Social Security Spousal Benefits After Divorce: Is Income Disparity OK?

When mediating a divorce settlement, a 50-50 split of assets isn’t always equitable when Social Security benefits are taken into account.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Editor’s note: This is part two of a two-part series about how divorce and other circumstances can affect Social Security Social Security benefits and retirement income. Part one is The Impact of Social Security on Divorced Retirement Income.

In my previous article, I covered the basics of Social Security for divorced individuals. We saw how a divorced spouse qualifies for their own benefit or 50% of their ex’s primary insurance amount (PIA) and what it means in practice. In this article, we will be covering what happens when the ex passes away and also what happens when there is a pension involved.

Then we will go through an example that shows how a recipient of Social Security divorce benefits can end up with significantly less retirement income than her ex.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Social Security Benefits When Your Ex Dies

Mike and Marie are 66 and have been married for more than 10 years and divorced for more than two. Because Marie is single and not remarried, she qualifies for a divorced-spouse retirement benefit based on Mike's record, whether or not Mike has filed.

If Mike has passed away, Marie receives a divorced-spouse survivor benefit based on Mike's record if she is currently unmarried or if she remarried after age 60. In addition, Marie's benefit will be 100% of Mike's PIA, the amount that Mike would have received at full retirement age. In the case of Mike dying, Marie's retirement benefits are capped to full retirement age.

What if the same two people have married, divorced, remarried each other and divorced again? In that case, the length of the two marriages can be added together (including the time in between) to reach the qualifying minimum of 10 years. That is, if the remarriage happens before the end of the calendar year following the divorce!

Say Mike and Marie were married for seven years, from May 2002 to August 2009. They remarried in December 2010 and divorced again in November 2013 for three years. The total for the two marriages is 10 years. Mike and Marie meet the 10-year requirement because their second marriage happened before the end of the calendar year after the first divorce.

If, instead, Mike and Marie had remarried in January 2011, the 10-year clock would have been reset to zero.

Pension Repercussions on Social Security

In my previous article, Jill and Jack divorced, and she had no Social Security record of her own and met the requirements to receive half of Jack’s PIA of $3,000. But let’s consider what would happen if Jill had a record of her own.

When Jill applies for her divorced spouse's retirement benefit, what if she also worked for an employer not participating in the Social Security system? For example, many state and municipal government employees are exempt from paying into the Social Security system. For instance, if Jill was a teacher for her town's school system, in many states (but not all) she could qualify for a state pension. But then her divorced-spouse Social Security benefit would be reduced by two-thirds of the amount of her pension because of the Government Pension Offset (GPO) rule. As a result, Jill's Social Security benefit may be zero, depending on the size of her pension.

How would that work? Jill currently receives a $3,000 monthly teacher pension in Texas. She has divorced Jack after more than 10 years of marriage. Jack's PIA is $3,000. Jill's divorced-spouse benefit of $1,500 would be reduced by $2,000 (two-thirds of $3,000), which reduces the benefit amount to zero. She doesn't get any Social Security.

If Jack dies, Jill becomes eligible for a divorced-spouse survivor benefit. After the GPO reduction, she will receive $800 ($3,000 - $2,000 = $800).

Suppose the spouse with the benefit also qualifies for a pension from an entity that doesn't pay into Social Security. In that case, the Windfall Elimination Program (WEP) kicks in. That reduces the spouse's benefit payments, and the ex-spouse's benefit adjusts downward as well.

Note that if Jill benefits from a pension but always paid into Social Security, she would not be subject to the GPO and WEP rules. She may have other challenges that require the help of a professional to sort out, but she would benefit fully from both her Social Security and her pension.

What Does It All Mean?

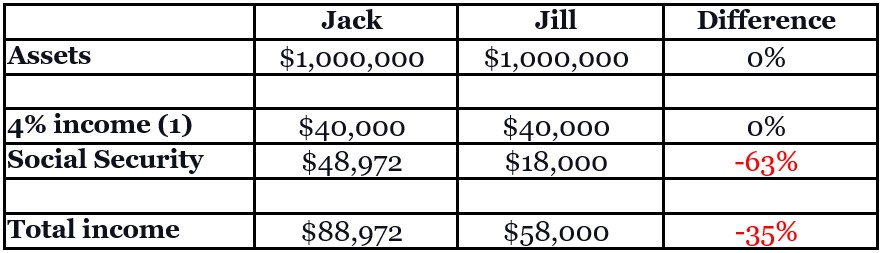

As a reminder, Jack and Jill are retired and decided to divide their assets 50-50. Jack also benefits from a $3,000 Social Security PIA retirement benefit, and Jill has a divorced-spouse benefit of $1,500. Jack opts to delay his Social Security until 70 when his benefit would increase to $4,081. Jill has no such option.

A common (but potentially dangerous) rule of thumb in retirement planning is that if a retiree begins retirement by taking a 4% distribution from assets and increases it annually with inflation, the retiree will not run out of assets in their lifetime.(1)

As detailed in the table below, Jack and Jill’s 50-50 division of assets may look fair. However, Jill's income will be 35% less than Jack's.

Last Words

In the example, the difference between Jill's and Jack's total incomes comes to slightly more than $2,500 a month. Over a 20-year lifetime, it can easily add up to more than $600,000. When you add Social Security cost-of-living adjustments (COLA), the difference could be more than $875,000.

This is not a challenge that can be dealt with directly in litigation, because the courts have no jurisdiction over Social Security. However, a couple mediating could potentially address the issue to achieve a more balanced retirement income for both and a more equitable settlement. Most likely, that would require the assistance of a divorce financial planner.

The example of Jack and Jill is simplified from cases we might run across. There may be other assets, such as a pension, a vacation home and rental real estate. There may be child support and alimony. Maybe Jill qualifies for her own Social Security benefit. There may be an inheritance looming. Jack and Jill may be further away from retirement. Their investment styles may differ.

Diverse circumstances will complicate the analysis, often beyond what can be easily handled by a lawyer or a mediator. However, it is crucial for a couple and their mediator and lawyers to understand the consequences of their decisions. That is so especially for women because they will need to stretch their assets to meet their longer statistical life expectancy.

I have a series of handy flow charts that can help guide mediators and clients through the decision complexities. Please ask for it at info@insightfinancialstrategists.com.

(1) The 4% rule is widely used as a rule of thumb to estimate retirement income from assets. It was initiated in a 1994 study by Bill Bengen published in the Journal of Financial Planning. More recent revisions of the study imply that the safe withdrawal rule could be less than 4%. Other methods to plan retirement income may be more appropriate depending on the case.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Chris Chen CFP® CDFA is the founder of Insight Financial Strategists LLC, a fee-only investment advisory firm in Newton, Mass. He specializes in retirement planning and divorce financial planning for professionals and business owners. Chris is a member of the National Association of Personal Financial Advisors (NAPFA). He is on the Board of Directors of the Massachusetts Council on Family Mediation.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.