Deeper Regional Banking Crisis Unlikely after Triple Failure: Kiplinger Economic Forecasts

Lending could still contract, while financial regulators want more oversight of non-banks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Our highly experienced Kiplinger Letter team produces regular forecasts on the banking and finance sectors to help you make better decisions about your investment and personal finances (Get a free issue of The Kiplinger Letter or subscribe.) You will always get them first by subscribing, but we will publish many (but not all) of the forecasts a few days afterward online. Here’s the latest forecast…

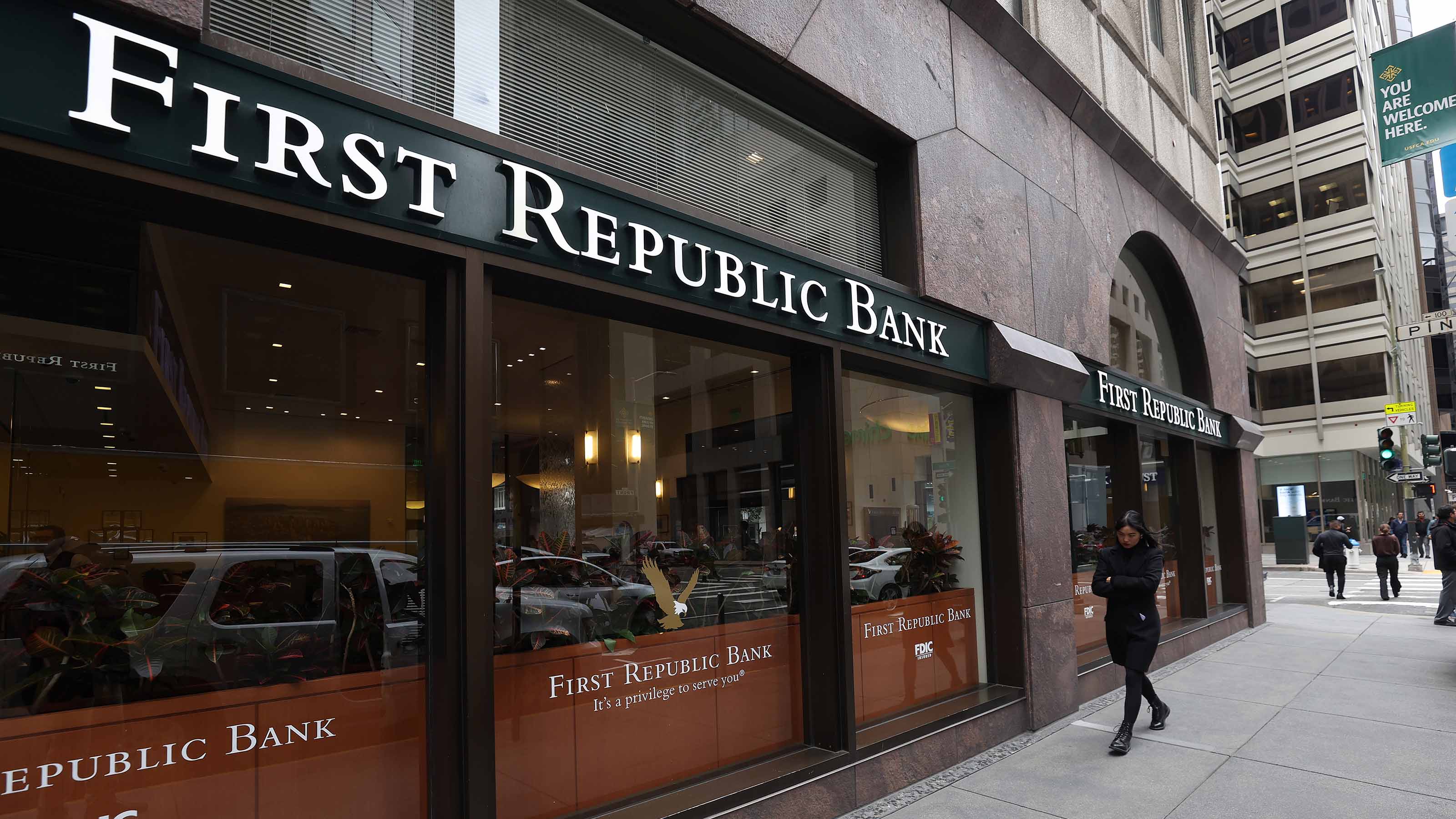

The failure of First Republic Bank has once again sparked concerns about the U.S. financial system. Bank regulators have taken control of First Republic and sold most of its operations to JPMorgan Chase & Co (JPM).

