How To Save Social Security — Pay More Taxes? Cut Benefits?

These proposals to save Social Security may require big changes, but a survey shows Americans want politicians to act. Are you willing to pay more taxes?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Finding ways to save Social Security is at the top of many Americans' minds, and for good reason. The program, which provides a safety net for over 70 million Americans, is facing a financial shortfall. If nothing is done by 2035, it could run out of money in its trust fund. That would force a 17% reduction in Social Security benefit payments.

There are many reasons that Social Security is in trouble, but changing demographics is the primary one. The chart below demonstrates that America's aging population means fewer young workers are paying into the system per retiree, with the trend gaining steam over the next two decades.

Another factor exacerbating the shortfall is the recent adoption of the Social Security Fairness Act (SSFA). This program will increase Social Security checks for 3.2 million workers who receive public pensions. It is projected to hasten that shortfall by six months if Congress does nothing to shore up Social Security’s coffers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That bleak outlook for Social Security has prompted lawmakers, think tanks and non-profits to weigh in on how to fix it. While the strategies vary, some agree a mix of raising taxes and boosting revenue can be a way to cover the shortfall and keep Social Security fully afloat.

Save Social Security by reducing costs, boosting revenue

Take the U.S. Government Accountability Office’s ideas, for starters. Issued this past summer, the GAO calls for a combination of improving finances and raising payroll taxes. The way GAO sees it, reducing program costs could be achieved by changing eligibility requirements and benefit amounts. The cost cuts could come by reducing the current and future benefits for everyone collecting Social Security or only for certain groups. The GAO points out that as it stands, Social Security provides benefits to retired workers and, in some instances, their dependents and survivors. Another option is to increase the payroll tax revenue collected by Social Security.

“Acting now to address Social Security’s financial woes would reduce the impacts of changes on beneficiaries," the GAO wrote in a blog post. "Acting now would allow changes to be gradually phased in. It would also give Americans more time to plan for any changes affecting their retirement security."

The GAO isn’t alone in calling for increasing revenue and benefit cuts to fix Social Security. Wendell Primus, an economist and visiting fellow at Brookings Institute, argues that his proposal submitted to the chief actuary by Rep. Steny Hoyer (D-MD) would eliminate Social Security’s deficit and enable the trust fund to grow beyond its 75-year budgeting window.

On the revenue side, Primus — a former Congressional staffer — recommends several measures to reform Social Security. He proposes increasing the taxable wage base (the income an employee earns that is taxed by Social Security) from $176,100 to about $300,000. His plan would also increase the payroll tax from 12.4% to 12.6% and tax benefits for people making $100,000 or more as income tax.

Pushing the full retirement age further out

On the cost-cutting side, Primus proposes increasing the full retirement age for people who have seen “meaningful” increases in life expectancy and can work for more years, extending the average earnings from the highest 35 years of working to 40 years and phasing out the dependent spouse’s benefit. The latter item recognizes that more women are working and thus will collect their own Social Security benefits.

Primus also suggests that all money collected from taxing retirement and disability benefits be placed into the Social Security trust fund. Under current law, these tax proceeds may also line the pockets of other programs, including the Health Insurance Trust Fund for Medicare, Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust fund. It’s worth noting that this component would require a change in Medicare. As it stands, about 85 cents of every Social Security tax dollar a worker pays goes to the Social Security trust fund.

The proposal would also increase certain immigration caps so more people can participate in Social Security and extend coverage. Recognizing the growing health care needs of America's aging society, he recommends adding immigration pathways for direct care workers, such as home health aides.

