Stock Market Today: Nasdaq Falls for a Fifth Straight Day

Stronger-than-expected economic data weighed on markets for most of the session, but the S&P 500 and Dow ended the day in the green.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

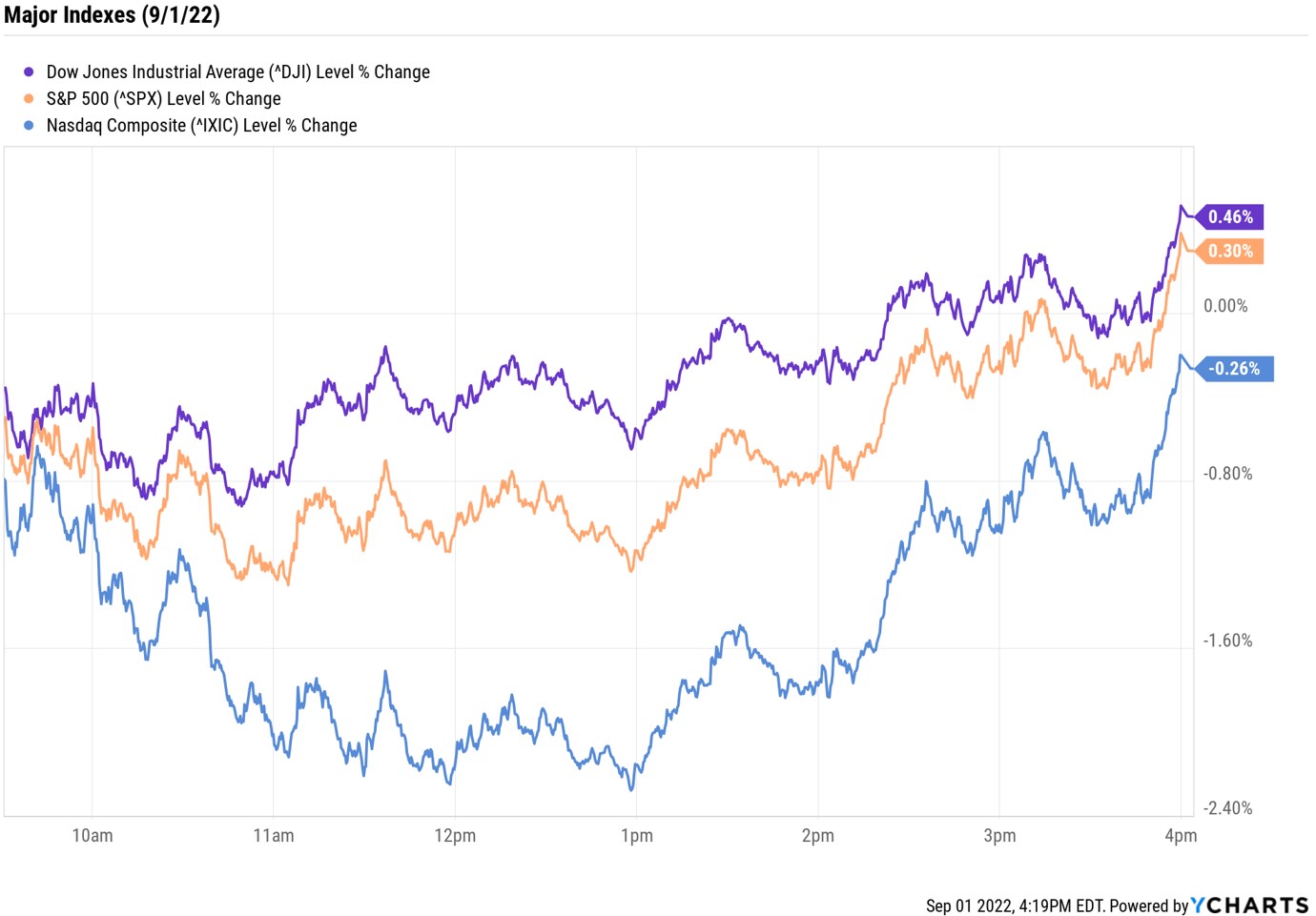

Stocks kicked off September on a choppy note, though two of the major market indexes managed to push higher in the final minutes of trading.

