15 Estate Planning Terms You Need to Know

Sometimes industry jargon can turn otherwise understandable concepts into stumbling blocks. Here are simplified explanations, definitions and uses for some estate planning tools.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Estate planning, though often perceived as complex and confusing, becomes less daunting with increased understanding. While initiating the process may seem overwhelming, a well-executed and thorough estate plan serves as a crucial initial step in safeguarding your family and legacy.

What are the essential steps? What truly matters? And what do all those unfamiliar terms signify? To help you navigate this process, I've compiled and clarified 15 estate planning terms you should understand.

Estate planning definitions and terms to know

1. Codicil: A formally executed document that amends the terms of a will so that a complete rewriting of the will is not necessary. It will either explain, modify or revoke aspects of an established document.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Purpose: Codicils are required to change/update your will after significant life changes such as births, deaths, marriages, divorces or moving out of state.

2. Conservator: An individual or a corporate fiduciary appointed by a court to care for and manage the property of an incapacitated person in the same way that a guardian cares for and manages the property of a minor.

Purpose: A conservator's primary purpose is to protect the financial and/or personal well-being of an individual who is unable to manage their own affairs due to incapacity or legal limitations.

3. The Generation-Skipping Transfer Tax (GSTT): a separate tax that is imposed in addition to the estate tax. It is applied to outright gifts and transfers in trust that exceed the GSTT exemption. These transfers, which can occur during one's lifetime or at death, are made to beneficiaries who are two or more generations younger than the donor, such as grandchildren or great-grandchildren. The tax is currently calculated at a flat rate of 40%, which is equal to the top estate and gift tax rate

Purpose: The GSTT is designed to prevent the avoidance of gift or estate tax at the skipped generational level. Some states also impose a state-level generation-skipping transfer tax.

4. Gross Estate: This estate planning term refers to the total value of an individual's property at the time of their death. It also encompasses certain assets they previously transferred, which are still subject to federal estate tax regulations.

Purpose: This comprehensive valuation is a key component in determining federal estate tax liability.

5. GSTT exemption: The GSTT exemption amount is $13.99 million per individual in 2025. The amount is currently set to revert to a $5 million baseline in 2026, and is projected to be $7 million when indexed for inflation, unless Congress acts prior to this date to extend the increased exemption.

Purpose: The exemption allows you to reduce or potentially eliminate the transfer taxes associated with gifting or passing money to grandchildren or other skip beneficiaries.

6. Heir: A person entitled to a distribution of an asset or property interest under applicable state law if you die intestate due to the absence of a will. “Heir” and “beneficiary” are not interchangeable, although they may refer to the same individual in a particular case. Anyone you chose to leave a bequest is a beneficiary, only those related by blood or law can be your heir.

Purpose: If you die without a valid will, you die intestate, and your state's intestacy laws determine how your assets are distributed, typically to close relatives. Intestate succession laws would then dictate the order in which your assets are distributed to your heirs.

7. Life estate: A life estate grants a beneficiary, also called the life tenant, the legal right to use a property for the duration of their life under state law. This represents the entirety of their interest in the property.

Purpose: Life estates provide a straightforward way to transfer property ownership to the next generation without the complexities of a will or trust. Because following the death of the life beneficiary, the title fully vests the person named in the deed or trust agreement. This person might be referred to as ‘the remainderman.’

8. Operation of law: The way some assets will pass at your death, based on state law or the ownership of the asset, rather than under the terms of your will.

Purpose: Ease and avoidance of probate; no specific steps need to be taken by the parties for the transfer to occur. These accounts or assets have a named beneficiary, such as a life insurance policy, retirement plan or a Transfer on Death (TOD) account.

9. Payable on death (POD) and Transfer on death (TOD) designations: POD and TOD are types of beneficiary designations for a financial account that will automatically pass title to the assets at death to a named individual or revocable trust outside of probate.

Purpose: POD and TOD accounts can be a simple and effective way to ensure the transfer of ownership of an account or policy to your chosen beneficiary.

