Stock Market Today: Investors Head for Safety Amid Another Selloff

Wall Street didn't have an appetite for marijuana stocks on 4/20 ... or many other risk assets, for that matter. Instead, investors sniffed out defensive plays such as utilities and REITs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks stumbled for the second consecutive day Tuesday, and they did so again amid a fairly slow drip of news.

Both domestically and globally, a pickup in COVID-19 cases is fostering worries about the size and pace of the economic recovery, though at the same time, the world's number of vaccinated continue to grow.

"Stocks are dropping again today with no clear catalysts. Markets are a little stretched at this point, so we may see stocks take a small step back here and there. That's normal, and we'd expect any dip to be bought quickly," says Callie Cox, senior investment strategist for Ally Invest, who points out that recent action has come amid low trading volume. "As long as volume stays low and news is quiet, we may see this wandering market continue to search for direction."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

When investors were buying, they were choosing safety: Utilities (+1.3%) and real estate (+1.1%) topped all other sectors Tuesday.

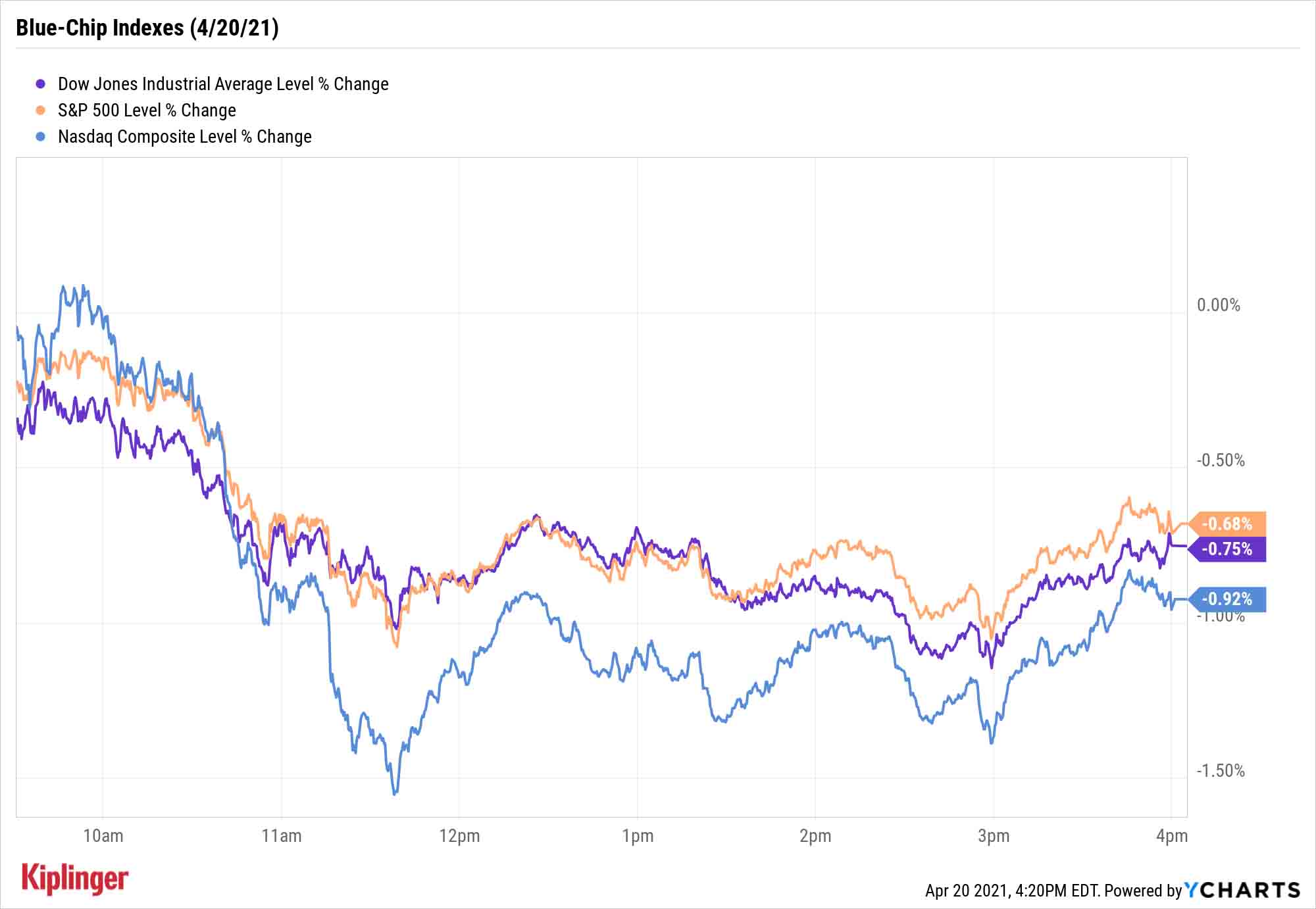

But the Dow Jones Industrial Average dropped 0.8% to 33,821. The Dow was led lower by the likes of Nike (NKE, -4.2%) which was downgraded on concerns over boycotts in China, and Boeing (BA, -4.1%), which dropped after CEO David Calhoun said its dividend likely won't be returning in the short term.

Meanwhile, the S&P 500 lost 0.7% to 4,134, and the Nasdaq Composite declined by 0.9% to 13,786.

Other action in the stock market today:

- Apple (AAPL, -1.3%) declined despite announcing a number of new products and updates Tuesday. The company unveiled more powerful iPads and thinner iMacs, both using M1 chips; a tile-like item tracker called AirTags, an updated Apple TV+ box and more.

- International Business Machines (IBM, +3.8%) gained after the company reported its first quarter of revenue growth in more than a year and beat earnings expectations.

- Johnson & Johnson (JNJ, +2.3%) beat top- and bottom-line estimates; meanwhile, the European Union said that while J&J's COVID-19 does appear to be linked to blood clot risks, its benefits outweigh those risks.

