.”

Nvidia has no statistically significant disparities in gender compensation, according to a third-party firm that analyzes its pay practices. NVDA also is ranked among industry leaders in human capital development, offering stock options and career development courses to help train and retain employees.

But ultimately, investors are seeking out returns. Wall Street thinks the chipmaker will deliver there, too.

RBC Capital’s Mitch Steves recently reiterated his Outperform rating on Nvidia with a $190 price target (20% upside potential). This top-rated analyst sees growth coming from gaming, data centers and increasingly complicated automotive technology. For instance, Steves says he thinks the data center business can roughly double over the near-term, and continue to grow by high double digits over the long-term.

As for gaming, Nvidia’s largest segment, the analyst tells investors: “We are bullish long-term given multiple tailwinds including 1) complexity of video games; 2) virtual reality; and 3) the potential for more customers to shift to Nvidia products vs. AMD GPUs gaming products,” referring to rival Advanced Micro Devices (AMD). Discover more NVDA insights from the Street at TipRanks.

NextEra Energy

- Market value: $104.2 billion

- TipRanks consensus price target: $227.43 (5% upside potential)

- TipRanks consensus rating: Strong Buy

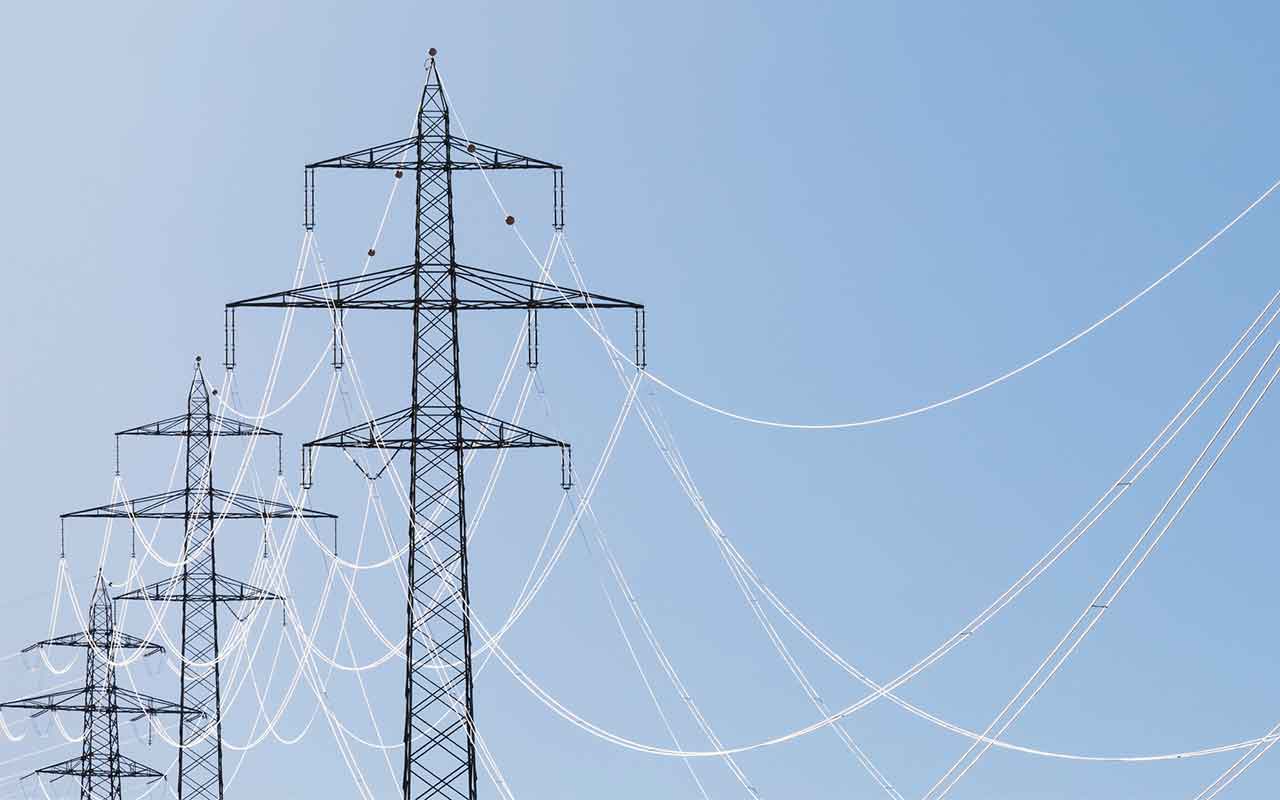

- NextEra Energy (NEE, $217.53) is the world’s largest generator of wind and solar energy. It’s also one among the top ESG stocks in its industry for renewable energy opportunities. NEE is the top-ranked electric/gas utility-industry company on Fortune’s 2019 “World’s Most Admired Companies” list and among the top 25 on the 2018 list of companies that “Change the World.”

