T. Rowe Price Financial Services Banks on a Turnaround

This fund is a good way to bet on an economic rebound.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The rollout of COVID vaccines has raised the prospects of a return to economic normality. That’s good news for financial stocks, which are sensitive to shifts in the economy.

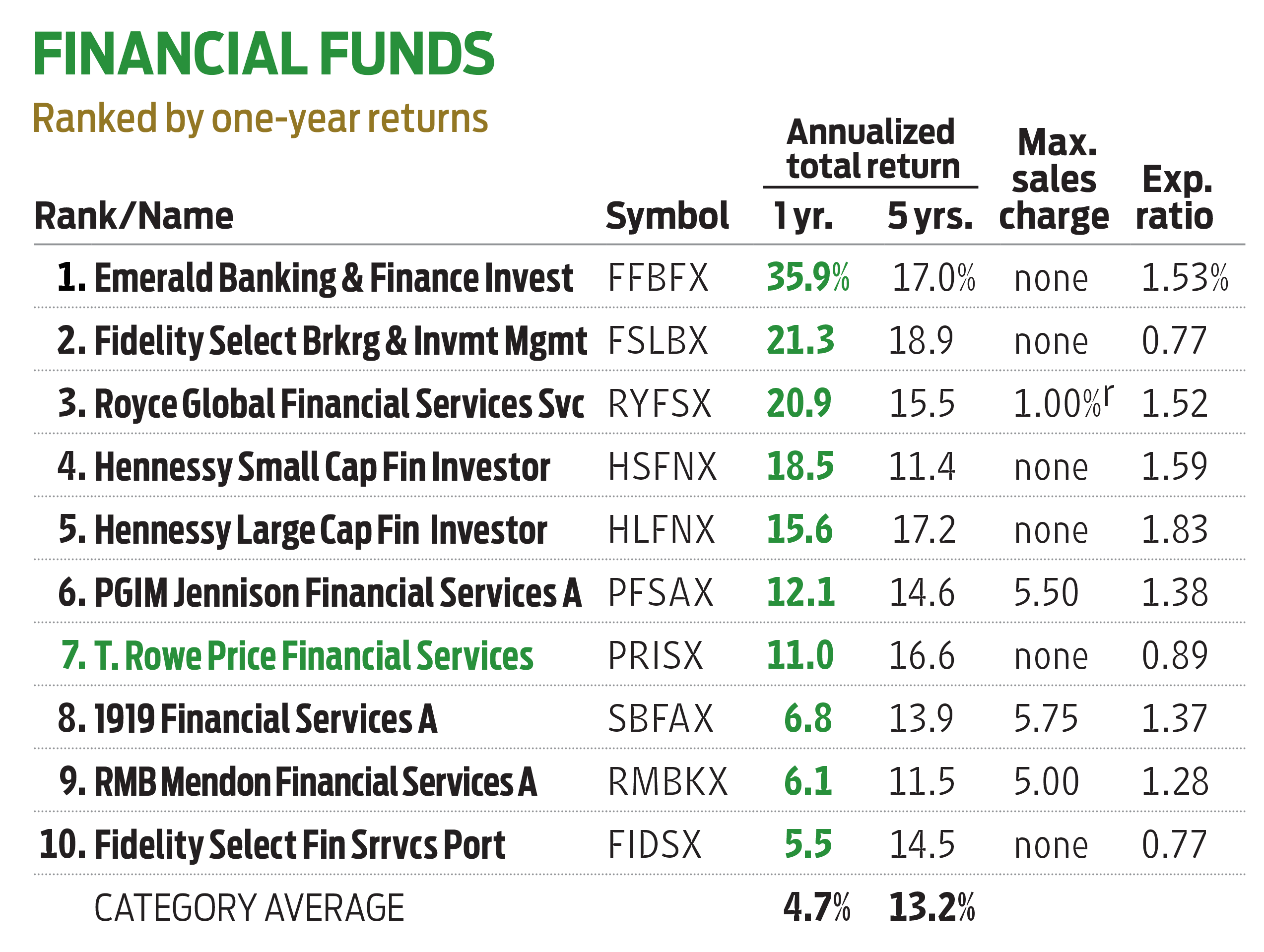

T. Rowe Price Financial Services (PRISX) invests broadly across the sector, in major and regional banks, payment networks, insurers and asset managers. Manager Gabriel Solomon builds his portfolio one stock at a time, digging into each firm’s fundamentals. He invests in companies of all sizes, with a three- to five-year holding period in mind. And he’s on the prowl for bargains: “The fund tends to have a contrarian and deep-value bias,” says Solomon, who works closely with a team of analysts around the globe.

That partiality came in handy in 2020. Financial stocks cratered in the spring amid uncertainties about the virus. Solomon beefed up stakes in Wells Fargo, Fifth Third Bank and Signature Bank, a New York–based commercial bank. He added new positions in Capital One Financial and Huntington Bancshares.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

“Every stock has its own story,” says Solomon. Wells Fargo, for one, is still restoring confidence after its fake-account scandal. “The market is underestimating what the company will look like on the other side,” says Solomon. Signature was beaten down due to its exposure to New York real estate, but its balance sheet is “close to pristine,” he says.

Valuation guides Solomon’s buy and sell decisions, but he’ll hold on to fast-rising stocks, such as Visa, as long as long-term growth prospects justify the valuation. Last year, he unloaded Citigroup stock—not because it had risen 57% in 2019, but because of a worrying rise in turnover among middle managers. “It’s important to continue to ask ourselves, What are we missing? Is the situation the same as we thought it was, is it getting better, or is it worse?” says Solomon.

