To Auto-Increase or Not to Auto-Increase Your 401(k) Contribution Rate

Automatically increasing your 401(k) contribution rate can be a great way to boost your savings. But could your next dollar work better for you elsewhere?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

During the past 30 years, there has been an important revolution in the administration of 401(k) plans. Often referred to as auto-increase or auto-escalation, here’s how it works: If you are automatically enrolled in a plan and don’t opt out of the auto-increase feature, then your deferral rate will increase over time, up to the plan maximum. The frequency, rate of increase and plan maximum can vary, but a common approach is an annual increase of 1 percentage point on the anniversary of your initial enrollment, up to a 10% maximum.

According to a 2021 study by the Plan Sponsor Council of America, more than half of all defined contribution plans have adopted an auto-escalation approach. It has also become increasingly common for plans with a default auto-increase provision to increase your rate above what is needed to receive the maximum employer matching contribution. For example, a plan that matches 100% of contributions up to 6% of pay deferred may automatically enroll you at 3% and then increase your rate by 1 percentage point per year until you reach a 10% auto-increase cap.

Most experts agree that, at a minimum, everyone participating in a plan offering a matching rate of 25% and higher should defer enough to receive the plan’s full matching contribution, as this “free money” provides a better rate of return than any alternative. For example, if the plan’s default deferral rate is 3%, but the plan matches 50% of contributions up to 6% of pay, you should (at a minimum) allow any rate increase to take place at least until reaching the 6% match-eligible deferral rate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Is an Auto-Increase in Your 401(k) Contributions Best?

If you can afford additional savings beyond getting the full employer matching contributions, you may question whether allowing additional voluntary (unmatched) 401(k) deferrals is the best use of your income. Or should you opt out of further rate increases to address other financial needs first?

Unfortunately, you won’t find this issue addressed in most benefit communications. They tend to treat each individual program (medical, dental, life insurance, 401(k), etc.) separately without considering how to allocate your income among the available choices, let alone consider other financial needs such as debt payment.

This is understandable given the almost infinite number of options available. So, how can you decide whether the best use of your money is to allow your deferral rate to automatically increase? While it’s not possible to recommend a single course of action, given each individuals’ unique circumstances, here are some alternatives to higher voluntary savings you might also consider.

Build Your Emergency Savings

Financial advisers stress the importance of having a side fund to pay unplanned expenses due to unforeseen events, such as a car accident, storm damage, unreimbursed medical expenses, etc. The amount you need depends on your annual income, but ideally you would start with at least $1,000 if you have no other savings. And pretax or Roth 401(k) contributions are not a good way to save for unexpected expenses for several reasons.

First, if you are under age 59½, the IRS will permit in-service withdrawals only for certain reasons that may not include emergency expenses. Further, the taxable portion of any withdrawal prior to age 59½ is subject to a 10% excise tax. The IRS also mandates that 20% of the taxable balances withdrawn – regardless of age – be withheld for federal income taxes.

Consider building emergency savings in a separate account outside of your 401(k) plan. Employers are starting to offer their employees help with funding these types of savings accounts by letting you contribute through regular payroll deductions.

Open a Health Savings Account (HSA)

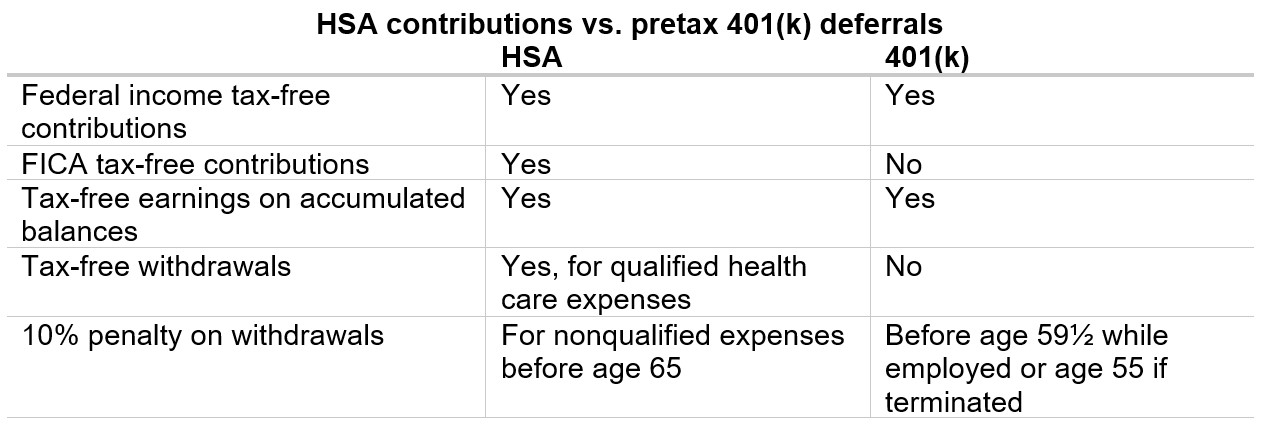

When a person enrolls in a qualified high-deductible health plan (HDHP), employers may also offer their employees the ability to contribute to a health savings account (HSA) to pay for qualified medical expenses on a tax-preferred basis. Both 401(k) plans and HSAs offer the ability to save on a tax-preferred basis, but the HSA has additional tax benefits in saving for qualified health care expenses not available in a 401(k) plan per the chart below.

In saving for future health care expenses, most financial experts agree that you should prioritize funding your HSA up to the annual limit before making voluntary contributions to your 401(k) plan. In 2022, you can make HSA contributions up to $3,650 if you have self-only coverage or up to $7,300 for family coverage. If you are at least age 55, you are permitted an additional $1,000 in annual catch-up contributions.

There is even a school of thought that the tax benefits of an HSA are so valuable they should be prioritized over receiving matching contributions, depending on your tax bracket and matching rate. But if you aren’t willing to do a more sophisticated analysis, funding the HSA next after getting your full matching contribution is a good rule of thumb.

Pay Down Credit Card Debt

A 2021 survey by the American Bankers Association estimated that more than 100 million credit card accounts carry a monthly balance. And there is a high cost to carry that debt: The third-quarter 2022 average annual percentage interest rate (APR) on interest-accruing credit cards is now 18.43%, and this increases to 22.21% for new card offers.

Based on these figures, there are likely millions of people who must decide between contributing more to their 401(k) plan or paying down credit card debt. To help frame that decision, compare current credit card rates to a recent analysis by Fidelity Investments indicating that the average annual return of a diversified investment portolio over the past 75 years varied (depending on level of risk taken) from 5% to 9%.

So, for most people, your credit card debt will grow faster (based on the APR) than the assets available to service it. This indicates that it’s wise to prioritize paying down your credit card debt over adding to voluntary savings.

Further, paying down your credit card debt has the added benefit of lowering your credit utilization percentage (the amount owed to your creditors compared to the maximum credit available) and, in turn, raising your credit score. A better credit score not only can qualify you for a lower interest rate and higher credit limits on future borrowing, but potentially lowers future insurance rates, as well as reducing any upfront deposits required for cell phones, utilities and housing.

Most of the messages we see about retirement plans stress the importance of savings and needing to start as soon as possible. There is no doubt that adding default provisions to 401(k) plans has furthered those goals. But if you really want to enhance your overall financial wellness, consider other forms of savings (including eliminating debt) as well as additional voluntary contributions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Alan Vorchheimer is a Certified Employee Benefits Specialist (CEBS) and principal in the Wealth Practice at Buck, an integrated HR and benefits consulting, technology and administration services firm. Alan works with leading corporate, public sector and multi-employer clients to support the management of defined contribution and defined benefit plans.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.