Do You Need a Family Office? Four Signs for the Very Wealthy

You may need a family office if you are a high-net-worth individual, because "being wealthy turns a family into a family business."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

No doubt, financial wealth has its perks. Eight-figure-plus portfolios. Multiple homes. Expensive cars. Lavish lifestyles. Financial freedom. But family fortunes come with headaches and challenges, too. Coming up with a plan to ensure the money lasts for generations. Knowing where and how to invest. Managing risk. Dealing with family dynamics. Defending against cybercrime. Ensuring the physical safety of family members. Keeping the kids grounded.

Being wealthy turns a family into a family business. And just like any corporate CEO knows, there’s a lot of stuff that needs managing: finances; human resources; data analytics; due diligence; tax planning; legal issues; philanthropy; succession, managing intergenerational wealth. The list goes on and on. “You’re essentially running a business,” said Brian Weiner, founder and CEO of FORG (Family Office Resource Group). “You’ve got some complexity now.”

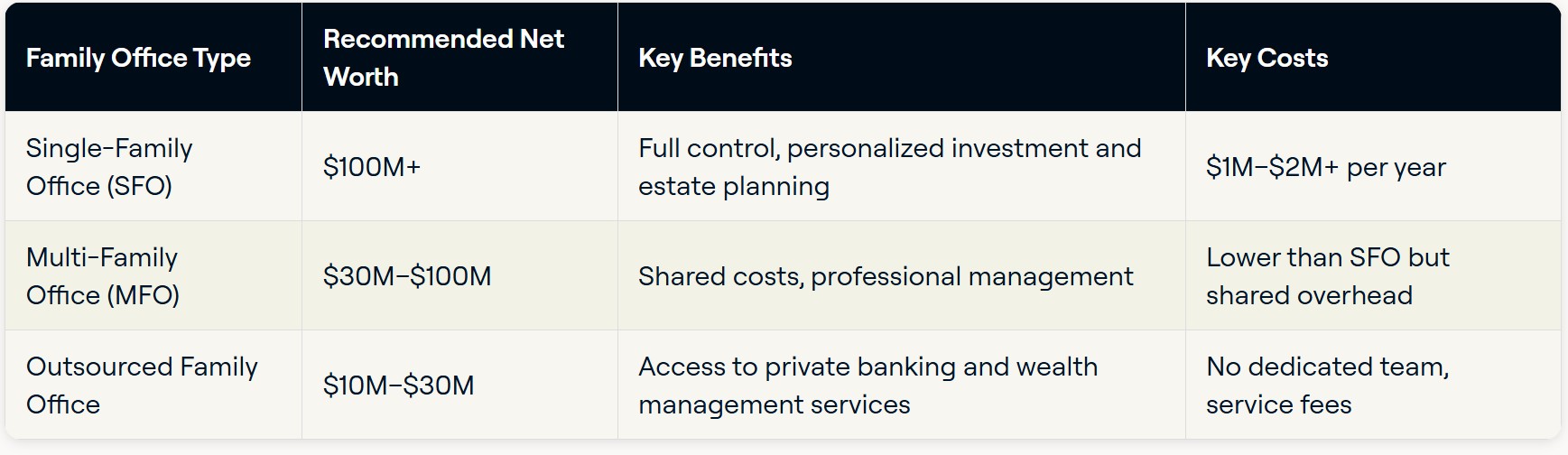

And the combination of vast wealth and financial and life complexity is when wealthy Americans need to decide whether they require a dedicated team of professionals to manage their family’s affairs, such as a family office. So, what is a family office? There are a few types, detailed below in a chart from Maestro.com.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Types of family offices

The most common is a so-called single-family office, or a private entity established by families to oversee their affairs. “A single family office is meant to do exactly what its namesake says, which is serve one family,” said Chris Wolfe, president and chief investment officer of Pennington Partners, a multi-family office firm.

“The real issue in any family office is to define the scope of activities. In some instances, the family office does everything from walking the dogs to find new private equity deals, to manage the ranch or whatever it is. (A single family office) is a way for the family to essentially run the business of managing their wealth.” The family assembles a team of specialists, ranging from investment pros to estate planning experts, lawyers, and accountants.

