Stock Market Today: Stocks Come Out Swinging to Start the Week

Financial stocks led a broad-based rally in equities to kick off the week. Strategists looked for signs that this latest recovery attempt can last.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

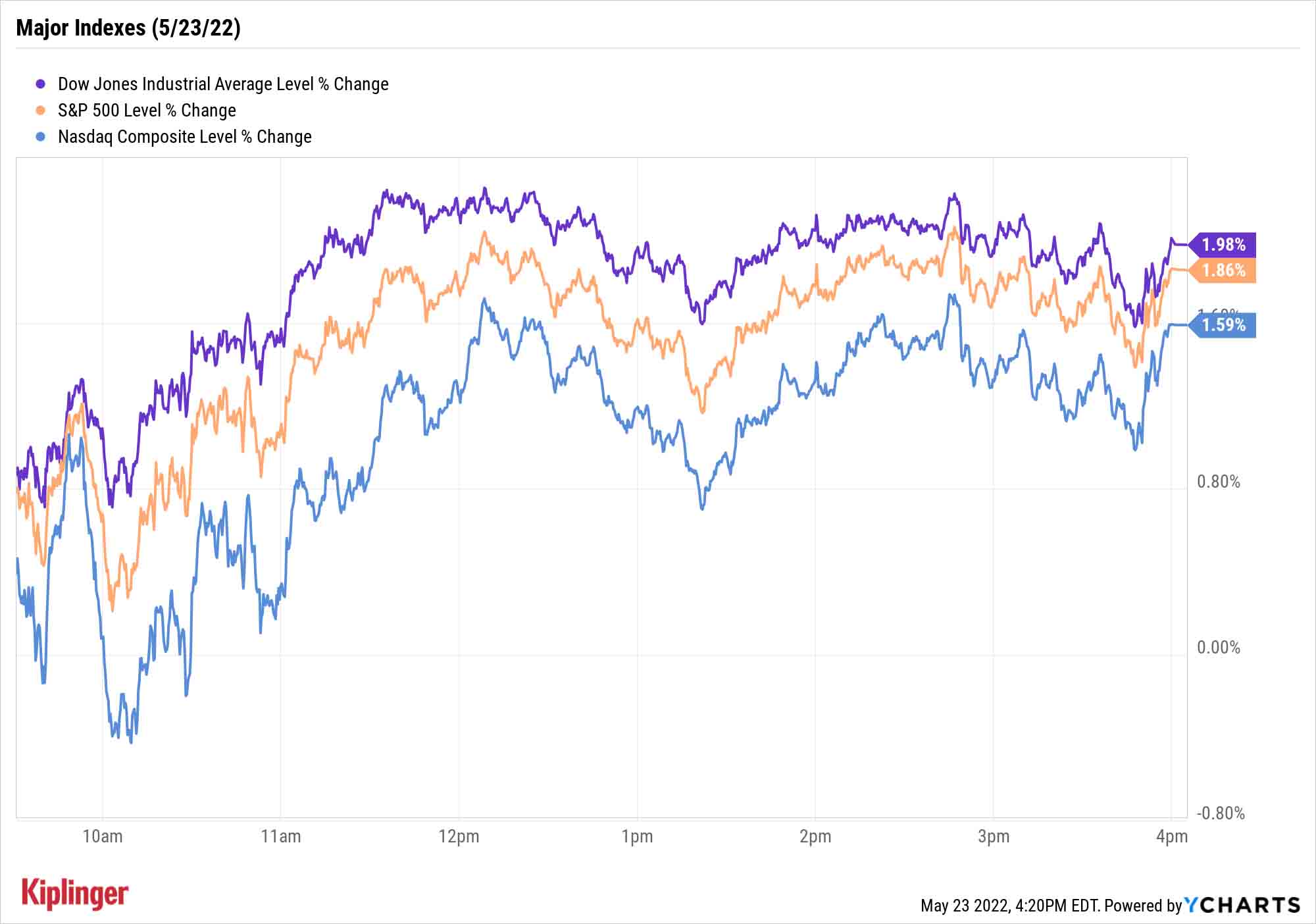

One trading session after the S&P 500 narrowly escaped bear-market territory, U.S. equity bulls went on the offensive in a day of robust and widespread gains.

