Stock Market Today: Rising-Rate Fears Keep Stocks in the Red

Stocks turned lower after ISM data showed continued strength in the U.S. economy, with the Nasdaq notching its seventh straight loss.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

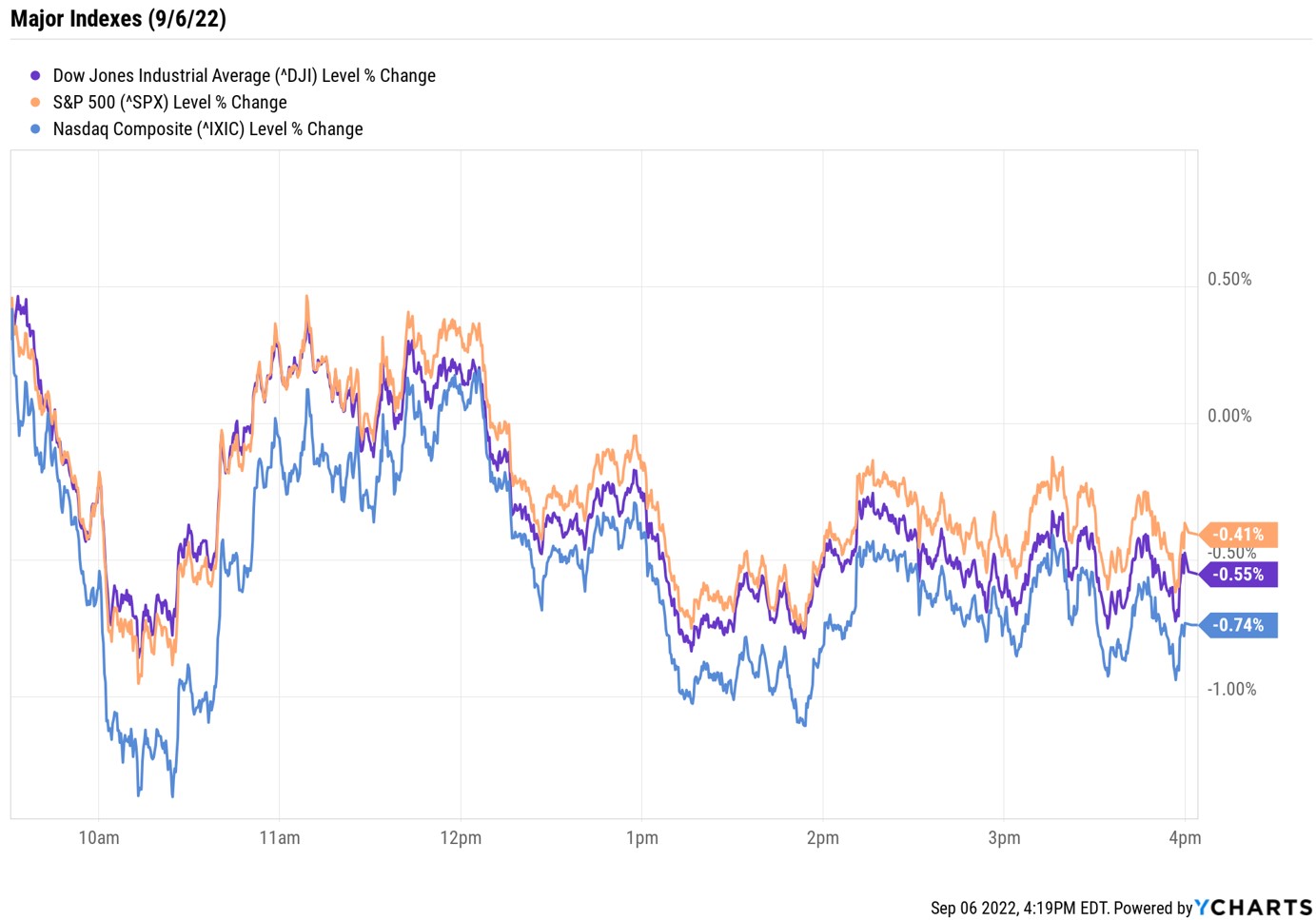

It was a choppy start to the short trading week, with stocks spending time in both positive and negative territory Tuesday. Bears gained the upper hand in the afternoon, though, with the three major indexes ending another day in the red.

Although this week's economic calendar is fairly thin, data from the Institute for Supply Management (ISM) this morning showed that activity in the services sector ticked up to 56.9% in August – the highest level since April – from July's 56.7%.

"This is the most recent piece of data to suggest the economy remains resilient and as such the market takeaway is that this gives the Fed more room to continue raising rates," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Futures markets are now pricing in a 75% chance of a 75 basis-point hike later this month from a coin flip late last week." A basis point is one-one hundredth of a percentage point.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In reaction to today's ISM data, the 10-year Treasury yield rose to its loftiest level since mid-June. This, in turn, weighed on shares in the communication services (-1.3%) and technology (-0.6%) sectors, with names such as streaming giant Netflix (NFLX, -3.4%) and chipmaker Intel (INTC, -2.8%) seeing notable declines.

As for the major indexes, the tech-heavy Nasdaq Composite fell 0.7% to 11,544, its seventh straight loss. The S&P 500 Index shed 0.4% to 3,908, and the Dow Jones Industrial Average gave back 0.6% to 31,145.

Other news in the stock market today:

- The small-cap Russell 2000 shed 1% to land at 1,792.

- U.S. crude futures posted a modest gain to end at $86.88 per barrel.

- Gold futures fell 0.6% to finish at $1,712.90 an ounce.

- Bitcoin spiraled 5.4% to $18,817.97. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Bed Bath & Beyond (BBBY) stock slumped 18.4% after Friday's death of the home goods retailer's chief financial officer, Gustavo Arnal, was ruled a suicide by New York City's medical examiner. "The entire Bed Bath & Beyond Inc. organization is profoundly saddened by this shocking loss," the company said in a statement. Laura Crossen, BBBY's chief accounting officer, will take over as finance chief on an interim basis. Bed Bath & Beyond gave a business update last week in which it said it would close underperforming stores and issue a common stock offering.

- ADT (ADT) rose 16.4% after the home security specialist scored $1.65 billion in new investments from State Farm and Alphabet's (GOOGL, -1.0%) Google. The funding will be used to "support product innovation," and "expand access for more customers to smart home innovation and technologies," ADT said in a statement. The cheap stock under $10 is now up more than 35% from its June lows.

Billionaire Investors' Biggest Q2 Stock Buys

It's becoming increasingly clear that the summer rally in stocks was not the start of a new bull market. "The 17% rally off the June lows appears to have been just a typical bear market rally," says Savita Subramanian, head of equity and quantitative strategy at BofA Securities. "Our bull market signposts continue to show no real signs of a bottom, with just 30% being triggered vs. 80%+ triggered in prior bottoms. September has seasonally been a weak month and we expect more pain in the market."

The market's head fake creates a situation in which at least some investors might want to re-evaluate their portfolios. And any assessment of your own holdings stands to benefit from a look at what other successful investors are doing.

Warren Buffett, for example, did plenty of bargain-hunting in the second quarter as the S&P 500 fell into bear-market territory. But Buffett was hardly alone. We recently took a look at the top stock picks of billionaire investors during Q2. The rich get richer for a reason, and studying where they're putting their money – especially during times of market turbulence – can be an instructive exercise for investors.

Karee Venema was long GOOGL as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.