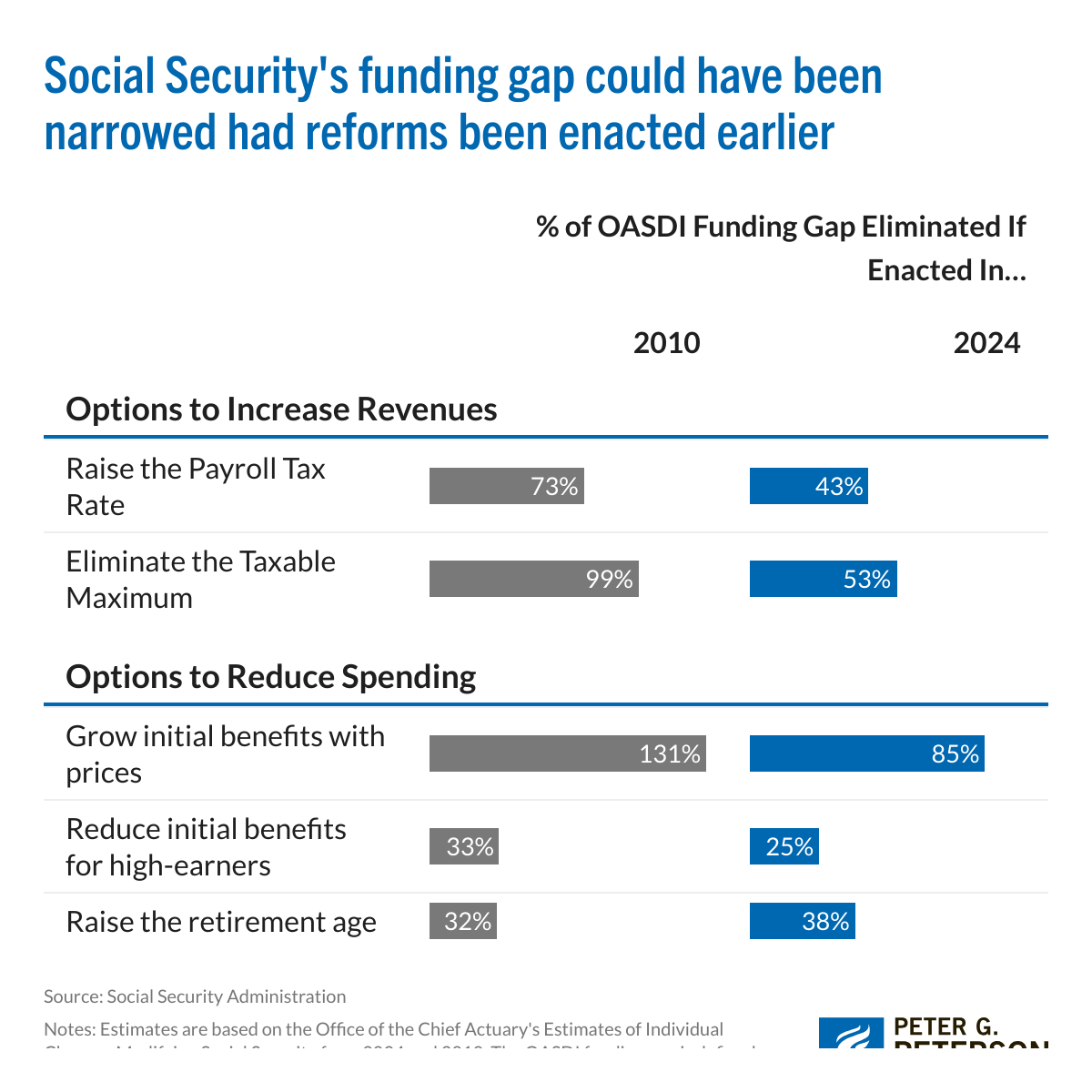

What's clear is that the problem is only getting worse. The Peter G. Peterson Foundation has done an excellent job of demonstrating the price of delay. Had we taken specific measures in 2010, they would have made much more of a difference than doing so in 2024, with the exception of raising the retirement age.

An end to 401(k)s?

Another idea, which has stirred controversy, is to abolish tax-sheltered savings plans like 401(k)s and IRAs. Proposed by Alicia Munnell, director of the Center for Retirement Research at Boston College, and Andrew Biggs, senior fellow at the American Enterprise Institute (AEI), the two economists argue the reduction in federal income taxes because of IRAs and employer-sponsored plans such as a 401(K) amounted to between $185 and $189 billion in 2020. What’s more, Munnell and Biggs say that these tax-favored retirement savings plans disproportionately benefit the wealthy. If these plans were abolished, those tax revenues could benefit retirees through Social Security instead.

“Revenues saved from repealing the retirement saving tax preferences could be reallocated to address the majority of Social Security’s long-term funding gap, strengthening a program that is crucial for the retirement security of older Americans while bypassing a decades-old debate about raising taxes or reducing Social Security benefits,” the economists wrote in a report.

Do Americans want higher payroll taxes?

Increasing taxes typically raises the ire of Americans. After all, who wants to pay more to the government? Well, it turns out that, at least according to a recent survey by the National Academy of Social Insurance, AARP, the National Institute on Retirement Security, and the U.S. Chamber of Commerce, 85% of Americans are on board.

The survey found that Americans value Social Security across party lines, generations, income and education. They see it as an essential piece of their retirement security. Of those polled, only 4% said it wouldn’t be important to their income when retired. Moreover, an overwhelming majority are willing to pay more taxes if it would save Social Security.

“Eighty-five percent say we should ensure benefits are not reduced, even if it means raising taxes on some or all Americans. The most strongly preferred of all options tested is eliminating the cap on payroll tax contributions for those earning more than $400,000 per year,” wrote the groups in a report on the findings. “Additionally, Americans across all groups, including a majority of Republicans, say they are willing to pay more themselves by gradually increasing the payroll tax rate to strengthen the program’s finances.”

The survey respondents rejected raising the retirement age or switching to a slower cost-of-living adjustment (COLA).

That survey coincides with another one by the National Institute on Retirement Security that examined more than 40 years of public opinion polling on Social Security and found strong support for the program and that confidence in Social Security increases with age. Just like the other survey, it also showed a “solid” majority of Americans believe more money should be spent on Social Security.

Americans want to keep Social Security solvent

Social Security has provided a safety net for retirees since the Great Depression and is something most Americans rely on when they stop collecting a regular paycheck. With the program facing potential insolvency, Americans appear united in doing what it takes to keep their benefits intact.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna Fuscaldo is the retirement writer at Kiplinger.com. A writer and editor focused on retirement savings, planning, travel and lifestyle, Donna brings over two decades of experience working with publications including AARP, The Wall Street Journal, Forbes, Investopedia and HerMoney.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.