This marks the third failure of a large regional bank since mid-March. There are some parallels between First Republic and Silicon Valley Bank, both of which catered to high-net-worth individuals and had an unusually high share of deposits above the $250,000 Federal Deposit Insurance Corporation (FDIC) limit.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As a result, many depositors moved their funds to larger banks when turmoil hit this spring. A crisis among regional banks still seems unlikely.

What’s next for the banking sector?

While headwinds will continue to plague the industry, vulnerability to rising interest rates varies greatly by bank. Those most at risk: Banks that benefited from a flood of customer deposits during the pandemic and used it to provide cheap mortgages to wealthy customers or buy long-term bonds. But no matter what, bank lending will contract, another source of drag on U.S. economic growth this year.

Financial regulators want to toughen oversight of nonbanks. The FSOC (Financial Stability Oversight Council) has announced a series of proposals to strengthen the process by which investment managers, insurers, hedge funds and other nonbank financial firms are designated as systemically important. For now, the label, which allows for extra oversight, applies only to the nation’s largest banks.

What rules could change?

A few Trump-era changes would be reversed, specifically, 2019 requirements that forced regulators to wait several years before designating a particular institution as systemically important. The new rules introduce a variety of metrics for regulators to determine whether a company’s distress could threaten U.S. financial stability.

Nonbank financial companies are opposed, arguing the rules should focus on specific activities rather than companies. Three large insurers — AIG, MetLife (MET) and Prudential — plus GE Capital (GE) were initially considered systemically important after the 2008 financial crisis. All four have since been freed from that status.

This forecast first appeared in The Kiplinger Letter. Since 1923, the Letter has helped millions of business executives and investors profit by providing reliable forecasts on business and the economy, as well as what to expect from Washington. Get a free issue of The Kiplinger Letter or subscribe.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rodrigo Sermeño covers the financial services, housing, small business, and cryptocurrency industries for The Kiplinger Letter. Before joining Kiplinger in 2014, he worked for several think tanks and non-profit organizations in Washington, D.C., including the New America Foundation, the Streit Council, and the Arca Foundation. Rodrigo graduated from George Mason University with a bachelor's degree in international affairs. He also holds a master's in public policy from George Mason University's Schar School of Policy and Government.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

The U.S. Economy Will Gain Steam This Year

The U.S. Economy Will Gain Steam This YearThe Kiplinger Letter The Letter editors review the projected pace of the economy for 2026. Bigger tax refunds and resilient consumers will keep the economy humming in 2026.

-

Trump Reshapes Foreign Policy

Trump Reshapes Foreign PolicyThe Kiplinger Letter The President starts the new year by putting allies and adversaries on notice.

-

Congress Set for Busy Winter

Congress Set for Busy WinterThe Kiplinger Letter The Letter editors review the bills Congress will decide on this year. The government funding bill is paramount, but other issues vie for lawmakers’ attention.

-

The Kiplinger Letter's 10 Forecasts for 2026

The Kiplinger Letter's 10 Forecasts for 2026The Kiplinger Letter Here are some of the biggest events and trends in economics, politics and tech that will shape the new year.

-

Special Report: The Future of American Politics

Special Report: The Future of American PoliticsThe Kiplinger Letter Kiplinger assesses the political trends and challenges that will define the next decade.

-

AI Appliances Aren’t Exciting Buyers…Yet

AI Appliances Aren’t Exciting Buyers…YetThe Kiplinger Letter Artificial intelligence is being embedded into all sorts of appliances. Now sellers need to get customers to care about AI-powered laundry.

-

What to Expect from the Global Economy in 2026

What to Expect from the Global Economy in 2026The Kiplinger Letter Economic growth across the globe will be highly uneven, with some major economies accelerating while others hit the brakes.