Stock Market Today: Dow Marks New Highs, Tech Makes a Mess

Another big day for energy prices (and a little help from Uncle Warren) sent Chevron higher Wednesday, helping to lift the Dow.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

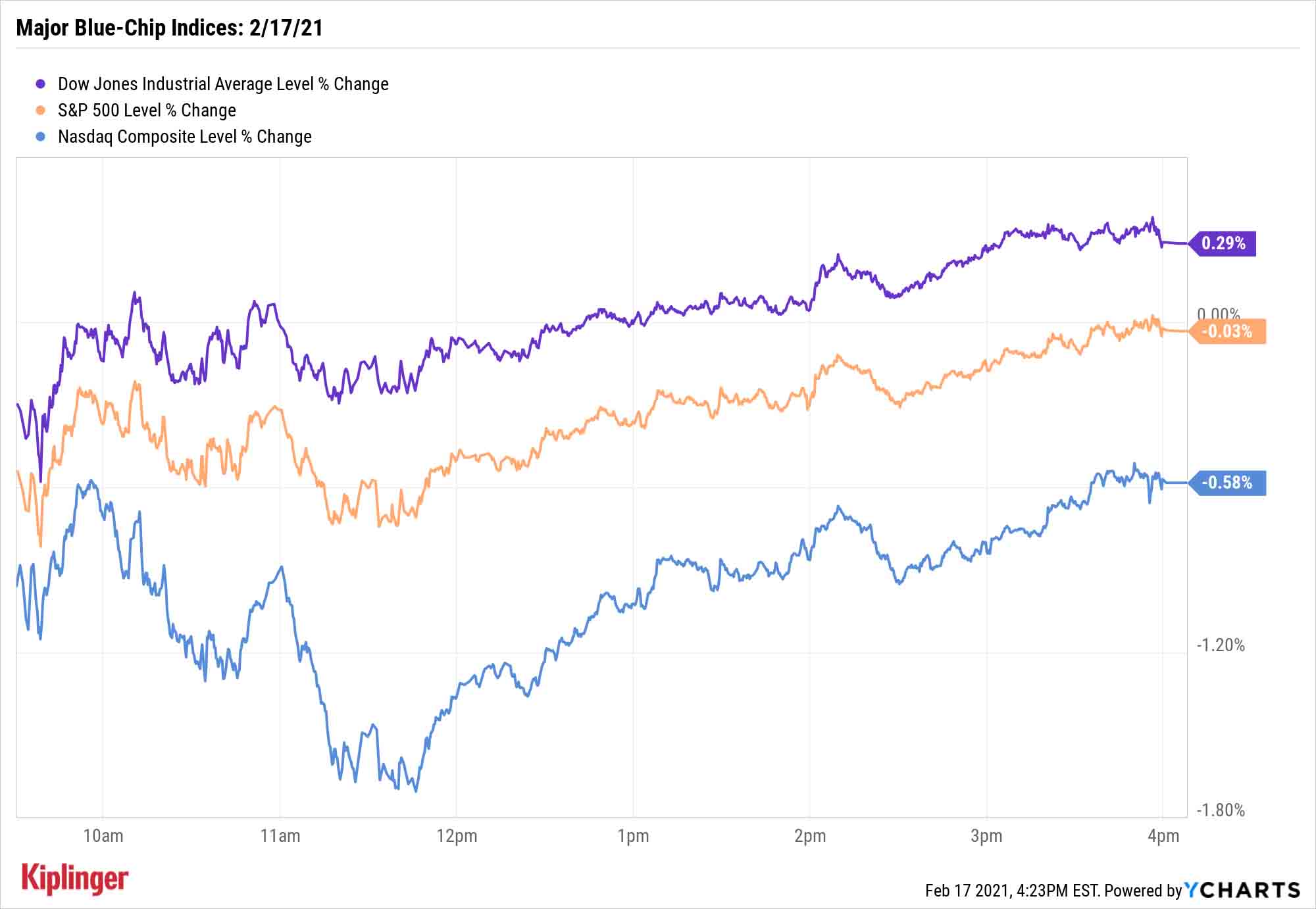

Investors were put through the information wringer on Wednesday, and the major blue-chip indices finished the day with pretty disparate results.

