7 Safe High-Yield Dividend Stocks Delivering 4% or More

These seven high-yield dividend stocks have sturdy foundations, according to the DIVCON dividend-health rating system and Wall Street experts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The benchmark 10-year Treasury note yields just around 0.6%, and the dividend on the S&P 500 yields just 1.8%. So where the heck are income investors supposed to get anything other than crumbs?

Oftentimes, investors will engage in the dangerous practice of reaching for yield. That is, they chase high-yield dividend stocks without regard for those securities' greater risk. But as any experienced income investor can tell you, a payout that's too good to be true can mean the company behind the payout is in trouble.

In short, income investors need safe, stable dividend stocks with relatively high yields. If they are primed to raise dividends going forward, it's a deal-closer.

We know some good ways to find them.

One option is to monitor the DIVCON system from exchange-traded fund provider Reality Shares. DIVCON's methodology uses a five-tier rating to provide a snapshot of companies' dividend health, where DIVCON 5 indicates the highest probability for a dividend increase, and DIVCON 1 signals the highest probability for a dividend cut. Within each of these ratings is a composite score determined by cash flow, earnings, stock buybacks and other factors.

Here are seven of the safest high-yield dividend stocks to buy right now. Each stock has a DIVCON score of 5 or better and yields at least 4%. This makes them generous dividend stocks you can count on, not just to maintain their payouts, but grow them going forward.

Data is as of Aug. 10. Analyst ratings and other data courtesy of S&P Capital IQ, unless otherwise noted. Stocks are listed by dividend yield, from lowest to highest. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price.

Verizon

- Market value: $244.1 billion

- Dividend yield: 4.2%

- DIVCON score: 58.5

Both DIVCON and Verizon's (VZ, $58.99) own history suggest the blue-chip telecommunications company will keep the dividend growth coming.

For one thing, the Dow stock is a member of the Nasdaq Dividend Achievers, an index comprising stocks that have raised their payouts for at least 10 consecutive years. Furthermore, in addition to high-ranking DIVCON score, VZ has more than ample free cash flow to support the dividend. For the 12 months ended June 30, the company paid out $10.1 billion in dividends but generated free cash flow of $15.7 billion after paying interest on debt.

Yes, the second half of 2020 is all about Verizon building out its 5G network. However, analysts say VZ's comparatively greater focus on telecommunications vs. rivals is a big selling point.

"Verizon represents one of the cleaner stories across cable and telecom services given its leadership position in wireless and continued strong execution, with relatively less exposure to secularly challenged PayTV, media/advertising, and business wireline revenues as compared to some of its peers," write Deutsche Bank analysts, who rate the stock at Hold.

Realty Income

- Market value: $21.6 billion

- Dividend yield: 4.5%

- DIVCON score: 55.5

Realty Income (O, $62.46) holds a special place in the hearts of some income investors given its nature as a monthly dividend stock.

In fact, Realty Income is known as "The Monthly Dividend Company" because it disburses payments like clockwork every 30 days or so ... and because it literally refers to itself as that on its corporate website.

Many real estate investment trusts (REIT) are suffering in the economic downturn. Fortunately, Realty Income's portfolio of more than 6,500 properties is heavy on retailers that hold up when times are tough – dollar, drug and convenience stores – and lighter on gyms and movie theaters, which are getting hammered in the pandemic.

Stifel analysts, who rate the stock at Buy, note that Realty income collected 91.5% of July rent and looks to be returning to offense.

"The company has one of the sector's strongest balance sheets, in our view, lowest costs of capital, and pays a consistent and growing monthly dividend," Stifel writes.

The bottom line is that Realty Income looks to be among the safest high-yield dividend stocks on offer. As a testament to its stability, O has paid a dividend for 601 consecutive months and counting.

MetLife

- Market value: $36.1 billion

- Dividend yield: 4.6%

- DIVCON score: 60.5

It's been a tough year for the insurance industry. That's just how it goes in a pandemic.

MetLife (MET, $39.78), for instance, has rebounded considerably off the March lows yet remains off 19% year-to-date.

Nonetheless, analysts feel confident about MetLife's prospects, partly because of this particular insurance giant's business mix.

"We think the company retains less COVID-19 related mortality exposure than peers, given (i) an average policyholder age of 48 and (ii) approximately 80% of in-force coverage at year-end 2019 was group life," writes Credit Suisse, which rates MET at Outperform (equivalent of Buy).

Wall Street leans more toward Credit Suisse's optimistic view than not. Nine analysts rate MET at Strong Buy or Buy, while five say it's a Hold (and none call it a Sell). And their average target price of $43.71 gives MetLife's stock implied upside of about 15% over the next 12 months or so.