- The Russell 2000 dropped 2.0% to 2,188.

- U.S. crude oil futures dropped 76 cents, or 1.2%, to settle at $62.67 per barrel.

- Gold futures added $7.90, or 0.5% to settle at $1,777.30 an ounce.

- The CBOE Volatility Index (VIX) jumped another 8.2%, following a strong advance Monday, to reach 18.71.

- Bitcoin prices recovered a little, up 1.0% to $56,650. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Netflix (NFLX) was off by more than 11% in early after-hours trading after a wide miss on first-quarter global subscriber numbers. Specifically, global paid net subscriber additions of 3.98 million were well below the 6.2 million expected. The company did beat revenue and earnings projections.

4/20: A Buzzkill for Cannabis Investors

You might not have been aware, but today was a holiday for some: 4/20 is a date widely celebrated by marijuana aficionados … and increasingly, investors.

As it happened, weed stocks admittedly wilted under the spotlight today, despite yesterday's House passage of a bill that would let banks provide services to the industry in states that have legalized marijuana use. The AdvisorShares Pure US Cannabis ETF (MSOS), for instance, declined 3.2%.

However, many marijuana plays are still sitting on strong returns year-to-date, and several drivers still point to big long-term potential.

"With more states considering legalizing cannabis, combined with the future uptick in sales from states such as New York and New Jersey that have recently legalized recreational cannabis, I expect that cannabis sales will continue to experience strong growth," says Jason Wilson, cannabis and banking expert at ETF Managers Group, the issuer of the ETFMG Alternative Harvest ETF (MJ, -4.5%). "In the longer term, as the cannabis industry continues to mature, I would expect to see the strongest sales growth in derivative products, such as cannabis-infused beverages."

If you're feeling "canna-curious," start out by learning which red flags you should be watching for in this emerging industry.

If you feel you're ready to go, consider this list of 10 marijuana picks – complete with traditional stocks, but also real estate investment trusts (REITs), special purpose acquisition companies (SPACs) and even a couple funds for those interested in a more diversified approach.

Kyle Woodley was long BA and MSOS as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.