7 Ways the Pandemic Will Change College Forever

Colleges and universities face steep budget cuts, enrollment challenges and new types of competition as a result of COVID-19. We cover the changes you'll see on campus this fall -- and beyond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The pandemic will force major changes in higher education — not just in the fall but for years to come, as colleges and universities face steep budget cuts, enrollment challenges and new types of competition.

Adapting won’t be easy, and institutions that don’t embrace change will likely suffer. Many schools will be forced to shut down or merge. Two hundred or more institutions, mostly very small schools, could close in the coming years.

Policymakers in Washington will keep a close watch on these sudden changes in higher ed, which will influence updates to federal student loan programs, grants, and more.

College Enrollment Will Dip by 10% or More at Some Schools

Many students will cancel college plans because they can no longer afford to go. One bad sign for schools: There’s been a notable drop in both existing students and high school seniors filling out the Free Application for Federal Student Aid (FAFSA), which is a strong indicator of enrollment. The sharpest decline has been among students from low-income households. There are also reports that more incoming freshmen are expressing interest in deferring for a year.

Enrollment by international students will fall off a cliff. Many foreign students will be unable to get visas or flights because of travel restrictions. Others will avoid U.S. schools because of virus-related fears. Some will be put off by restrictive health measures that alter the much sought after on-campus experience.

The hardest-hit schools include those that have lots of foreign students and those with sky-high prices but middling or poor education rankings. Small schools could get whacked, too, since they often rely heavily on tuition to fund operations. For them, not hitting enrollment targets by even just a bit can be financially devastating.

Keep an eye out for schools that decide not to hold in-person classes in the fall and choose to mandate virtual learning. That could turn off scores of students and parents who don’t want to shell out full price for online learning.

Some schools may buck the trend, luring students with more-affordable tuition and flexibility to choose online or in-person classes.

Community Colleges Will Grow in Popularity

Students who choose to study closer to home (for vastly cheaper tuition) will fuel a surge in enrollment at community colleges and elsewhere — if not in the fall, then soon after. Vocational training programs, national online-only schools and nontraditional online courses will see more interest.

Greater student interest in lower-cost, more-flexible options will create more competition. For example, BYU-Pathway Worldwide allows students to try out classes before committing. California’s Calbright College offers adults flexible online options geared to work readiness. Community College of Denver is creating a subscription plan for returning students with some college and no degree to complete general education courses.

College Budgets Will Decline as Well

Fewer students means major losses in tuition revenue. That’s on top of severe state funding cuts for higher ed (one-third of revenue for public universities is from state and local sources). Schools expect to lose more than $20 billion in enrollment revenue and more than $11 billion in a range of auxiliary services, such as food services, book stores and recreation facilities. Other losses, from downsized sporting events to lost parking revenue, will bite as well.

Pressure is ramping up for private schools to tap more of their endowments to shore up the books, but don’t expect a drastic change as schools opt to spend conservatively. Some schools have agreed to dip in a bit deeper (Princeton University will spend 6% of its endowment this year instead of the 5% it usually spends, for example). A large chunk of endowment money is restricted to specific projects. The portion of restricted funds is often higher for schools with smaller endowments.

Fewer Faculty and Staff

Tens of thousands of college employees have been laid off or furloughed already, and more layoffs are coming for faculty and staff, though some will be brought back eventually.

It’s hard to see what type of personnel won’t be affected. Cuts will include professors from programs that are shrunk or shuttered; all types of administrative positions; dining and other service staff; sports coaches and assistants. Many schools are planning to not renew contracts for certain professors and other staffers. The fallout could lead to worse student/faculty ratios and fewer student activities, among other things.

