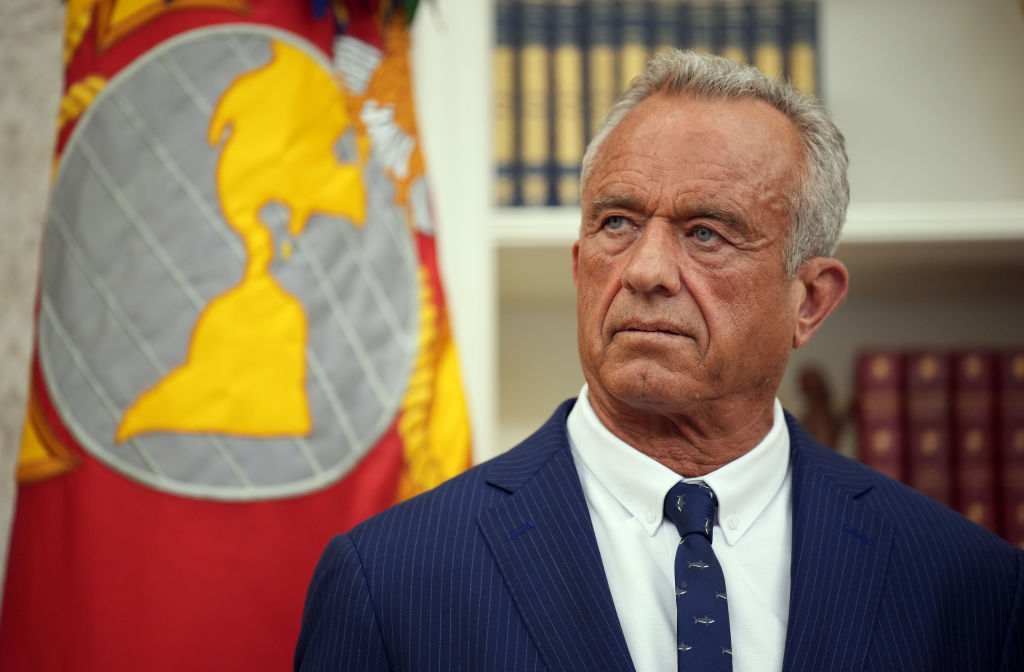

How RFK Jr. May Change Medicare and Your Retirement

Robert F. Kennedy Jr. now heads up the HHS, which includes Medicare. In one of his first actions, the agency announced it was laying off 10,000 workers. Here's a look at how his leadership might change your retirement.

Donna Fuscaldo

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After a shaky road that had many public officials questioning his understanding of healthcare programs like Medicare and Medicaid, Robert F. Kennedy Jr. was recently confirmed as the new head of the U.S. Department of Health and Human Services (HHS).

As HHS secretary, Kennedy has the power to change health care for younger Americans and retirees alike.

In one of Kennedy's first major actions as the head of HHS, the government agency announced it was laying off about 10,000 full-time workers, is streamlining operations by consolidating 28 divisions within HHS to 15 and creating a new division to be called Administration for a Healthy America, or AHA. HHS says the moves will save taxpayers $1.8 billion a year.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The workforce reductions are in addition to the 10,000 staffers that left when President Trump took office and offered voluntary separations. The federal health department's staff will shrink to 62,000 as a result.

Here’s how the workforce reductions will shakeout:

-Food and Drug Administration will decrease its workforce by approximately 3,500 full-time employees

-The Centers for Disease Control and Prevention will decrease its workforce by approximately 2,400 employees

-The National Institutes of Health will decrease its workforce by approximately 1,200 employees

-Centers for Medicare and Medicaid will decrease its workforce by approximately 300 employees

As part of the shakeup the Administration for Community Living (ACL), which provides critical programs that support older adults and people with disabilities including the Administration for Children and Families (ACF), ASPE, and the Centers for Medicare and Medicaid Services (CMS), will be integrated into other departments at HHS. HHS said it will not impact Medicare and Medicaid services.

While Medicare and Medicaid services aren't being impacted in this current overhaul here’s what might happen to Medicare under his leadership.

1. No immediate cuts to Medicare

As part of his recent campaign, President Donald Trump stated, "We will protect Medicare and ensure seniors receive the care they need without being burdened by excessive costs."

The nonpartisan Committee for a Responsible Federal Budget confirmed that Trump's budgetary proposals for Medicare during his initial presidential term were proposals to reduce the cost of Medicare — not proposals to reduce the benefits older Americans receive. Based on this, it’s unlikely that Kennedy will actively seek to cut Medicare benefits.

While Medicare benefits may not be targeted in the current shakeup, older Americans could face more bottlenecks in the context of applying for Medicare or simply getting information.

2. Better integration of Medicare and Medicaid? Maybe

While Medicare eligibility hinges mainly on age, Medicaid is primarily geared to the poor, with eligibility depending on meeting state income-related requirements. An estimated 12 million Americans are dually eligible for both Medicare and Medicaid.