The figures speak for themselves. “NextEra has reduced its carbon dioxide emissions rate by 52 percent since 2001 and is targeting a reduction of more than 65 percent by 2021, relative to a 2001 baseline,” writes RBC Capital. It’s also investing a whopping $40 billion in the U.S. to develop projects that will generate jobs while advancing its clean energy strategy. NEE is “committed to innovation and is leveraging technology, artificial intelligence, and big data to develop wind and solar energy in a more efficient, reliable, and cost-effective way,” RBC’s analysts write.

NextEra also is a strong investment in RBC Capital’s eyes. Analyst Shelby Tucker describes the company as “a core holding not just within a utility fund, but also within a broader portfolio.” He believes the stock deserves a premium multiple “given its strong management team, exposure to the high-growth renewable development space, and above-average earnings and dividend growth.” Specifically, Tucker expects 8% to 10% annual EPS growth through at least 2021, fueling a minimum of 12% annual dividend growth during that time.

“We see potential upside in the form of another large, regulated acquisition or in the form of greater than expected synergies from the Gulf Power acquisition,” Tucker adds. You can check out current pro opinions on NEE at TipRanks.

Microsoft

- Market value: $1.04 trillion

- TipRanks consensus price target: $153.70 (13% upside potential)

- TipRanks consensus rating: Strong Buy

The world’s largest company, Microsoft (MSFT, $136.13), also is a key sustainable investing holding. And it shouldn’t come as much of a surprise. Co-founder Bill Gates is one of the world’s most famous philanthropists. Gates, who still sits on the company board, and his wife Melinda Gates, have so far donated a jaw-dropping $45.5 billion via their charitable foundation.

Notably, Microsoft has committed to investing at least 1% of profits in community development projects. It also has achieved 100% carbon neutrality since 2012 thanks to a self-imposed carbon fee. What’s more, the company is dedicated to improving clean technology opportunities by investing in energy-efficient IT infrastructure and services.

It also has a relatively strong track record on the more controversial topic of user data. “Ranked among industry leaders in terms of transparency regarding the protection of users’ personal data; Microsoft discloses procedures for handling government data requests, including national security order,” RBC Capital analysts write.

Shareholders aren’t complaining, either. Year-to-date, MSFT stock has put up a 34% gain, lifting its three-year return to 139%. That clobbers the broader indexes.

“Multi-year growth engines of Office 365 and Azure continue to show fundamental strength, and margin expansion across Commercial Cloud is continuing with scale and execution,” writes five-star analyst Matthew Hedberg, who boosted his price target on Microsoft shares from $136 to $153 (12% potential upside) following the company’s stellar quarterly earnings report.

“We think Azure can scale to multiples of its current size as workloads grow on hyperscale cloud platforms and MSFT maintains a strong second position to leader (Amazon Web Services) in Western economies,” Hedberg writes to investors. See why other top analysts are bullish on Microsoft.

Gilead Sciences

- Market value: $80.0 billion

- TipRanks consensus price target: $81.87 (30% upside potential)

