The Best Semiconductor Stocks to Buy

When considering the best semiconductor stocks, there's Nvidia and then there's everyone else. Here, we look at the mega-cap chipmaker and a few of its peers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Semiconductors are at the heart of the artificial intelligence (AI) boom, powering everything from advanced chatbots and sprawling data centers to smart devices and edge computing.

As AI becomes more embedded in how we work and live, the hardware behind the scenes is becoming just as critical as the algorithms themselves.

A recent forecast from IDC underscores the scale of this transformation: Global spending on AI is projected to soar from about $235 billion in 2024 to roughly $630 billion by 2028, marking an average annual growth rate close to 30%.

Why are semiconductors such a linchpin in this story? Simply put, they make modern AI possible.

Whether it's GPUs crunching massive datasets, AI-specific chips accelerating machine learning tasks, or the sophisticated equipment that produces these chips, semiconductors determine how fast, efficient, and scalable AI can be.

For investors with a long-term view, this trend represents a powerful growth engine.

The demand for high-performance, AI-ready chips is rising fast – driven by cloud providers, enterprises, government technology initiatives, and the broader push toward smarter, more autonomous systems.

With high barriers to entry, deep technical know-how, and dominant market positions, chipmakers are well positioned to benefit as AI continues to expand.

With that in mind, here are five semiconductor stocks well positioned to ride this wave.

Data is as of June 25.

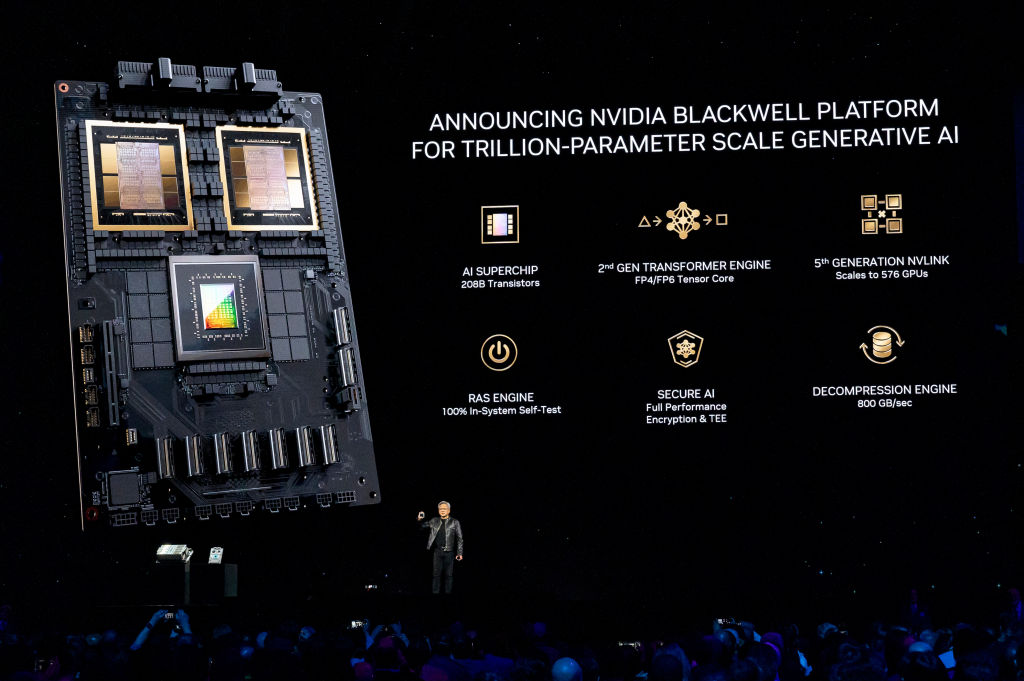

Nvidia

- Market value: $3.8 trillion

- Dividend yield: 0.0%

Nvidia (NVDA, $154.31) stock has been on a tear – and there’s little reason to think the momentum won’t continue.

The company sits at the center of the AI boom, thanks to a well-rounded ecosystem that’s tough to match.

At the core are its high-performance GPUs, the proprietary CUDA software stack, and seamless integration with major AI frameworks.

No other company has assembled a platform so finely tuned for AI workloads.

And, while U.S. restrictions on advanced chip exports to China present a challenge, Nvidia’s financial performance hasn’t missed a beat.

In its latest quarter, Nvidia posted $44.1 billion in revenue, representing a 69% year-over-year jump.

The data center business – which now accounts for the lion’s share of sales – grew 73% to $39.1 billion, fueled by heavy spending from cloud giants like Microsoft (MSFT), Meta Platforms (META) and Google parent Alphabet (GOOGL).

