Stock Market Today: Wall Street Welcomes Biden With Resounding Rally

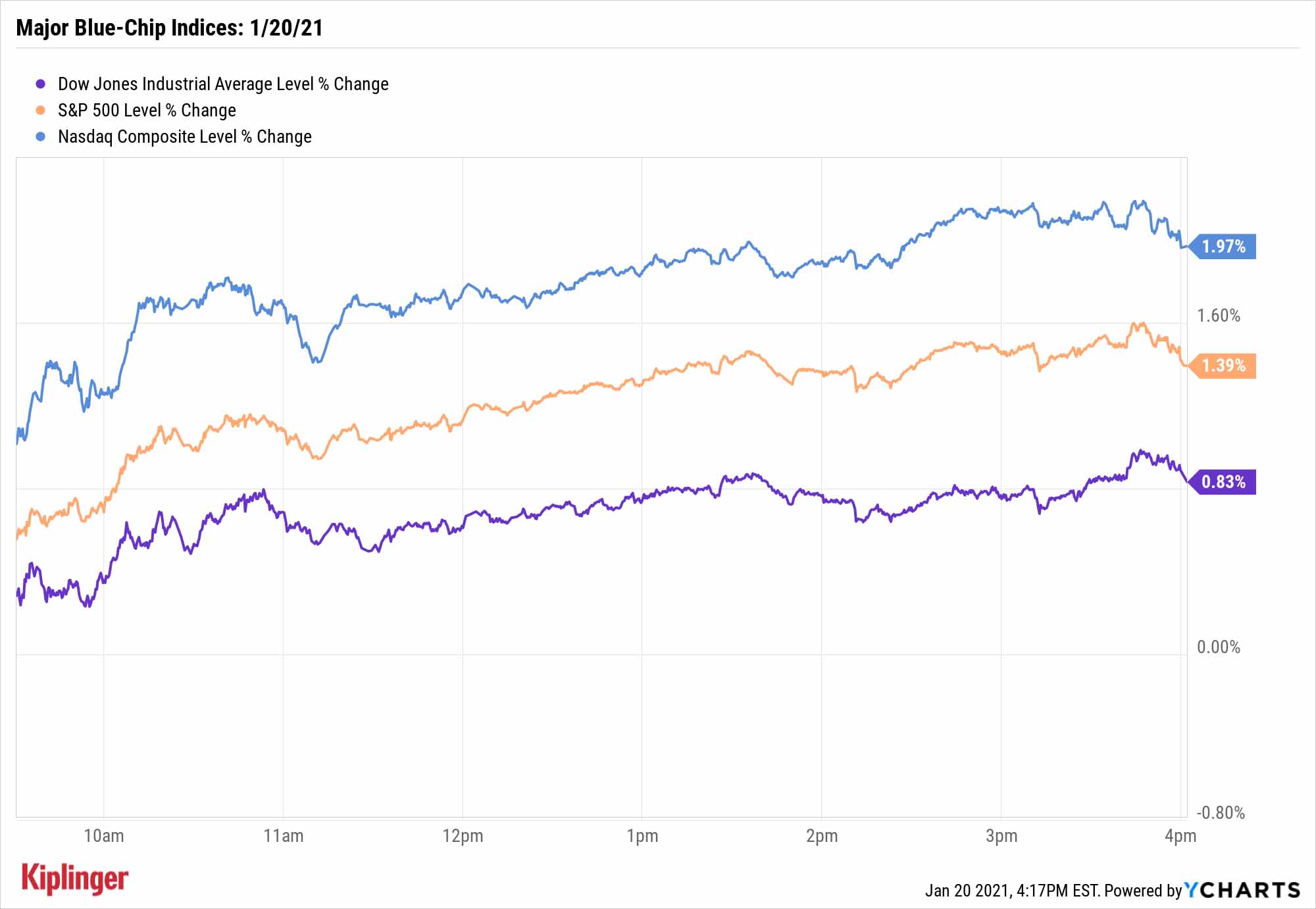

The major indices finished at record highs Wednesday as investors digested the new president's inauguration message and hopes for his stimulus plan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Joe Biden was sworn in as the 46th president of the United States on Wednesday in a smaller, sparser inauguration ceremony than in years past, but one that was no less cheered by investors, who drove the blue-chip indices to fresh highs.

Biden's message was a welcome one, touting unity as a solution to the hurdles facing America:

"This is our historic moment of crisis and challenge. And unity is the path forward," he said. "We have never, ever, ever, ever failed in America when we've acted together."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Wall Street, of course, is more focused on policy than speeches, and is now keying in on the perceived benefits of the new president's stimulus proposal. (Treasury Secretary Nominee Janet Yellen endorsed Biden's plan yesterday.)

The Dow Jones Industrial Average, up 0.8% to 31,188, finished with a record close. Strong performances from the "FAANGs" – Facebook (FB, +2.4%), Amazon.com (AMZN, +4.6%), Apple (AAPL, +3.3%), Netflix (NFLX, +16.9%) and Google parent Alphabet (GOOGL, +5.4%) – launched the S&P 500 (+1.4% to 3,851) and Nasdaq (+2.0% to 13,457) to new heights.

Netflix's outsized jump was fueled by a strong fourth-quarter report that saw the streaming video provider pass 200 million global subscribers.

"We feel the company's robust original content pipeline and improving cash flow leave it well-positioned to remain consumers' top choice in streaming entertainment for years to come," say Canaccord Genuity analysts Maria Ripps and Michael Graham, who rate the stock Buy and raised their 12-month price target from $630 per share to $670.

The small-cap Russell 2000 joined in, climbing 0.4% to a record 2,160.

Other action in the stock market today:

- Gold futures surged 1.4% higher to hit $1,866.50 per ounce.

- U.S. crude oil futures settled 0.5% higher, at $53.24 per barrel.

- Bitcoin prices, at $36,433 on Tuesday, declined by 3.9% to $35,007. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How Long Will the Market Honeymoon Last?

Investors are sure to continue betting on industries and sectors most likely to get a lift from the nation's change in management. Green energy stocks have been all the rage, for instance, and could continue to receive a bid.

Don't count out traditional energy plays, however. Erin Swenlin, senior analyst at Stockcharts.com, points out that "with the possible crackdown on fracking and fossil fuels by the new administration, scarcity will afford the oil and natural gas industries more gains."

But like some of her peers, Swenlin is warning about potential short-term overheating.

"We're seeing a market that is more than overbought. ... it is running well past earnings potential," she says, warning of a looming correction – one that could occur "when investors realize that the vaccine hasn't solved our economic problems."

That could be a blessing in disguise, at least for new money.

Many "Biden picks" have already appreciated considerably since we first highlighted them ahead of the November election, and a correction could produce more palatable pricetags for a number of stocks that should have Washington on their side for at least a couple years to come. If you want to build such a watch list, look no further than this list of 20 top stocks for the Biden administration.

Kyle Woodley was long AMZN and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

A Scary Emerging AI Threat

A Scary Emerging AI ThreatThe Kiplinger Letter An emerging public health issue caused by artificial intelligence poses a new national security threat. Expect AI-induced psychosis to gain far more attention.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.