The January retail sales report was, in the words of Barclays strategists, "significantly stronger than expected," showing overall sales up 5.3% month-over-month following three straight months of declines.

"We had expected an overall improvement in January sales, after three months of declines," says Pooja Sriram, vice president, US Economist at Barclays Investment Bank. "In particular, we expected the additional support to households from government pandemic-relief programs to support spending.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Households started receiving the $600 per individual rebate check in January, as well as the federal unemployment assistance of $300 per week, under the COVID relief bill signed into law in late December."

Another sign of economic resilience was rising U.S. wholesale inflation, which rose 1.3% month over month in January, reflecting strong domestic and export demand alike.

Interestingly, minutes from the January Fed meeting, released today, demonstrated worry about America's path, with participants noting that "economic conditions were currently far from the Committee's longer-run goals."

"The minutes from the latest Fed meeting didn’t stray too far from the message Fed Chair Powell has been sending to market participants in his recent speeches where he indicated it’s not the right time to change policy," says Charlie Ripley, senior investment strategist for Allianz Investment Management.

However, Bob Miller, BlackRock's head of Americas Fundamental Fixed Income, says even the past few weeks since that meeting have "left that meeting's minutes looking somewhat stale."

"If we see vaccinations continuing apace, delivery of pending massive fiscal policy support and the arrival of warmer weather, we expect the resumption in spring of more 'normal looking' levels of previously shuttered economic activity. If accurate, the economy will be making 'substantial further progress' toward the FOMC's goals - to use the Committee's guidance for when they might no longer want to maintain the current pace of asset purchases."

U.S. crude oil futures continued to climb amid supply disruptions in Texas, by 1.8% to $61.14 per barrel, pushing up the likes of Dow Jones Industrial Average component Chevron (CVX, +3.0%). The Dow managed to notch another record high, finishing up 0.3% to 31,613. However, a technology-sector slump sent the Nasdaq Composite 0.6% lower to 13,965.

Other action in the stock market today:

- The S&P 500 slipped marginally to 3,931.

- The small-cap Russell 2000 lost another 0.7% to 2,256.

- Gold futures declined for a fifth consecutive session, falling 1.5% to $1,772.80.

- Bitcoin prices, at $48,783 on Tuesday, shot 7% higher to 52,266. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Out Now: Buffett's Latest Picks

Yes, Chevron did have swelling energy prices on its side, but it also had a new ally: Warren Buffett.

The legendary value investor and CEO of Berkshire Hathaway (BRK.B) unveiled his latest transactions in a Tuesday evening 13F filing to the SEC, revealing that his holding company had taken a stake in the integrated energy giant during the final quarter of 2020.

And that was far from Uncle Warren's only move.

Buffett, just like many retail investors, spent much of 2020 making wholesale changes to the Berkshire Hathaway equity portfolio. He was every bit as active during Q4, entering four new stakes, exiting five stocks outright, and tinkering with another dozen positions.

If you're curious as to what the Oracle of Omaha is bullish on, or what has fallen out of his favor, read on as we examine each of Warren Buffett's 21 latest portfolio moves over the most recent quarter:

Kyle Woodley was long Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Dow Soars 588 Points as Trump Retreats: Stock Market Today

Dow Soars 588 Points as Trump Retreats: Stock Market TodayAnother up and down day ends on high notes for investors, traders, speculators and Greenland.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow, S&P 500 Rise to New Closing Highs: Stock Market Today

Dow, S&P 500 Rise to New Closing Highs: Stock Market TodayWill President Donald Trump match his Monroe Doctrine gambit with a new Marshall Plan for Venezuela?

-

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market Today

'Donroe Doctrine' Pumps Dow 594 Points: Stock Market TodayThe S&P 500 rallied but failed to turn the "Santa Claus Rally" indicator positive for 2026.