Looking ahead, the company is gearing up for more growth.

Production is ramping for its next-generation Blackwell chips, which promise major performance gains.

Meanwhile, large-scale AI infrastructure deals in places like Saudi Arabia and the UAE are opening new doors and helping to diversify Nvidia’s customer base.

Even after its meteoric rise, Nvidia shares don’t look overly expensive. The stock trades at 29 times forward earnings – modest, considering Wall Street expects 45% revenue growth over the next year.

Compared to slower-growing tech peers with similar valuations, Nvidia still looks like a standout in the AI gold rush.

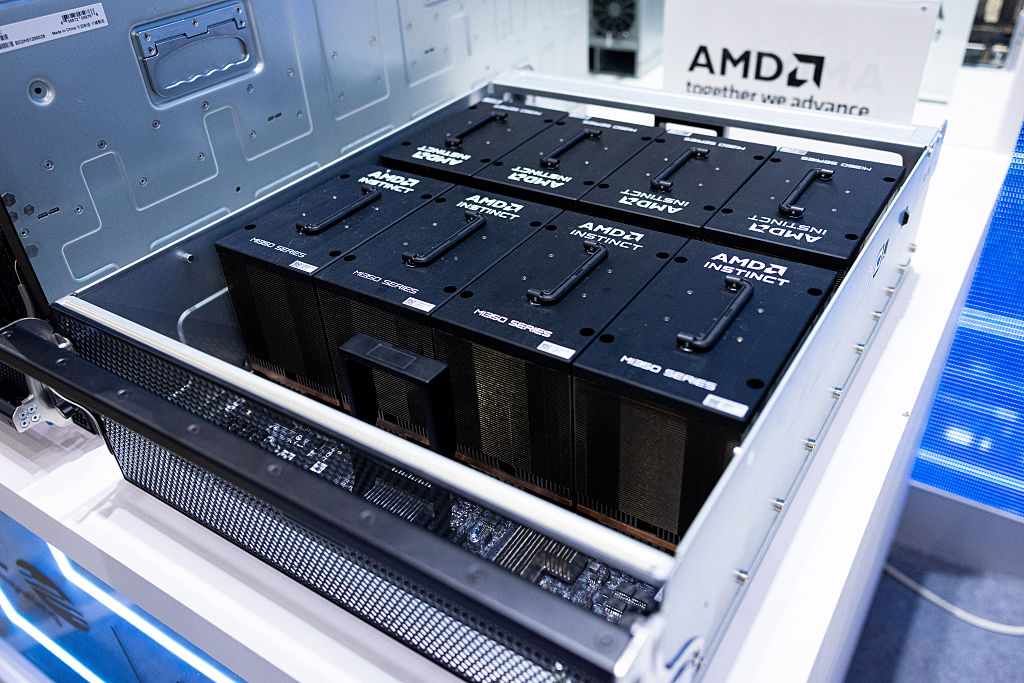

Advanced Micro Devices

- Market value: $232.5 billion

- Dividend yield: N/A

Advanced Micro Devices (AMD, $143.40) is bracing for a $1.5 billion revenue hit in 2025 due to tightening U.S. export restrictions to China.

But even with that drag, the chipmaker’s broad product lineup – ranging from CPUs and GPUs to software and full-rack AI systems – offers a resilient foundation as it targets the booming AI market.

One of AMD’s key strengths is a strong product roadmap.

The recently launched MI350 accelerator boasts a 35-fold improvement in inferencing performance over its predecessor and quadrupled compute capacity.

Early signs suggest strong customer traction.

Looking further ahead, AMD has the MI400 and the Helios rack system slated for 2026, with the MI500 series expected to follow in 2027.

These next-generation platforms will combine MI400 GPUs with Venice and Verano CPUs and Pensando Vulcano networking gear – part of a rack-scale architecture designed to compete with Nvidia.

Meanwhile, partnerships like the new agreement with Saudi Arabia’s HUMAIN highlight the global appetite for AMD’s AI systems.

The company is also reinforcing its full-stack software strategy with ROCm 7 and continued investment in the AMD Developer Cloud.

All of this supports AMD’s push into a data-center AI market that could top $500 billion by 2028.

Analysts at Melius Research expect the company’s AI-driven revenue to surge nearly 50% in 2026, surpassing $9 billion, a sign AMD’s layered approach – from the MI350 to the MI500 – could be a winning strategy.

Qualcomm

- Market value: $171.2 billion

- Dividend yield: 2.3%

Qualcomm (QCOM, $155.93) is pushing well beyond its mobile roots with a series of strategic moves aimed at capturing growth across AI, edge computing and next-generation connectivity.

