Don't Let a "Clunker" Fund Drag Down Your 401(k)

401(k) lineups are loaded with overpriced, underperforming fund options. Here's how you can dump the clunkers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Your 401(k) fund lineup at work may not stack up with the star-studded roster of the World Series champion Los Angeles Dodgers. And some of your funds may not hug market curves like a well-tuned Ferrari. In fact, your 401(k) plan is more likely than not to include overpriced and underperforming funds that could crimp the growth of your retirement nest egg, according to a recent report from Abernathy Daley 401k Consultants.

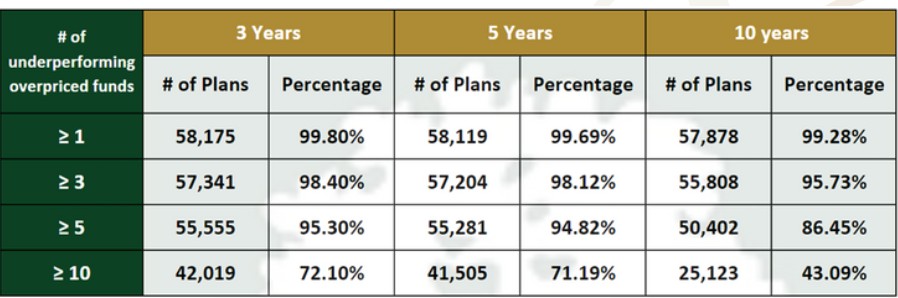

The analysis of 58,300 U.S. 401(k) plans from 2015 to 2025 found that nearly all (more than 99%) offer at least one overpriced and underperforming fund to plan participants over a period of three, five, and 10 years. And more than 94% contain at least three such funds. Over 85% include at least five such funds. The study notes that this is the case despite there being “cheaper, higher-performing alternatives.”

And the so-called clunker list extends over the long haul, too. More than 70% of 401(k) plans contain at least 10 overpriced and underperforming funds over three- and five-year periods, and 43% of plans have 10 of these expensive laggards over a period of 10 years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Hot to spot a 401(k) clunker

As part of the analysis, the study identified alternative funds in 401(k) lineups from the same investment category (e.g., large-cap growth), lower expense ratios, and higher returns over three-, five-, and 10-year periods. The expense ratios on the so-called “cheaper alternative” funds in the study was an annual expense ratio of 0.50 or less for passive index funds, and fees of 0.75% or less for active fund strategies.

The report authors blame the weakness in 401(k) fund lineups on the inclusion of actively managed funds, which charge higher expense ratios than passive index funds that mimic a market benchmark like the S&P 500, resulting in so-called “fee drag.” Historical data show funds run by stock pickers also post lower returns than the benchmarks they track over time, in large part due to fees eating into returns. What’s more, academic research shows it is impossible to determine which actively managed fund will outperform an index fund in any given year or period, according to the Abernathy Daley report.

That said, there are actively managed funds with strong track records that have been successful in generating market-beating returns. The problem is that today’s winner may not be tomorrow’s stock market star.

The downside to "suboptimal" fund options, the study notes, is that employees lose a significant amount in potential retirement savings.

"There’s real money at stake," said Matt Daley, president of Abernathey Daley 401k Consultants. "It’s not pennies. It could be hundreds of thousands of dollars" over a 401(k) saver's lifetime.

But since many 401(k) savers often aren’t aware of the impact fees have on returns, many plan participants inadvertently select funds offered in their 401(k) plans that have larger odds of producing returns that are smaller than the gains of the S&P 500 or market benchmark the fund is trying to hurdle.

Consider this example from the Department of Labor that highlights how high fees can curtail the growth of a 401(k) account balance over time.

"Assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. If returns on investments in your account over the next 35 years average 7% and fees and expenses reduce your average returns by 0.5%, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account. If fees and expenses are 1.5 %, however, your account balance will grow to only $163,000. The 1 percent difference in fees and expenses would reduce your account balance at retirement by 28 percent."

Fees matter

"The cost of the funds you’re investing in is very important," said David Schneider, a certified financial planner and president of Schneider Wealth Strategies.

When you consider that American workers had $12.2 trillion invested in defined contribution plans at the end of March 2025, and retirement savings accounted for 34% of all household financial assets, according to the Investment Company Institute (ICI), it’s clear that 401(k) savers should be scrutinizing the funds in their 401(k) plan more closely. Savers need to ensure they are selecting funds that give them the best chance of amassing as big a nest egg as possible and achieving their financial goals.

What to look for in a 401(k) lineup

"Now’s a good time to take a second look at your plan,” said Daley. “Don’t just set it and forget it."

401(k) plan participants can dodge underperforming funds by choosing so-called "foolproof" funds, or low-cost, well-diversified index funds that keep pace with the market and other benchmarks, minus rock-bottom fees, says Steven Abernathy, CEO of Abernathy-Daley.

Passively managed index funds are widely available and cost below 0.10%, according to the Abernathy Daley 401 (k) Consultants’ study.

While investments in index funds won’t ever result in market-beating returns, they ensure that retirement savers don’t lag the market. The index fund option, such as a fund that mimics the S&P 500 stock index or the total U.S. stock market, ensures that "plan participants avoid mistakes that could lead to lost investment opportunities,” said Abernathy.

The key benefit of a 401(k) account, which is designed for a long-term horizon leading up to retirement, is its ability to grow wealth with the help of compounding, or earning interest or capital appreciation on top of earlier principal investments and prior gains.

But high fees, which take a slice out of account balances, mean less money benefits from compounding.

“Compounding fees is the same thing, only in reverse,” said Daley. “Fees can really eat into your savings.”

Here’s an example from the Abernathy Daley study. Consider a $500,000 investment in Fund X that charges a 0.45% fee and earns a 7% annual return versus Fund Y (0.08% fee and 7% gain per year). After 30 years, Fund X is valued at $3,306,813 and Fund Y at $3,806,129, which places the total loss to fees and underperformance at $499,316 (or 13.1% of potential wealth).

When eyeballing a 401(k) fund lineup, plan participants should be on the lookout for funds with "index" in their names, and ones with rock-bottom expense ratios of just a few basis points, says Jamie Cox, a financial advisor and managing partner at Harris Financial Group. Examples include Vanguard S&P 500 Index Fund (VFIAX), which invests in large-cap U.S. stocks and charges 0.03%, and Fidelity Total Market Index Fund (FSKAX), which invests in all sizes of U.S. stocks and carries an expense ratio of 0.015%.

Index funds are solid investments for three reasons. First, low fees. “They’re not cost-free, but they’re close,” said Cox. Second, you get pure exposure to the asset class the index tracks. In the case of the S&P 500, you get exposure to growth-oriented large-company stocks. Finally, you get broad diversification, which keeps you from putting all your eggs in one basket. “It steers investors away from the risk of owning just a single stock,” said Cox. Index funds, he adds, check all the boxes for a successful investment.

Part of Schneider’s advisory business is setting up 401(k) plans for clients who are small business owners. "What we generally try to do is stock the 401(k) with lots of good, low-cost investment options, so that employees aren’t going to be choosing from a rogue’s gallery,” said Schneider. “I tell clients that a good 401(k) is going to offer the essential building blocks for a well-diversified, all-weather portfolio, not just funds that have done well in recent years. A fund, however, does not have to be a pure index fund to be a worthwhile investment, but costs matter. If you look at the expense ratio of the fund, that’s going to tell you a lot."

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Shell is a veteran financial journalist who covers retirement, personal finance, financial markets, and Wall Street. He has written for USA Today, Investor's Business Daily and other publications.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.