Stock Market Today: Stocks Start Short Week With a Snap-Back

Every sector finished in the black during a broad recovery session Tuesday ... even though there was little to justify the powerful move higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

A light-news Tuesday gave the stock market the breathing room it needed to mount an aggressive rebound rally.

Whether the rally is of the short-lived "relief" variety remains to be seen. Today's widespread bullish action came on the heels of a 5.8% drop in the S&P 500 last week – the second consecutive 5%-plus decline for the index, which is a rarity (more on that in a moment).

There wasn't much in the way of news that would otherwise justify a powerful move upward. Existing-home sales for May dropped by 3.4% month-over-month to a seasonally adjusted annual rate of 5.41 million, which was just a tick higher than estimates for 5.40 million. Year-over-year, existing-home sales were down 8.6% – a stark contrast to the 45.5% YoY jump in May 2021. Median home prices were $407,600 in May, up from $395,000 in April.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Sales of higher priced homes are holding up, but sales of homes under $500,000 are falling as higher interest rates price more buyers out of the market," says Bill Adams, chief economist for Comerica Bank. "Higher income and wealth households have been less sensitive to the rise in rates so far, cushioning sales at the high end, but this segment will likely soften too with stocks in a bear market."

Tops on Tuesday were energy stocks (+5.2%), led by Exxon Mobil (XOM, +6.2%) and Diamondback Energy (FANG, +8.2%). U.S. crude oil futures improved by 1.0%, to $110.65 per barrel, after Exxon CEO Darren Woods said he expected three to five years of tight oil markets.

Tesla (TSLA, +9.4%) – up by double-digits after CEO Elon Musk said the company's biggest hurdle wasn't competition, but supply-chain issues – also helped consumer discretionary stocks pull off a 2.9% return.