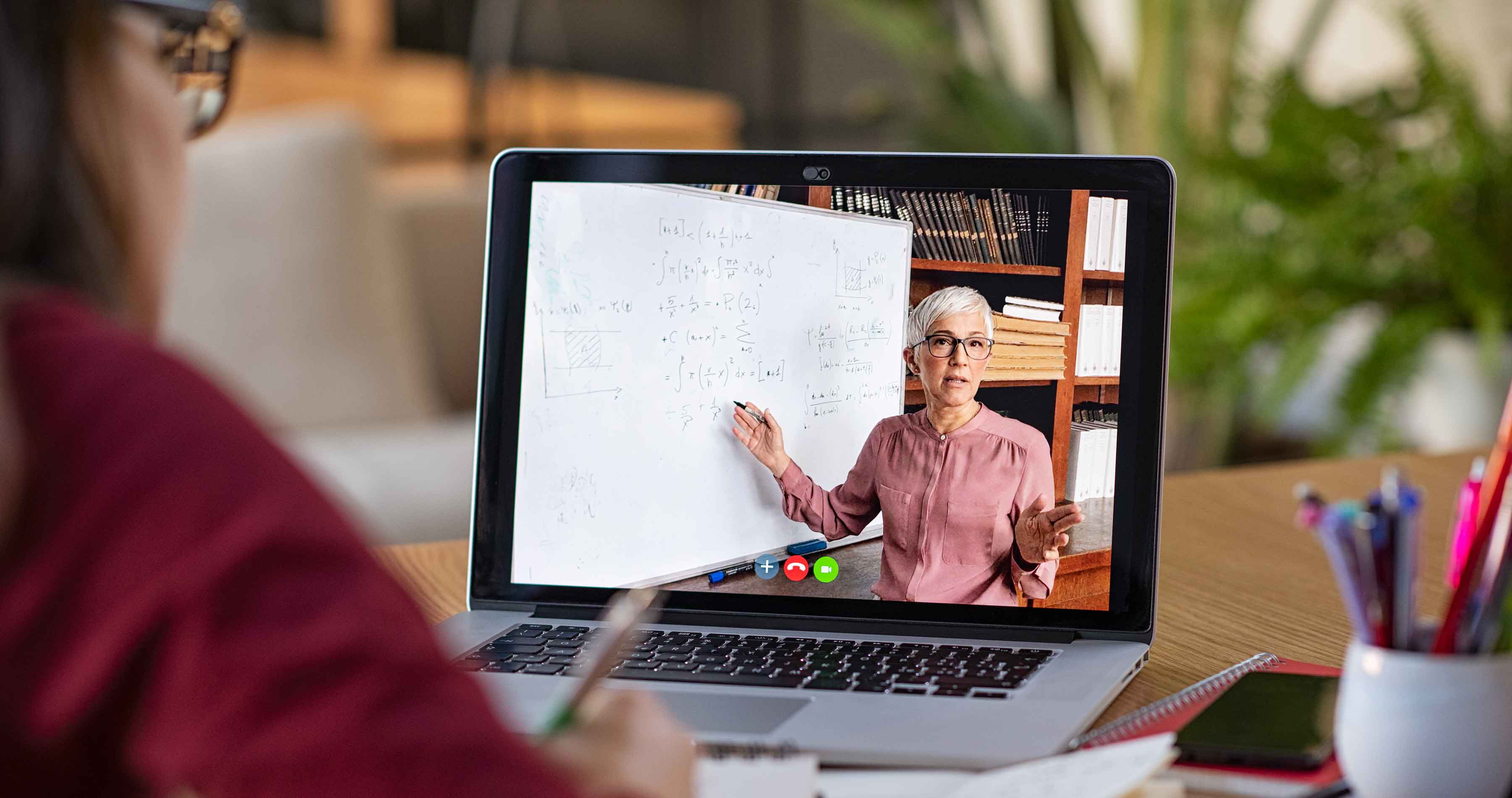

More Online Learning

Look for an explosion of online learning options to generate new revenue. Traditional schools still lag leading online educators, such as for-profit colleges. That spells more sales to colleges by learning software vendors such as Blackboard, Canvas and Moodle.

Innovation in education technology will accelerate — more virtual experiences that feel like a real classroom, new artificial intelligence tools to automate grading, etc.

More Partnerships With Local Employers

State schools and private colleges will partner more closely with businesses to meet new demands of local employers and to land funding for new programs. Schools will be straining to save money to stave off additional cuts as they speed up plans to adapt for future student demand. More than ever, prospective students will ask, “Will I land a good-paying job after graduation?”

Schools will strive to answer that by soliciting money and input from businesses for re-tooled or new academic programs. <

No Parties – at Least, Not This Fall

Did you hear us – no parties! NO P-A-R-T-... oh, never mind.

Seriously, the on-campus experience won’t be easy in the near term. Schools need the capability to test, trace and quarantine. Students will need to follow strict rules, including wearing masks, no partying, restricted travel to and from campus, required flu vaccinations, limited social gatherings and much more. Don’t plan on chatting with professors after class. They’ll be behind Plexiglas and will jet out the door when class ends. Feel sick? Schools will make students quarantine in solo dorm rooms and take courses online.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

John Miley is a Senior Associate Editor at The Kiplinger Letter. He mainly covers AI, technology, telecom and education, but will jump on other business topics as needed. In his role, he provides timely forecasts about emerging technologies, business trends and government regulations. He also edits stories for the weekly publication and has written and edited email newsletters.

He holds a BA from Bates College and a master’s degree in magazine journalism from Northwestern University, where he specialized in business reporting. An avid runner and a former decathlete, he has written about fitness and competed in triathlons.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

New Ways to Use 529 Plans

New Ways to Use 529 PlansTax-free withdrawals from 529 plans could help you sharpen your job skills.

-

I Want to Help Pay for My Grandkids' College. Should I Make a Lump-Sum 529 Plan Contribution or Spread Funds out Through the Years?

I Want to Help Pay for My Grandkids' College. Should I Make a Lump-Sum 529 Plan Contribution or Spread Funds out Through the Years?We asked a college savings professional and a financial planning expert for their advice.

-

What to Do With Your Tax Refund: 6 Ways to Bring Growth

What to Do With Your Tax Refund: 6 Ways to Bring GrowthUse your 2024 tax refund to boost short-term or long-term financial goals by putting it in one of these six places.

-

What Does Medicare Not Cover? Eight Things You Should Know

What Does Medicare Not Cover? Eight Things You Should KnowMedicare Part A and Part B leave gaps in your healthcare coverage. But Medicare Advantage has problems, too.

-

15 Reasons You'll Regret an RV in Retirement

15 Reasons You'll Regret an RV in RetirementMaking Your Money Last Here's why you might regret an RV in retirement. RV-savvy retirees talk about the downsides of spending retirement in a motorhome, travel trailer, fifth wheel, or other recreational vehicle.

-

How Intrafamily Loans Can Bridge the Education Funding Gap

How Intrafamily Loans Can Bridge the Education Funding GapTo avoid triggering federal gift taxes, a family member can lend a student money for education at IRS-set interest rates. Here's what to keep in mind.

-

How an Irrevocable Trust Could Pay for Education

How an Irrevocable Trust Could Pay for EducationAn education trust can be set up for one person or multiple people, and the trust maker decides how the money should be used and at what age.

-

UTMA: A Flexible Alternative for Education Expenses and More

UTMA: A Flexible Alternative for Education Expenses and MoreThis custodial account can be used to pay for anything once the beneficiary is considered an adult in their state. There are some considerations, though.