Stock Market Today: Dow, S&P Shrug Off China Weakness, Afghan Upheaval

Stocks slumped early Monday on slower-than-expected China growth and Middle East turmoil, but the Dow and S&P 500 recovered to set new highs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Global headlines ranging from dour to disastrous appeared poised to send stocks to sizable losses early Monday, but the major indexes overcame the gloomy news and even managed to scratch out a couple new highs.

Earlier Monday, China announced weaker-than-expected economic growth than expected for July, with retail sales up 8.5% year-over-year (below estimates of 11.5%) and industrial production improving by 6.4% (7.8% est.).

"Slowdown concerns in the region have been persistent for some time now and those concerns are coming to bear in the data," says Michael Reinking, senior market strategist at the New York Stock Exchange. "The recent mitigation measures which include major port closures are raising additional supply chain concerns."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, the Taliban's rapid takeover of Afghanistan amid the U.S. military's pullout also had investors on edge. Energy stocks such as Exxon Mobil (XOM, -1.5%) and Chevron (CVX, -1.0%) were Monday's worst-hit sector, as U.S. crude oil futures declined 1.0% to $67.77 per barrel.

However, David Bahnsen, chief investment officer of wealth management firm The Bahnsen Group, says "the immediacy of this particular development in Afghanistan is not particularly relevant to oil markets, but that could change if there exists a multi-month expansion of jihadist influence in the broader Middle East region out of this."