During his Jan. 29 Senate confirmation hearing, Kennedy stated that "dual eligibles are not right now served very well under the system" and acknowledged the need for better integration of care. While Kennedy said he looked forward to consolidating the programs to improve care, he didn’t have a concrete plan and admitted that integration would be difficult.

3. Expanding access to Medicare Advantage

As of 2024, an estimated 33.8 million Americans, or roughly 55% of the Medicare population, received health coverage through Medicare Advantage. Private insurers provide these plans and must offer at least the same level of coverage as original Medicare. Medicare Advantage enrollment has also doubled over the past decade.

Many seniors choose Medicare Advantage plans because they commonly offer supplemental benefits beyond what original Medicare covers, such as dental care, eye exams, and hearing aids and testing. A good number of Medicare Advantage plans also offer fitness and wellness benefits.

As a Medicare Advantage enrollee himself, Kennedy knows these privately run plans have benefits. He also said he thinks most people would prefer coverage under Medicare Advantage but cannot afford it. Some Medicare Advantage plans have $0 monthly premiums, but they usually come with higher deductibles and other costs.

Although Medicare Advantage plans are popular, they receive a high number of complaints from beneficiaries. In general, Medicare Advantage customers complain about slow care approvals and denial of prior authorizations for care.

Dr. Mehmet Oz, President Trump’s pick to head up the Centers for Medicare & Medicaid Services (CMS), suggested limiting the number of procedures subject to prior authorization under Medicare Advantage to 1,000, compared to about 5,500 procedures today, during his confirmation hearing in early March.

Finally, it's unclear how emphasizing Medicare Advantage would save the government and U.S. taxpayers money. Advantage programs reportedly cost 22% more per beneficiary than traditional Medicare, likely because Advantage companies must generate a profit.

Dr. Oz promised to scrutinize Medicare Advantage insurers in an effort to reduce costs during his recent confirmation hearing.

“We’re actually apparently paying more for Medicare Advantage than we’re paying for regular Medicare. So it’s upside down,” he said in front of the Senate Finance Committee.

4. Vaccine coverage under Medicare

Currently, Medicare covers all adult vaccines recommended by the CDC's Advisory Committee on Immunization Practices, with no out-of-pocket costs to enrollees. But with a history of anti-vaccine activism, it's unclear as to what changes Kennedy might make in the context of vaccine coverage for older Americans.

The issue of vaccination is especially urgent in the face of a growing measles epidemic.

In a November 2024 NPR interview, Kennedy said, "We're not going to take vaccines away from anybody. We are going to make sure that Americans have good information." There’s a good chance vaccine coverage under Medicare will not change in the near term. That said, many in the scientific community are concerned about Kennedy's long-term vaccine plans.

5. Prescription drug coverage under Medicare

The Inflation Reduction Act (IRA), passed during the Biden administration, sought to lower out-of-pocket healthcare costs for older Americans. One big change it made was capping the price of insulin at $35 per month, as well as putting a $2,000 annual cap on out-of-pocket costs for Medicare Part D enrollees. The IRA also paved the way for drug price negotiations, leading to lower costs.

On January 20, 2025, President Trump revoked Executive Order 14087, titled “Lowering Prescription Drug Costs for Americans.” This order complemented the IRA and supported lower prescription costs for Medicare enrollees. In light of this, uncertainty abounds regarding future prescription drug costs for older Americans.

To be clear, Trump’s move shouldn’t actually impact current Medicare drug prices, as that would require overturning the IRA. Congress could partially or fully repeal the IRA through legislation, but that hasn’t happened. The Trump administration clarified that the IRA program would continue negotiating Medicare drug prices.

Meanwhile, Kennedy has long supported measures to lower drug costs for Americans of all ages. In a September 2024 op-ed in The Wall Street Journal, Kennedy wrote, "Legislators should cap drug prices so that companies can’t charge Americans substantially more than Europeans pay."

During the Jan. 29 Senate confirmation hearing, Kennedy reiterated the need for drug reform and lower prices. However, without a new executive order allowing HHS to explore options for drug reform, it’s unclear where drug prices for Medicare enrollees will go.

Older Americans can hope that as part of Kennedy’s pledge to make America healthy again, he’ll continue to support drug price caps and limits on out-of-pocket spending for Part D and Medicare Advantage plan participants.

Meanwhile, Dr. Oz promised to uphold the Medicare drug price negotiation program launched during the Biden administration.

"It's the law. I'm going to defend it and use it," Oz told senators during his confirmation hearing.

All told, any changes Kennedy makes to Medicare have the potential to impact millions of people’s retirement. We’ll need to stay tuned.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Maurie Backman is a freelance contributor to Kiplinger. She has over a decade of experience writing about financial topics, including retirement, investing, Social Security, and real estate. She has written for USA Today, U.S. News & World Report, and Bankrate. She studied creative writing and finance at Binghamton University and merged the two disciplines to help empower consumers to make smart financial planning decisions.

- Donna FuscaldoRetirement Writer, Kiplinger.com

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.