(A Little) Greed Is Good When It Comes to Investing

Investors seem to feel only a little greedier than usual right now, and when investors feel that way, there are usually positive stock market returns ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There’s a certain appeal to being a contrarian investor. Zigging when others are zagging. Going against the herd. And when you’re proven right, it feels pretty darn good (and can pay off handsomely).

One of the first adages contrarian investors learn comes from Warren Buffett. In his 1986 letter to Berkshire Hathaway shareholders, Buffett wrote about being fearful when others are greedy, and greedy when others are fearful.

Such moments are easy to recall. Maybe you bought Bitcoin near its 2021 top, when fear of missing out (FOMO) was in full swing. Or you saw a huge opportunity to buy stocks in March 2020, during the COVID crash … but couldn’t bring yourself to pull the trigger.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Those tops and bottoms burn into our memories. But when it comes to investing around them, there’s a problem: They are rare.

It’s been nearly 36 years since 1987’s Black Monday stock market crash. From that time period up until today, the United States has had five bull and bear market cycles. That means 10 days of tops and bottoms. Over 36 years.

How are we to invest the rest of the time?

It turns out, when others are greedy, being fearful can cost you. Big-time.

How investor sentiment has changed

This is particularly important to keep in mind today, because investor sentiment has dramatically changed compared to a year ago. One way to measure this is the American Association of Individual Investors (AAII) Sentiment Survey. Every week, the AAII polls individual investors about their sentiment on the market for the next six months. Investors can indicate whether they are bullish, bearish or neutral.

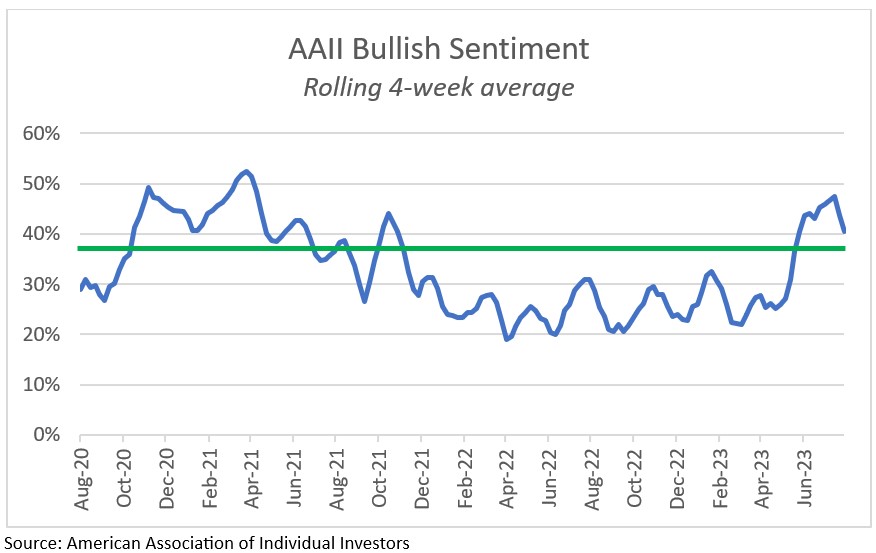

The chart below shows how bullish investor sentiment has changed over the past three years. The long-term average for bullish sentiment is 37.5% (the green line), so anything above that level could be considered more optimistic than usual.

There was plenty of optimism going around in 2021. There’s nothing like reaching new all-time highs to get investors feeling good about the stock market. The party ended in 2022, and naturally, investors were less enthused.

In hindsight, it’s easy to see that this is the exact opposite of how investors should have been feeling. They felt great when stocks were about to go over a cliff. Then they hated stocks right before the market was about to take off.

Is it time to look for the exits now?

When the market seems dismal, having perspective and keeping calm can be a huge advantage. In our mid-year letter to SAM clients in 2022, we noted that investors were unbelievably pessimistic, with AAII bullish sentiment at its lowest point in 30 years. Lower than the early days of COVID. Lower than the 2008 Global Financial Crisis. Lower than the bursting of the tech bubble.

We told our clients that “the type of market pullback we’re seeing today is what leads to big gains in the future.” That has proven to be correct. But how should investor sentiment be guiding decisions in today’s market?

The contrarian in you might be thinking that with investors feeling good about stocks again, it’s time to look for the nearest exit doors. But not so fast. Investors’ bullish sentiment over the past month has averaged 40.5%. That’s only a little higher than the long-term historical average of 37.5%.

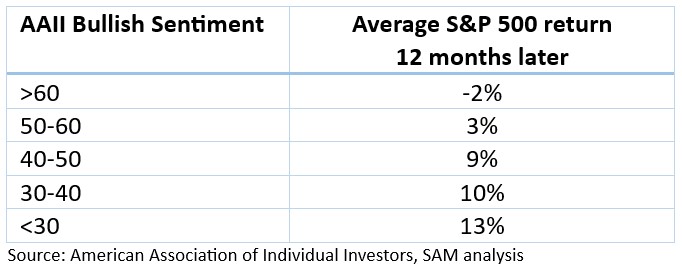

In other words, investors are only a little greedier than usual. And it turns out, when investors are feeling just a little greedy, there are usually positive returns ahead.

Sure, you might do a little better if you buy when bullish sentiment is down in the dumps. But the reality is, it doesn’t happen that often. The market goes up more often than it goes down. And as mentioned, the market going up makes investors feel more bullish.

Bull markets often end when investors have reached a state of euphoria. Today, investors are slightly more optimistic than average. And there are still plenty of bull market skeptics!

We’re certainly a long way away from euphoria. Now is not the time to be fearful. Or greedy. As we’re telling SAM clients: Now is the time to stick to your investment plan. And if you don’t have a well-thought-out plan geared toward reaching your financial goals, there’s no time like the present!

related content

- Three Investments That Put Your Money to Work With Less Risk

- Dividends Are in a Rut

- 5 Stocks Warren Buffett Is Buying (and 8 He's Selling)

- Four Random Facts and Thoughts About Warren Buffett

- The 12 Best Stocks to Buy Now

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael is a Portfolio Manager and Deputy Chief Investment Officer at SAM, a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. He sources investment opportunities and conducts ongoing due diligence across SAM’s portfolios. Michael co-manages SAM’s Income and Tactical Select strategies. Prior to joining SAM, Michael worked with high-net-worth private clients for the largest independent wealth management firm in the United States. He was also a senior analyst for one of the largest investment-grade bond managers in America. Michael joined SAM in 2017.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.