In early June, the company announced a $2.4 billion deal to acquire Alphawave Semi, an acquisition that brings high-speed wired connectivity intellectual property (IP) under Qualcomm’s roof and sharpens its focus on data-center AI.

Alphawave’s expertise in serializer/deserializer (SerDes) technology, chiplet subsystems, and interconnect technology fits neatly with Qualcomm’s Oryon CPUs and Hexagon NPUs.

The combination gives Qualcomm a clearer shot at the AI inferencing market, where it’s now poised to take on more established players in the data-center space.

Hot on the heels of that announcement, Qualcomm also opened a new AI R&D center in Vietnam.

The facility will focus on generative and agent-based AI across a range of platforms – from smartphones and PCs to XR, automotive, and IoT. It also highlights Qualcomm’s forward-looking investment in emerging technology.

At the Augmented World Expo, Qualcomm showed off the Snapdragon AR1+ platform, which powers the new RayNeo X3 Pro smart glasses. The glasses can run generative AI on-device, without needing a smartphone tether, an early but notable step into the growing spatial computing market.

These moves come amid a strong second quarter for Qualcomm. Smartphone chip shipments rose about 12% year over year, while the IoT and automotive businesses jumped 27% and 59%, respectively.

But it’s the Alphawave acquisition that may prove the linchpin of Qualcomm’s long-term data-center ambitions.

By integrating compute, connectivity, and AI into a unified stack, the company is positioning itself for broader relevance across data-center, edge, and extended reality ecosystems.

It’s a multifront strategy – one that could help fuel Qualcomm’s next chapter of growth.

ASML

- Market value: $320.6 billion

- Dividend yield: 1.0%

You may not see ASML (ASML, $815.24) splashed across headlines, but this Dutch firm plays a critical – almost irreplaceable – role in today’s semiconductor landscape.

ASML is the sole provider of extreme ultraviolet (EUV) lithography machines, the sophisticated tools used to manufacture the world’s most advanced chips.

These machines are engineering marvels. Each one takes about a year to build, includes more than 100,000 individual parts and carries a price tag of about $200 million.

Despite the cost, major chipmakers such as Taiwan Semiconductor (TSM), Intel (INTC) and Samsung are eager buyers.

The reason is that EUV lithography is essential for producing chips with tiny 3-nanometer features and below – the kind needed to power high-performance processors and AI systems.

ASML’s monopoly in this niche gives it a towering competitive edge. Decades of research and development have built a technological lead that competitors have yet to close.

In its latest earnings report for the first quarter of 2025, ASML posted net sales of EUR7.7 billion, with new bookings coming in at EUR3.9 billion. While those figures can vary quarter to quarter, the more telling number may be its backlog – EUR39 billion worth of future orders as of the end of 2024.

This is a strong signal that demand for ASML's tech remains resilient.

Marvell Technology

- Market value: $65.5 billion

- Dividend yield: 0.3%

Marvell Technology (MRVL, $75.93) is quietly becoming a key player in the AI infrastructure arms race.

The semiconductor company, best known for its custom chips and networking gear, is gaining traction among cloud giants such as Google and Microsoft as well as Amazon.com (AMZN) and Amazon Web Services.

These hyperscalers increasingly rely on Marvell’s integrated platforms to power their cloud and AI workloads.

What sets Marvell apart? Its extensive IP in high-speed networking, accelerators and application-specific integrated circuits (ASICs) gives it a leg up in designing performance-optimized, energy-efficient solutions.

For cloud customers juggling scale and speed, Marvell’s one-stop-shop approach is proving attractive. The company’s latest results reflect that momentum.

In its fiscal 2026 first quarter, Marvell posted a record $1.895 billion in revenue, a 63% increase from the same period last year. Data-center sales surged 76% year-over-year and now make up nearly three-quarters of total revenue. On an annualized basis, that puts Marvell’s top line around $6.5 billion.

Looking ahead, Marvell sees even more upside in the booming market for custom AI chips. The company recently raised its total addressable market forecast for this segment to $55 billion by 2028, up from a prior estimate of $43 billion.

That bullish revision follows an investor update revealing 18 custom chip design wins – spread across more than 10 hyperscalers, compared with just four a year earlier.

Marvell aims to capture about 20% of this expanding pie, fueled by growing demand from both sovereign and commercial cloud initiatives.

If current trends hold, it’s a slice that could grow considerably in the years to come.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Taulli has been developing software since the 1980s when he was in high school. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction. He can be reached on Twitter at @ttaulli.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.