Four Personality Traits Lead to More Retirement Savings

Only 10% of workers have the traits that lead to more retirement savings. Are you one of them?

Ellen B. Kennedy

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

People who wind up with more retirement savings tend to share four behavioral traits. You can probably guess some of them. It is a truism, for example, that good retirement planning requires the ability to delay gratification now for a reward later. This trait is often exemplified by the "marshmallow test," which asks children to delay eating a marshmallow for the reward of a second one later. We're all like those squirming children when we try to save rather than spend, but some of us find it easier to do. What do your habits say about you?

Traits that lead to more retirement savings

You don’t check the traffic report, confident you’ll get to work on time. You skip the office snacks to keep your weight-loss goals. As soon as your boss arrives, you’re ready to discuss a raise. Before that though, you catch up on the latest financial news from Kiplinger.

If this sounds familiar, you’re in luck. You likely possess the four key behavioral traits that contribute to greater retirement savings, according to a recent survey by Goldman Sachs Asset Management in collaboration with Syntoniq, a behavioral finance research firm.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The study, "Retirement Mindset Matters," surveyed 5,261 workers and retirees. It revealed that individuals who find it easier to prepare for retirement typically exhibit these “optimal” behaviors: high optimism, high future orientation, high financial literacy and a preference for reward over risk. This underscores that financial success is as much about mindset as it is about number-crunching.

However, if this doesn’t quite sound like you, you’re not alone. Only 10% of respondents had all four traits, while 85% showed a mix. About 5% lacked all four traits. Fortunately, it’s possible to cultivate these optimal traits or mitigate the impact of less beneficial behaviors.

1. Optimism: It pays to look on the bright side

Defined as the tendency to expect positive outcomes, optimism encourages proactive financial behaviors, like creating personalized financial plans and adapting investments in volatile markets.

According to the survey, respondents with high levels of optimism were more likely to report their retirement savings as on track or ahead of schedule (83%), compared to those with low optimism (41%). This positive outlook also correlates with lower financial stress.

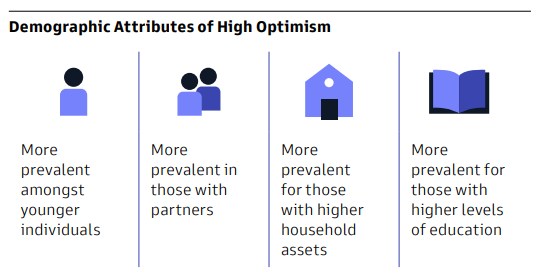

Younger workers with a higher educational level were more likely to be highly optimistic.

While a Harvard Health report says optimism may be around 25-30% inherited, it’s not an immutable trait. For instance, research shows that practicing gratitude, such as jotting down a few things you’re thankful for, helps foster a more positive mindset.

For those inclined toward pessimism, a financial advisor could offer a fresh perspective on the challenges you face. Such “positive reframing” has been shown to help people build psychological resilience.

On the other hand, optimism must be grounded in realism and facts in order to serve you well. A recent study from the University of Bath, “Looking on the (B)right Side of Life: Cognitive Ability and Miscalibrated Financial Expectations,” surveyed 36,000 households. The results? "Excessive optimism," or optimism paired with low cognitive ability, tends to lead to poor decision-making.

2. Future orientation: Prioritize tomorrow for a brighter future

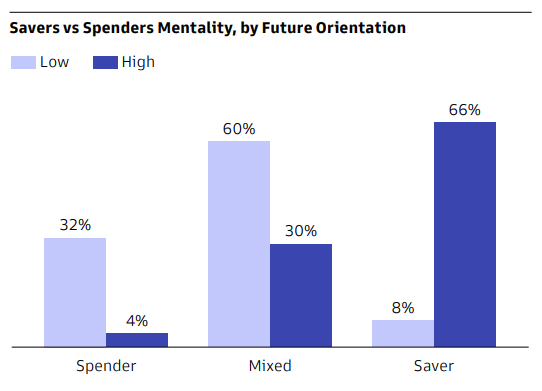

People who feel strongly connected to their future selves exhibit a high future orientation, which is akin to envisioning one’s life through a forward-looking lens.

The research found those with high future orientation are more likely to prioritize retirement planning and engage in prudent spending and savings habits. In fact, 70% with high future orientation have a personalized financial plan, compared to only 48% of those with low future orientation.

Meanwhile, those less focused on the future are more likely to cash out retirement plans during job changes or dip into emergency savings.

Studies indicate greater future orientation is associated with the development of specific future goals and stronger planning ability, even beginning in adolescence. This suggests that setting clear future goals and actively working toward them can enhance your future orientation.

A simpler way to cultivate this mindset is to automate your retirement plan contributions, a strategy that ensures consistent savings and integrates high future orientation into your life.

