Should You Ditch Your Medicare Advantage Plan? Most People Do

If you're tempted to ditch your Medicare Advantage plan, you're not alone. Here's when it's a good idea and how to go about it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Medicare coverage doesn't just mean signing up for government insurance. In fact, more than half of Medicare recipients now get their coverage through a Medicare Advantage plan, or Medicare Part C plan, which is offered by a private insurer.

Advantage plans are an alternative to original Medicare, replacing Part A (hospital coverage), Part B (outpatient care coverage), and sometimes Part D (prescription drug coverage).

Enrollment in these plans is expected to grow to 60% of the eligible population by 2030, with many people drawn to them because they're often marketed as "zero premium" plans with out-of-pocket limits, while Medicare Part B has uncapped spending and charges premiums. The Trump administration strongly favors the expansion of Medicare Advantage plans.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Yet, while Advantage Plans seem like a good alternative, a substantial number of older Americans who sign up for them don't stick with them. In fact, among those who signed up between 2011 and 2022, around half left their plans within five years.

Recent research published in the journal Health Affairs helps demonstrate why so many are opting out of their Advantage Plan during open enrollment, either by switching to a different Part C plan or by returning to traditional Medicare instead. Since these Advantage plans are less likely to attract beneficiaries over the long term, the study warns that such plans will likely have less incentive to cater to participants with chronic conditions.

Should you ditch your Medicare Advantage plan? Why others are

Researchers sought to gain insight into why Medicare Advantage participants were disenrolling by using information from the Medicare Current Beneficiary Survey, linked with data on Medicare Advantage enrollment. The survey measures patient satisfaction with access to medical care, as well as the cost and quality of the care they receive.

Researchers found two primary factors drove departures from Medicare Advantage plans, and neither was related to cost. Instead, most people who disenrolled did so because of difficulty accessing care as well as concerns about the quality of their care.

Access issues, in particular, were especially likely to prompt Advantage customers not just to switch to a different Medicare Part C plan but instead to return to traditional Medicare. This makes sense, given that traditional Medicare doesn't impose the same limits as Advantage Plans on which doctors or care providers patients can visit.

Hospitals have also been ending their affiliations with Medicare Advantage Plans, creating huge problems when break-ups happen outside of the open enrollment period, and Advantage Plan customers suddenly find themselves without coverage at the hospital where they'd been treated.

Researchers also revealed that individuals with health issues were more likely to switch out of their Medicare Advantage plan. Those who described themselves as being in poor health were:

- More than twice as likely as other Advantage members to express difficulty with getting care;

- More than three times as likely to be dissatisfied with the quality of care they are getting

- More than twice as likely to be unhappy with the cost of their care

- More than twice as likely to be dissatisfied with their specialty care.

"People who stay in [Medicare Advantage} are shopping for better service, but … those who switch to traditional Medicare are the ones potentially with high health care needs, who are much more strongly driven by dissatisfaction with access to care issues " said Geoffrey Hoffman, Ph.D., Associate Professor, U-M School of Nursing and one of the study's authors.

This tendency to switch between Advantage plans or back to original Medicare could undermine the long-term effectiveness of these plans while also driving up the nation's cost to provide original Medicare. The study warns that Advantage plans will likely focus on the short-term healthcare needs of beneficiaries due to plan hopping.

How you can find the right Medicare plan

Since concerns about care quality and accessibility were the most likely reasons for retirees to switch out of their Medicare Advantage Plan — often back to traditional Medicare — it's clear that these are issues that older Americans should pay attention to when shopping for an Advantage Plan.

Those shopping for coverage should visit the Advantage plan's website to find their searchable directory and determine if their preferred care providers accept that insurance plan. Plan websites may also offer a comprehensive directory of all care providers whose services are covered, providing insight into the breadth of the plan's network. The Medicare Advantage open enrollment period is from January 1 to March 31 each year. original Medicare's open enrollment period is from October 15 to December 7 each year.