DIVCON notes that MetLife has more than enough free cash flow to cover its dividend, putting it among the market's safe high-yield dividend stocks. In 2019, MET generated $5.8 billion in free cash flow after paying interest on debt, and paid out just $1.8 billion in dividends, according to S&P Capital IQ data.

South Jersey Industries

- Market value: $2.4 billion

- Dividend yield: 4.9%

- DIVCON score: 57.25

Shares in South Jersey Industries (SJI, $23.92) are off a painful 27% for the year-to-date, but analysts expect the hefty dividend payer to stabilize from here on out.

That's because the gas utility's second-quarter results, announced Aug. 5, might not have been all that inspiring, but they certainly were reassuring.

"The company reported that it experienced no material financial impact from COVID-19; looking forward, it reaffirmed its 2020 guidance," writes Janney, which rates SJI at Buy. "We note the yield at just under 5% is very attractive for growth & income investors."

A number of analysts are taking a more cautious approach than Janney, however. Of the nine analysts covering SJI tracked by S&P Capital IQ, three rate it at Strong Buy, one says Buy, two call it a Hold, one says Sell and one has it at Strong Sell. Collectively, their average recommendation comes to Hold.

Still, growth investors can point to the fact that Wall Street expects South Jersey's earnings to grow at an average annual rate of 9.4%. Income investors can count on not just receiving the hefty payout, but getting dividend hikes in the future, DIVCON's rating suggests.

AbbVie

- Market value: $163.0 billion

- Dividend yield: 5.1%

- DIVCON score: 58.5

Pharmaceutical giant AbbVie (ABBV, $92.38) is about as stalwart a dividend grower as they come. This safe high-yield dividend stock has raised its payout annually for 48 consecutive years, including its time combined with Abbott Laboratories (ABT), earning it a place on S&P's list of Dividend Aristocrats.

DIVCON's system suggests that the streak won't end anytime soon. Free cash flow over the past 12 months more than amply covers the dividend.

The solid financials are one of the benefits of the company's strong line-up of best-selling drugs, such as Humira, a popular rheumatoid arthritis drug. AbbVie also makes cancer drug Imbruvica, the Viekira Pak hepatitis-C treatment and testosterone replacement therapy AndroGel.

The width of ABBV's pipeline – which also includes dozens of products across various stages of clinical trials – is a strength. For instance, Credit Suisse notes that AbbVie topped the Street's projections in the second quarter, as stronger immunology demand offset weaker Botox sales.

UBS analysts write about the sheer potential power of the pipeline: "Rinvoq (rheumatoid arthritis) and Skyrizi (plaque psoriasis), despite COVID, will be >$2B in first full year with only one indication for each. If we assume Rinvoq and Skyrizi 'in-play' share, eventually translates to TRx share across all the indications in development, these two products alone will replace Humira completely."

Piper Sandler, which rates ABBV at Overweight (Buy), writes that the company's strong Q2 showing shows that COVID-19's impact on biopharma stocks has been less than feared.

Federal Realty Investment Trust

- Market value: $6.1 billion

- Dividend yield: 5.3%

- DIVCON score: 55.5

Few REITs have been steadier dividend payers than Federal Realty Investment Trust (FRT, $80.23).

Federal Realty, a rare real estate member of the Dividend Aristocrats, has lifted its dividend for a whopping 53 consecutive years. The most recent improvement came on Aug. 5, when it hiked its cash dividend by a penny per share to $1.06 quarterly.

FRT, which owns retail and mixed-use real estate in several major metropolitan areas, is recovering from the shutdown. Stifel (Buy) notes that all of the company's 104 properties are currently open, and 87% of tenants are open vs. 47% on May 1.

"Federal owns a portfolio of best-in-class retail centers," Stifel analysts write. "Its portfolio includes large-scale mixed-use developments that help drive Federal's above-average growth."

Among Stifel's cohort, eight rate the stock at Strong Buy, three say Buy and six call it a Hold, while two see the REIT as a Strong Sell.

This high-yield dividend stock has registered roughly 60% dividend expansion over the past decade, including a 2.9% top-up to the cash distribution announced in August 2019.