Thursday's early selling came courtesy of stronger-than-expected economic data that stoked worries the Federal Reserve will continue to be aggressive in raising rates and hold them higher for longer. Specifically, the Labor Department this morning said weekly jobless claims fell by 5,000 last week to a seasonally adjusted 232,000. Economists were expecting initial unemployment claims to arrive at 248,000. (Reminder: Tomorrow morning will see the release of the last nonfarm payrolls report – the most significant of the job numbers – to come out ahead of the Fed's September meeting.)

Elsewhere, the Institute for Supply Management's purchasing managers' index (PMI) – a measure of manufacturing activity – held steady at 52.8 in July. "While that marks the lowest level in two years, that's still better than expectations calling for a decline," says Priscilla Thiagamoorthy, economist at BMO Capital Markets. "The details were also mostly positive with new orders clawing back into expansionary terrain, up 3.3 points to 51.3." She adds that "supplier delivery improved to the best level since January 2020, suggesting easing supply constraints."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also weighing on the market was a major spike in the 10-year Treasury yield, which jumped 12.5 basis points to 3.257%, its highest level since June. (A basis point is one-one hundredth of a percentage point.) Rising rates and news that the U.S. government is restricting sales of certain chips to China and Russia delivered a hard punch to semiconductor stocks, with Nvidia (NVDA, -7.7%) and Advanced Micro Devices (AMD,-3.0%) ending sharply lower.

As such, the tech-heavy Nasdaq Composite fell 0.3% to 11,785, its fifth straight loss. The S&P 500 Index (+0.3% at 3,966) and the Dow Jones Industrial Average (+0.5% at 31,656) managed to erase earlier losses to end the day with modest gains.

Other news in the stock market today:

- The small-cap Russell 2000 shed 1.2% to 1,822.

- U.S. crude futures slumped 3.3% to $86.61 per barrel as China initiated a new round of COVID-19 lockdowns in the city of Chengdu.

- Gold futures fell 1% to $1,709.30 an ounce, their lowest settlement since July 20.

- Bitcoin retreated 1.7% to $19,870.30. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Okta (OKTA) plunged 33.7% after the software company warned of issues arising from its acquisition of Auth0. Okta bought the identity platform for $6.5 billion back in May 2021, and the firm has faced challenges integrating the sales staff. "Sales integration problems were a primary headwind to billings [in Q2] as OKTA experienced elevated attrition rates from sales employees, causing disruptions and confusion in its go-to-market," says CFRA Research analyst Janice Quek (Buy). "The company also saw longer sales cycles as a result of the macro environment. We cut expectations on its topline growth as OKTA tackles these challenges, but remain positive on the company on favorable prospects of the industry, OKTA's market share in Identity, and the likely short-lived nature of current headwinds."

The Best Bargain Stocks Investors Can Buy

If it's any consolation for investors, what goes down will eventually come back up. True, the market's recent selloff stirs up familiar fears investors have had all year long, and plenty of uncertainty remains.

The drawdown could get worse before it gets better, says Dan Ashmore, investing expert at investment information website Invezz. "The only thing we know for a fact is that, historically, such large drawdowns often make for a good time to buy," he adds. "With a time horizon long enough – and that is the key – it's a nice time to buy."

That sentiment is shared by Kiplinger columnist James A. Glassman. "Smart investors take a long view, both forward and backward. They look carefully at a company's progress over the years and then try to forecast a decade out. With this kind of analysis, the 2022 decline is clearly a buying opportunity," Glassman writes. With this in mind, he disclosed five of the biggest tech bargains to buy right now – each of which represents solid picks for long-term investors.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.