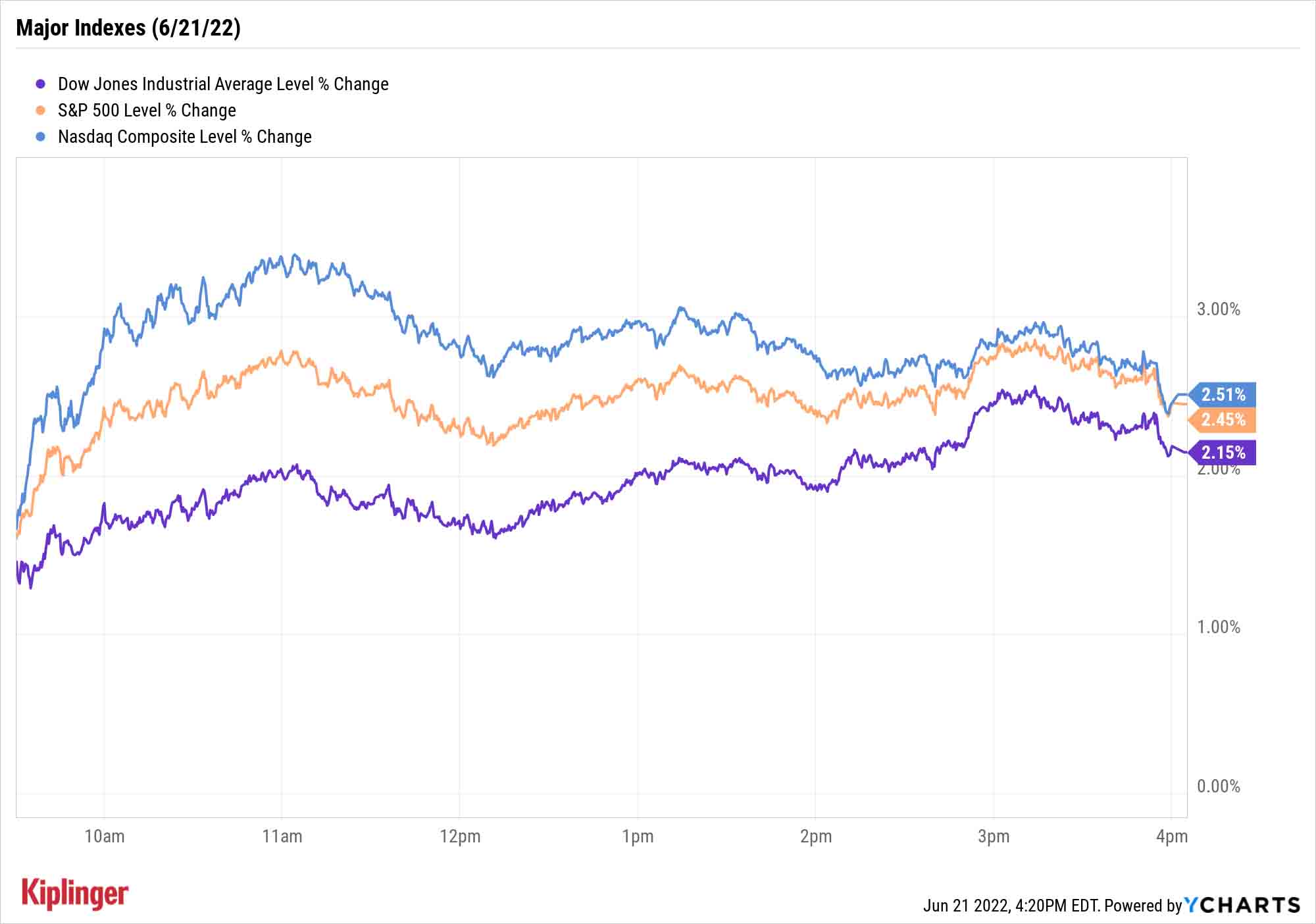

The Nasdaq Composite was out in front of a wide recovery, up 2.5% to 11.069. It was followed closely by the S&P 500 (+2.5% to 3,764) and Dow Jones Industrial Average (+2.2% to 30,530).

Other news in the stock market today:

- The small-cap Russell 2000 flew 1.7% higher to 1,694.

- Gold futures shed 0.1% to settle at $1,838.80 per ounce.

- Bitcoin had a whirlwind weekend, dipping below $18,000 at its nadir but recovering to $20,889.75, a 1.8% improvement from Friday afternoon's level. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Palantir Technologies (PLTR) jumped 5.7% after BofA Securities analyst Mariana Perez Mora intiated coverage on the big data analytics stock with a Buy rating and a $13 price target, nearly 50% above today's close at $8.71. "We see Palantir as a beneficiary of rapidly growing demand for AI-platforms in both commercial and government end-markets," the analyst says. "Palantir's dominant position in the AI-powered software market, differentiated end-to-end & highly-secure solutions and first mover advantages should support more than 30% annual revenue expansion and improving profits in the midterm." Perez Moya also points to "increased urgency on modernizing military and intelligence capabilities," which she believes will create significant opportunity for PLTR stock.

- Spirit Airlines (SAVE, +7.9%) got a lift today after JetBlue Airways (JBLU, -1.6%) raised the buyout offer for its discount airline peer by $2 per share to $33.50 per share. The offer includes $1.50 per share too cover part of the breakup fee for Frontier Group Holdings' (ULCC, +1.6%) $2.9 billion bid for Spirit. JBLU also said it would be willing to commit to "significantly" more divestitures in order to gain regulatory approval. Spirit's board is expected to jdiscuss and vote on the competing bids at a shareholder meeting scheduled for next Thursday, June 30. "Spirit needs some near-term relief from its over indebtedness and overcommitted position on flight equipment purchases, in our view" says CFRA Research analyst Colin Scarola, who maintained a Hold rating on SAVE. "The JBLU offer won't provide that, but Frontier's can, in our view, making it likely Spirit shareholders opt for the Frontier offer. At any rate, Spirit shares remain extremely high risk, in our view."

Just How Long Will This Momentum Last?

So, about the market's big back-to-back weekly dips ...

Michael Reinking, senior market strategist for the New York Stock Exchange, said Friday that the S&P 500's second consecutive week of 5%-plus declines – along with a few other signals – pointed to the possibility of a "tactical bounce," and that bounce did indeed materialize today.

"The week is still young, so it is way too early to declare victory, but let's take a look at just how rare back-to-back 5% declines are and what the return profile looks like going forward," he said Monday.

Double-digit declines have happened only eight times since 1970 – including twice during the Great Financial Crisis and a three-week streak in 1987 that Reinking counts as two instances. The following week was up in 7 of 8 instances by an average of 2.6% (the lone exception was the day before Black Monday) … but what happens after that oversold bounce?

"Returns in the intermediate term are more mixed, with returns three months later only higher in 38% of instances," he says. "However, that improves over time, with the average return one year later [roughly] 28%, with a median return of 18.5%."

A long way of saying to bottle up today's energy – there's no guarantee it willl last.

It also means investors setting their portfolios up for the rest of the year must continue with a discriminating eye. As we near 2022's midway point, we're focused on the top opportunities for the coming year. We've recently explored potential targets in specific areas such as small caps and real estate investment trusts (REITs), but today we're widening our scope to the entire market.

Read on as we look at the 15 best stocks from across the market that look poised for a sharp rebound after a difficult first six months.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.