A few single-stock headlines did some of the driving Monday. JPMorgan Chase (JPM, +6.2%), for instance, rocketed higher after CEO Jamie Dimon said "there's a very good chance" that his bank would hit a key performance target (17% return on tangible common equity) in 2022, and possibly exceed it in 2023. The announcement, a reversal of more dire guidance earlier this year, sent the sector, including Citigroup (C, +6.11%), Bank of America (BAC, +5.9%) and Wells Fargo (WFC, +5.2%), higher too.

Also Monday, shares of VMware (VMW, +24.8%) popped amid a Bloomberg report that semiconductor firm Broadcom (AVGO, -3.1%) was in talks to acquire the $40 billion virtualization and cloud computing firm.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

While little information about a potential deal was available, Stifel analyst Brad Reback says "We believe it makes sense on many fronts as a Broadcom-controlled VMware will likely be much more profitable, less dependent on top-line growth and have less pressure to accelerate its ongoing shift to a (software-as-a-service) model."

The Dow Jones Industrial Average climbed 2.0% to 31,880, while the Nasdaq Composite was up 1.6% to 11,535. And all 11 of the S&P 500's sectors finished in the green, pushing the index 1.9% higher to 3,973 to give it some distance away from bear-market territory.

Some of the day's upward momentum might have been simply good old-fashioned dip-buying now that equity valuations have cooled off significantly from earlier-year levels. "Remember when stocks looked expensive on valuation?" say BofA Securities researchers. "The forward P/E ratio of the S&P 500 is now 16.5x, down from the high of 21.4x."

But investors might want to stay cautious, given a number of previous head fakes from the market. Michael Reinking, senior market strategist at the New York Stock Exchange, said it would be important for the S&P 500 to, among other things, close above Friday’s high, which it did.

"One thing that I will highlight that is different about today's rally than the last few attempts is that while the strength is broad-based, the leadership is coming from financials, and not just the beaten-up long duration/tech stocks that have led to the downside."

Other news in the stock market today:

- The small-cap Russell 2000 was 1.1% better to 1,792.

- U.S. crude oil futures eked out a marginal gain to end at $110.29 per barrel.

- Gold futures rose 0.3% to settle at $1,847.80 an ounce, marking a third straight win.

- Bitcoin recovered to above the $30,000 level over the weekend, but shed all of those gains Monday afternoon, hitting $29,058.38, off 0.7% from Friday afternoon's prices. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Autodesk (ADSK) shed 4.1% after Deutsche Bank analyst Bhavin Shah downgraded the AutoCAD software developer to Hold from Buy. This comes ahead of ADSK's fiscal first-quarter earnings report, set to be released after Thursday's close, with Shah noting that recent conversations with platinum partners indicate mixed quarterly results. The analyst also points to the potential for downside revisions to fiscal-year estimates due to slowing adoption of multi-year contracts, as well as forex and Russia-related headwinds.

- Starbucks (SBUX) became the latest company to announce it is completely exiting operations in Russia, joining the likes of McDonald's (MCD) and Exxon Mobil (XOM). The coffee chain was one of many companies that pulled out of Russia when the country invaded Ukraine earlier this year. Starbucks has been in the Russian market for 15 years and has 130 locations throughout the country that account for less than 1% of its annual revenue. CFRA Research analyst Catherine Seifert maintained a Hold rating on SBUX in the wake of the news. "SBUX said it plans to pay associates in Russia their salaries for the next six months and provide assistance as they 'transition to new opportunities outside of Starbucks,'" the analyst says. "Weighing still-decent sales trends with an expected margin contraction in 2022, we view the shares as fairly valued versus peers, but worth holding."

Get the Best of Both Worlds. Get GARP.

Until the light at the end of the tunnel is identified as the sun, and not an oncoming train, investors would be wise to be especially discriminating when considering any new positions. Value stocks continue to be a popular choice among the analyst community, for instance, as Wall Street continues to severely punish gaudily priced stocks at the faintest whiff of trouble.

Wells Fargo Investment Institute strategist Chris Haverland and analyst Austin Pickle suggest looking at more than just price, however.

"We believe multiples may continue to decline in the near term as investors price in the increasing likelihood of a recession," they say. "In this environment, we favor focusing on reasonably priced, high-quality U.S. companies with consistent revenue and earnings growth."

Investors looking for this blend of value and growth are looking for "GARP": growth at a reasonable price. By focusing on both traits, investors can improve their chances of avoiding both stocks at high risk of a valuation-related tumble, as well as companies that are merely cheap because their prospects are lacking. Read on as we explore seven great GARP stocks that fall into this happy middle ground.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.