Stock Market Today: Bond Yields, Goldman a One-Two Punch for the Bears

The 10-year Treasury yield hit a two-year high and Goldman whiffed on its Q4 earnings report, sending 10 of 11 sectors into the red Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Any bit of calm investors enjoyed over the long holiday weekend was sapped quickly Tuesday morning as the markets kicked off the short week with a faceplant.

Vexing the technology sector (-2.5%) specifically and the major indexes broadly was yet more upward momentum in interest rates, with the 10-year Treasury reaching 1.86% – a level last seen in January 2020.

"The chances of the Fed raising rates more than the market expects is now the likely outcome, which is contributing to market volatility," says Jon Maier, chief investment officer at Global X. "The long end of the interest rate curve has been moving up rather quickly, with the 10-year Treasury noticing a 2-year high this morning."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also of note was Goldman Sachs (GS, -7.0%), which reported a wide fourth-quarter earnings miss thanks to worse-than-expected trading profits and higher employee salaries. Big banks including JPMorgan Chase (JPM, -4.2%), Morgan Stanley (MS, -4.9%) and Bank of America (BAC, -3.4%) fell in sympathy.

But Julius de Kempenaer, senior technical analyst at StockCharts.com, warns not to throw the baby out with the bathwater:

"The charts of the aforementioned banks are turning more negative, but it does not mean the entire sector is negative," he says. "Banks are only one group inside the financial sector, which in general is in pretty good shape on the back of rising interest rates."

Microsoft (MSFT, -2.4%) also pulled on the major indexes; its $68.7 billion buyout of Activision Blizzard (ATVI, +25.9%) sent the gamemaker soaring, but investors weren't as keen on MSFT shares.