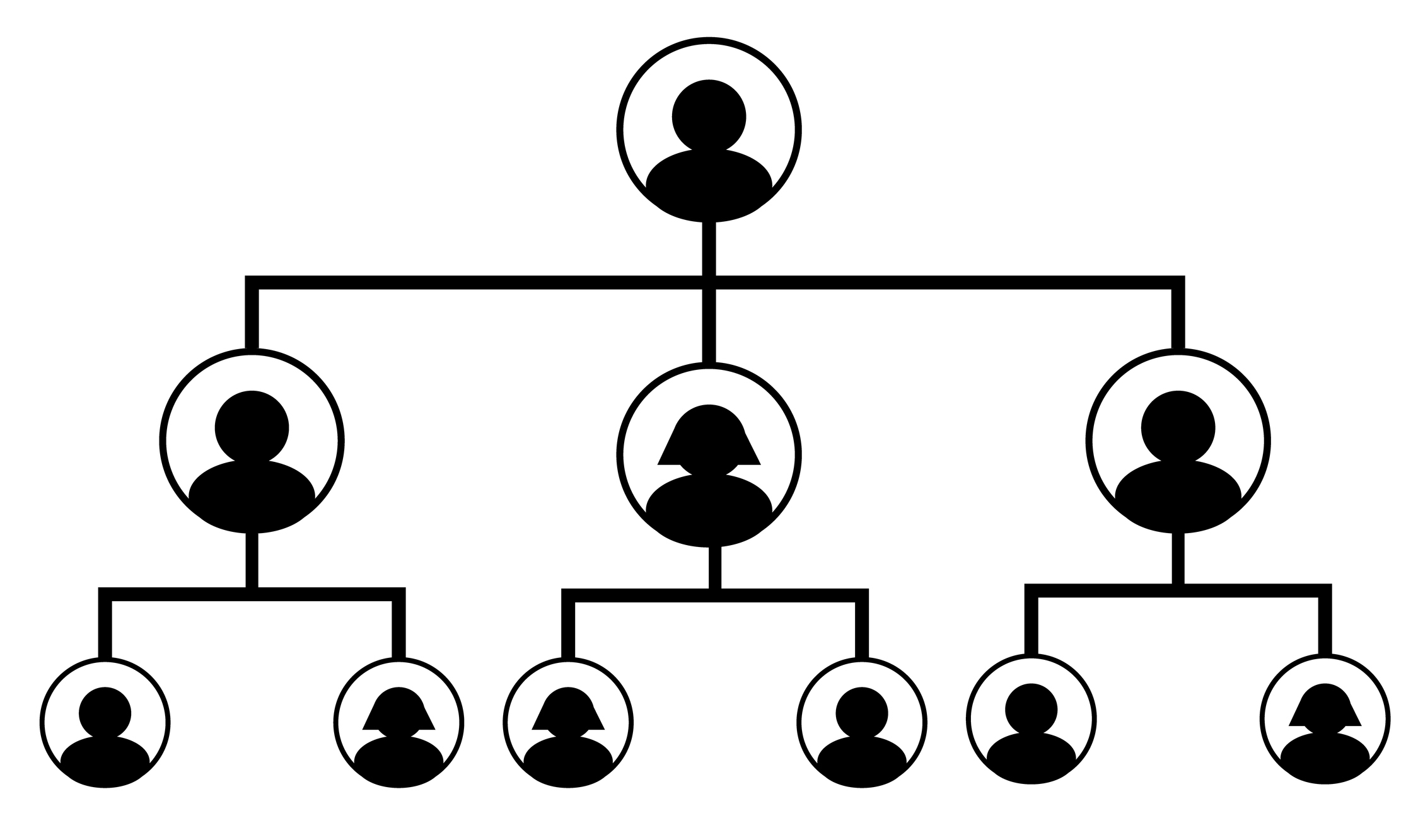

10. Per Stirpes: This Latin term, meaning "per branch," describes a method of distributing property in estate planning. It follows the family tree, with descendants inheriting the share their deceased ancestor would have received if alive. Under per stirpes, each branch of the named individual's family is entitled to an equal portion of the estate.

How it works:

- If all adult children are living, each receives an equal share

- If an adult child has passed away, that adult child's share is divided equally among their children

Purpose: It simplifies planning by eliminating the need to name specific contingent beneficiaries for every possible scenario. And it ensures that each "branch" of the family receives an equal share.

12. Qualified domestic trust – A ‘QDOT’ is a marital trust created for the benefit of a non-U.S. citizen spouse containing special provisions specified by the Internal Revenue Code to qualify for the marital deduction.

Purpose: Estate planning advantages normally afforded to spouses are not available to non-citizen spouses even if they are permanent legal residents. A surviving non-citizen spouse is not entitled to an unlimited gift tax deduction or an unlimited marital deduction.

13. Remainderman: A remainderman, in property law, is someone who is entitled to inherit property in the future. This inheritance occurs after the termination of a preceding estate, most commonly a life estate. The remainderman is a third party who is not the creator or initial holder of the estate.

Purpose: Naming a remainderman ensures a clear and planned transfer of property when the life tenant passes away. This process can often bypass probate, thereby reducing associated costs and complexities.

14. Residue or residuary estate: The property remaining in an estate after payment of the estate’s debts, taxes, and expenses, and after all specific gifts of property and money have been distributed according to the will.

Purpose: The primary goal is to ensure all estate assets are identified and distributed as the deceased person wished. If a residuary clause is absent, any leftover assets will be distributed based on intestacy laws, potentially contradicting the intentions of the deceased.

15. Spendthrift provision: A clause in a trust that prevents beneficiaries from giving away their interest in the trust to others, a voluntary transfer, and also protects their interest from being claimed by their creditors through an involuntary transfer. This is often included to safeguard the trust assets from claims of the beneficiary’s creditors.

Purpose: Spendthrift clauses are frequently incorporated when a beneficiary is prone to financial mismanagement, has issues with substance abuse, or faces other challenges that could jeopardize trust funds.

Knowing is half the battle

Estate planning is the final piece of a sound financial plan. You can not only ensure your assets are distributed according to your wishes but organize them in a way to reduce friction and costs after you pass. Trusts are one instrument you can use to transfer assets to your intended beneficiary, reduce your tax burden and preserve more of your wealth.

Knowing the meaning of various legal terms and their purpose can help you better understand your estate planning needs and options. The next step is to create or update your estate plan.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna joined Kiplinger as a personal finance writer in 2023. She spent more than a decade as the contributing editor of J.K.Lasser's Your Income Tax Guide and edited state specific legal treatises at ALM Media. She has shared her expertise as a guest on Bloomberg, CNN, Fox, NPR, CNBC and many other media outlets around the nation. She is a graduate of Brooklyn Law School and the University at Buffalo.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.