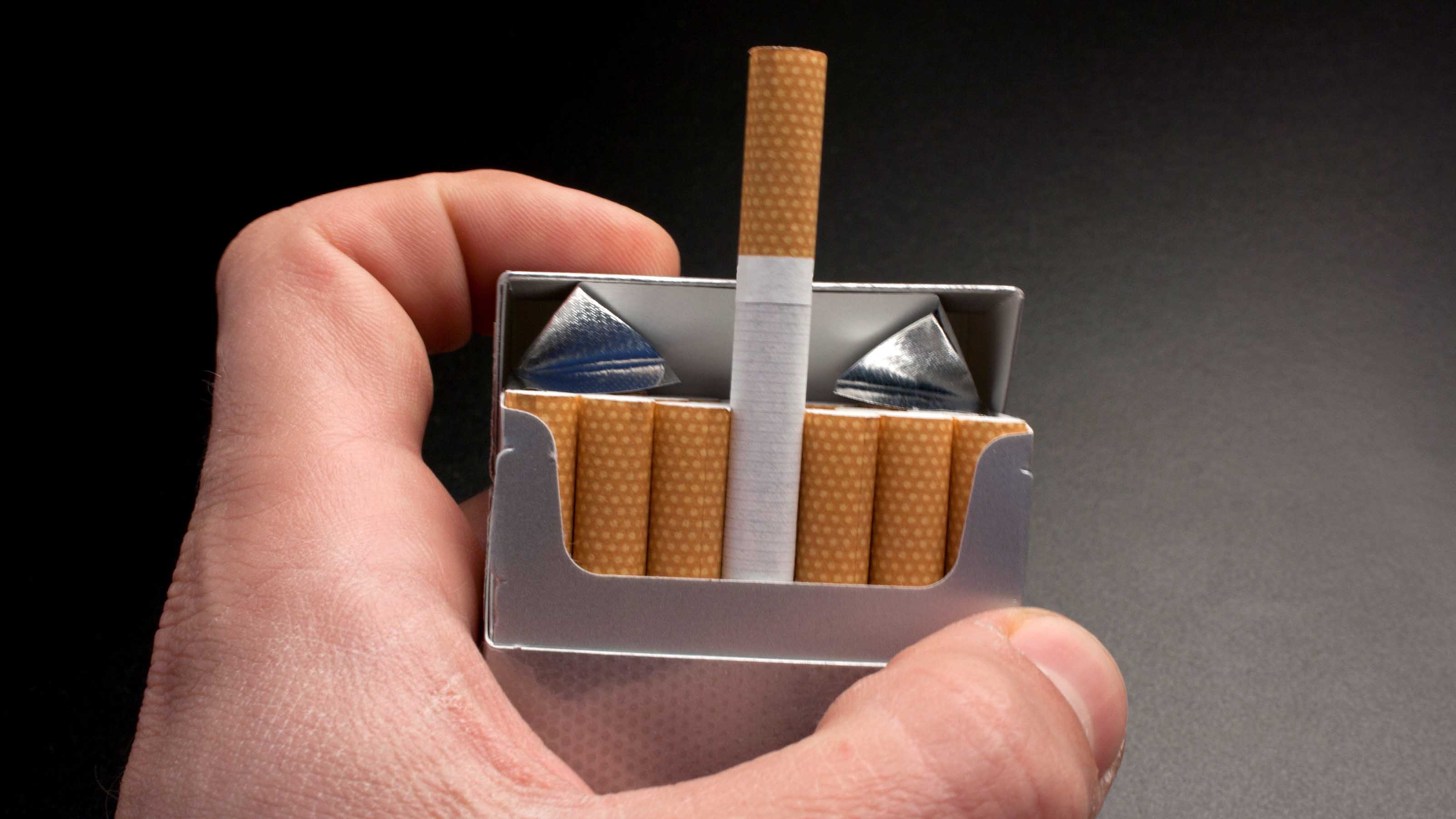

Altria

- Market value: $80.3 billion

- Dividend yield: 8.0%

- DIVCON score: 55.5

Income investors who count on Altria's (MO, $43.22) fat dividend can sleep well at night, both DIVCON and the analyst community say.

Stifel calls the stock a Buy based on its strong growth outlook, a return to consistency in its growth and the "robust" dividend yield.

"The company maintains dominant market share positions in its categories, holds future growth opportunities around its reduced risk products (RRPs), and alongside the robust pricing power in its core business supports our positive bias for the shares," Stifel's analysts write.

MO's dividend payout ratio is set at approximately 80% of adjusted earnings per share, the tobacco company says. That's good news for potential dividend growth. Despite the many headwinds against tobacco, analysts expect Altria's adjusted earnings per share to increase 6% to $4.58 a share in 2021, and another 16% in 2022.

Most importantly, Altria generates enough free cash flow to cover the dividend payments with plenty of room to spare. That places it among Wall Street's safe high-yield dividend stocks ... even if the 8% yield is in rarefied air.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.