Stock Market Today: Stocks (and the Fed) Stay the Course

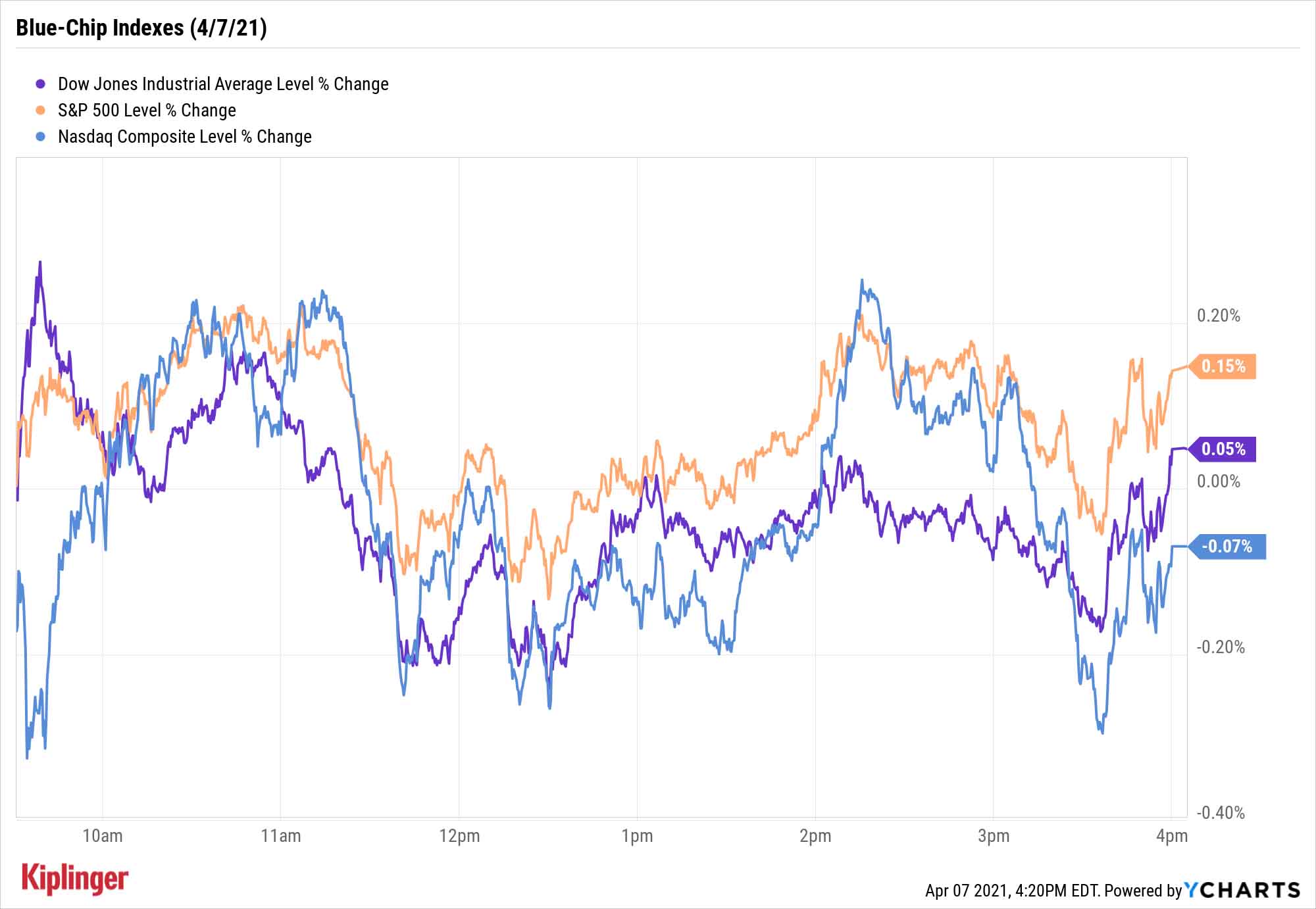

The FOMC's March minutes didn't give investors much else to munch on, resulting in a mostly sideways Wednesday for the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The market flipped between minor gains and losses throughout a fairly mundane Wednesday that the Federal Reserve failed to spice up.

This afternoon, the Fed released its minutes from the Federal Open Market Committee meeting in March, and officials expressed patience in keeping its easy monetary policy in place, believing it will be "some time" until its economic and price-stability goals are met.

"Without doubt, the March FOMC meeting minutes point to a desire to maintain a highly accommodative stance of monetary policy for the foreseeable future," says Bob Miller, BlackRock's head of Americas Fundamental Fixed Income. But he adds that "the March meeting also saw seven of 18 participants who did not think keeping the target policy range unchanged for three more years was appropriate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"That's now becoming too many voices to squelch. … We think this debate will unfold further as the economy (and inflation) strengthen in the coming months."

There were individual pockets of motion across today's market – larger tech-related stocks such as Twitter (TWTR, +3.0%) and Nvidia (NVDA, +2.0%) headed higher, as did recovery plays such as retailer L Brands (LB, +3.6%) and cruise line operator Carnival (CCL, +1.4%).

But the broader indexes hardly moved. The Dow improved marginally to 33,446.26. The S&P 500 gained just 0.2% to 4,079, but that was enough to mark a new all-time high.

Other action in the stock market today:

- The Nasdaq Composite was off marginally to 13,688.

- The small-cap Russell 2000 had a much rougher go at things, dropping 1.6% to 2,223.

- U.S. crude oil futures headed higher again, up a modest 0.4% to $59.55 per barrel.

- Gold futures slipped a mere 0.1% to $1,741.60 per ounce.

- Bitcoin prices took a tumble, falling 3.6% to $56,136. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Which Stocks Should You Watch? Here's What a Machine Had to Say.

Over the past few years, we've frequently touted the potential of artificial intelligence (AI). This technology's ability to revolutionize everything, from industrial logistics to toasting your bread, has made the companies who enable artificial intelligence, or best utilize it, into many of the market's top returners.

Several AI-focused funds have come to life as a result, and some of today's most innovative companies have AI flowing through their business.

But artificial intelligence can do more than power profitable stocks – apparently, it can pick 'em, too.

Near the start of 2021, we explored an AI-powered analytics platform and some of its selections, and, since then, those stocks have clobbered the market. Naturally, we're curious whether this "robo-picker" can continue to outperform, so we've taken a fresh (and expanded) look at this system's top stocks to watch right now. You should, too.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.