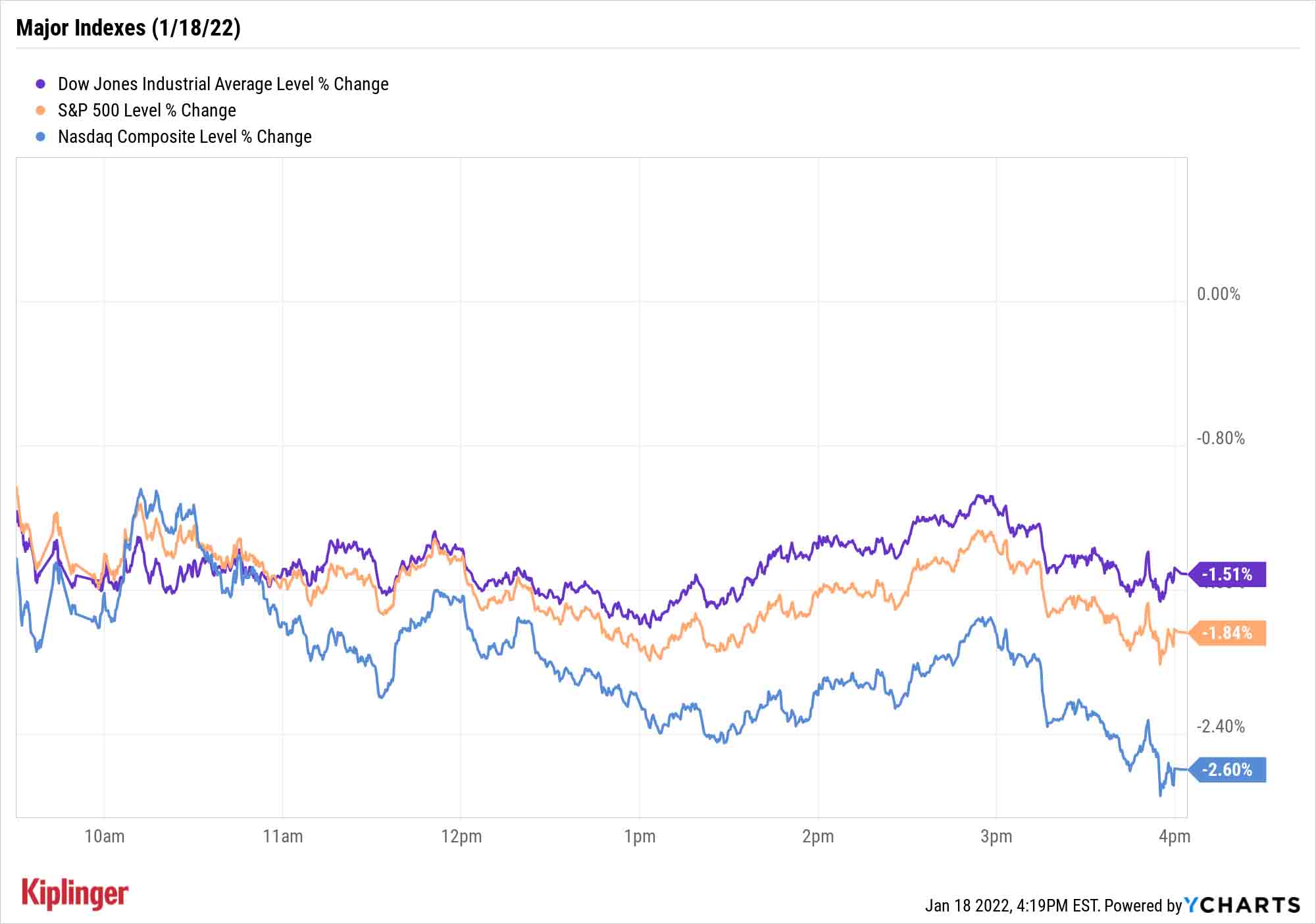

The Nasdaq Composite fell the hardest, off 2.6% to 14,506, but the Dow Jones Industrial Average (-1.5% to 35,368) and S&P 500 (-1.8% to 4,577) weren't terribly far behind.

Other news in the stock market today:

- The small-cap Russell 2000 plunged 3.1% to 2,096.

- U.S. crude oil futures spiked 1.9% to end at $85.43 per barrel – their highest settlement since 2014. " The combination of geopolitical stress (Ukraine, UAE) and resilient demand despite omicron’s emergence (according to OPEC's latest report) drove crude action today," says Michael Reinking, senior market strategist for the New York Stock Exchange.

- Gold futures slipped 0.2% to finish at $1,812.40 an ounce, their third straight loss.

- Bitcoin fell along with other risk assets, dropping 3.2% to $41,798.34. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Charles Schwab (SCHW) followed the lead of its fellow financial firms, sinking 3.5% in the wake of its earnings report. In the fourth quarter, SCHW took in earnings of 86 cents per share and revenue of $4.71 billion – falling short of analysts' consensus estimates for earnings of 88 cents per share and revenue of $4.79 billion. Still, CFRA Research analyst Michael Elliott maintained a Buy rating on SCHW. "We believe SCHW will benefit significantly from rising rates, as net interest revenue accounts for over 60% of revenues," Elliott wrote in a note. "Further, the continued integration of recent acquisitions (TD Ameritrade), strong client growth, and SCHW's ability to utilize economies of scale provide further catalysts to growth."

- Shares of The Gap (GPS) slid 6.7% after Morgan Stanley analyst Kimberly Greenberger downgraded the retail stock to Underweight from Equalweight (the equivalents of Sell and Hold, respectively). The downgrade came as part of a broader note on specialty retail, department stores and footwear, which Greenberger says are facing tough year-over-year comparisons in 2022. "Against above-trend apparel consumption, signs of inventory re-stocking, the return of some promotional (price discounting) activity and ongoing cost inflation across Softline P&Ls, [there is] risk of year-over-year revenue, margin, profit and earnings-per-share erosion," she says.

Don't Ghost Growth

"Growth" is a four-letter word these days, at least when it comes to talking about investment opportunities in the new year.

Value stocks are largely the favored call for 2022 amid economic expansion and expected rate-hikes out of the Federal Reserve. Emblematic of value bulls' expectations are Jason Pride and Michael Reynolds, executives at private investment firm Glenmeade:

"Value stocks that trade at discounted valuations have until now been unable to sustain a significant run of outperformance relative to growth stocks," they say. "However, a sustained rise in short term and longer-term interest rates could be the key to resolving this market conundrum."

That doesn't, however, make growth sapor non grata – it just means investors will have to temper expectations for the investing style in 2022, and hope for more substantial profits farther down the road in some cases.

Growth exchange-traded funds (ETFs) can come in handy on this front. General growth-flavor funds can help you diversify across hundreds of stocks, minimizing single-stock risk and helping you remain invested until better days arrive. Meanwhile, some targeted funds might be able to ignore broader growth malaise and log strong returns thanks to their underlying trends.

This short list of nine such growth ETFs is a great place to start for buy-and-hold and tactical investors alike.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.