Bond Advice for Today's Market: Think Big Picture

A bad day for stocks is often worse than a bad YEAR for bonds. Investors need to remember that right about now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There is an old joke that some statisticians tell, that “a person with their head in an oven and their feet in the freezer is comfortable — on average.” Statisticians are not known for their sense of humor (clearly), but the joke is an effective warning about some of the shortcomings of relying on averages.

Statistically, a simple average camouflages extremes within its sample data. And, while the statistician’s joke is somewhat extreme, it is no less extreme than the actual returns in the long-run average annual returns for stocks and bonds that set many investors’ return expectations.

What’s an 'average' annual return anyway?

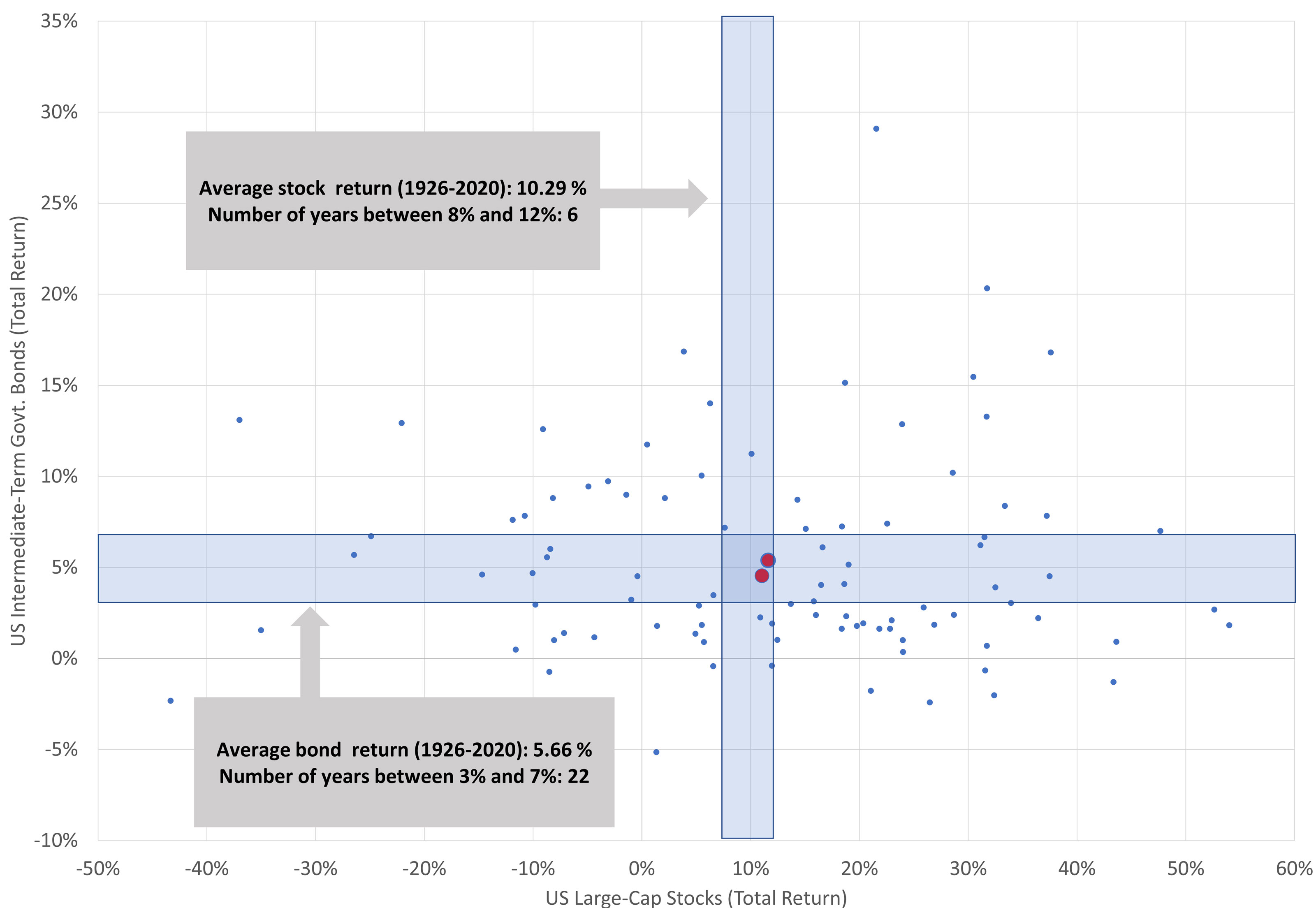

If quizzed, it is likely that many investors would estimate the average annualized returns for U.S. stocks and bonds to be about 10% and 5%, respectively. Those averages are composed of decades of returns and describe history perfectly. However, although they describe the average annualized returns, they are a far cry from the typical or "average" experience. In fact, in only two years from 1926 through 2020 did both the stock and bond market deliver returns within 2% (+/-) of their historical averages (see Figure 1).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Figure 1: Annual stock and bond returns, 1926-2020

In 2021, U.S. stocks gained 25.7%, while U.S. bonds lost 1.5%.* While it is fair to say that it was a great year for stocks, is it fair to say that it was a bad year for bonds because they didn’t return their 5.7%* average? Probably not. The only thing rarer than a year with “average” returns might be a year that investors appreciate their bond allocations amid a bull market for stocks.

For those of you thinking about abandoning bonds, here are some ideas that may help:

A bad day for stocks is often much worse than a bad year for bonds.

While investors prefer gains to losses, they also prefer small losses to big losses. While far from being predictive, Figure 1 demonstrates that negative returns in bonds have tended to be both infrequent and modest. In fact, the bond market’s worst annual return was a loss of 5.1% in 1994. However, the stocks of the S&P 500 index have posted daily losses that bad or worse 25 times since 1926.

Sometimes, the further the distance, the clearer the picture.

