How to Write a Check for a Wedding Gift

Make sure the newlyweds are able to make use of your thoughtful gift.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Writing a check to give as a wedding gift seems so simple. You don't have to spend time scouting the registry, you just jot down the information, seal it in a card and dash off to the party. But if you don't take a minute to think about what you're writing, your gift could cause a headache for the newlyweds.

My husband and I were exceedingly lucky to have guests who shared their generosity with us when we got married. But once we started trying to deposit our checks, we ran into snags and rejections based on how the checks were written. Some bank tellers required us both be present to cash a check, and otherwise we crossed our fingers and hoped we wouldn't get arrested for identity theft using digital deposit.

Thankfully, we never had to face security or make a dreaded phone call asking a guest to send a newly written check, and now I'm ultra-aware of the importance of getting a check right when I'm giving one as a gift to my friends and family.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

So, as wedding season is upon as again, I'm sharing the knowledge with you on how to write a check for newlyweds, by following these guidelines:

Beware of writing 'and' on a wedding check

In my professional life as an editor, I pay careful attention to word choice. When I'm writing a check to shove into an envelope on the shuttle on the way to a wedding venue, though, I'm not that attentive.

As it turns out, much like in literature, there's a huge difference between using the words "and" and "or" on a check. If you write a check to newlyweds using both their names with an "and" between them (i.e. "John Smith and Jane Pierce"), they will both likely need to endorse the check in order to deposit it — and their particular banking institution may be more stringent in checking identities or requesting a joint account to deposit it.

However, if you write their names with an "or" between them ("John Smith or Jane Pierce"), "either could deposit it," confirmed Maribel Ferrer, a spokesperson for Chase.

By the way, you can also use this tip for other situations. For example, if you're writing a check for a child, like for a baptism, bar mitzvah, sweet 16 or quinceañera, you can write the minor's name along with "or [parent's name]" to ensure it can be deposited however the family manages finances.

Check what name(s) you're putting on a wedding check

Only a third of women who have never been married say they would take their spouse's last name, according to Pew Research Center, but it's still common to celebrate a wedding by congratulating "Mr. and Mrs. Smith."

You may want to avoid that celebration on a check, though. First, it's possible the newlyweds have no intention of sharing a last name in marriage, and of course, the heteronormative tradition doesn't apply to same-sex marriages. Second, even if one newlywed does take the other's last name, the timing of getting legal documents and bank accounts updated may not align with the timing of your check.

"If you know the couple has a strong preference one way or the other, the basic tenet of good etiquette is to address people how they want to be addressed," Daniel Post Senning of the Emily Post Institute told Kiplinger. So, if you know what they want to do with their names — or are familiar enough to ask the couple or someone close to them — etiquette dictates that's what you can use on a check.

And one more basic point that's true for writing a check for anything, really: Make sure you get the names right.

That means check the spelling and also check the names themselves. Many artfully designed wedding invitations and websites use first and middle names rather than last names — which could be misleading or unhelpful if you're not familiar with both spouses. When in doubt, use the first and last names you know best for a check.

You can write a wedding check with one name

Rather than addressing a check to both newlyweds and trying to navigate getting each name right and making sure to clearly write "or," a simple solution is to address a check to only one of the newlyweds.

"People don’t always have joint bank accounts or the same or new last names, so often structurally it’s easier to make it out to one person," said Senning.

Ferrer at Chase had one more suggestion for this method: "Use the memo line to indicate it is a wedding present."

But how do you choose which name to use? You can follow an etiquette path of your choosing, Senning said. "The very traditional orientation is that gifts are sent to the bride," he explained.

However, he said, another perfectly valid modern option is that "you might think of the person you were the most connected to," so if you're going to a wedding because you're cousin is the groom, for example, you can make the check out to him.

You could also write a check out to "cash," but remember it's a potential security issue, as anyone could deposit it. Be aware, too, that some banks will not accept checks marked for "cash" or will have specifications around them.

