Can Under Armour (UAA) Turn In Another Earnings Beat?

Our preview of the upcoming week's earnings reports includes Under Armour (UAA) and Etsy (ETSY).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We're in a busy stretch for corporate earnings, and in the week of Aug. 2-6, investors will start to get a closer look at how consumers were spending their money in the second quarter. That's because several retail-related names are set to report their quarterly financial results.

Among them is Under Armour (UAA, $20.45), which is scheduled to tell all in the earnings confessional ahead of the Tuesday, Aug. 3, open.

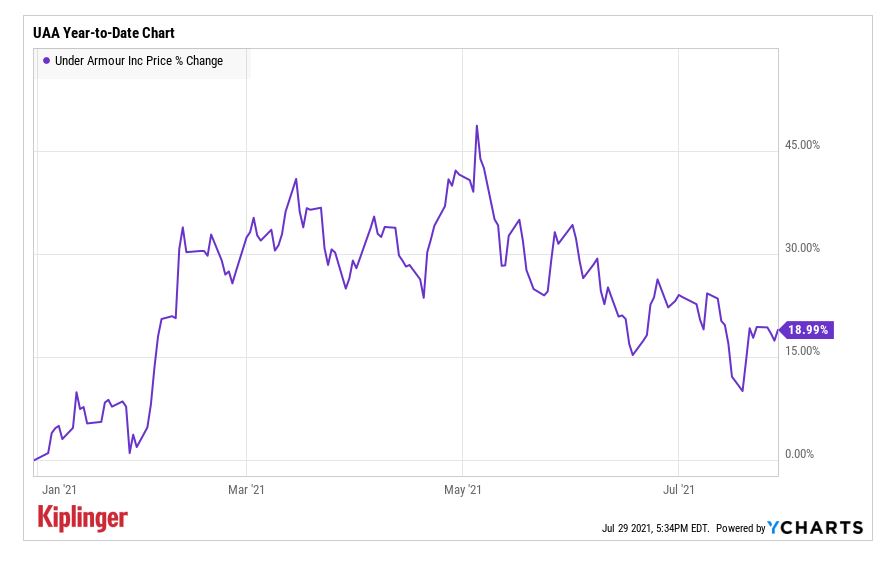

UAA shares had a strong start to 2021, entering the year trading near the $17 per-share mark before climbing all the way up to annual-high territory above $26 by May.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

This notable milestone was hit the day after the athletic apparel maker's first-quarter earnings report, in which it revealed better-than-expected adjusted earnings per share (EPS) of 16 cents compared to a loss in the year prior. Revenues of $1.3 million – up 35% year-over-year (YoY) – were also higher than analysts were projecting. In addition, the company lifted its full-year forecast, with CEO Patrik Frisk citing "a solid balance sheet and well-managed inventory."

While shares have pulled back dramatically since then, analysts are upbeat this earnings report will continue to show growth in UAA's top and bottom lines.

"We expect Under Armour's second quarter will surpass guidance and Street expectations on rebounding domestic sales, and project an 80%-plus increase in North American sales translating to revenue slightly ahead of 2019 levels," William Blair analysts Sharon Zackfia and Tania Anderson say.

But while the analysts are encouraged by Under Armour's first-half rebound, they maintain a Market Perform (Hold) rating on UAA shares. Their concern? The stock's enterprise value is roughly 20 times the research firms 2022 EBITDA (earnings before interest, taxes, depreciation, and amortization), suggesting it could be expensive at the moment.

Deutsche Bank analysts "see upside to gross profit margin and the top line driven by a favorable pricing environment and pent-up demand for the back-to-school season." They maintain a Buy rating on UAA shares with a $31 price target, representing expected upside of 52% over the next 12 months or so.

Overall, the consensus EPS estimate for UAA's second quarter is for 5 cents, compared to a per-share loss of 31 cents in the year ago period. Revenues are projected to surge 70.6% year-over-year to $1.2 billion.

Will Etsy Impress Amid Tough Comps?

Etsy (ETSY, $198.98) shares sold off dramatically in the wake of the company's first-quarter earnings report. Despite beating estimates on both the top and bottom line, the company warned its second-quarter results would show a slowdown in gross merchandise sales (GMS), or the volume of goods sold. This is because of tough year-over-year comparisons due to the popularity of the online marketplace during the early stage of the pandemic.

The shares have rebounded since then and are currently up about 12% for the year to date. And given the negative reaction to ETSY's GMS warning back in May, it could be that the negative news has already been priced in.

Jefferies analyst John Colantuoni says ETSY's second-quarter guidance has been a "key overhang" on the stock. "Our analysis of historical results suggest that traffic growth in April and May (29% average) indicates there is upside to the second-quarter consensus given actual GMS growth has on average been nearly double traffic growth in the last two years," he adds.

And following the stock's sharp decline since March, ETSY represents a "compelling buying opportunity." He maintains a Buy rating on the shares.

Etsy's second-quarter report is due out after Wednesday's close. The consensus estimate among analysts is for the retailer to report earnings of 63 cents per share, a roughly 16% decline from what it took in a year ago. Its top line is forecast to have increased 22.4% year-over-year to $524.8 million.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.

-

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Bank of America Stock 20 Years Ago, Here's What You'd Have TodayBank of America stock has been a massive buy-and-hold bust.