Often, it’s hard for investors to see the benefits that high-quality bonds can add to their portfolios, especially when the returns they are posting are modest — or even modestly negative. And today, concerns for higher interest rates due to higher-than-expected inflation are making it even more challenging for investors to ignore some pundits’ suggestions that holding bonds is a bad idea.

I was given a magnifying glass when I was young, and I started looking at everything through it. Eventually, I looked at the Sunday comics and realized that for all I saw, I wasn’t seeing everything. The cartoons were nothing but a variety of colored dots! Magazine photos, too. It made me wonder how much else I was missing because I wasn’t looking closely enough. Now, I realize that when I was close enough to see the dots, I missed the bigger picture – literally.

Similarly, the dots in Figure 1 paint a picture that’s easy to overlook when you’re too narrowly focused: The principal benefit of investment-grade bonds isn’t their frequency of positive returns but the infrequency of large, negative returns. And, yes, if the returns in Figure 1 were inflation-adjusted, the frequency of negative returns for both bonds and stocks would increase. However, that would not change what Figure 1 tells us: High-quality bonds in a portfolio can help moderate the volatility of stocks.

The bottom line: Keep your eye on the big picture.

A well-diversified portfolio can benefit from bonds: More likely than not, a bad year for bonds will be much better than a bad day for stocks. While that certainly won’t insure your portfolio against losses, it can certainly help moderate the losses when the markets turn intemperate.

Having a well-diversified portfolio that includes an allocation to high-quality bonds can help keep a bad day in the stock market from turning into a bad year for your portfolio.

* Stock performance as measured by the CRSP U.S. Total Market Index. Bond performance as measured by the Bloomberg U.S. Aggregate Float Adjusted Index. Bond average is a geometric mean return for the Ibbotson® SBBI® U.S. Intermediate-term (5-Year) Government Bonds (Total return).

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Don Bennyhoff, CFA®, serves as the Chairman of the Investment Committee and Director of Investor Education at Liberty Wealth Advisors, a $1.7B RIA. An industry expert who spent over 22 years at The Vanguard Group, Don was a Founding Member of Vanguard’s Investment Strategy Group, and served as a Senior Investment Strategist.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.