Stock Market Today: Tech, Energy Pop as Stocks Soar Into the Weekend

A tumultuous week ended on a high note as stocks ignored a lackluster April retail report and staged a broad-based rally.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks finished the week with a raucous relief rally driven by not very much of anything.

A five-day stretch that was mostly defined by clear signs of red-hot economic recuperation closed with a relatively shrug-worthy data point Friday. Namely, retail sales, which had jumped 10.7% month-over-month in March, were flat in April, and "core" retail sales (ex-automobiles and gasoline) were actually down 1.5% month-over-month.

It wasn't all that bad. Barclays economists note that rather than a material slowing, "the move in April reflects more of a pullback after the unsustainable jump in March helped by rebate checks and fading winter-weather effects."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Energy stocks were the best-performing sector (+3.1%) amid a nice 2.4% move higher in U.S. crude oil futures, to $65.37 per barrel. But technology and tech-esque stocks did a lot of the barking Friday.

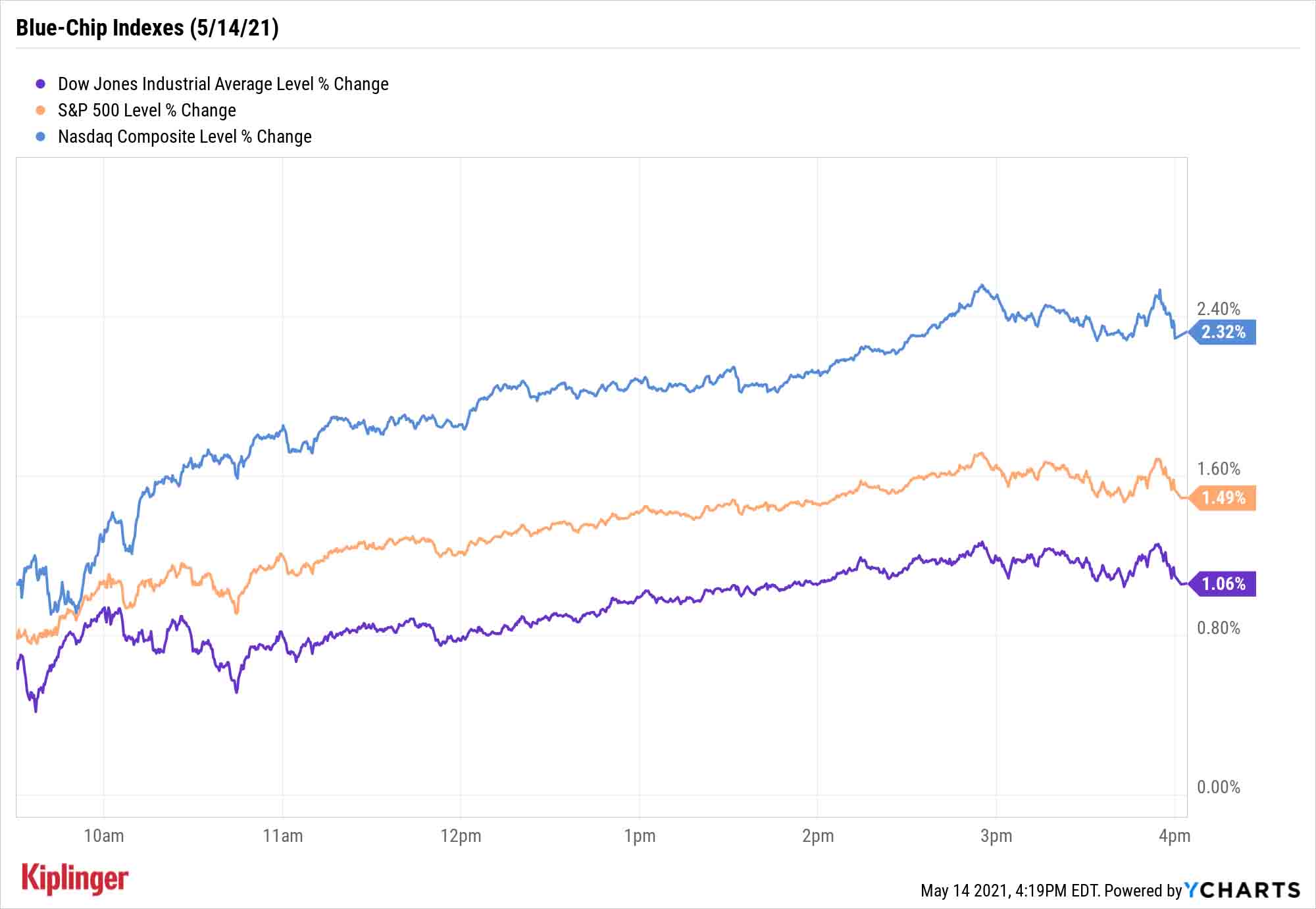

Big moves in the likes of Nvidia (NVDA, +4.2%), Facebook (FB, +3.5%) and Tesla (TSLA, +3.2%) sent the Nasdaq Composite 2.3% higher to 13,429. Dow Jones Industrial Average tech components such as Salesforce.com (CRM, +2.7%) and Intel (INTC, +2.5%) sent the index up 1.1% to 34,382. And the S&P 500 closed 1.6% higher to 4,178.

Small caps, which have struggled over the past week, also jumped to life, with the Russell 2000 advancing 2.4% to 2,224.

Other action in the stock market today:

- One name that didn't participate in today's broad-market rally was Walt Disney (DIS, -2.6%). The entertainment giant reported first-quarter earnings that came in above estimates, but both revenues and Disney+ paid subscribers missed the mark.

- DoorDash (DASH, +22.2%), on the other hand, soared after its earnings report. The food delivery service unveiled higher-than-expected revenues for its first quarter and lifted its full-year gross orders value, which helped offset a wider-than-anticipated per-share loss.

- Looking ahead to next week, several high-profile retail earnings will roll in, with Home Depot (HD) and Walmart (WMT) among the top ones to watch.

- Gold futures edged up 0.8% to finish at $1,838.10 an ounce.

- The CBOE Volatility Index (VIX) plunged again, off 18.7% to 18.81.

- Bitcoin recovered partially from Thursday's deep dive, gaining 3.3% to $50,205.77. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

More Fuel for the Value Fire?

Friday marked a brief deviation from 2021's rotation away from growth stocks to value plays, but plenty of experts still see signs of continued performance out of value.

BCA Research and BofA Global Research are among analyst outfits that have recently pointed to more bullish signs. The latter points out that performance trends in actively managed funds suggest investors still haven't made a fully committed pivot into value – and thus there's still more money that could flow into bargain-priced stocks.

Which bargain-priced stocks?

We would answer that question by pointing you in the direction of our favorite value stocks to buy … but we'd also argue that you don't necessarily have to pick.

Value-oriented exchange-traded funds (ETFs) have gone bananas amid this monthslong rotation, and that party will likely keep raging as long as value remains in style. You can slice the value pie in myriad ways, meaning there are ETF options for investors who favor large companies, small firms, international picks and more.

Read on as we explore 10 different value ETFs and explain what they can contribute to your portfolio.

Kyle Woodley was long CRM as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.