- TipRanks consensus rating: Moderate Buy

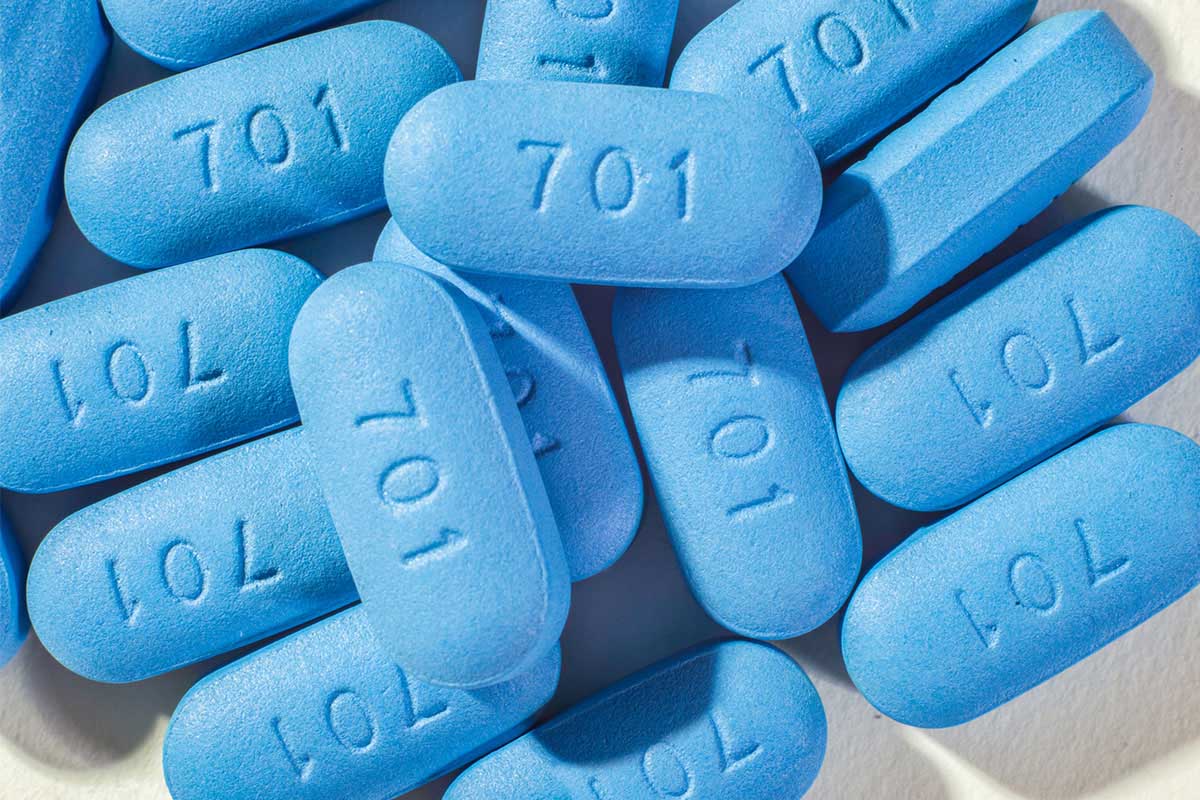

Last but not least, we have biopharma giant Gilead Sciences (GILD, $63.14). According to RBC Capital, Gilead is ranked among industry leaders in terms of increasing access to health care globally. As the firm writes, “Gilead has expanded into emerging markets and uses tiered pricing models based on affordability.”

Gilead also boasts impressive gender diversity statistics. Currently 40% of the senior management team and 30% of board members are women, notes RBC Capital. Gilead also is making waves in environmental responsibility, setting a target to reduce certain greenhouse gas emissions by a quarter by 2025 (versus 2016 levels) through renewable-energy and energy-efficiency technologies.

According to top-rated analyst Brian Abrahams, GILD is poised for outperformance, too. “We expect improving sentiment, continued strong commercial execution, and successful pipeline diversification into cellular therapy and inflammation to help drive share appreciation,” he writes. In particular, the analyst calls filgotinib, for the treatment of rheumatoid arthritis and Crohn’s, “a potential blockbuster in the pipeline.”

Abrahams reassures investors that Gilead’s HIV franchise can continue to thrive for the next few years. “We believe Biktarvy’s strong profile and robust launch, along with favorable demographic and pricing dynamics, will underpin good HIV franchise sustainability through 2025, with nearer-term competitive threats overblown; we expect this to maintain a strong foundation for GILD’s valuation,” he says.

Abrahams reiterated his Buy rating earlier this month, assigning a $91 price target that implies 44% upside from current levels. Get the full scoop on Gilead’s analyst consensus at TipRanks.

Harriet Lefton is head of content at TipRanks, a comprehensive investing tool that tracks more than 5,000 Wall Street analysts as well as hedge funds and insiders. You can find more of their stock insights here.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

5 Actions to Set Up Your Business With Your Exit in Mind

5 Actions to Set Up Your Business With Your Exit in MindWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.