Your Kids' Tax Brackets Could Lead to Unequal Inheritances

Sometimes, divvying things up equally means one child might end up with less because of tax implications. Here’s how to avoid that.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Estate planning is a critical aspect of comprehensive financial planning, especially when it comes to ensuring your heirs receive the maximum benefit from your legacy. Among the various components of estate planning, the designation of beneficiaries for individual retirement accounts (IRAs) is a particularly nuanced decision with far-reaching tax implications.

The distinction between Roth IRAs and traditional IRAs (or company retirement plans) is crucial to understand when planning for the future of your heirs. Each type of account is subject to different tax rules upon distribution:

- Roth IRAs. These accounts offer tax-free distributions to beneficiaries, which can be particularly advantageous for heirs who are in higher tax brackets.

- Traditional IRAs and retirement plans. Distributions from these pre-tax accounts are taxed according to the beneficiaries' individual tax rates, which means that the actual amount received after taxes can vary significantly among your heirs.

A one-size-fits-all approach in designating equal percentages to each beneficiary may not be the most effective strategy. Instead, a more tailored approach that considers the unique tax brackets of each beneficiary can lead to a more equitable distribution of your estate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Impact on after-tax inheritance

Consider a scenario where Clara is 80 years old and looking to maximize the amount that goes to her heirs, subsequently reducing the amount claimed by Uncle Sam at tax time. Ray is a prominent attorney in the highest tax bracket of 37%. Steven earns less money and falls in the 12% federal tax bracket.