Looking ahead, Solomon is optimistic. Going through the pandemic, the sector survived “an incredible stress test and came out really strong,” he says. Consumer and commercial borrowers overall are in healthy shape, too, which could fuel loan growth. Against this backdrop, a rise in interest rates, a traditional boost to bank profits, would be “icing on the cake,” says Solomon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Stock Market Today: Stocks Retreat Ahead of Nvidia Earnings

Stock Market Today: Stocks Retreat Ahead of Nvidia EarningsMarkets lost ground on light volume Wednesday as traders keyed on AI bellwether Nvidia earnings after the close.

-

Stock Market Today: Stocks Edge Higher With Nvidia Earnings in Focus

Stock Market Today: Stocks Edge Higher With Nvidia Earnings in FocusNvidia stock gained ground ahead of tomorrow's after-the-close earnings event, while Super Micro Computer got hit by a short seller report.

-

Stock Market Today: Dow Hits New Record Closing High

Stock Market Today: Dow Hits New Record Closing HighThe Nasdaq Composite and S&P 500 finished in the red as semiconductor stocks struggled.

-

Stock Market Today: Stocks Pop After Powell's Jackson Hole Speech

Stock Market Today: Stocks Pop After Powell's Jackson Hole SpeechFed Chair Powell's Jackson Hole speech struck a dovish tone which sent stocks soaring Friday.

-

Stock Market Today: Stocks Drop Ahead of Powell's Jackson Hole Speech

Stock Market Today: Stocks Drop Ahead of Powell's Jackson Hole SpeechSentiment turned cautious ahead of Fed Chair Powell's highly anticipated speech Friday at the Jackson Hole Economic Symposium.

-

Stock Market Today: Stocks Rise After Jobs Data Lifts Rate-Cut Odds

Stock Market Today: Stocks Rise After Jobs Data Lifts Rate-Cut OddsPreliminary data from the Bureau of Labor Statistics shows job growth was lower than previously estimated.

-

Stock Market Today: Stocks Snap Lengthy Win Streak

Stock Market Today: Stocks Snap Lengthy Win StreakThe recent stock market rally ran out of steam Tuesday as sentiment turns cautious ahead of Jackson Hole.