When It Comes to Your 401(k), Trust But Verify

Few people review the accuracy of their 401(k) accounts. But mistakes do happen, so you should review your statements and paystubs just like you would your bank statements. Here’s what to watch out for.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Back when defined contribution plans first became popular in the mid-1980s, it was very common for quarterly statements to be distributed at worksites rather than mailed home. When statements were distributed, colleagues would often gather around to compare fund returns and question one another if anything looked amiss. I particularly recall being upset one quarter when my plan’s S&P 500 index fund significantly underperformed its benchmark. Then one of my colleagues pointed out that index funds are designed to mirror their benchmark as closely as possible, so any substantial differences in performance are likely to be a mistake and should be reported. It was, in fact, an error that I never would have caught if it hadn’t been for this casual conversation.

Now, many employees work remotely, and plan statements and confirmations are accessed electronically. For all the benefits of our digital age, we have lost the “crowdsourcing” of any issues or problems through co-workers taking 15 minutes to ask each other if everything seems accurate. There’s also a widely held belief among plan administrators that few participants review their accounts beyond checking their balance, given how long errors can go unchallenged. For example, I recently heard about thousands of participants having their contributions defaulted to the wrong fund for over 10 years without anyone noticing.

Where mistakes creep in

Let’s be clear: The overwhelming number of transactions recordkeepers manage daily are processed correctly, and fraud perpetrated against plan accounts is exceedingly rare. However, issues do periodically arise, particularly involving the calculation of plan contributions. Plan contributions not only involve the recordkeepers who account for your transactions, they also involve your company's payroll systems. And when errors occur, you might think your plan would simply make you “whole” for any mistakes. Unfortunately, this isn’t always the case. For instance, some correction efforts don’t extend to former employees who have already received a plan distribution. Also, administrators have some leeway to only correct accounts if the benefit to participants exceeds the cost of correction. And some plans have a stated policy that any errors must be reported within a specific time frame – typically three months – or your account is deemed correct.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Considering you know your contribution and investment elections, you are in the best position to ensure the accuracy of your plan account. So, where should you begin? To start, here are some common issues that occasionally occur and how you can verify your account is accurate.

Depositing plan contributions

Even though plan deferrals may appear on your paycheck, there is an additional step involved to transmit those deductions to your plan recordkeeper for posting to the plan. And occasionally, errors can creep into this process. For example, an individual business unit may be omitted from the plan’s submission, or deductions from an off-cycle payroll (e.g., special bonus payments) may be omitted.

What you can do: Ask your plan administrator for a deposit schedule and go online to verify your contributions were credited in the stated timeline. The Department of Labor requires your own contributions be deposited by the 15th of the month following the payroll period, but most plans are required to deposit contributions on the earliest date that they can be reasonably segregated from the employer's general assets. (Unfortunately, some plans don’t have a fixed schedule but general guidelines.)

If you believe contributions are not being deposited timely and the issue isn’t being addressed by the plan administrator, you can contact the Employee Benefits Security Administration for assistance.

Plan compensation

Anyone who looks at a paycheck knows your compensation comprises multiple elements beyond base pay, such as bonus, overtime, sales incentives, etc. And plans differ in what pay elements are included in calculating plan contributions. What can sometimes happen is that a particular element of plan compensation – such as special bonuses or other pay types affecting only a select group of employees – are incorrectly overlooked in calculating plan contributions.

What you can do: First, you can find your plan’s definition of compensation in the Summary Plan Description. Then, multiply your plan eligible compensation by your deferral percentage and make sure it agrees with your plan contributions. The best times to do this are when you initially join the plan, when your pay increases, or when you receive any one-time or annual compensation payments, such as a bonus.

Employer matching contributions

The employer matching contribution formula in many plans is straightforward: A plan will match a percentage of employee contribution up to certain limits, e.g., 100% match on the first 5% of pay deferred as a contribution. But there can be added complexities to the process, such as allowing different deferral elections for regular salary and an annual bonus, a separate election for catch-up contributions (allowed for those 50 or older), or whether your pre-tax deferral election will “spill over” to after-tax contributions once you reach the annual pre-tax contribution limit ($20,500 in 2022).

