Stock Market Today: Strong Start to Earnings Season Sends Dow Higher

Goldman Sachs' (GS) record Q1 and a strong day for Chevron (CVX) helped keep the Dow in positive territory on an otherwise choppy Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

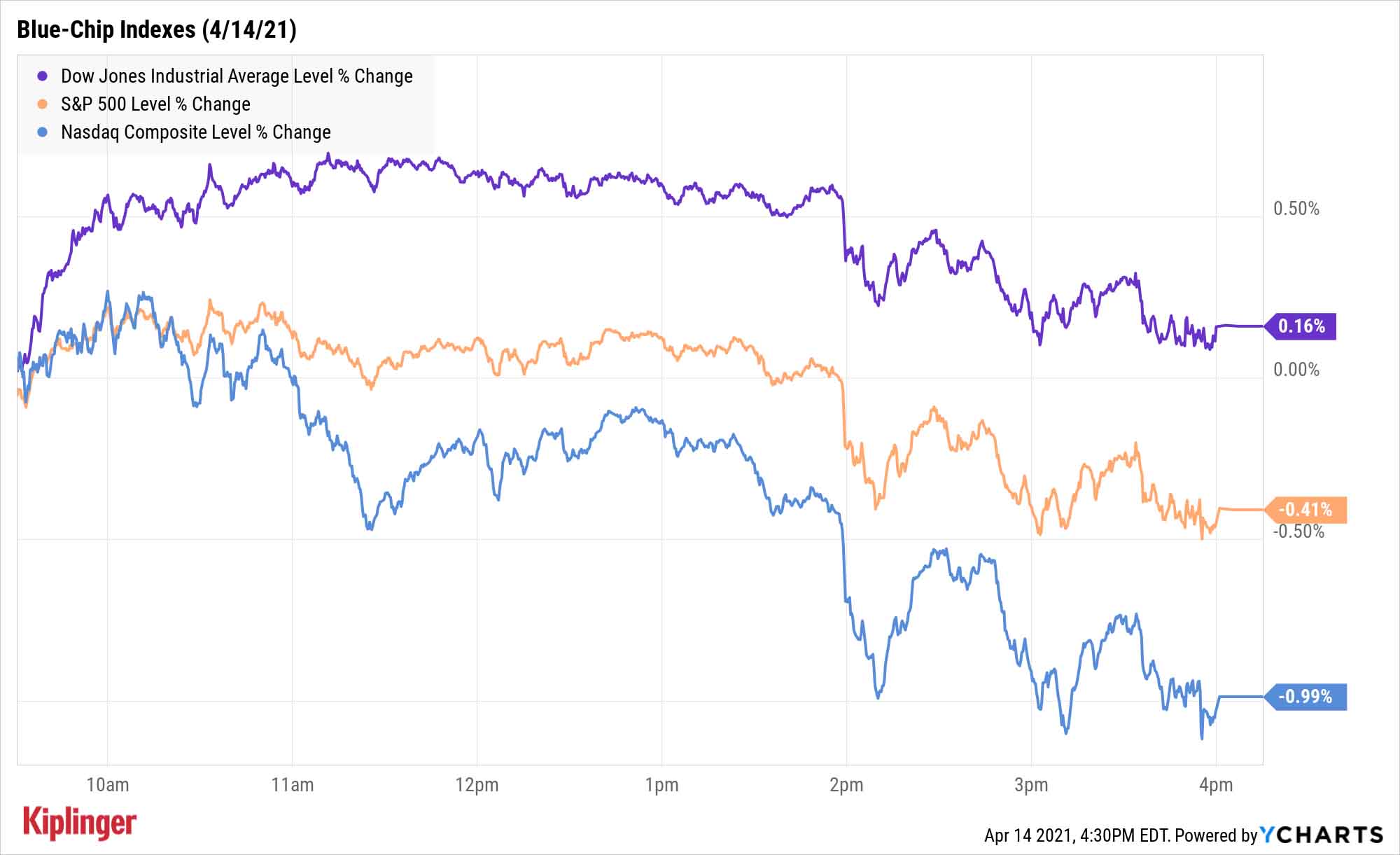

The Dow Jones Industrial Average was the clear winner among the blue-chip indexes Wednesday as Wall Street got its initial taste of 2021's Q1 earnings season.

The industrial average gained a modest 0.2% to finish at 33,730 with help from Goldman Sachs (GS, +2.3%), which jumped after the investment bank reported record first-quarter profits.

"GS is executing on all cylinders with industry-leading performance, and we believe the capital markets will remain very active in a low-rate, risk-on environment," says Kenneth Leon, director of equity research at CFRA.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Quarterly results from Wells Fargo (WFC, +5.6%) were also well-received, with the mega-bank topping top- and bottom-line expectations. However, JPMorgan Chase (JPM, -1.9%) slumped on disappointing loan revenues.

The energy sector (+2.8%) was another big winner today after data from the Energy Information Administration showed domestic crude oil supplies fell more than expected last week. That lifted U.S. crude oil futures by 4.9% to $63.15 per barrel, marking the commodity's highest finish since March 17. In turn, integrated oil majors Exxon Mobil (XOM, +2.9%) and Chevron (CVX, +2.0%) both enjoyed a robust move higher.

But it wasn't enough to keep the S&P 500 above water, with the broad-market index falling 0.4% to close at 4,124. The Nasdaq Composite declined 1.0% to 13,857.

Other action in the stock market today:

- The Russell 2000 rose 0.8% to close at 2,247.

- Gold futures fell $11.30, or 0.7%, to settle at $1,736.30 an ounce.

- The CBOE Volatility Index (VIX) rose 2.0% to settle at 16.99.

- Bitcoin prices dropped 1.5% to $62,028. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Another Day, Another Big Stock Debut

Also Wednesday, investors enjoyed the latest in a string of high-profile stock offerings.

Cryptocurrency exchange Coinbase (COIN) kicked off its highly anticipated direct listing by opening at $381.00 – well above the $250 reference price set by the Nasdaq on Tuesday – before closing up 31.3% to $328.28. Coinbase joined a laundry list of outstanding offerings in 2021 that include the likes of online gaming platform Roblox (RBLX), female-led dating-app operator Bumble (BMBL) and popular online education provider Coursera (COUR). And the dealmaking is far from over.

Yesterday, we pointed you in the direction of several special purpose acquisition companies, or SPACs, that are looking to join an explosive trend of companies going public in an alternative way. But don't sleep on traditional initial public offerings (IPOs).

Dozens of exciting deals are on tap for the rest of the year, and even more could be on the way as additional companies file with the SEC. Here, we've rounded up a baker's dozen of the hottest upcoming IPOs, including a popular consumer-goods firm that recently threw its hat in the ring.

Kyle Woodley was long RBLX as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Small Caps Can Only Lead Stocks So High: Stock Market Today

Small Caps Can Only Lead Stocks So High: Stock Market TodayThe main U.S. equity indexes were down for the week, but small-cap stocks look as healthy as they ever have.

-

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market Today

Dow Adds 292 Points as Goldman, Nvidia Soar: Stock Market TodayTaiwan Semiconductor's strong earnings sparked a rally in tech stocks on Thursday, while Goldman Sachs' earnings boosted financials.