Basic check-writing tips

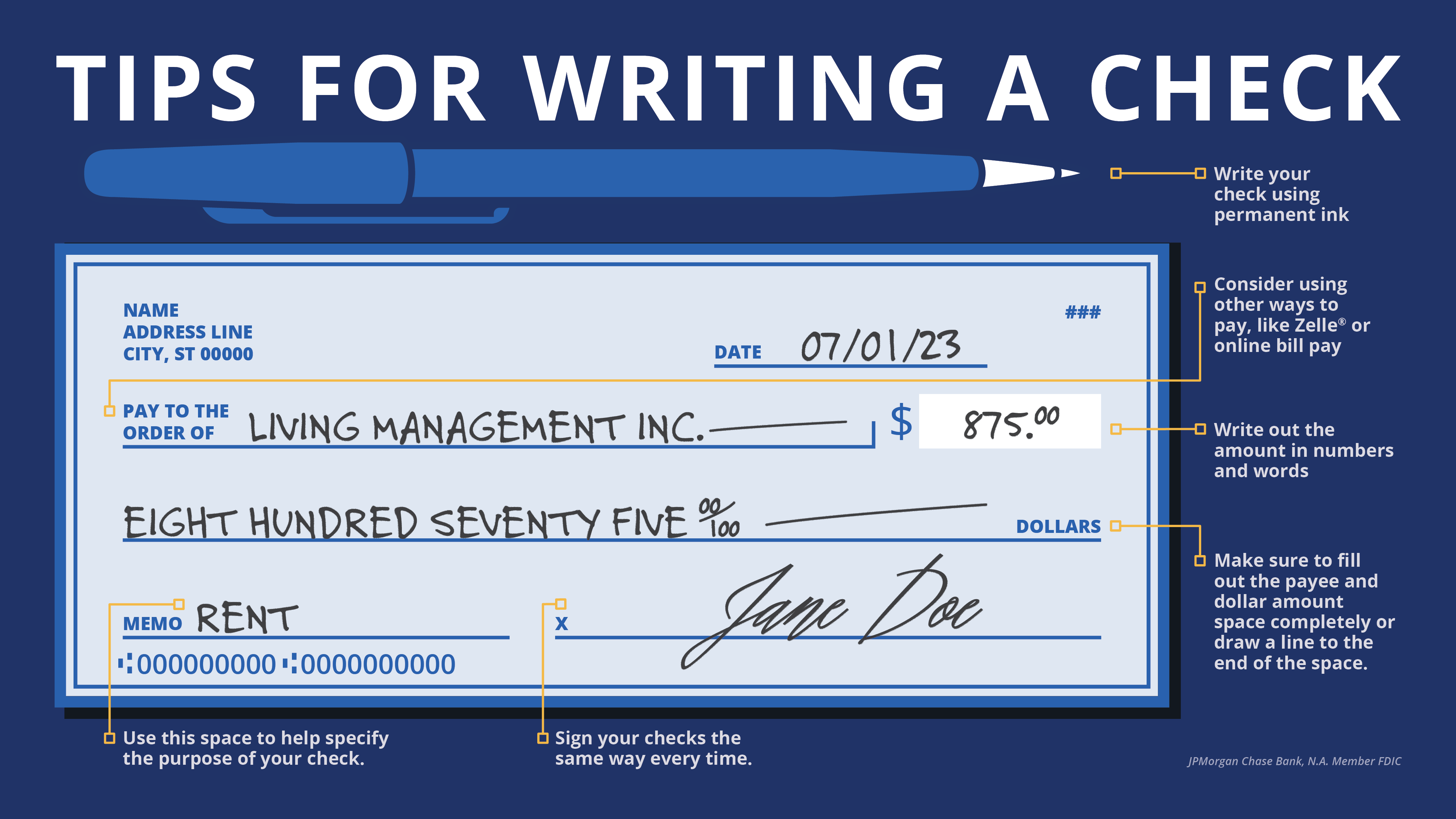

Any time you write a check, you should follow some basic guidelines, many of which are outlined in the above graphic from Chase, including:

- Use permanent ink when you write a check

- "Make sure that the words and numbers match the written amount. For example, One hundred dollars, $100.00," Ferrer said

- Either use the entire payee line when you write the recipient's name or draw a line to fill the space so that someone who finds the check can't add anything to it

How to give money as a wedding gift

If you have concerns about using paper checks, many brides and grooms these days also use electronic methods, like a "fund" you can contribute to on a wedding website.

While the Emily Post Institute approved of online "funds" (like for a honeymoon) in its wedding registry etiquette guide, Senning pointed out that some guests don't like that they can have fees, which is why people may opt instead for giving in the form of cash or a check.

You can also ask the couple if they'd accept gifts in other electronic forms, like Venmo or Zelle, or, as Knight Kiplinger suggested, give a gift certificate to a place they're likely to frequent. Kiplinger's advice is also useful if you're not comfortable giving cash as a gift.

That's understandable: Like with so much around marriage, wedding gifting norms are changing, including that registries are becoming less prioritized. (Speaking for myself, we had a small registry — frankly, we didn't have enough space in our apartment for more objects, which may be a widespread issue for younger generations, given the realities of the housing market.)

Senning had another recommendation: "A cash gift, depending on how it’s presented, can feel impersonal. So try making an effort to personalize the gift — to include a note with it or make something out of the exchange, even just tucking it into a card, look the person in the eye, smile, wish them the best on this next stage of their life."

Ultimately, it's not the end of the world if something is a little off with a check. As I said, my husband and I managed everything just fine in the end — and believe me, we appreciated every single one of those checks, as I'm sure every newlywed does. These tips could just give you some peace of mind for the next wedding you celebrate.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Alexandra Svokos is the digital managing editor of Kiplinger. She holds an MBA from NYU Stern in finance and management and a BA in economics and creative writing from Columbia University. Alexandra has over a decade of experience in journalism and previously served as the senior editor of digital for ABC News, where she directed daily news coverage across topics through major events of the early 2020s for the network's website, including stock market trends, the remote and return-to-work revolutions, and the national economy. Before that, she pioneered politics and election coverage for Elite Daily and went on to serve as the senior news editor for that group.

Alexandra was recognized with an "Up & Comer" award at the 2018 Folio: Top Women in Media awards, and she was asked twice by the Nieman Journalism Lab to contribute to their annual journalism predictions feature. She has also been asked to speak on panels and give presentations on the future of media and on business and media, including by the Center for Communication and Twipe.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

My First $1 Million: Retired From Real Estate, 75, San Francisco

My First $1 Million: Retired From Real Estate, 75, San FranciscoEver wonder how someone who's made a million dollars or more did it? Kiplinger's My First $1 Million series uncovers the answers.

-

To Love, Honor and Make Financial Decisions as Equal Partners

To Love, Honor and Make Financial Decisions as Equal PartnersEnsuring both partners are engaged in financial decisions isn't just about fairness — it's a risk-management strategy that protects against costly crises.

-

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)

Top 5 Career Lessons From the 2026 Winter Olympics (So Far)Five lessons to learn from the 2026 Winter Olympics for your career and finances.