A multi-family office brings together similar services and expertise under one roof, with the primary difference being that it manages the affairs of multiple families.

An outsourced family office performs several of the services of a multi-family office, but keeps fees lower by outsourcing some services.

There are an estimated 6,000 to 7,300 family offices in the U.S., according to Family Office Exchange. The family office concept dates to the 1800s, when they were established to manage the fortunes of successful tycoons, such as J.D. Rockefeller and wealthy families like the Carnegies and Vanderbilts, according to Deloitte.

How much money do you need to use a family office?

There are many ways to generate enough wealth required to consider a family office. So, how much dough do you need before considering a family office? “It generally starts at about $30 million and then goes up from there,” said Weiner.

That’s when the number of experts required to manage your family finances and affairs starts to mushroom and complexities mount. And if you sold a business to create your wealth, you’ll no longer have specialists like CPAs and tax attorneys on the payroll to manage your windfall. “Who’s going to run the family books?” said Weiner.

What’s more, a wealthy family that earns 10% on their money will double their money every seven years. That means the $30 million today will be $60 million in seven years and $120 million 14 years from now. “And then, you’re at a whole other level,” said Weiner. And along the way, you’ll have to deal with a full range of new financial complexities, not to mention more personal matters that a traditional financial advisor or wealth management firm isn’t equipped to address.

“Are you going to want to talk to a bank about your adult children’s substance abuse issues or sibling rivalry? Are you going to use a bank to handle cybersecurity and personal threat assessments?” said Weiner. “Absolutely not. That’s why you will use other firms so you can piecemeal together your own family office.”

Here are four scenarios when forming a family office may make sense.

1. You have zero interest in managing the family fortune

From a financial standpoint, you’ve succeeded beyond your wildest dreams. But you’re simply not jazzed about the idea of managing your family fortune or affairs. Creating a single family office or hiring a multi-family office makes sense if “you have no desire to be in the business of managing money,” said Wolfe. “You don’t want to devote time to it. You just want to outsource it.”

2. Running the family empire is simply too complex

“Another piece is complexity,” said Wolfe. “You know, as your wealth grows, things like trusts, taxes, estate issues and investing opportunities become incredibly challenging to sift through. You need a filter.”

3. You will benefit from specialized expertise and services

Like any business, the business of running a family and managing wealth requires experts with specialized knowledge. To properly manage your affairs, you also need to have all these other services provided a la carte. “The service function (is key),” said Wolfe. ‘Hey, I have 22 different checking accounts and four houses. I have a boat. I need some help renting a plane.’ As your lifestyle changes and grows, you need to access a number of different things. And a family office should be helping you with all of that.”

For example, a key service provided by a family office is paying bills and financial reporting. An investment manager might help you fine-tune your asset allocation, manage your portfolio, and benchmark your returns. But what family offices do is pay the bills for you and provide a precise accounting of your spending.

That’s where specialized services, such as personal bookkeeping and billpay experts, come in. If you have three homes, for example, just keeping track of the bills for those properties can be challenging. You’ve got tax payments to all these different municipalities, insurance payments and you’re spending money on a car at each of the properties. Things start to add up. It becomes challenging to keep up and not miss payments.

Paybill specialists also help wealthy folks get a better idea of how much they are spending on credit cards and homes. Paybill specialists aggregate all that information together and can tell you at a very detailed level what it costs to operate a property in each category. You can then make strategic decisions that you just can’t make without good data.

4. The family office emerges as your new career path

“Sometimes people get into the family office business because they want to start a new business on their own,” said Wolfe.

Often, starting a family office makes sense if you find you are simply spending too much time each week managing your family's assets, adds Wolfe. ‘If you're spending something like 20 hours managing your family's affairs, you have to start asking the question, ‘What am I doing?’ It may be fun or a hobby, but 20 hours a month starts to get intense. And the rules and laws have changed around all sorts of taxation and other opportunities. So, you get to a place where complexity (becomes overwhelming) and you start to question whether I'm maximizing the value of my wealth.”

A family office is a way to successfully manage your affairs with the help of others while also freeing up time to focus on other things you value in life.

“If a family office isn't giving the family peace of mind, it’s not doing a good job,” said Wolfe.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.