One Trick That’ll Help You Live a Wealthier and Happier Life: Framing

From elections to stock markets, there’s a lot you don’t have control over, but your frame of mind is not one of them. And it’s more important than you may know.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The happiness we feel about our money, work, relationships and life in general isn’t derived by only what happens, but also how we perceive what happens.

A famous saying often attributed (rightly or wrongly) to Roman emperor and Stoic philosopher Marcus Aurelius goes like this: “Everything we hear is an opinion, not a fact. Everything we see is a perspective, not the truth.”

What he seems to be articulating is a cognitive bias named more than 1,500 years later as the “framing effect.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The framing effect is the psychological principle that our decisions are influenced by how choices are positively or negatively presented. It is related to the groundbreaking research of Amos Tversky and Daniel Kahneman known as prospect theory, which states the pain of a loss is twice as powerful as the pleasure of a gain. What that means is that when given the choice, people prefer a sure gain over a probable one, and they prefer a probable loss over a definite loss.

When presented with a positive frame, people tend to avoid risks. But when presented with a negative frame, people tend to seek risks. As a simplification of one role-playing experiment involving a life-or-death scenario shows, people will avoid letting 10 out of 100 lives perish but will take the opportunity to save 90 out of 100 lives, even though each option results in the same outcome.

A Key Route to Positive Thinking: Framing

You can see the concept of framing at work at your local grocery store. For example, beef advertised as “95% lean,” versus “5% fat.” Or, more misleading, food products that don’t naturally contain gluten labeled as “gluten-free” just to make them appear healthy. Gluten-free candy, anyone?

Framing is considered one of the strongest cognitive biases that impact the decision-making process. It can influence everything from our political and social attitudes – what we call spin – to how we spend money and even what type of health insurance we choose.

While all of this may sound alarming, there is a major silver lining. We are not relegated to being only involuntary victims to framing. Instead, we also have the ability to use it as a tool to make better decisions and become happier people.

How Framing Can Help Investors’ Outlook

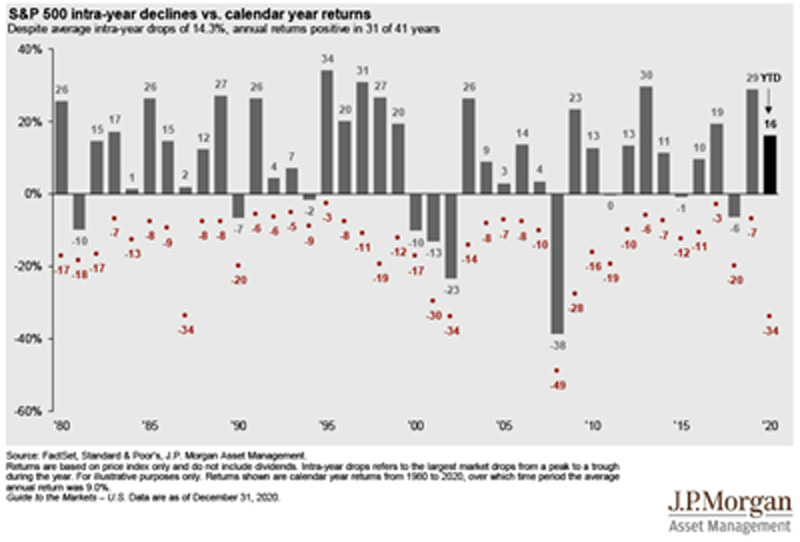

One of the most enlightening investment charts out there is from J.P. Morgan Asset Management’s Guide to the Markets showing the S&P 500’s annual low points and ending year returns since 1980. It certainly comes in handy during wild stock market swings.

The average intra-year market decline has been 14.3% over the past 41 years. Yet annual returns have been positive in all but 10 years, or more than 75% of the time. Of course, the past is no guarantee of the future. But it goes to show there are two ways of looking at a market drop: as something to worry about, or as a typical short-lived decline in another typical year that will likely end in the black.