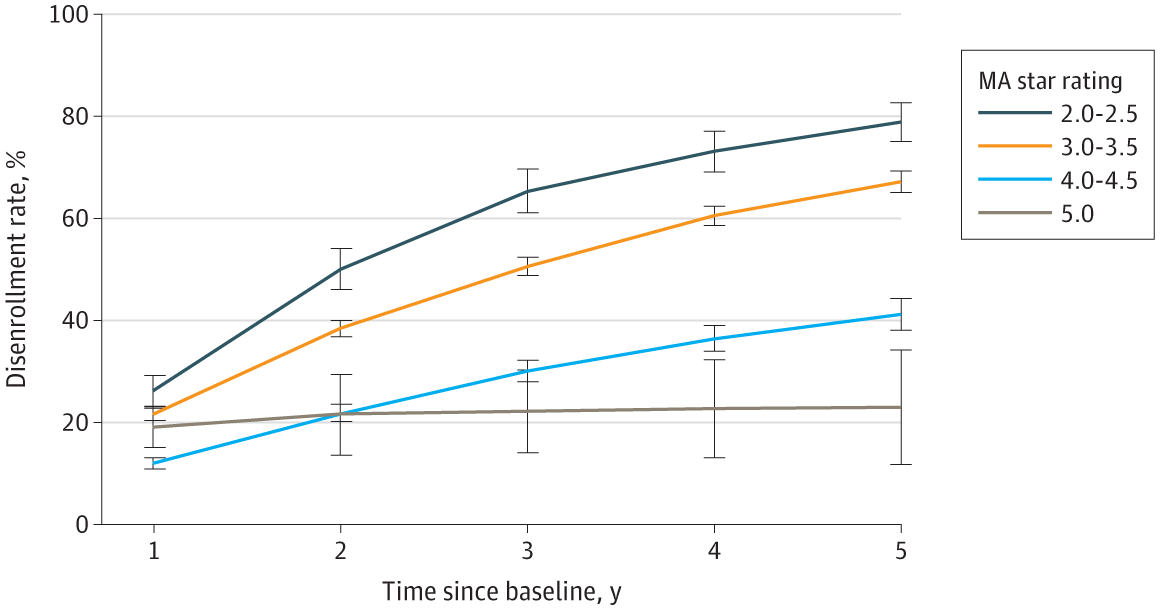

Those looking for a plan should also check the Star Ratings published on the Medicare Plan Finder by the Centers for Medicare and Medicaid Services (CMS). The Health Affairs research revealed that enrollment in a plan with a low star rating was far more likely to result in dissatisfaction with the Medicare Advantage Plan and to lead to disenrollment when given the opportunity, as shown in the figure below.

Disenrollment by Medicare Advantage star ratings over five years

"While imperfect, the star rating a plan receives is still signaling something important, that our study tells us is definitely linked to why people are switching," Hoffman said.

Online guides that provide insight into shopping for a Medicare Advantage plan can also be a helpful resource. It's best to start exploring these tools before open enrollment, though, to prepare in advance, as there's limited time to sign up for coverage you're committing to for the year — except in situations where major life changes entitle you to a special enrollment period.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Christy Bieber is an experienced personal finance and legal writer who has been writing since 2008. She has been published by Forbes, CNN, WSJ Buyside, Motley Fool, and many other online sites. She has a JD from UCLA and a degree in English, Media, and Communications from the University of Rochester.

-

8 Boring Habits That Will Make You Rich in Retirement

8 Boring Habits That Will Make You Rich in RetirementThese mundane activities won't make you the life of the party, but they will set you up for a rich retirement. Discover the 8 boring habits that build real wealth.

-

QUIZ: Are You Ready To Retire At 55?

QUIZ: Are You Ready To Retire At 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

10 Decluttering Books That Can Help You Downsize Without Regret

10 Decluttering Books That Can Help You Downsize Without RegretFrom managing a lifetime of belongings to navigating family dynamics, these expert-backed books offer practical guidance for anyone preparing to downsize.

-

QUIZ: Are You Ready To Retire at 55?

QUIZ: Are You Ready To Retire at 55?Quiz Are you in a good position to retire at 55? Find out with this quick quiz.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.