Stock Market Today: Stocks Tread Water, Bitcoin Joins the Trillion-Dollar Club

The Dow finished flat as a pancake as the stock market continues to stall against all-time highs, but Bitcoin continued building a head of steam.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

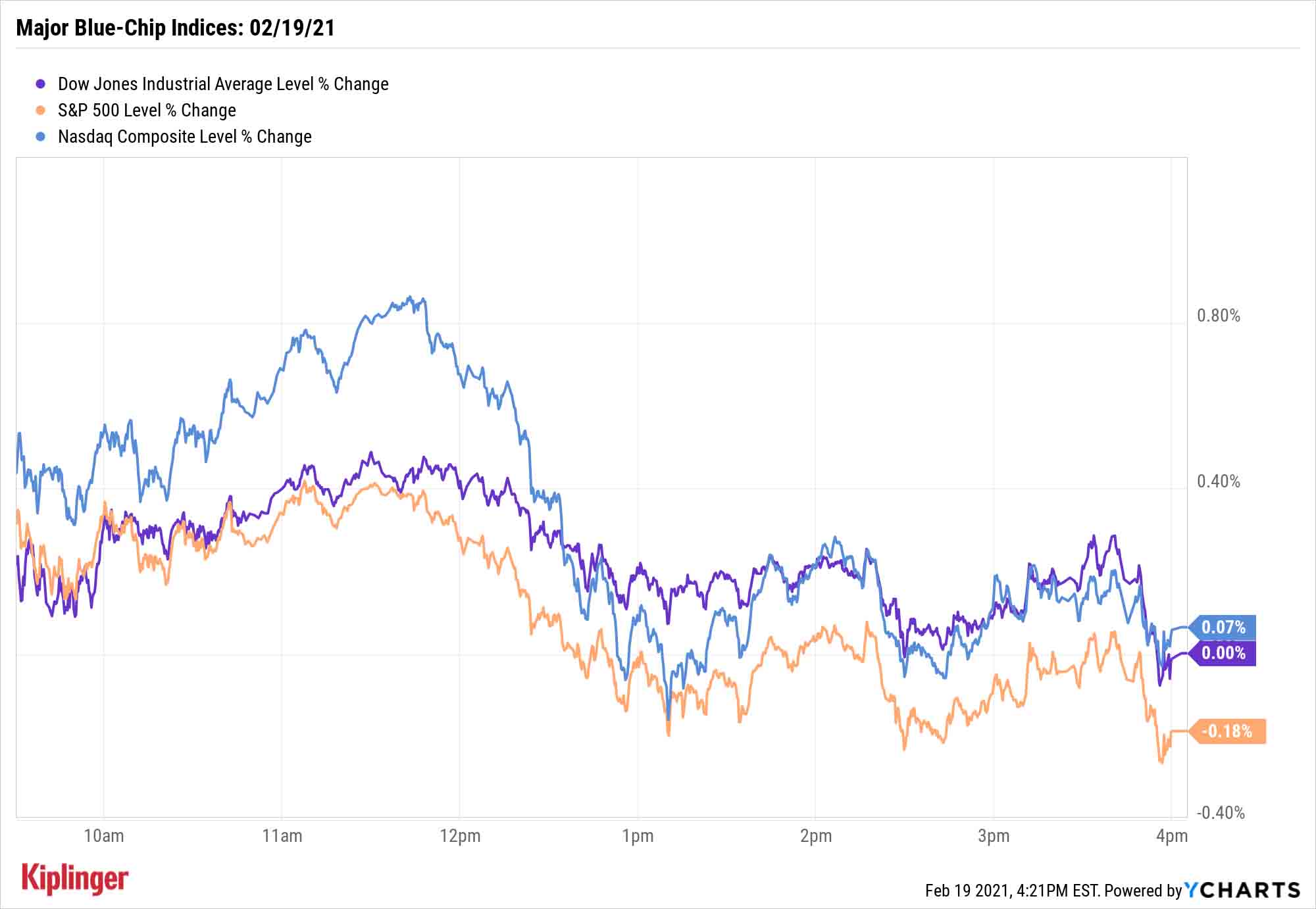

We've discussed this week the idea that the stock market might be running out of gas, and that certainly appeared to be the case Friday, as stocks finished mixed after giving up most of their morning gains.

That wasn't a problem for the digital currency Bitcoin, however.

Traders found several positive economic indicators to consider. U.S. businesses are expanding at their strongest rate in six years, according to IHS Markit's flash reading of the purchasing managers index, which rose to 58.8 in February from 58.7 in the month prior. And Deere (DE, +9.6%) provided some optimism after raising its 2021 profit forecast amid expectations for better equipment sales.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

However, a pop at the market open lost steam as the day progressed, fitting right in with a week that saw equities struggle up against all-time highs. The Dow Jones Industrial Average, up 154 points at its zenith, finished less than 1 point higher instead, closing at 31,494.

One potential problem remains just how optimistically priced stocks are already.

"Most of our indicators suggest stocks are pricing in a lot of good news," says Savita Subramanian, equity and quant strategist for BofA Securities. "In fact, over $3T in stimulus may already be priced in on one measure: the ratio of S&P 500 market cap to the M2 money supply. The ratio currently stands at 1.7x, the highest level since Feb 2020, and to get to the post-crisis average of 1.4x, we estimate additional $3.1T of M2 would be needed."

Other action in the stock market today:

- The S&P 500 declined 0.2% to 3,906.

- The Nasdaq Composite finished with a marginal gain to 13,874.

- The small-cap Russell 2000 rebounded after a dreary Thursday, rising 2.2% to 2,266.

- U.S. crude oil futures declined 0.8% to settle at $60.05 per barrel.

- Gold futures gained 0.1% to $1,777.40 per ounce.

Bitcoin: The Trillion-Dollar Cryptocurrency

If the stock market has lost its momentum this week, Bitcoin has surely found it. The digital currency, which has exploded by more than 1,300% since its 2020 bear-market lows, continues to grab Wall Street's attention as it reaches new milestones.

On Friday, Bitcoin prices eclipsed the $55,000 mark and finished regular trading hours at $55,397. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.) That marks a 6.3% daily climb, and an 18.8% jump higher since Monday morning.

Assets invested in Bitcoin have now surpassed $1 trillion; for perspective, if Bitcoin were a publicly traded company, it would now be worth more than Tesla (TSLA, $749 billion) or Facebook (FB, $745 billion).

Fueling that gain is one of the drivers we cited in our 2021 outlook for Bitcoin: institutional investors, who are quickly pouring huge sums of money into Bitcoin and other digital currencies.

Should you join them?

Bitcoin remains a high-risk investment, and also a difficult-to-access one if you only have a traditional brokerage account – you can't buy the digital currency without accessing a cryptocurrency exchange. But you can purchase crypto-connected companies such as these eight stocks. And you can also access crypto via a small but growing number of funds, similar to how you'd buy SPDR Gold Shares (GLD) to gain exposure to gold.

Read on as we introduce you to the newest option for crypto investors – a Bitcoin fund that charges less than half the fees of the current market leader – and explain its perks, as well as potential future threats.

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

5 Actions to Set Up Your Business With Your Exit in Mind

5 Actions to Set Up Your Business With Your Exit in MindWhen you're starting a business, it may seem counterintuitive to begin with exit planning. But preparing will put you on a more secure footing in the long run.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.