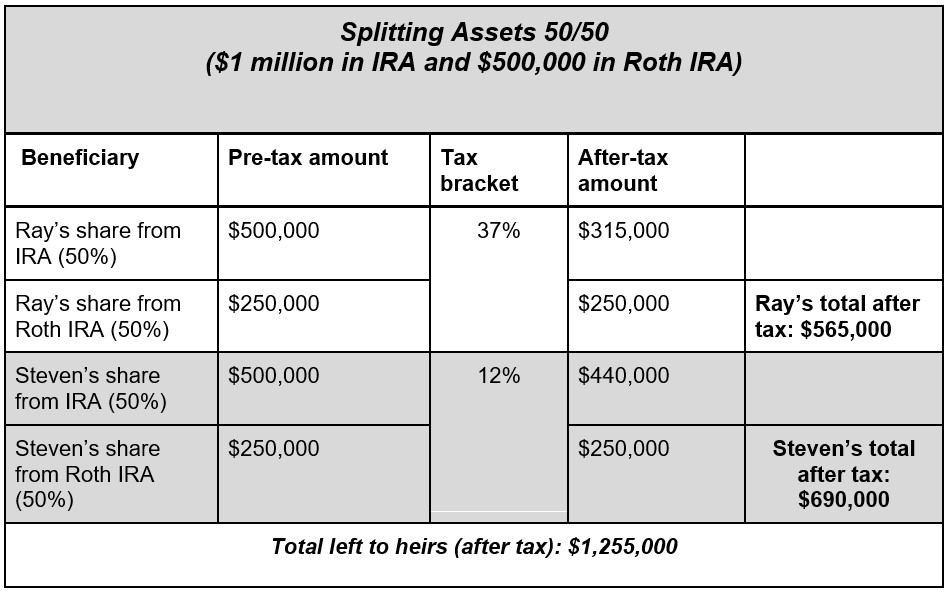

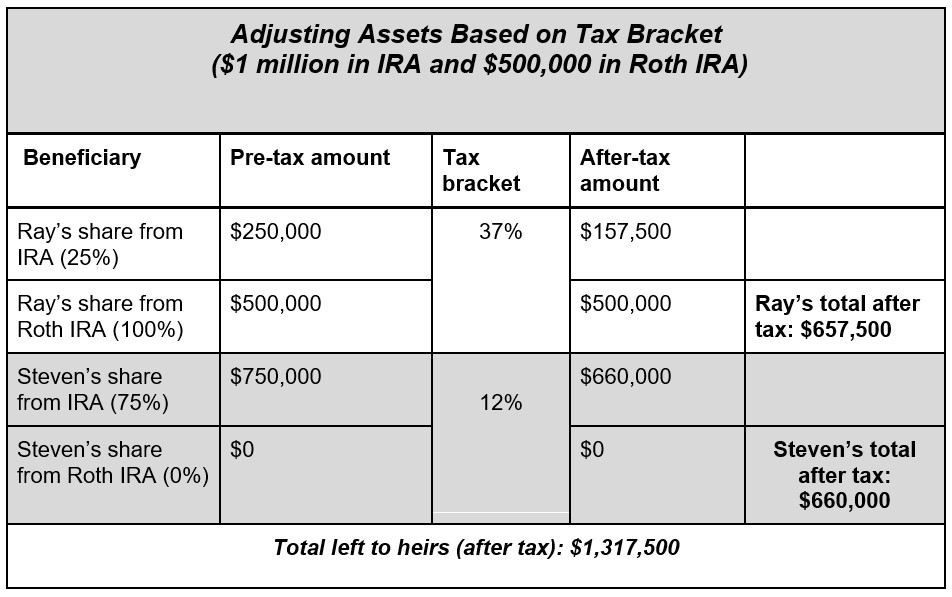

Clara has $1 million in a traditional IRA (pre-tax account) and $500,000 in a Roth IRA. Initially, she had split both accounts 50/50 between her two sons. However, leaving more of the tax-free Roth to Ray may make sense because he is the higher-earning beneficiary. More of the traditional IRA could be left to Steven, as he is in a lower tax bracket, and the taxable distributions from the IRA are less impactful. Consider the following:

By adjusting the amount going to each beneficiary, Clara's distribution was more equitable to each child. She also was able to have less of her inheritance lost to taxes. In fact, she was able to give her heirs a total of $62,500 more ($1,317,500 - 1,255,000) than by splitting each account 50/50.

This also works when considering how much to leave a beneficiary from taxable brokerage accounts. Because of how capital gains are taxed, you may be able to leave your heirs more money by adjusting the amount each beneficiary receives based on their tax bracket.

Tax-efficient estate planning

In essence, strategically designating IRA beneficiaries transcends mere asset distribution; it is a testament to the power of informed financial planning and the profound impact of tax considerations on inheritance. This example illuminates a path for families that can significantly enhance the value of their legacy for their heirs.

By eschewing the traditional equal-split approach in favor of a model that aligns with each beneficiary's unique tax situation, individuals can ensure that their heirs are positioned to receive the maximum possible benefit from their inheritance. This method not only honors the benefactor's intent to provide for their loved ones but does so in a manner that is both tax-efficient and equitable, allowing for a legacy that is felt more deeply and preserved more completely.

The case of Clara and her sons serves as a compelling illustration of how adjusting beneficiary designations to account for different income levels and associated tax brackets can result in a more favorable after-tax outcome. Such strategic adjustments, while requiring careful consideration and possibly the guidance of a certified financial planner, can significantly reduce the tax burden on the estate. This allows a greater portion of one's life savings to reach the intended recipients — fully embodying the true spirit of a given legacy.

Investment advisory services offered through Osaic Advisory Services, LLC (Osaic Advisory), a registered investment advisor. Osaic Advisory is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Advisory.

Related Content

- Resist the Taboo: Talk to Your Kids About Family Wealth

- To Protect Your Kids, Consider These Estate Planning Steps

- Four Ways to Give Money Tax-Free to Your Kids When You Die

- IRS Quietly Changed the Rules on Your Children’s Inheritance

- How to Optimize Taxes When You Tap Your Retirement Accounts

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Antwone Harris, MBA, CFP®, is a seasoned financial professional with over 20 years of experience helping clients transition from their main careers to the next phase of their lives. As a former VP-Senior Financial Consultant at Charles Schwab Inc., he managed over $890 million in client assets and ranked in the top 5% of more than 1,100 advisers nationwide. His financial expertise has been featured in major media outlets such as CBS, ABC, NBC, FOX, The Washington Post, Bloomberg, The Financial Times and Kiplinger. Harris is a CERTIFIED FINANCIAL PLANNER™ and a Retirement Income Certified Professional®, focusing his practice on creating comprehensive plans for individuals approaching or already in retirement. Recognizing the anxiety surrounding retirement preparation, Harris founded Platinum Bridge Wealth Strategies to provide specialized financial planning for those nearing or in retirement.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.

-

Life Loves to Throw Curveballs, So Ditch the Rigid Money Rules and Do This Instead

Life Loves to Throw Curveballs, So Ditch the Rigid Money Rules and Do This InsteadSome rules are too rigid for real life. A values-based philosophy is a more flexible approach that helps you retain confidence — whatever life throws at you.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.