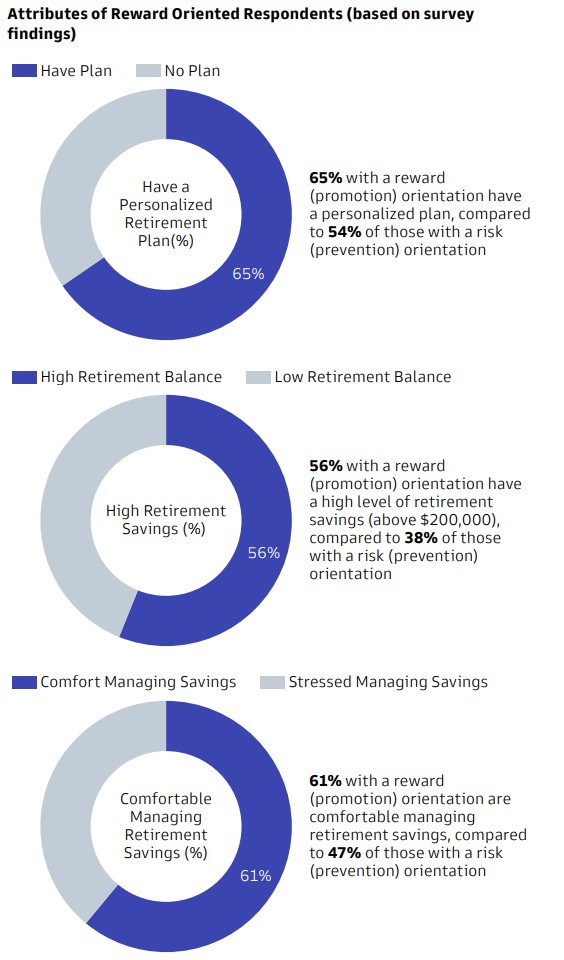

3. Reward focus: Keep your eyes on the prize rather than the risks

The survey further divides retirement savers into two groups based on their focus: reward or risk. Reward-focused individuals emphasize goal achievement and gains, while risk-focused ones prioritize security and protection. Reward-focused savers exhibit better retirement preparedness, with 56% having retirement savings over $200,000, compared to 38% of risk-focused savers.

This disparity is linked to proactive financial behaviors associated with a reward orientation, such as aggressive saving or investing.

Although switching between these groups may not be straightforward, you can develop the confidence to become more proactive. Consider reflecting on past successes, which one study suggests boosts confidence and reduces anxiety.

This is where a personalized retirement plan can help. Analysis by LIMRA, a financial services trade association, shows that 87% of people with a written retirement plan feel confident in achieving their desired retirement lifestyle, in contrast to 70% with an informal plan.

4. Financial literacy: The more you know, the more you save

There’s a clear benefit to financial literacy — understanding financial concepts like compound interest and inflation — based on the survey results. It found that 56% of those with high financial literacy feel comfortable managing retirement savings, compared to just 51% of those with low literacy. Those more knowledgeable in finances tend to engage in better financial practices, including maintaining emergency funds and controlling spending.

Unfortunately, many Americans get a failing grade. The 2023 TIAA Institute-GFLEC Personal Finance Index reveals a concerning trend: U.S. adults correctly answered fewer than half of 28 basic financial questions. Even more alarming, a quarter couldn’t answer even seven correctly.

To improve financial literacy, actively seek out and study reliable financial information from trusted sources. Additionally, consider engaging with a financial adviser or taking financial education courses for guided learning.

Curiosity, a bonus trait

Although the study didn't include curiosity among the traits most likely to lead to a better retirement, we think it is important enough to add it here. There are several reasons. First, older adults who are more curious tend to have better brain health as they age. That's not surprising, since a curious mind has greater plasticity. Second, the pace of change in financial instruments (such as cryptocurrency), technology (AI, for example), environment and culture has been accelerating. Those people who approach these changes with curiosity rather than anxiety or avoidance will likely be better at adapting to new developments in work, saving and investing.

Overall, these traits matter

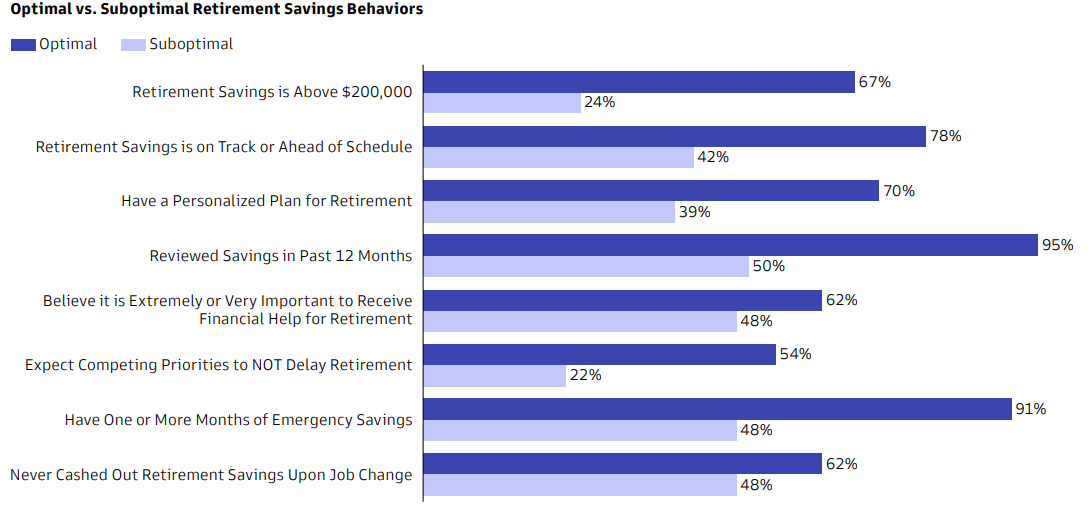

The study compared the most optimal savers, who exhibited all four positive traits with the most suboptimal savers. The eight metrics of good retirement savings habits show that optimal savers put their money where their traits are. As a result, they are more likely to have a happy retirement than the suboptimal savers.

We all aspire to a comfortable retirement, but sometimes there’s a gap between our dreams and our preparedness. Overcoming this gap requires a positive mindset, focusing on balancing life’s pleasures today while diligently planning for our future goals.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

- Ellen B. KennedyRetirement Editor, Kiplinger.com

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.