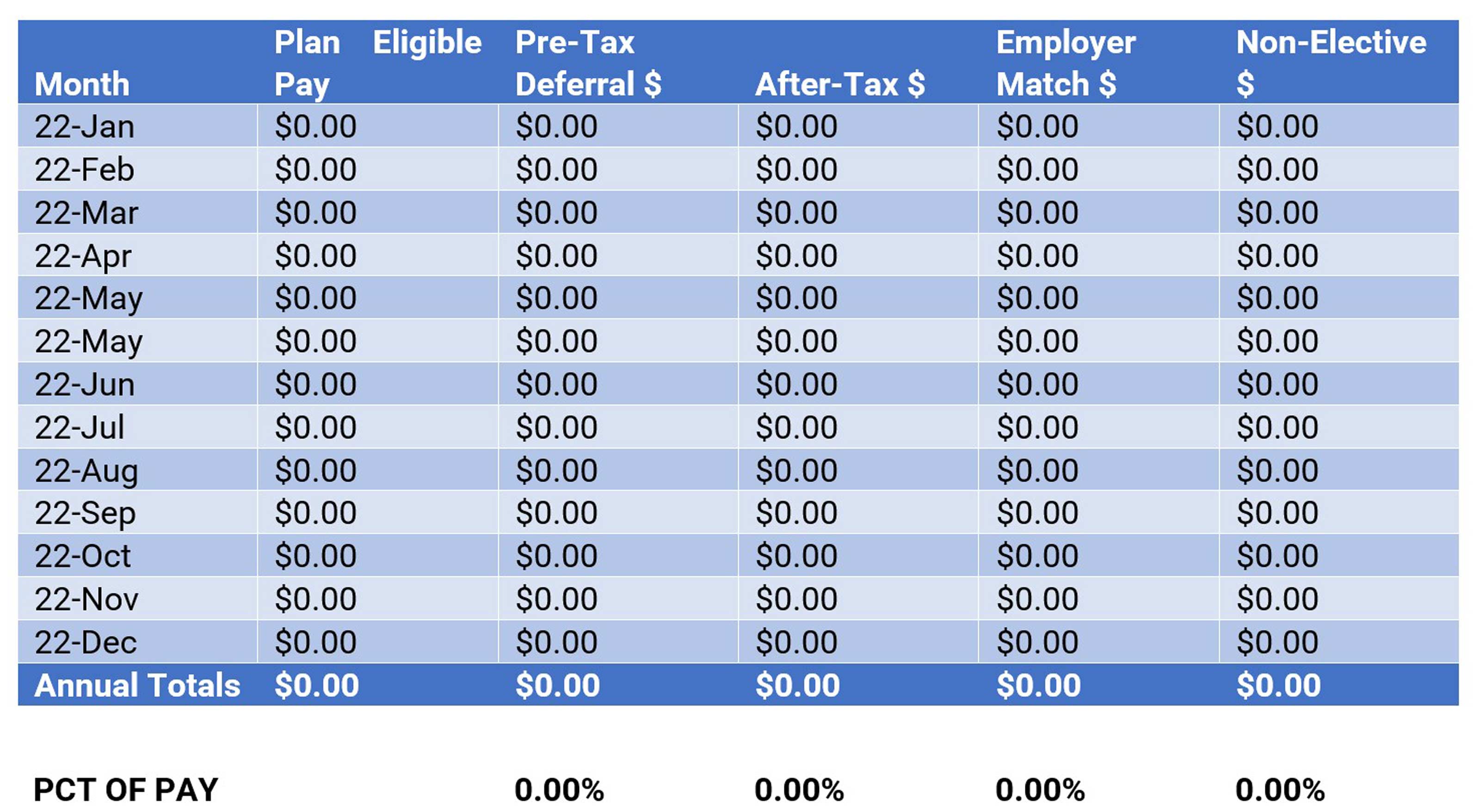

What you can do: You can set up a sample template as shown below to total your actual contributions and compensation, calculate the percentage of pay you received in employer contributions, and verify you received the full amount due under the terms of the plan.

Take the example of a plan that matches 100% of pre-tax and after-tax contributions up to 6% of pay. You can use the spreadsheet above to verify that if the sum of your pre-tax and after-tax contributions exceeded 6% of plan compensation, you received 6% of pay in employer matching contributions.

There are legitimate cases based on the terms of your plan where you may not receive the full matching contribution under the plan if you vary your deferral percentage throughout the year. But even if no error was involved, this type of analysis can make you aware of the benefit of managing your contribution rate to receive the full matching contribution for the year.

The bottom line

The instances cited aren’t a comprehensive checklist but some factors to consider when reviewing your plan account. If you have any questions, contact your plan recordkeeper for an explanation as quickly as possible. (Remember, there are never any “stupid” questions about your money!) If you still aren’t satisfied, contact your HR or Benefits Department before your final recourse, which is to submit a formal appeal to the Plan Administrator as outlined in your plan’s Summary Plan Description.

Most people already review – at least occasionally – statements for their checking account, credit card, cellphone and internet service. Why not add your retirement plan balances to that list?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Alan Vorchheimer is a Certified Employee Benefits Specialist (CEBS) and principal in the Wealth Practice at Buck, an integrated HR and benefits consulting, technology and administration services firm. Alan works with leading corporate, public sector and multi-employer clients to support the management of defined contribution and defined benefit plans.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.