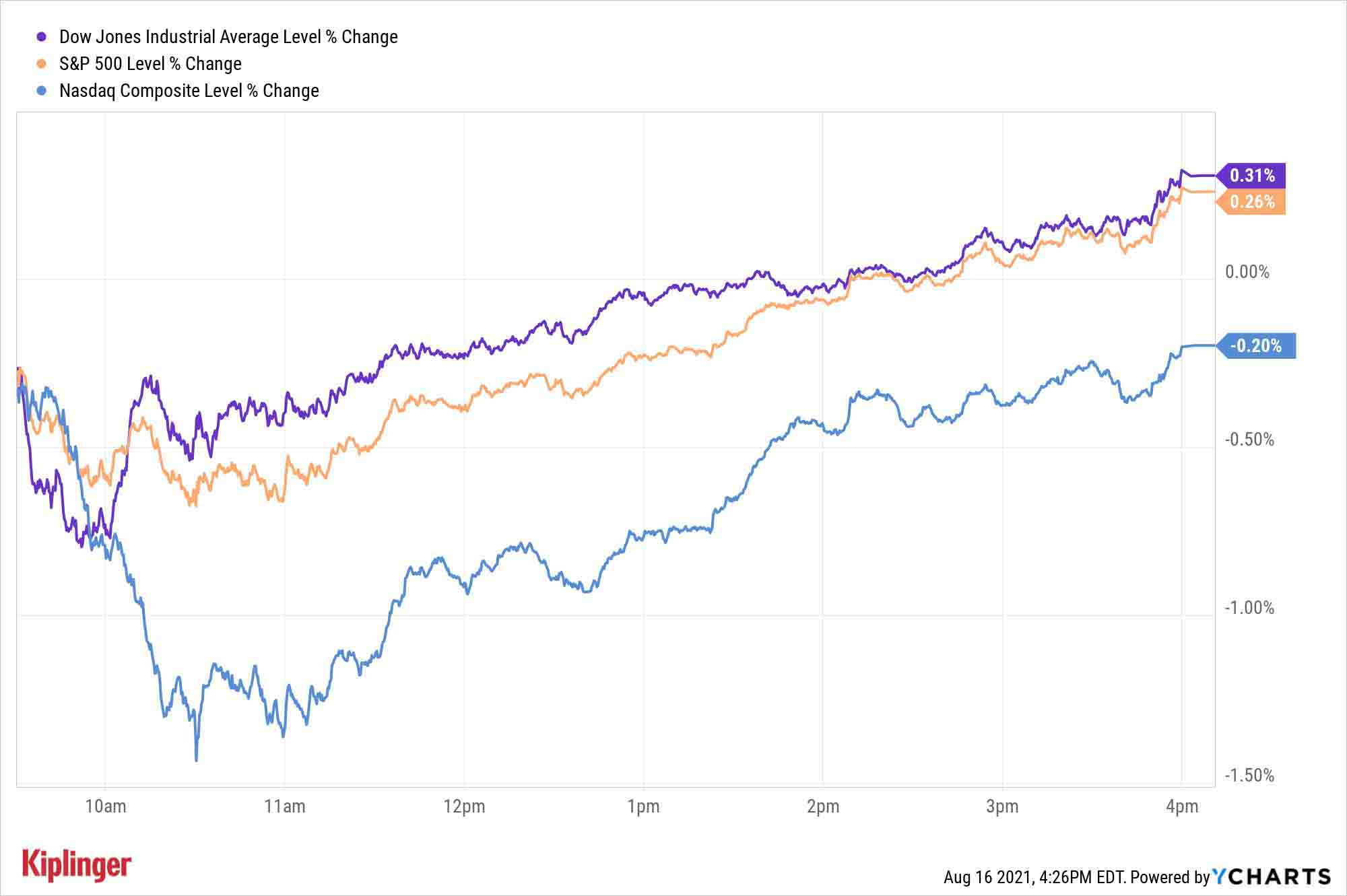

But while stocks broadly swooned to start the day, they regained most if not all of that lost ground by the close. The Dow Jones Industrial Average, off by more than 280 points (0.8%) at Monday's lows, finished up 110 points (0.3%) to a record 35,625. The S&P 500 also rebounded, closing up 0.3% to an all-time high 4,479.

And while the Nasdaq Composite finished off 0.2% to 14,793, that was far better than the 1.4% decline it was posting at the day's nadir.

"I would have expected much more downside given a difficult weekend of geopolitical headlines in the Middle East and since the good news of earnings season is now behind us," Bahnsen adds.

A quick reminder: Warren Buffett's Berkshire Hathaway (BRK.B) files its quarterly Form 13F today. Visit Kiplinger.com/investing later this evening to learn about the legendary investor's latest buys and sells.

Other news in the stock market today:

- The Russell 2000 declined 0.9% to 2,203.

- Tesla (TSLA) fell 4.3% today after the National Highway Traffic Safety Administration (NHTSA) initiated a formal investigation into the electric vehicle (EV) maker's self-driving Autopilot system. This follows several crashes and one fatality dating back to 2018. The Tesla models that were involved in the accidents "were all confirmed to have been engaged in either Autopilot or Traffic Aware Cruise Control during the approach to the crashes," according to the documents filed by the NHTSA.

- Rocket Companies (RKT) slumped 5.0% after the mortgage lender released its second-quarter earnings report. For the three-month period, the company reported lower-than-anticipated adjusted earnings per share of 46 cents and revenues of $2.8 billion.

- Gold futures rose 0.7% to settle at $1,789.80 an ounce.

- The CBOE Volatility Index (VIX) gained 3.8% to 16.03.

- Bitcoin soared into the $48,000s over the weekend, but pulled back on Monday to $46,000.35, a 1.0% decline from Friday afternoon's levels. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Pensions Say "No" to These Stocks

Over the past few years, we've explored the rise of "responsible" investing.

Whatever its form – socially responsible investing (SRI), environmental, social and corporate governance (ESG) or impact investing – investors are increasingly concerned with more than just a company's bottom line. That has given rise to a wide swath of ESG-focused ETFs and other funds that retail investors can use to grow their wealth while also expressing their values.

This type of investing has become more popular at an institutional level, too, with even pensions including some stocks based on various ESG metrics … and excluding others.

While making a pension plan's "exclusion list" is hardly a kiss of death on its own, it can be nonetheless educational to note which companies don't make the cut – because if an increasingly values-focused Wall Street starts to follow suit, demand for these stocks could dry up, putting downward pressure on shares. We recently looked at nine such stocks, but keep close watch down the road: If these companies address the issues that got them shunned in the first place, they get off these exclusion lists.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.