By framing things in the right way, you can make smarter choices with your money that lead to better outcomes. It can help you avoid rash decisions, such as impulse buying and making emotional investment changes.

It can make you more content with what you have (what I have now is what I once wanted) and more dedicated to saving (to spend this money is to live a life I may not want, but to save is to eventually live the life I do want).

To Be Happy, Have the Right Frame of Mind

There are a variety of ways to frame situations that are conducive to your financial goals. For example, if your friend is getting married in Aruba, and it’s not in your budget to go, instead of thinking to yourself, “We’re missing our friend’s destination wedding,” tell yourself, “We’re choosing to stay committed to our financial goals.” Or say there’s a hot shoe sale going on. Tell yourself, “Yes, that’s a great sale , but it’s still spending money I don’t need to spend.”

But there is much more. Framing can also help you find greater peace of mind and happiness – every day. Research indicates that people become happier with age, greatly because they start to perceive the world in a more positive and impartial light. Journalist John Leland came to that conclusion while spending a year interviewing six New York City residents who were 85 and older. He documented his experience in the book Happiness Is a Choice You Make.

“Older people are more content, less anxious or fearful, less afraid of death, more likely to see the good side of things and accept the bad, than young adults,” Leland writes. A day spent at the doctor’s office for a bad hip was still the gift of another day of being alive. A new complicated device meant spending quality time with the grandkids as they teach you how to use it. For older adults “problems were only problems if you thought about them that way. Otherwise they were life — and yours for the living.”

Give It a Try Yourself

We all have ability to frame situations differently, in a way that leads to better decisions and better outcomes. It can alter our perceptions, changing the way we see ourselves and the way we see others. What do you think if you see someone’s unmade bed? They’re lazy? Sloppy?

Now, what if we frame it in a more compassionate way. Perhaps, it is the habit of someone who is too consumed with work outside the home to be able to give much time to this one detail.

Give it a try. Plan a day to actively reframe things around you. And, whenever something bad happens, pause and ask yourself how you can turn it into a positive. You can work your mind like a muscle until you find yourself more receptive to how things are and less upset over how you wish they were. It’s when you do that, when what you want most – a happy, fulfilling life – happens.

Here are some examples framing things differently:

- Your company’s 401(k) match: It’s limited to a measly 6%, OR it’s a guaranteed 100% return on your contribution.

- A beat-up used car parked next to a Ferrari: Thousands of dollars in income parked next to thousands of dollars in debt

- A pair of $300 shoes: 10 hours of work at $30 per hour in wages

- A kid’s temper tantrum: He’s an out-of-control brat, OR he’s a child who is frustrated at not yet having the words to express himself.

- Someone who is always late: She’s irresponsible and thoughtless, OR she’s someone who respects many people’s time and is too optimistic about how many meetings she can squeeze in.

- Difficult feedback at work: I’m being picked on, OR I’m getting information to help me improve —and surpass the people giving me difficult feedback.

- Market downturn: It’s time to sell everything, OR some good stocks are available at a discount.

You don’t always get to decide what happens in life, but you do always get to decide how you will react, which ultimately determines how events shape you. This brings to mind the oft-cited 2005 Kenyon College commencement speech by writer David Foster Wallace about the value of education in making concerted choices to see the world truthfully and not in a mindless, unfulfilling default mode.

He starts with a story: “There are these two young fish swimming along and they happen to meet an older fish swimming the other way, who nods at them and says, ‘Morning, boys. How’s the water?’ And the two young fish swim on for a bit, and then eventually one of them looks over at the other and goes ‘What the hell is water?’”

Many of us go through life asking the same question, he says. We make choices based on our set perceptions without trying to see for what they truly are. Wallace continues: “The only thing that’s capital-T True is that you get to decide how you’re gonna try to see it.”

But reframing doesn’t come naturally. So, he ends with a proclamation that it is a continuous process, that it will take an “…awareness of what is so real and essential, so hidden in plain sight all around us, all the time, that we have to keep reminding ourselves over and over: ‘This is water.’”

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.